July 1st, 2025

Explore the latest news about Bitcoin Halving, stay up to date on the major developments related to the event, check expert insights, Bitcoin (BTC) price forecasts and more.

As the Bitcoin miner capitulation post the BTC halving comes to an end, market analysts are predicting the bitcoin price to reach $100K by the year-end.

Analysts suggest Bitcoin’s current consolidation phase could be beneficial for the bull run.

Marathon Digital said that the company won’t be raising funds to achieve its target of 50 EH/s and that it would be fully self-funded.

The altered dynamics, as many point out, to be caused by Bitcoin halving might introduce shifts that might be difficult for new crypto adopters to grasp and understand.

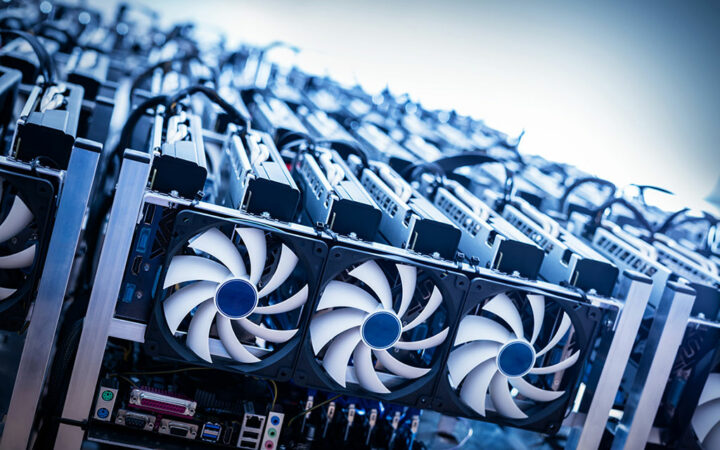

Bitcoin miners saw a significant increase in earnings due to the Runes protocol. On the halving day, miner revenue soared to a record $107 million despite the 50% reduction in block rewards.

According to a recent Bitfinex market report, the Bitcoin supply squeeze has already begun following the recent halving event.

As the NYSE conducts its survey, US regulators are closely scrutinizing an application for the establishment of a 24/7 stock exchange.

Since the halving event, Stacks (STX) token surged by 20%, Elastos’ ELA token has surged by 11%, while SatoshiVM’s SAVM has seen a 5% increase in value.

The Bitcoin race to $100K and beyond was triggered by the BTC halving event 2024 over the weekend amid heightened demand from institutional investors.

The price trajectory of Bitcoin has remained little unchained despite speculations and projections by different analysts before the halving.

Richard Teng cautioned that the extent of future growth will depend on various factors, including overall market sentiment and rates of adoption.

As Bitcoin price rebounded prior to options expiry, traders took advantage of negative funding rates to initiate long positions, leading to a recovery.

With Bitcoin’s recent price surge, it can be inferred that Schiff’s post questioning the leading cryptocurrency’s safe haven status may have been premature.

Breaking down the losses across different blockchains, BTC traders took the highest hit, with $4 million liquidated in the network in the last 24 hours.

Bitwise CEO Hunter Horsley said that several RIAs and multi-family offices have been exploring Bitcoin investments while staying low-key and conducting research silently.

Bitcoin Halving is a significant event that halves the number of new Bitcoins that miners can produce per block. It happens only once in about every four years, which is when every 210,000 blocks are reached by miners.

The supply of Bitcoin is finite as its network would stop producing more coins once the twenty one-millionth bitcoin is mined. At this point, there would be a limited amount of bitcoin in circulation, that’s why bitcoin is often referred to as digital gold.

First BTC Halvening: The 2012 Event

As the first of its kind, the 2012 block halving happened at the 210,000th block.

Second BTC Halvening: The 2016 Event

The second block halving happened at the 420,000th block.

In 2020 the event, which is expected to take place on May 14, will consequently reduce the supply of bitcoins as miners would get 6.25 bitcoins per block mined, this number was 50 before the first halving that took place in 2012.

However, it is important to note that the event is not scheduled based on date, instead, it is scheduled in block height. After the second halvening that happened in 2016, the miner’s reward per block reduced from 25 to 12.5, which is still the current miner’s reward per block.

BTC halving decreases the number of new bitcoins generated per block. This means the supply of new bitcoins is lowered by 50% given the same mining capacity.

One of the major advantages of BTC halving its ability to reduce Bitcoin’s inflation rate. The May 2020 bitcoin halving is expected to be the third halving event since bitcoin’s inception in 2009. This means that the halving will take place on the 630,000th block. The fourth halving, which is expected to happen sometime between April and June 2024, will occur at block 840,000.

Bitcoin Halving is a significant event that halves the number of new Bitcoins that miners can produce per block. Bitcoin Halving happens only once in about every four years, which is when every 210,000 blocks are reached by miners.

The supply of Bitcoin is finite as its network would stop producing more coins once the twenty one-millionth bitcoin is mined. At this point, there would be a limited amount of bitcoin in circulation, that’s why bitcoin is often referred to as digital gold.

The last bitcoin halving event was the second of its kind and it occurred on Saturday, 9th of July 2016 at block 420,000. The halving saw miners’ reward per block decrease from 25 to 12.5.

The 2020 Bitcoin halving will take place at the 630,000th block and is predicted to happen on the 12th of May, 2020. Consequently, miner’s reward per block would decrease by half from 12.5 to 6.25. This halving is expected to lead to a major increase in demand for bitcoin as its supply would see a significant decrease after the halving event.

At every point of the bitcoin halving events, speculations of Bitcoin’s price rising keeps making the news. Bitcoin is often called digital gold because its supply reduces with time and for the fact that there could only be 21 million bitcoins created. Halving reduces the circulation of bitcoins and the digital asset becomes rarer. BTC’s price was $12 before the first halving event in 2012, this increased to $130 just three months after. In a similar fashion, Bitcoin’s price increased from $651 to $760 three months after the second halving event of 2016. Judging, from the previous events, one wouldn’t be off the grid to predict that the value of Bitcoin could rise after the forthcoming 2020’s bitcoin halving.