Samsung Projects ‘Better than Feared’ Earnings Guidance for 2022 Q2 Despite Weak Consumers’ Demand

The demand weakness and challenges facing semiconductor firms set the pace for the Samsung 2022 Q2 earnings guidance.

The demand weakness and challenges facing semiconductor firms set the pace for the Samsung 2022 Q2 earnings guidance.

Over the last week’s trading sessions, US stocks are showing a good uptick. Analysts think that the drop in the flow of negative news has helped the market to revive its lost grounds.

The regulatory concerns associated with the potential deal between Merck and Seagen may attract antitrust scrutiny from regulators.

As GameStop surged in reaction to the stock split news, the company’s shares closed at $117.43.

While the US stock market is bracing for a recession, several market experts are expecting this to be a mild one.

While Tesla stock dipped 4% on Tuesday, JPMorgan believes that the automobile company could plunge further.

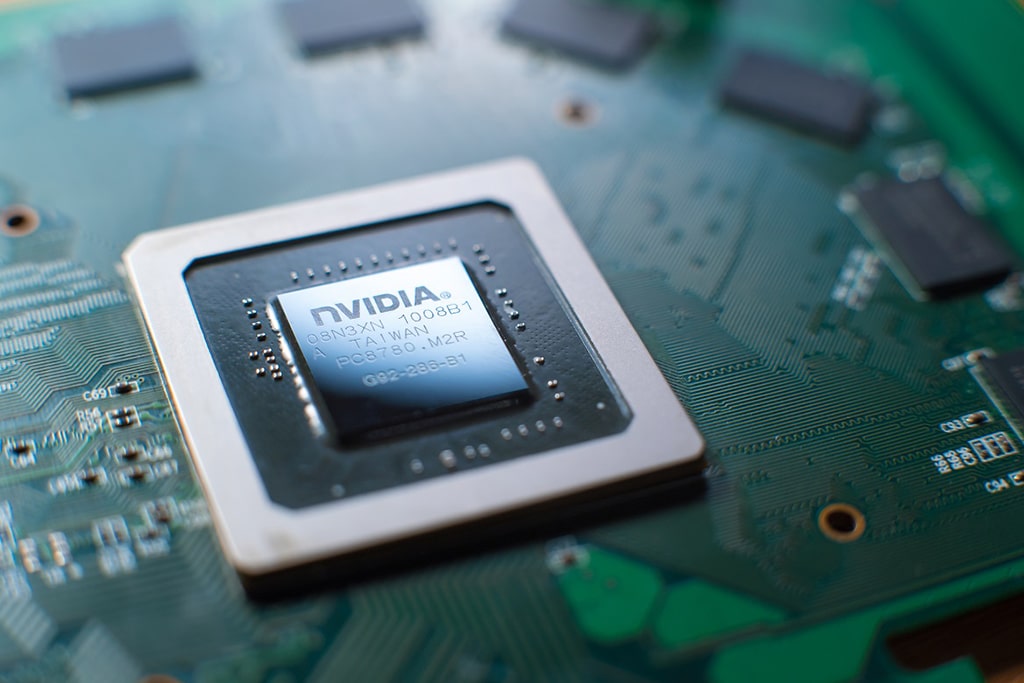

Nvidia expects to sell significantly fewer semiconductor chips after the crypto winter and inflation reduced global demand.

Amid talks of a recession and contracting markets, economists expect the upcoming jobs report will show an additional 250,000.

Tesla has posted its Q2 results for vehicle production and deliveries ahead of its incoming financial report later this month.

The S&P 500 and the US equity market have had a brutal first half of 2022. With inflation fears sticking around, the market could likely continue to stay in selling pressure going ahead.

The US stock futures decline in early trading hours. Market sentiment turns negative along with consumer confidence. Here’s what analysts think is the extent to which S&P 500 can correct further.

Consumer confidence in the economy sees a sharp fall, leading to a broader market correction on Tuesday. Market loses steam as there’s no catalyst to support the recovery.

European stocks saw a two-week high on Monday due to the ease of COVID-19 restrictions in China.

After a week of recovery, the US stock market continues to remain tepid with no clear catalyst to carry the rally forward.

American cryptocurrency exchange Coinbase has seen its shares fall in the pre-market following the downgrade call by analysts from the investment banking giant, Goldman Sachs Group.