LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Gemini is a highly-regulated crypto exchange with a wide range of digital assets, suitable for beginners and crypto veterans. But is it the right option for you? Find out in our in-depth review.

Gemini is a U.S.-based crypto exchange that offers a wide selection of cryptocurrencies, powerful tools for both investors and traders, and industry-leading security. In our Gemini review, we’ll cover everything you need to know about this crypto exchange.

Our review dives into Gemini’s fees, trading options, user experience, and more. Keep reading to find out if Gemini is the best exchange for you in 2026.

| Category | Rating / Details |

| Overall Rating | ⭐8.5/10 |

| Privacy | Full KYC required; operates under U.S. and EU regulatory compliance |

| Transaction Speed | Instant Buy purchases are immediate; spot and futures trades execute in real time |

| Fees | Instant Buy: 2.49% (1.49% for limit orders); Spot trading: 0.20% maker / 0.40% taker |

| Ease of Use | Beginner-friendly web and mobile interface with simple instant buy tools |

| Supported Assets | 80+ cryptocurrencies, largely USD pairs |

Our Gemini Review Verdict Summarized

We found that Gemini stands out for its selection of the top crypto assets and user-friendly interface, but with some caveats.

The 80+ assets on the platform may be seen as a positive or a negative: it is enough to capture a broad range of the top assets without overwhelming new users, but some investors may want a broader choice of small-cap altcoins or meme coins.

Gemini has a relatively wide range of tradeable assets for a U.S. exchange, although some assets like crypto futures and tokenized stocks aren’t available (yet) in the U.S.

The platform offers advanced traders and institutions the tools they need through the ActiveTrader platform, including useful order types (such as maker-or-cancel and fill-or-kill orders) and extensive charting tools.

Gemini’s Instant Buy fees are slightly lower than those of its competitors, but its spot and futures trading fees are slightly above average.

Gemini is a highly regulated exchange, holding a BitLicense from the New York Department of Financial Services (NYDFS) and a Markets in Crypto Assets (MiCA) license from the European Union. It backs all customer assets 1:1 and holds the highest level of cybersecurity certificate.

- Year founded: 2014

- Number of cryptocurrencies: 80+

- Other tradeable assets: Perpetual futures, tokenized stocks

- Availability: U.S., UK, EU, Singapore, 50+ other countries

- Licensing: NYDFS BitLicense, MiCA

Gemini Pros and Cons

Before we dive into our full Gemini review, let’s detail the main benefits and drawbacks that we found in our analysis of the platform.

Pros

- Below-average Instant Buy fees

- Fee-free withdrawals to crypto or a bank account

- Easy-to-navigate web platform and mobile app

- 100+ crypto-crypto trading pairs available in ActiveTrader

- Supports recurring buys on a custom schedule

- Highly regulated and secure exchange

Cons

- Futures and tokenized stock trading are currently not available in the U.S.

- KYC-only exchange means privacy-focused traders will need to look elsewhere

- Above-average spot trading fees

- Will not suit traders who want more choice than 80+ assets

- Customer support is only available by email

What Is Gemini?

Gemini is a U.S.-based centralized crypto exchange that operates around the globe, including in all 50 U.S. states, the UK, the EU, and major Asian markets.

The exchange was founded in 2014 by Cameron and Tyler Winklevoss, the eccentric pair of Bitcoin billionaires who helped launch Facebook alongside Mark Zuckerberg.

The Gemini homepage in the U.S. Always make sure you visit the official site. Source: Gemini

Gemini offers trading on 80+ cryptocurrencies and provides several ancillary products, including a self-custody crypto wallet, a staking platform, the GUSD stablecoin, and a crypto credit card.

It also offers institutional crypto services for major investment firms and businesses. Outside the U.S., Gemini offers crypto derivatives trading, including on crypto futures, as well as tokenized stock trading.

Gemini’s Products & Services

In addition to offering a centralized cryptocurrency exchange, Gemini offers a range of other products and services.

- ActiveTrader: ActiveTrader is Gemini’s advanced spot crypto trading platform. It’s available to all users of the exchange.

- Web3 wallet: Gemini’s self-custody crypto wallet supports tokens and dApps across Ethereum, Arbitrum, Polygon, Base, and Optimism.

- Futures trading: Gemini supports perpetual crypto futures trading on 25 token pairs. Futures trading is not available in the U.S. or the UK.

- Staking: Gemini offers flexible staking on ETH, SOL, and MON.

- GUSD: GUSD is a USD-backed stablecoin created by Gemini. It’s used as the paired token for all perpetual futures contracts at Gemini.

