Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Plasma raised $74 million at $500 million valuation with Bitfinex leading Series A funding round participation.

- The super-app enables direct stablecoin payments with fee-free transfers and global coverage across 150 countries.

- USDT maintains $172 billion market cap as largest stablecoin while generating $179 billion daily trading volume.

The recently launched Tether-backed, purpose-built layer-one (L1) blockchain for stablecoins, Plasma, announced Plasma One on September 22—a super-app that is a stablecoin-native neobank and card. Both the Plasma network and the super-app will have their operations centered around USDT initially.

According to the official announcement, users will be able to “pay directly from [their] stablecoin balance while earning 10%+ yields.” Other announced benefits include 4% cash back while using Plasma One cards, coverage in 150 countries, and fee-free transfers inside the app.

The team mentions the growing demand for the dollar worldwide, and different use cases depend on which part of the world the user is in. For example, they mention Istanbul, Dubai, and Buenos Aires, claiming to have gathered feedback from users and merchants in these places to customize the experience and address the lack of trust and easy onboarding while dealing with stablecoins on other chains.

“We’re going to build the most efficient rails in global finance because stablecoins are cheaper, faster, and more reliable than legacy alternatives. We’re going to onboard the best partners in the world by working to connect on-and-off ramps, FX providers, card networks, and banks all in one seamless interface. We’re going to create world-class products with Plasma One setting the high watermark for a stablecoin neobank in terms of utility, coverage, and user experience,” the team stated in their official announcement.

Plasma: A Tether-Backed Project

Besides the focus on the Tether-issued stablecoin, USDT, Plasma has other significant connections to the leading company.

The project had its Series A private funding round led by Bitfinex—Tether’s sister company and exchange arm, both owned and operated by iFinex Inc.—together with Framework Ventures. Paolo Ardoino is the CEO of both Bitfinex and Tether while also being listed as an angel investor in this Series A round.

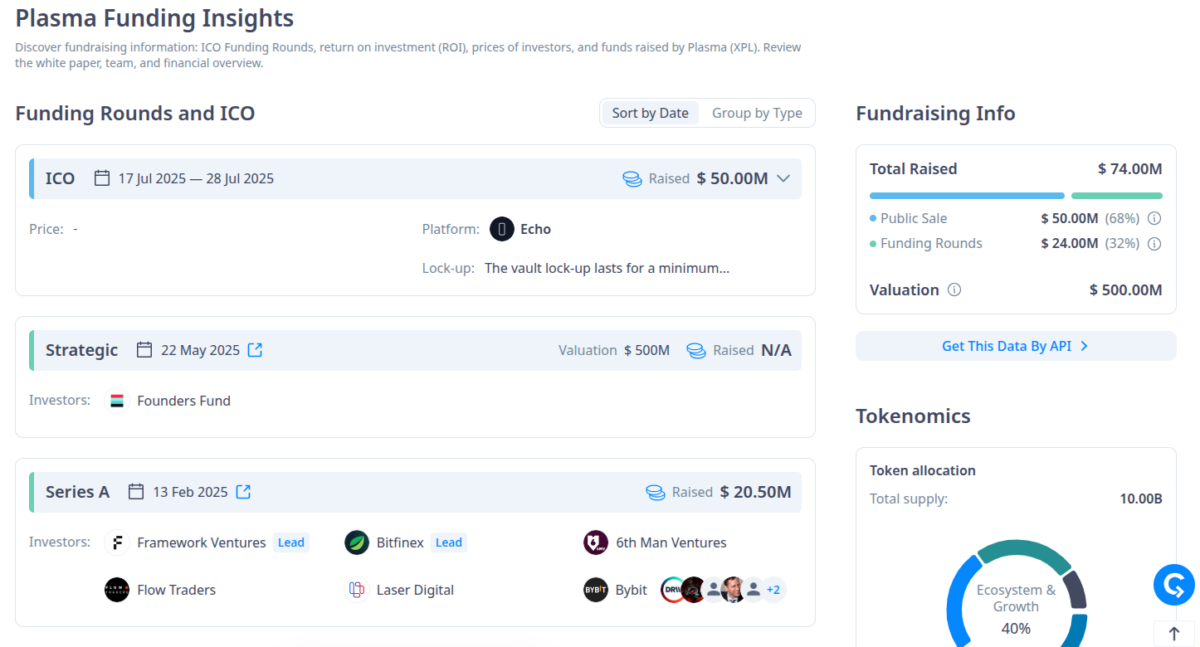

Plasma has raised $74 million at a $500 million valuation. Previous funding rounds raised $24 million, while the XPL public sale raised $50 million, based on data from CryptoRank.io.

Plasma funding rounds and ICO as of September 22, 2025 | Source: CryptoRank.io

As of this writing, USDT is the largest stablecoin by market capitalization and the largest cryptocurrency by volume, with a $172 billion market cap and $179 billion in 24-hour volume, notably higher than its capitalization.

The token is often seen as a canary for the cryptocurrency market and one of the main on-ramp avenues, with large USDT issuances working as a signal for upcoming bull rallies—like what Coinspeaker reported earlier in September. On September 4, Tether minted 2 billion USDT in unusual activity under a similar economic context to the same activity in December 2024, which led Bitcoin to new highs.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.