LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Bitpanda Review (2026): Fees, Safety & Who It’s Best For

24 mins

24 mins Bitpanda is an investment platform founded in 2014 and regulated in Europe. It lets users trade cryptocurrencies, stocks, ETFs, and precious metals from a single app.

Alongside basic spot trading, it also offers margin trading with up to 10x leverage on selected assets.

Our criteria-based Bitpanda review helps readers make an informed decision and compare findings with other popular exchanges. We tested Bitpanda with a real brokerage account to evaluate commissions, spreads, security, user friendliness, eligibility, and other core factors.

Bitpanda Quick Verdict

Bitpanda suits beginners who want a safe and simplified way to invest across multiple asset classes. It supports minimum purchases of €1 and provides access to more than 650 cryptocurrencies, over 10,000 stocks, ETFs, and ETCs, precious metals, and commodities with bank transfers, card payments, and PayPal.

Based on our testing, verification is a quick process. Bitpanda primarily serves European clients, so it does not accept U.S. or Canadian residents.

Bitpanda at a Glance

| Category | Details |

| Overall Rating | ⭐8.5 / 10 |

| Fees | High |

| KYC Required | Yes |

| Supported Assets | 650+ cryptocurrencies, 10,000 stocks, ETFs, and ETCs, precious metals, and commodities |

| Availability | 40+ countries, including most of Europe, the UK, and Turkey |

| Best For | Beginner users searching for an all-in-one trading app |

| Not Ideal For | Traders who prefer extremely tight spreads |

Key Takeaways

- Bitpanda users pay from 0.99% to trade cryptocurrencies on the main brokerage platform, while the Fusion spot exchange has commissions from 0.02%.

- Bitpanda users pay up to 2.99% to trade cryptocurrencies on the main brokerage platform, while the Fusion spot exchange caps commissions to 0.25%.

- Bitpanda holds 16 licenses, segregates customer funds in cold storage, and supports multi-factor authentication.

- Traders can access over 650 cryptocurrencies from a unified account, which includes Bitcoin, major altcoins, and top meme coins like Dogecoin and Pepe.

- The Austria-based platform supports about 40 countries, which cover European nations, the UK, and Turkey.

What Is Bitpanda?

Bitpanda was founded in Vienna in 2014 and operates as a regulated digital brokerage for European users. The platform started with cryptocurrency trading and has since expanded to cover additional asset classes, including stocks, ETFs, and precious metals.

On January 29, 2026, Bitpanda launched a unified investing platform, adding stocks, ETFs, and precious metals to its existing cryptocurrency offering. All assets are accessed through the same regulated app. The platform also supports margin trading with leverage of up to 10x across selected assets.

Eric Demuth, Paul Klanschek, and Christian Trummer founded the platform to simplify digital asset investing for retail clients.

The founders stated their aim was a beginner-friendly interface that requires no learning curve, and extensive regulatory approval allows it to accept convenient payment methods without relying on third-party gateways.

Bitpanda states that over 7 million people use the platform. Source: Bitpanda

Bitpanda primarily functions as a broker rather than a traditional exchange, as it sells digital assets directly to consumers. This structure lets beginners invest in cryptocurrencies seamlessly, as they bypass order books and other market participants.

Fusion is Bitpanda’s advanced spot exchange. While it offers real spot markets with order books, it aggregates liquidity from Binance, Coinbase, and other global platforms. We found that Fusion lacks superior analysis tools, yet its fees are significantly lower compared to Bitpanda’s brokerage platform.

Regarding asset support, Bitpanda lists over 650 cryptocurrencies, mostly as fiat-to-crypto pairs such as BTC/USD, ETH/EUR, and XRP/GBP. Recent ecosystem expansion features non-crypto markets, too.

On January 29, Bitpanda launched an expanded investment platform that added stocks and ETFs to its existing cryptocurrency and precious metals offering. The update introduced access to more than 10,000 stocks and ETFs through the same Bitpanda account. Stock and ETF trades are charged at a flat €1 fee per transaction.

Bitpanda operates legally in over 40 countries, holding licenses, regulations, or registrations in 16 jurisdictions. It complies with European legislation like the Markets in Crypto-Assets (MiCA) and General Data Protection Regulation (GDPR), and regular audits ensure client-fund segregation and relevant consumer protections.

Who Is Bitpanda Best For and Who Should Avoid It?

Bitpanda is best suited for users who want a simple investing experience. The platform allows users to trade and invest across multiple asset classes from a single account. Supported features include market and limit orders, fractional shares, and recurring investment plans for selected products such as stocks, ETFs, and ETCs.

