LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Our Kraken review focuses on the practical questions most users care about, including how much it costs to trade, how the platform approaches security, and how user-friendly the app and Kraken Pro interfaces are.

Kraken is a US-based centralized crypto exchange founded in 2011, which provides access to spot markets and operates under a clear regulatory framework. Our Kraken review focuses on the practical questions most users care about, including how much it costs to trade, how the platform approaches security, and how user-friendly the app and Kraken Pro interfaces are.

To assess this, we tested account creation, KYC verification, fiat deposits, and spot trades across both the Kraken app and Kraken Pro in December 2025. We identified an early trade-off: Kraken’s Instant Buy service charges a 1% fee plus the spread (and payment fees), increasing costs for casual users. In contrast, Kraken Pro uses a tiered maker-taker model, starting at 0.25% maker and 0.40% taker for entry-level trading volumes.

Kraken Quick Verdict

Kraken is ideal for intermediate and advanced users who seek lower trading fees and a strong security track record, especially among top crypto exchanges. Costs are competitive on Kraken Pro, but Instant Buy depends on wider spreads. Availability varies by region, with certain US state restrictions.

Kraken at a Glance

| Category | Details |

| Overall Rating | ⭐8/10 |

| Fees | Low on Kraken Pro (start at 0.25%-0.40%), higher on Instant Buy (1% + spread + extra payment fees) |

| KYC Required | Yes |

| Supported Assets | ~587 crypto assets (region-dependent) |

| Availability | 190+ countries supported (with country/state-level restrictions) |

| Best For | Active traders who want lower fees and custody controls |

| Not Ideal For | Casual buyers who prefer simple interfaces and flat pricing |

Verdict Summary

Overall, Kraken performs well in security controls, has a transparent fee structure on Kraken Pro, and supports a wide range of markets, which contributes to its long-standing market presence. However, higher costs for Instant Buy, a steeper learning curve, and uneven regional access slightly lower its score.

Key Takeaways

- Fees: Kraken Pro maker-taker fees (starting at 0.25%-0.40%) are lower than many US-focused exchanges, but Instant Buy charges a flat 1% fee, plus the spread and extra payment fees.

- Security: There have been no publicly confirmed platform-level security breaches since Kraken’s launch in 2011. The platform uses cold storage and publishes proof-of-reserves reports that verify control of reserve wallets and enable clients to confirm their balances were included.

- Asset Coverage: Over 500 supported assets, with meaningful regional differences. US users generally have access to fewer tokens than users in parts of Europe.

- Availability: A complete list of Kraken supported countries is published on its website, though access may change as local regulations shift. New York and Maine residents are excluded, and access to derivatives is jurisdiction-dependent.

- KYC: Identity verification is mandatory, with higher verification levels required for fiat deposits, withdrawals, and higher account limits.

Who Is Kraken Best For and Who Should Avoid It?

Best For

Kraken is best for active spot traders who use limit orders and trade often. Kraken Pro’s maker-taker fees decrease at higher volume levels, which can make costs more predictable for users executing regular trades.

The platform may also appeal to users who prioritize custody controls and a long operating history. Kraken has operated since 2011 without any publicly reported platform breaches and relies primarily on cold storage, along with proof-of-reserves disclosures.

In certain parts of the world, users may have access to a wider selection of assets and a broader product set, which can also include access to crypto presales through Kraken Launch.

Not Ideal For

Kraken is less suitable for casual buyers who rely on Instant Buy. Spreads are comparatively high, and card-related fees can push total costs above those of flat-fee or broker-style platforms.

US-based users interested in perpetuals or Kraken Pro Futures will face limited access, as Kraken Pro Futures is only available to non-US users. Eligible US clients can access CME-listed crypto futures through Kraken Derivatives US, which is a different product with separate contract coverage.

What Is Kraken?

Kraken is a centralized crypto exchange based in the US and was founded in 2011, making it one of the longest-operating exchanges in the industry. Its core products include spot trading, staking on selected assets, and, for eligible non-US users, margin trading and derivatives such as futures and perpetual contracts. Kraken also supports fiat deposits and withdrawals in multiple currencies.

The platform operates through two primary interfaces: a basic mobile and web app, and a full exchange interface. The standard Kraken smartphone and web app, and its Instant Buy flow, enable a simplified purchase flow for new users. The full exchange interface is known as Kraken Pro, and provides access to order books, advanced order types, charting tools, and tiered maker-taker fees.

