Chinese AI Stocks See Explosive Growth from Growing Interest in ChatGPT

Increasing interest in OpenAI’s ChatGPT initiative has sent the stocks of several Chinese-based AI companies skywards.

Increasing interest in OpenAI’s ChatGPT initiative has sent the stocks of several Chinese-based AI companies skywards.

However, some analysts believe the new Google AI-powered Bard will outshine its competitors like Microsoft by a huge margin in the future.

On the financial outlook for the year, Robinhood expects its full-year total operating expenses to fall between $2.375 billion and $2.515 billion.

Disney CEO Bob Iger believes the company’s fiscal Q1 2023 earnings report points towards sustained growth and profitability.

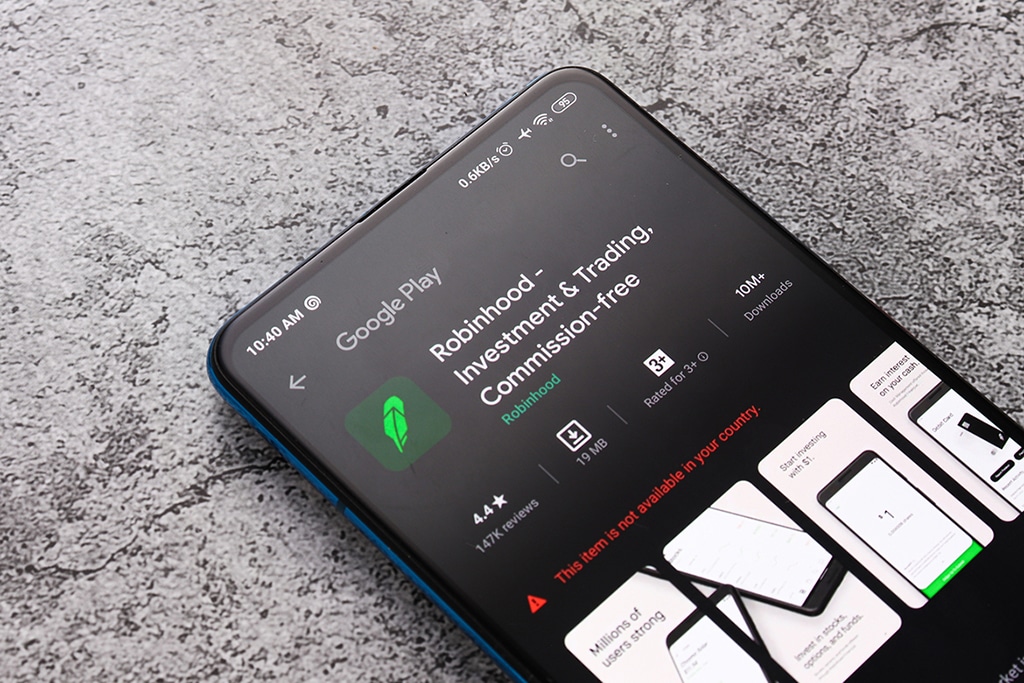

Stock trading app Robinhood recently announced plans to buy back a sizable SBF HOOD stake in conjunction with the DOJ.

During the last year of 2022, Maersk benefitted greatly from the surge in ocean freight rates. In its forward-looking guidance for 2023, the Danish shipping giant is expecting a drop in the EBITDA.

Societe Generale reported revenue rose by 8% year-over-year to 28.1 billion euros.

After the pandemic, individuals and businesses still rely on Zoom, but the uncertainty of the global economy leads to tough measures. Zoom will not only lay off employees but also decrease salaries for the executive team.

With its already ambitious plans to grow its revenue and profit on a steady basis, BNP Paribas is looking at diversifying its businesses in order to harness the potential in new markets.

BP apparently saw significant growth across its top and bottom lines. The oil giant said its net debt in the fourth quarter was reduced from $30.6 billion to $21.4 billion.

Chinese tech giant Baidu is currently riding high on the news that the company is launching an AI chatbot called ‘Ernie bot.’

Without naming the investors, Canoo said it would sell 50 million new shares, together with warrants that allow the investors to have the option to buy up to an additional 50 million.

Pinterest experienced an initial 12% decline in stock value following its less-than-expected Q4 2022 revenue haul.

Activision realized higher-than-expected net bookings of $3.57 billion for Q4 2022 as it hopes to conclude its Microsoft deal in June.

Since the beginning of 2023, the Nasdaq index is up by 15.60% in one of the major recoveries after last year’s downfall.