Passive investors can use savings plans that run automatically based on user-defined schedules and amounts, with no brokerage fees.These recurring investments allow users to build positions gradually over time without active management.

The €1 purchase minimum allows digital asset exposure with sensible amounts, and convenient payments like Visa, MasterCard, and PayPal ensure a simple purchase experience in local currencies.

A Bitpanda user buys €100 worth of Dogecoin on a simplified dashboard. Source: Bitpanda

Buy-and-hold investors building diversified portfolios may find Bitpanda relevant, as the platform offers access to around 650 cryptocurrencies alongside more than 10,000 stocks, ETFs, and commodities. Users can set long-term investment goals via recurring orders and the dollar-cost averaging strategy.

Conversely, Bitpanda is not suitable for some trading profiles, particularly derivative traders who prioritize low margin requirements. The best crypto futures trading platforms offer leverage of up to 1000x, but Bitpanda caps traders to just 10x.

Traders relying on low fees, such as scalpers and day traders, may also consider other platforms. Digital assets with a market capitalization below €100 million incur a 2.49% commission, and, apart from BTC, stablecoins, and the exchange’s native token, major altcoins incur a 1.49% commission.

Bitpanda Fees Explained: Trading, Spreads & Withdrawals

Our Bitpanda review evaluated the broker, exchange, and non-trading fees and compared them with other popular platforms.

Discover Bitpanda fees in the following sections and decide whether they suit your crypto trading strategy.

Broker Trading Fees

Bitpanda’s main brokerage dashboard charges three separate commission rates based on the digital asset category:

- Stablecoins: 0.99%

- BTC, Vision (VSN), and most altcoins: 1.49%

- Tokens with a market cap below €100 million: 2.49%

The broker charges these fees “per side”, which includes entry and exit positions. Bitpanda provides no fee reductions for large volumes or market makers, as it sells directly to buyers.

Bitpanda is cheaper than some brokerage platforms, but considerably more expensive than most spot exchanges. Gemini charges a 1.49% commission and a 1% convenience fee on all brokerage markets, while Bitpanda users get lower rates on hundreds of cryptocurrencies (apart from small-caps, which align with Gemini’s standard brokerage fees).

Bitpanda Fusion Spot Trading Fees

Bitpanda’s Fusion platform, which offers spot exchange markets with aggregated liquidity, helps users reduce trading costs. It charges a flat 0.25% commission, and as users increase their monthly trading volume, they get fee discounts.

The lowest Fusion commission is 0.02%, but this rate applies only to monthly volumes exceeding $250 million. Bitpanda offers the same fee structure for makers and takers, unlike many popular exchanges.

So, how does Bitpanda Fusion compare with industry competitors?

Crypto.com charges a 0.25% entry-level commission on limit orders, which mirrors Bitpanda. It applies 0.5% fees to takers, though, so Bitpanda is cheaper for those who prefer market orders.

OKX, Binance, and Bybit are five times cheaper than Bitpanda, as takers pay just 0.1% per side. MEXC currently offers 0% commissions for both order types, but its dynamically adjusted fees change frequently.

Spreads & Hidden Costs

All trading platforms charge spreads. The spread is the difference between the bid and ask prices, and it reflects an indirect and hidden cost. Bitpanda does not publish minimum or average spreads, which lacks transparency.

We placed over 100 trades to support this Bitpanda review and found brokerage spreads are much wider than the Fusion exchange. This is standard with most brokers, as they charge a convenience premium to avoid spot exchanges.

The best practice is to compare Bitpanda quotes with global spot prices on CoinMarketCap; the percentage difference approximates the real-time spread.

Deposits & Withdrawals

Bitpanda traders eliminate deposit and withdrawal fees on all accepted fiat payment methods, including PayPal, debit/credit cards, and Apple Pay. It contrasts with Gemini, Kraken, Coinbase, and other brokerage services, which typically charge 3–5% of the purchase amount.

Crypto deposits are fee-free, and withdrawals align with blockchain network fees, so Bitpanda charges no additional markup. Bitpanda withdrawal fees for Bitcoin and Ethereum are currently 0.000039 BTC and 0.0006 ETH.

Real Cost Example

Here is a real example that illustrates Bitpanda fees:

A Bitpanda user deposits EUR into their account via PayPal fee-free. They purchase €100 worth of ETH on the standard brokerage platform at a 1.49% commission.