Kraken website homepage. Source: Kraken

From a regulatory standpoint, Kraken is a KYC-compliant exchange with registrations and licenses across several jurisdictions, including the US and Europe. It publishes proof-of-reserves attestations and maintains public disclosures around security and compliance. However, these don’t guarantee solvency or eliminate custodial risk entirely.

Kraken Fees Explained: Trading, Spreads & Withdrawals

Trading Fees (Kraken Pro)

On Kraken Pro, users pay maker-taker trading fees that depend on several factors, such as whether an order adds liquidity (maker) or removes it (taker), and the user’s 30-day trading volume.

Kraken Pro spot trading fees range from 0.02% to 0.25% for maker fees and 0.08% to 0.40% for taker fees, with lower rates applying at higher-volume tiers. Exact rates can also vary by the trading pair (for example, stablecoin/FX pairs may price differently).

There’s no code to enter to reduce Kraken Pro trading fees – the only two levers are volume tier and using limit orders when they make sense. A separate discount model exists via Kraken+, but it applies to Buy, Sell, and Convert functions within the basic Kraken mobile app and web interfaces (not Kraken Pro).

Kraken Pro fee structure. Source: Kraken

Spreads & Hidden Costs (Instant Buy, Convert)

Spreads primarily show up within Kraken’s Instant Buy, Sell, and Convert flows. Kraken describes this as a displayed fee plus, where applicable, a spread baked into the quoted price. That spread can vary even for similar transactions because it’s influenced by order size and market conditions.

One hidden cost to note: converting tiny residual balances can trigger a fixed 3% fee when using “Convert Small Balances” below the minimum order size. Users must confirm the quoted rate before conversion, as Kraken applies the cost automatically once the threshold is reached.

Deposits & Withdrawals (Fiat & Crypto)

Kraken’s deposit and withdrawal fees vary by method and region, based on local fiat infrastructure. Kraken lists standard bank-transfer options like SEPA and Faster Payments as free in many cases, while some methods (including card) carry fees.

For USD withdrawals, Kraken lists ACH as free and FedWire at $4 (via supported processors), with times that vary by method. Kraken’s withdrawal fees for crypto depend on the asset and network. Fees are subject to change, and Kraken states the final cost is shown at confirmation.

Real Cost Example (One Trade, One Withdrawal)

To see how Kraken fees work in practice, here’s an example: A user buys $1,000 worth of BTC on Kraken Pro using a market order. If their tier is 0.40% taker, the trading fee is $4.00. The user then withdraws BTC to an external wallet and pays the BTC withdrawal fee shown at confirmation (plus any network-related variability). Their total estimated cost would then be $4.00 plus the withdrawal fee (which is often a few dollars’ worth of BTC).

If the same $1,000 purchase is made via Instant Buy using a card, Kraken prices the trade differently. Kraken displays a single quoted price that already includes a fixed trading fee and a spread relative to the live market rate, and card payments incur an additional processing fee. In practice, the quoted-price model means users pay both an explicit fee and an implicit cost through the execution price.

Kraken Products & Features

Spot Trading

Kraken Pro supports full order-book trading with market, limit, stop-loss, take-profit, trailing stop, and iceberg orders. Only Kraken Pro includes these tools. On the basic Kraken mobile and web app, users can place basic buy and sell orders, including market orders, limit orders, and recurring buys.

Kraken Pro web interface. Source: Kraken

Derivatives

Derivatives access is available through Kraken Derivatives US, which provides CME-listed crypto futures to eligible clients. Only non-US users can access Kraken Pro Futures (perpetuals/international futures), and availability remains subject to local rules.

Earn & Staking

Staking is available on selected Proof-of-Stake assets, with yields that vary by network and jurisdiction. Staking terms are flexible, but Kraken may stake only a portion of allocated funds rather than the full balance. Partial allocation can reduce effective yields compared to self-managed staking options.

Cards & Payments

A crypto-linked payment card is available under the Krak brand, enabling users to spend supported balances at merchants and earn up to 1% cashback (in cash or crypto). Regional restrictions limit availability, and point-of-sale conversions that involve selling crypto can introduce execution costs.

Krak crypto debit card. Source: Kraken

Wallet Model

Assets held on Kraken’s exchange are custodial, meaning Kraken controls the private keys. A separate self-custody mobile wallet is also available, so users can manage their own keys, but must also take responsibility for keeping those keys secure. This is a trade-off that must be considered with any of the best crypto wallets.