- Credit card: Gemini offers a crypto cashback credit card with up to 4% rewards and no annual fee.

What Cryptocurrencies Can You Trade on Gemini?

Our Gemini cryptocurrency exchange review found that the platform supports trading in over 80 cryptocurrencies. This is comparable to many other U.S. exchanges but fewer than global competitors.

You can trade nearly all of the most popular Layer 1 blockchain tokens, Ethereum Layer 2 tokens, stablecoins, DeFi tokens, metaverse tokens, and meme coins. Some of the most traded cryptocurrencies on Gemini include:

- Bitcoin

- Ethereum

- XRP

- Solana

- Dogecoin

- Chainlink

- Zcash

- Shiba Inu

Notably, most of the tokens on Gemini trade directly against USD rather than against USD-denominated stablecoins like GUSD. This can boost liquidity on the exchange and make prices more predictable. The exchange also offers major coins like BTC and ETH in pairs with foreign currencies such as GBP and EUR.

Pairs available in the United States, from Bitcoin and ETH to XRP and Dogecoin. Source: Gemini

Gemini’s mobile and web exchange offers a limited number of crypto-to-crypto trading pairs, and most involve BTC as the paired token. However, the ActiveTrader platform offers more than 100 crypto-crypto token pairs for spot trading.

Gemini also offers 25 perpetual crypto futures contracts, all of which are paired with the GUSD stablecoin. Perpetual futures can be traded with up to 100x leverage. Gemini advertises around $41 million in weekly trading volume, which is relatively low compared to other crypto futures exchanges. Gemini futures trading isn’t available in the U.S. or the UK.

In addition to cryptocurrencies, Gemini has launched a limited number of tokenized stocks. These are blockchain-based representations of popular U.S. stocks. When buying tokenized stocks, you don’t own the underlying shares, but can speculate on price movements in stocks. Tokenized stock trading isn’t available in the U.S. at this time.

Gemini Fees

Gemini is offering different rates based on the payment method, order type, and other factors.

To invest in crypto using Gemini’s Instant Buy feature, you’ll pay 2.49% regardless of payment method. That’s quite a bit lower than exchanges like Coinbase and Binance, both of which charge fees of 3.5%-4.5% for credit and debit card payments. Gemini reduces the fee to 1.49% if you use a limit order instead of making an instant purchase.

However, Gemini’s spot trading fees are higher than those of many competitors. Fees start at 0.20% for makers and 0.40% for takers on the exchange’s ActiveTrader platform. For comparison, spot trading fees at Binance start at 0.10% for both makers and takers.

Volume discounts are available at Gemini if you have at least $10,000 in monthly trading volume. The first discount tier offers fees of 0.15% for makers and 0.30% for takers.

Gemini’s futures trading fees are competitive, but not the lowest in the industry. They start at 0.02% for makers and 0.07% for takers. Margex, one of the most popular crypto futures exchanges, charges 0.019% for makers and 0.060% for takers. However, volume discounts are available at Gemini starting at $10,000 in monthly trading volume.

Gemini also charges fees for certain types of deposits and withdrawals. ACH transfers and crypto transfers are free for both deposits and withdrawals (although you must pay network fees for crypto payments). Debit cards incur a 3.49% fee, and PayPal incurs a 2.50% fee for deposits. Wire transfers are free for deposits and $25 for withdrawals.

Here’s a summary of Gemini crypto fees:

| Transaction | Fee |

| Instant Buy | 2.49% (1.49% for limit orders) |

| Spot Trading | 0.20% maker / 0.40% taker |

| Futures Trading | 0.02% maker / 0.07% taker |

| Deposits | Free for ACH, crypto, wires; 3.49% for debit cards and 2.50% for PayPal |

| Withdrawals | Free for ACH and crypto (network fees apply); $25 for wires |

User Experience: Is Gemini User-Friendly?

We found Gemini to be one of the best crypto exchanges around for beginners, while still offering plenty of advanced features to cater to experienced traders, and our major impression of Gemini is that it lets you choose how deep you want to dive into the platform.

Beginners and investors can stick to Gemini’s main dashboard and instant buy feature, which lets you enter the token you want to buy and the amount, and then instantly make a purchase. Investors can also set up recurring purchases on a customizable schedule to benefit from dollar-cost averaging, a nice touch that many other exchanges don’t offer.

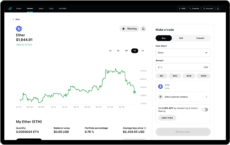

The dashboard for Ethereum on Gemini is simple to understand and has quick purchase tools. Source: Gemini

Compared to exchanges like Binance, we found Gemini’s basic interface to be much easier to navigate. There are fewer options being thrown at you, and the navigation menus are more streamlined. Even if you’ve never used a crypto exchange before, it’s pretty easy to find your way around.