The trader receives approximately €98.51 in ETH, excluding spreads. To withdraw that ETH to a private wallet, they pay network fees of approximately €0.31.

Note that the same trade on Bitpanda Fusion reduces the commission from 1.49% to 0.25%.

Bitpanda Products & Features (What’s Included & What’s Not)

Our Bitpanda review tested the platform’s most popular features and markets. We discuss our findings below.

Spot trading

Bitpanda’s core brokerage division technically supports spot trading because investors receive real digital assets “on the spot”. However, the brokerage structure eliminates order books and market participants, so only the Fusion platform offers true spot trading dynamics.

Bitpanda Fusion aggregates liquidity from major crypto exchanges. Source: Bitpanda

Fusion traders place various order types, such as market, limit, and stop-loss, and the exchange fills those orders using existing liquidity. Bitpanda aggregates liquidity from multiple Tier 1 exchanges, which is intended to minimize slippage and accelerate execution times.

Although the Fusion dashboard provides basic analysis tools, it lacks the same professional-grade features as Binance and Bybit. These spot exchanges provide high-level technical tools with deep customization.

Derivatives

Eligible clients (all Bitpanda-supported countries except the UK) can trade cryptocurrencies with leverage across two core products.

Margin accounts require a 10% initial margin on major digital assets like BTC and Ethereum (ETH), which converts to a maximum leverage of 10x. Other markets provide smaller limits of between 2x and 5x.

European clients may also trade contracts-for-differences (CFDs). These derivative products track real-time crypto prices and allow traders to speculate on both market directions. The European Securities and Markets Authority (ESMA) strictly regulates CFDs. To comply with ESMA, Bitpanda caps crypto CFD leverage to just 2x, so traders must post a 50% margin to enter positions.

As per Financial Conduct Authority (FCA) regulations, Bitpanda restricts UK retail clients from trading any leveraged crypto product.

Earn

Bitpanda clients earn passive yields on both fiat money and cryptocurrencies.

When users transfer fiat to their Cash Plus balance, they automatically generate interest without minimum holding terms and withdrawal penalties. The Cash Plus feature offers APYs of 1.99% (EUR), 4.08% (USD), and 4.04% (GBP). Avoid storing cash in Bitpanda purely for interest, as some platforms offer more competitive rates.

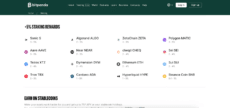

Bitpanda’s staking product suits long-term investors who seek yields on their digital asset investments. It supports dozens of staking cryptocurrencies, from ETH, Tron (TRX), and Sui (SUI) to BNB (BNB), Cardano (ADA), and Polygon (POL).

Bitpanda allows users to stake their crypto balances to earn passive yields. Source: Bitpanda

Major staking coins earn sub-5% yields, while less popular assets like Casper (CSPR) and Starknet (STRK) pay over 10%. Bitpanda distributes staking rewards weekly and, other than ETH, users avoid minimum lock-up terms.

Some Bitpanda users are ineligible for staking rewards, including Austria account holders. The platform plans to expand into additional regions soon.

Bitpanda Cards

Verified Bitpanda users located in the Eurozone (countries that adopt the Euro) can apply for a Visa debit card that links to their crypto, stocks, and precious metals account balance.

The card works similarly to any other debit card; users buy goods and services online and in-store, and withdraw cash from ATMs. When users make purchases, Bitpanda converts the default asset into the local currency, and the merchant receives the funds in real-time.

Cardholders also receive 1% cash back on all crypto-related transactions and will avoid monthly and foreign exchange (FX) fees.

Before you apply for the card, consider the €1 minimum purchase requirement and that non-crypto payments do not trigger cashback rewards.

Important: Each card purchase represents an asset disposal. If Bitpanda converts digital assets at a higher spot price than you originally paid, you may be liable for capital gains tax. So make sure you review local tax laws in your home country for further guidance.

Wallet Model

Bitpanda automatically transfers crypto purchases to the user’s account wallet, which offers a custodial framework. As the platform manages private keys and seed phrases on the account holder’s behalf, Bitpanda users face custodial risks.

Multi-factor authentication and biometrics (mobile app only) help protect users against cybersecurity threats, but investors should consider non-custodial storage for a safer experience.

Bitpanda offers a separate mobile app for its non-custodial wallet service. Source: Bitpanda

One option is Bitpanda’s proprietary decentralized finance (DeFi) wallet. Available as a mobile app for iOS and Android, wallet users control their private keys and stored assets with complete autonomy. However, it supports Ethereum Virtual Machine (EVM) and Solana Virtual Machine (SVM)-compatible networks only.

We reviewed the best crypto wallets for 2026 and found that other providers support more blockchains, features, and security tools. Popular Bitpanda wallet alternatives include Best Wallet, Trust Wallet, and Exodus.

Broker vs Exchange: Key Differences

When Bitpanda users buy cryptocurrencies from the brokerage service, they purchase assets directly from the platform. Bitpanda includes commissions and unspecified spreads into a final quote, based on the purchase amount and digital asset. The process works similarly when investors cash out cryptocurrencies, but in reverse.

As the brokerage dashboard is aimed at handholding inexperienced traders who feel intimidated by spot exchange platforms, Bitpanda charges higher fees and wider spreads.

Bitpanda’s Fusion exchange replicates conventional market dynamics. The platform matches buy and sell orders, so demand and supply determine price movements. It partners with Kraken, Coinbase, OKX, Binance, and other popular exchanges to aggregate global liquidity.

In addition to more competitive fees, Fusion traders have access to charts and indicators. We tested the analysis platform extensively but found it to be more basic than many exchange competitors.

| Feature | Broker | Exchange |

| Fees | 0.99–2.49% per side, depending on the market. | 0.25% per side, reduced gradually based on 30-day volumes. Minimum commission of 0.02%. |

| Spreads | Wide (unspecified) | Competitive (unspecified) |

| Order Types | None. Instant execution only. | Market, limit, stop-limit, stop-market, take-profit |

| Target User | Beginners | Intermediate to advanced traders |

What Cryptocurrencies Are Supported on Bitpanda?

Bitpanda traders buy and sell over 650 cryptocurrencies, including the best crypto like BTC, ETH, ADA, BNB, and Solana (SOL). Users find markets via the search box or category filters such as new crypto coins, artificial intelligence (AI), and meme coins.

We verified the advertised markets manually and found that most pairs contain fiat currency. Fiat-to-crypto pairs include USD, EUR, and GBP.

Bitpanda supports three stablecoins: USDC (USDC), EURC (EURC), and EUR CoinVertible (EURCV). Due to European stablecoin regulations, notable omissions include Dai (DAI) and Tether (USDT).

Although Bitpanda prevents UK clients from trading CFDs and margin products, it does not ban specific digital assets. All listed cryptocurrencies are available site-wide.

Is Bitpanda Safe and Legit? Security & Trust Breakdown

Asset safety is the most crucial aspect when selecting a cryptocurrency exchange. So, is Bitpanda legit? Time to discuss Bitpanda’s security mechanisms, licensing framework, and potential safety risks.

Asset Storage & Controls

Bitpanda’s security documents confirm that the company holds client-owned cryptocurrencies in segregated wallets, held by an unnamed trustee. The trustee framework protects user funds even if Bitpanda becomes insolvent.

Bitpanda keeps the majority of customer assets in cold storage wallets, which remain offline at all times. The cold storage infrastructure mitigates remote hacking attempts. It holds some cryptocurrencies in warm wallets to facilitate brokerage orders, spot exchange liquidity, and account withdrawals.

The firm states that it does not speculate with client assets, such as using them for collateral or external loans.

Bitpanda supports additional security tools that clients must manually activate within their account dashboard.

It enables multi-factor authentication logins, where users input limited-time verification codes to access the account. This feature strengthens two-factor authentication, as the system generates two separate codes via email and mobile.

Besides logins, Bitpanda requires these codes for other sensitive account requirements like withdrawals and password changes. We strongly recommend activating them to minimize cybersecurity vulnerabilities.

Compliance & Regulation

The broker holds an SOC 2 Type 1 report to demonstrate the highest security and compliance standards, as well as its commitment to data protection.

Bitpanda’s SOC 2 Type 1 certification demonstrates a commitment to security and compliance. Source: Bitpanda

Operating in the regulation-heavy European market, Bitpanda complies with a wide range of legislative measures, including the GDPR and MiCA. It also implements comprehensive KYC verification procedures to comply with the 5th EU Anti-Money Laundering Directive. These procedures require Bitpanda users to verify their identity before accessing account features.

The Bitpanda group holds 16 licenses, which cover broader European frameworks, including the Markets in Financial Instruments Directive 2014 (MiFID II) and the Payment Services Directive 2 (PSD2). These licenses enable Bitpanda to serve retail and institutional clients, and facilitate EUR deposits and withdrawals.

The provider also holds licenses with individual nations throughout Europe, such as the MICAR approval in Austria, Germany, and Malta.