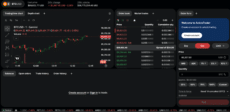

More experienced users and traders will spend most of their time in Gemini’s ActiveTrader platform, which offers lower fees and advanced trading tools. This is a technical-focused spot trading interface that offers access to TradingView charts, Gemini’s order book, market depth plots, and advanced risk management tools.

We found ActiveTrader to be more customizable than the trading platforms offered by most other exchanges, especially since you can completely modify the layout using premade trading modules.

ActiveTrader gives a more advanced interface for traders who are familiar with the basics. Source: ActiveTrader/Gemini

Just beware that ActiveTrader is only available for the web. There are no desktop or mobile apps, which can be a significant shortcoming for some traders.

It’s worth noting that Gemini has a massive library of educational resources available to users, with a library of nearly 500 articles to explore to get up to speed on crypto trading, blockchain technology, DeFi, and more.

Gemini Mobile App

Gemini offers a mobile app for iOS and Android that we found to be simple in design and easy to navigate. You can sign up for an exchange account directly through the app, then easily monitor your portfolio and crypto market movements from the dashboard.

You can set up watchlists and price alerts, and the Gemini app will send push notifications based on your alerts so you don’t miss important price movements.

Using Gemini and following the market on mobile. Source: Gemini

It’s quick to enter an instant buy order through the Gemini app, and investors can also set up recurring buys. Traders can switch to Advanced mode to access spot trading on mobile.

You’ll find mobile-friendly candlestick charts along with Gemini’s order book, depth book, and open orders details to inform trades. It’s much more limited compared to ActiveTrader, but spot trades in the Advanced mobile interface qualify for the same spot trading fees.

Importantly, you can also access Gemini’s Web3 wallet through the main Gemini app. The self-custody wallet doesn’t have its own app.

The Gemini app scores a 4.5-star rating on Google Play after more than 22 million reviews, and a 4.7-star rating in the Apple App Store after nearly 1 million reviews.

Features & Tools

Let’s take a closer look at some of Gemini’s key features for investors and traders.

Recurring Buys

Gemini enables you to set up recurring crypto purchases for tokens you want to invest in. You can choose any purchase frequency. Recurring buys are charged the same 2.49% fee as Instant Buy purchases.

Staking

Gemini offers staking on three tokens: ETH, SOL, and MON. Staking APYs are variable, but there’s no minimum amount you need to start staking, and you can unstake your tokens at any time. Gemini deducts a 30% service fee from your staking rewards, which is slightly lower than Coinbase’s standard staking commission.

It’s worth noting that the SEC sued Gemini over its Earn program in 2023. However, the suit was recently settled as part of a broader shift in U.S. crypto regulations.

Futures Trading

Gemini offers perpetual crypto futures trading for users outside the U.S. and UK. There are 25 token pairs available, all of which are traded against the GUSD stablecoin. Leverage is available up to 100x for high liquidity pairs. Gemini doesn’t offer crypto options trading at this time.

Gemini Credit Card

Gemini offers a crypto cashback Mastercard with no annual fee. It earns 4% cashback on gas and transit purchases, 3% cashback on dining, 2% on groceries, and 1% on everything else.

You also get a $200 welcome bonus when you spend $3,000 in the first 90 days after account opening and 10% cashback on purchases from select internet brands. You can choose from any of 50 cryptocurrencies for your cashback and change tokens as often as you like.

The credit card selection on Gemini with varying rates and bonuses. Source: Gemini

Gemini Wallet

Gemini offers two crypto wallets. One is a custodial wallet offered by default to all Gemini customers. When you buy crypto on Gemini, this is where your tokens are held.

The second wallet is Gemini Wallet, a non-custodial Web3 wallet that you can opt into or opt out of. It’s separate from the Gemini exchange, although it’s linked to your Gemini account, so you can buy and sell tokens within the wallet interface.

Gemini Wallet is compatible with tokens and dApps on the Ethereum, Arbitrum, Polygon, Base, and Optimism blockchains. It enables you to connect to decentralized exchanges and other DeFi platforms on these networks for quick token swaps, staking, borrowing, lending, and more. The Gemini Wallet app has its own library of dApps to help you navigate Web3.

If you don’t already have a self-custody wallet and are thinking about using Gemini as your crypto exchange, then Gemini Wallet is worth considering.