In March 2025, Bitpanda secured a Dubai Virtual Assets Regulatory Authority (VASP) license to spearhead its global expansion plans. Despite its VASP approval, the broker does not currently accept traders from the United Arab Emirates.

Proof of Reserves & Transparency

The FTX bankruptcy highlighted the importance of asset reserve transparency. Proof of Reserves via the Merkle Tree system lets customers verify that exchanges hold their crypto investments.

Third-party companies frequently audit Bitpanda’s reserves, yet the broker does not publish reports on its website. Instead, account holders must request audited reserves via email or telephone. This manual requirement contrasts with most licensed exchanges, which provide daily updates in the public domain.

Past Incidents or Controversies

No publicly reported major breaches as of January 2026.

Is Bitpanda Easy to Use? A Look at the User Experience

A simple and user-friendly experience is one of Bitpanda’s key strengths. The company designed its crypto ecosystem with beginners in mind, and having tested Bitpanda, we confirm that the brokerage requires no prior trading experience.

Before users buy and sell cryptocurrencies, they must complete Bitpanda’s onboarding process. New customers provide personal information and contact details, and per regulatory requirements, answer several questions about their investing goals and knowledge.

New Bitpanda customers typically complete KYC verification in minutes. Source: Bitpanda

Clients complete the simple KYC process on a desktop or mobile device by uploading a government-issued ID. Our KYC experience was seamless, since Bitpanda approved our documents almost instantly.

Further research indicates that some users have encountered upload issues due to poor image quality or failing to display all four corners of the ID card. Bitpanda’s help center explains that a poor internet connection can also cause verification problems.

After KYC verification, Bitpanda guides users through the account funding process. The platform supports deposits via everyday payment types, including debit/credit cards, local bank transfers, and popular e-wallets.

Funded account holders then visit the brokerage interface to invest in their preferred cryptocurrencies. The two-step process requires users to select the digital asset they want to buy and the total purchase amount in their local currency.

To buy XRP on Bitpanda, users simply specify the asset and investment size. Source: Bitpanda

The Bitpanda app for iOS and Android provides the same investment experience. Both apps optimize the trading interface for smaller screens, with clear button icons and expandable menus. Mobile users get full functionality, including payments, customer support, and DeFi services.

Deposits, Withdrawals & Account Limits

Bitpanda supports nine account currencies: EUR, USD, GBP, CHF, PLN, DKK, SEK, HUF, and ZKD. Users who deposit funds in other currencies, such as Turkish clients, face FX fees.

Accepted payment methods vary by account currency. Most nationalities can deposit funds with Visa, MasterCard, Neteller, Skrill, PayPal, and Apple Pay, as well as local bank payments. Banking networks include Faster Payments (UK) and SEPA, which covers all European countries.

Bitpanda sets a minimum deposit requirement of €10 and daily limits of up to €10 million (or the currency equivalent), depending on the payment type. Daily limits update 24 hours after the original deposit, and the broker processes all fiat payment methods fee-free.

Verified users can also deposit cryptocurrencies into their Bitpanda account. The minimum deposit varies by digital asset. Bitcoin and Ethereum deposits must meet a 0.00015 BTC and 0.004 ETH minimum. These minimums vary frequently based on global spot prices.

Deposit processing times vary by currency and method, although debit/credit cards and e-wallets are typically instant. We found that bank transfers via Faster Payments often take minutes, while SEPA transfers arrive within 24 hours.

To withdraw funds from the Bitpanda account, all supported countries cash out via bank transfer, Skrill, or Neteller. Similar to most exchanges, the platform does not allow debit/credit card withdrawals. Daily cashout limits are €5 million, and no withdrawal fees apply.

Clients pay crypto withdrawal fees to cover network charges. Each supported digital asset has varying fees, and Bitpanda simply transfers these fees to the respective blockchain miners.

Customer Support: Availability, Speed & Common Issues

Although Bitpanda serves the European time zone, its customer service department operates 24 hours per day, seven days per week. It provides multilingual support in languages such as English, French, Dutch, Polish, and German.

We expect most Bitpanda customers will use the live chat feature, which is available on the desktop website and mobile app. We tested the live chat service across various days and times, and in most cases connected to an agent right away. Bitpanda users should expect slightly slower response times on weekends due to increased platform activity.

Additional communication methods include email and telephone. Those who seek telephone support must schedule a call via the online booking form. Agents call clients directly at the scheduled time, so users avoid toll charges. The telephone service is available in English, Italian, and French only.

Bitpanda vs Alternatives: Which Platform Should You Choose?

Bitpanda is just one crypto trading platform among hundreds of available options. It stands out in some areas and falls short in others. We compared key platform metrics with other brokers and exchanges to evaluate whether better alternatives exist.

Bitpanda vs MEXC

In the fee department, Bitpanda brokerage commissions are considerably higher than spot exchanges, but millions of beginners willingly pay these charges for a smooth investing experience.

Those who prioritize cost-effective trading may prefer MEXC. The spot exchange offers a commission-free experience across limit and market orders without minimum volume requirements. Yet, MEXC operates an unregulated exchange with no consumer protections.

- Choose Bitpanda if you favor a beginner-friendly experience in a regulated environment.

- Choose MEXC to avoid trading commissions, and you’re happy to trade with an unlicensed platform.

Bitpanda vs Kraken

Bitpanda has an effective licensing framework, and it follows all relevant laws in the jurisdictions it serves. If security and regulation are the overarching priorities, our research shows that Kraken takes safety to the next level.

For example, Bitpanda users must request asset reserve reports. Kraken publishes proof of reserves with full audited reports, enhancing transparency and trust.

- Choose Bitpanda for a beginner-friendly and safe trading experience, but with slightly less extensive supervisory oversight.

- Choose Kraken for more comprehensive regulatory protections and asset transparency, but with higher fees and longer KYC timeframes.

Bitpanda vs Binance

Bitpanda, including its Fusion spot exchange, provides limited tools and features for serious technical traders. It lacks the same analytical toolkit as many exchanges, with fewer indicators and chart customization options, and no ability to deploy automated solutions.

Binance appeals to seasoned traders who demand world-class research, analysis, and trading capabilities. Traders download native desktop software for Windows, Mac, or Linux to access dozens of technical and economic indicators, drawing tools, bespoke order types, and deep order book data.

The software enables third-party automated tools like algorithmic bots, which suit short-term strategies like scalping and momentum trading.

- Choose Bitpanda to buy and sell cryptocurrencies on a simple interface that requires no learning curve.

- Choose Binance to trade digital assets on highly advanced and customizable software with powerful analytical and trading features.

How We Tested Bitpanda

Instead of relying on publicly available data and secondary sources, we opened a real Bitpanda account to evaluate the end-to-end client journey, and then followed our criteria-based methodology to gain deep insight into the overall experience.

We completed the KYC verification process, deposited EUR via SEPA and PayPal, and placed over 100 buy and sell orders on the brokerage and Fusion spot exchange. Per order, we recorded trading commissions, spreads, slippage, execution speeds, and platform reliability. We also verified available markets and pairs, minimum order sizes, and trading limits.

Outside of traditional investing, we also traded cryptocurrencies with margin accounts and CFD instruments to assess Bitpanda’s leverage facilities and average liquidation zones.

We also allocated small amounts to platform features such as the DeFi wallet and staking program, and then compared our findings with similar industry concepts.

However, due to eligibility constraints, we did not test Bitpanda’s debit card, Launchpad service, or Cash Plus account. For these products, we reviewed official website content, guidance documents, and the general terms of service.

Our Bitpanda review is highly accurate as of February 2026, with regular updates planned to reflect product changes.

Final Verdict: Should You Use Bitpanda?

Overall, we found that Bitpanda is a fully licensed broker that prioritizes customer safety and regulatory compliance. Its simple trading interface resembles traditional retail-facing platforms like Robinhood and Webull, where users simply state the asset and purchase amount without complicated order types.

We expect that most traders will agree that fees remain the biggest trade-off, particularly when customers invest on Bitpanda’s brokerage platform, which charges 0.99–2.49% per side, plus variable spreads. As a reminder, the exchange accepts European, UK, and Turkish residents only, and its MICAR approval limits account holders to 10x leverage.

FAQ

Is Bitpanda safe?

What are the real fees on Bitpanda?

Is it available in my country/state?

Does Bitpanda require KYC?

Can I withdraw to a bank?

Are there spreads on Bitpanda?

How long do Bitpanda withdrawals take?

What is the Bitpanda minimum deposit?

References

- User agreement for the provision of services by Bitpanda (PDF)

- FCA statement on the Opinion of ESMA on our final rules for CFDs and CFD-like options (Financial Conduct Authority)

- Guidelines on the conditions and criteria for the qualification of crypto-assets as financial instruments (European Securities and Markets Authority)

- The Impact of MiCA Regulation on Crypto Companies in Europe (European Blockchain Convention)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.