However, it doesn’t offer as many features as other popular crypto wallets and only supports a small selection of networks. So, if you’re not using Gemini’s exchange or want to use unsupported networks, you may be better off with an alternative wallet.

Deposits & Withdrawals

Gemini supports deposits by ACH transfer, wire transfer, crypto, debit card, or PayPal. There are no fees for ACH, wire, or crypto deposits, but you’ll pay 3.49% for debit cards and 2.50% for PayPal. There’s no minimum deposit, but debit card and PayPal deposits are limited to a maximum of $1,000 per day.

You can withdraw funds from Gemini by ACH transfer, wire transfer, or crypto transfer. There are no fees for ACH withdrawals, crypto transfers only incur standard network fees, and wire transfer withdrawals cost $25. There’s a limit of $100,000 per day for ACH withdrawals.

Here’s a summary of deposit and withdrawal options.

| Available Methods | Fees | Limits | |

| Deposits | ACH, wire, crypto, debit card, PayPal | Free for ACH, crypto, wires; 3.49% for debit cards and 2.50% for PayPal | No minimum deposit; maximum $1,000 per day for debit cards and PayPal |

| Withdrawals | ACH, wire, crypto | Free for ACH and crypto (network fees apply); $25 for wires | No limit for crypto or wire transfers; $100,000 per day for ACH withdrawals |

How Secure Is Gemini?

Naturally, investors want to know whether the Gemini crypto exchange is safe. Gemini is a U.S.-based crypto exchange with shares publicly traded on the NASDAQ stock exchange. It’s considered highly secure and is regulated in numerous jurisdictions. The company holds a BitLicense from NYDFS and a MiCA license in the EU. All customer funds are backed 1:1 with reserves.

Gemini also takes key steps to protect the platform from cyberattacks. It is certified to the Service Organization Controls (SOC) 1 Type II and SOC 2 Type II standards, which are among the highest levels of cybersecurity certification. It also complies with the ISO 27001 cybersecurity standard.

Your Gemini account is secured with two-factor authentication by default, and you have the option to add a hardware key for additional security. You can also set up a whitelist of accounts for withdrawals.

Customer Support

Gemini offers customer support by email only. The exchange typically responds in about one business day, although this can be problematic if you have an immediate issue with your account. This isn’t uncommon in the crypto space, but some other popular exchanges like Coinbase offer more support options.

For self-directed support, there’s an online knowledge base with articles explaining Gemini’s fees, features, and payment options. It’s fairly comprehensive, but some articles could use a bit more depth, and there are no video tutorials.

Gemini has a large database of helpful information and uptime trackers. Source: Gemini

Account Types

Gemini offers personal and institutional accounts. Personal accounts are designed for most non-business users, including individual investors and traders. Professional crypto traders can also use a personal account.

Institutional accounts are designed for businesses and financial institutions. They offer multiple user roles, support for sub-accounts, and access to Gemini’s trading API. Institutional accounts must be approved by Gemini’s compliance team, which can take up to 7 days.

Who Gemini Is NOT For

Gemini might not be a natural fit for high-frequency or ultra-active traders who prioritize the lowest possible fees. While they will appreciate ActiveTrader for its advanced order types and a wide range of charting tools, our research indicates that the spot trading fees remain higher than those of major global competitors.

Previously, U.S. customers could not get access to crypto derivatives, although this appears to be changing at the time of writing, so this may become a positive in the future.

Gemini may also disappoint users who prefer to operate in a no-KYC environment or seek broader access to altcoins. The current 80+ selection should suit most crypto speculators, but if you are seeking specific projects or the thousands of meme coins out there, you may to keep looking.

Finally, the platform primarily relies on email-based support, with response times typically measured in business days rather than minutes. Therefore, users who value live chat or phone support may find the support features lacking.

How to Use Gemini

Here’s how to get started with Gemini in a few easy steps.

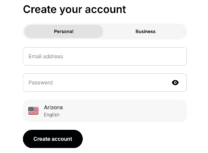

Step 1: Sign Up

The first thing you need to do is create a Gemini account. Head to the exchange’s website and click Get Started. Then enter your email address and a password and click Create Account.

Signing up on Gemini. Source: Gemini

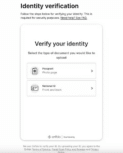

Step 2: Verify Your Account

Gemini requires all new customers to complete Know Your Customer (KYC) checks as part of the account setup process. You won’t be able to deposit funds or trade until you verify your account.

Navigate to your account settings and click Verify Your Identity. Enter the required personal details, including your full name, address, birthday, phone number, and Social Security number. You’ll also need to enter the code that Gemini texts to your phone.

Completing KYC checks on Gemini. Source: Gemini

Then follow the prompts to upload a copy of your driver’s license or passport and a copy of a recent financial statement or utility bill that shows your current address. If prompted, use your device’s camera to take a photo of yourself.

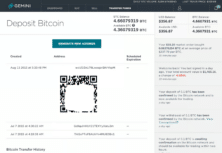

Step 3: Deposit Funds

Next, locate the Transfer button in the upper-right corner of the Gemini dashboard. Click it, then select Deposit into Gemini. Select your preferred deposit method.

For bank transfers or PayPal deposits, you’ll need to connect your account. For crypto deposits, you can select the token you want to transfer and then scan the displayed QR code with your crypto wallet. For debit card deposits, you can simply enter your card details.

How to deposit Bitcoin on Gemini. Source: Gemini

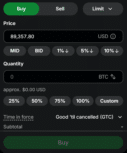

Step 4: Trade

Now you’re ready to start trading cryptocurrencies at Gemini. Open the ActiveTrader platform and select the cryptocurrency pair you want to trade. Using the order form, select Buy and enter the quantity of tokens to purchase. Review your trade, then click Buy to complete your purchase.

Selecting your quantity of BTC on Gemini. Source: Gemini

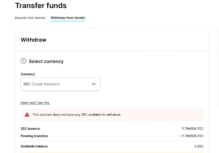

How to Withdraw Crypto on Gemini

When you’re ready to cash out, Gemini makes it easy. If you want to sell your coins and withdraw fiat, navigate to ActiveTrader and select the cryptocurrency you want to sell. In the order form, select Sell and then choose Sell All. Your crypto will immediately be sold, and the funds converted to fiat. If you want to withdraw your crypto instead, skip this step.

Navigate to the Transfer panel and click Withdraw from Gemini. Choose what fiat currency or cryptocurrency you want to withdraw, then enter the amount. Enter your wallet address or bank account information, then confirm your transaction to initiate your withdrawal.

Selecting your cryptocurrency before sending it to an external wallet. Source: Gemini

GUSD Token & Its Relation to Gemini

GUSD token is a USD-backed stablecoin built on the Ethereum blockchain, similar to Tether (USDT) or USD Coin (USDC). It launched in 2018 and today has a total issuance of around $150 million, making it a relatively small asset within this industry.

Gemini is the issuer of GUSD and acts as the custodian for all USD deposited and converted to GUSD. To encourage GUSD usage, Gemini offers free USD to GUSD conversions on its platform. USD deposits held by Gemini earn interest for the company and serve as a source of revenue.

You don’t have to use the GUSD token at all to use most of Gemini’s features. The only exception is futures trading, since all of Gemini’s futures contracts are denominated in GUSD.

Our Gemini Review Methodology

Our Gemini review is based on an in-depth review of this crypto exchange and all of its products and services. Our goal was to determine whether Gemini is a good crypto platform for a wide variety of users.

We opened an account and tested onboarding, the KYC process, the trading interface, Gemini Wallet, and ActiveTrader over a number of weeks, including buying and selling assets and comparing fees against their stated rates.

We did not email customer support, but relied on Gemini’s own documentation and reports from across the web to determine how we felt about email-only support. We did not test the Gemini credit card, but will save that for a future deep dive.

Gemini Review: Final Verdict

Our Gemini exchange review found that this is a trusted U.S. crypto exchange with a wide range of tradeable assets and reasonable fees. However, we expect more advanced users will wish for more than the current range of 80 digital assets on the platform.

That said, with a great reputation for security and an easy interface for people at the start of their crypto journey, there is plenty here to discover and a broad range of the top digital assets available to buy.

We especially liked Gemini’s support for recurring investments and staking, and industry-leading security features. The main downsides of the platform include slightly higher fees relative to competitors and limited customer support options.

FAQ

Is Gemini exchange safe?

Is Gemini a good crypto exchange?

What is Gemini exchange?

Who owns Gemini exchange?

Where is Gemini exchange located?

References

- Tokenized stocks offer new opportunities for investors, but carry unique risks (CNBC)

- Gemini, SEC Strike Tentative Deal To End Gemini Earn Lawsuit (CCN)

- Winklevosses’ Gemini Files for IPO as Crypto Listings Accelerate (Bloomberg)

- Dollar-Cost Averaging (DCA): What It Is, How It Works and Example (Investopedia)

- SOC 2 Type 1 vs Type 2 (SecureFrame)

- What Is Know-Your-Customer (KYC) in Crypto, and Why Do Exchanges Require It? (NotaBene)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

21 mins

21 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.