App vs Exchange – Key Differences

The Kraken app vs exchange distinction matters because the two interfaces serve different use cases. The main difference between the standard Kraken web and mobile app (including its Instant Buy flow) and Kraken Pro is how trades are priced and executed.

| Feature | App / Instant Buy | Kraken Pro |

| Fees | 1% + spread (and payment processing) | 0.25%-0.40% maker/taker (entry tier) |

| Spreads | Built into the quoted price | None (order book pricing) |

| Order Types | Market, limit, recurring buys | Market, limit, stop-loss, take-profit |

| Target User | Casual buyers, small purchases | Active traders, frequent transactions |

The app focuses on speed and simplicity, with preset purchase amounts and popular payment methods like cards and bank transfers. But that convenience comes at a higher effective cost due to spread-based pricing.

Kraken Pro provides access to order books, advanced order types, and volume-based fee tiers. Although it requires more time to learn how it works, Kraken Pro gives users direct control over execution and helps them avoid spread-based pricing.

What Cryptocurrencies Are Supported on Kraken?

Kraken supports a wide range of crypto assets, with the total number of listings varying by region due to local regulatory requirements. In most markets, users can access BTC and many of the top altcoins, including ETH, SOL, XRP, and ADA. Stablecoins like USDC and (outside the EEA) USDT/DAI are available.

Asset availability differs by location. US users generally have access to a more limited selection, often around 200 assets, while users in parts of Europe and other regions can trade a broader range. Kraken geo-fences some newer or higher-risk tokens (including many of the best meme coins) to stay compliant with local rules.

In select non-US jurisdictions, tokenized US equities and ETFs are available via Kraken’s xStocks feature. However, xStocks is not accessible in the US (or to US Persons), Canada, the UK, or Australia, and access depends on the client’s country of residence.

Is Kraken Safe and Legit? Security & Trust Breakdown

Asset Storage & Controls

For users asking “Is Kraken safe?”, the short answer is that it has a strong track record. Kraken holds most client assets in cold storage and keeps a smaller portion in hot wallets to support withdrawals and daily operations. The exchange also states that it provides controlled access to infrastructure, monitored facilities, and encryption of sensitive account data.

Account-level controls include two-factor authentication (including hardware keys), whitelisting of withdrawal addresses, and Kraken’s Global Settings Lock. This feature adds a time delay to specific security changes if an account is compromised.

Compliance & Regulation

Is Kraken legit? Yes, Kraken operates under KYC and AML requirements, and publishes a jurisdictional overview of its licensing and regulatory status. In Europe, Kraken announced that it has received a MiCA license from the Central Bank of Ireland, enabling services across the EEA through a regulated entity. In the US, Kraken’s disclosures list FinCEN Money Services Business registration for relevant group entities.

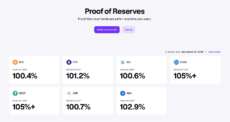

Proof of Reserves & Transparency

Kraken publishes proof-of-reserves attestations that use a Merkle tree to let clients verify inclusion and confirm on-chain control of reserve wallets. Proof of reserves improves transparency, but it’s not a guarantee of future solvency.

Kraken Proof of Reserves information. Source: Kraken

Past Incidents or Controversies

Kraken has not disclosed any exchange-wide breaches resulting in customer fund losses as of the time of writing. The company reported a June 2024 security incident in which nearly $3 million was withdrawn from Kraken-controlled treasury wallets following an exploit tied to a bug-bounty dispute. Still, the company confirmed the exploit did not involve client funds.

Is Kraken Easy to Use? A Look at the User Experience

Onboarding & KYC

Creating an account follows a standard flow: verify your email, complete identity checks, and select a verification level based on what you plan to do. Higher verification tiers unlock features such as fiat funding, higher limits, and access to advanced products where permitted.

Interface Clarity

As noted earlier in this Kraken review, how easy Kraken feels depends on which interface you choose. The main app is designed for simplicity, with basic buy-and-sell options and straightforward funding tools.

Conversely, Kraken Pro is a complete trading interface with order books, charts, and advanced order types. While more capable, it’s visually dense and less approachable for beginners.

Mobile vs Desktop

Kraken maintains separate mobile apps for its standard experience and Kraken Pro. The main app works well for basic account management and simple trades. Kraken Pro mobile includes charting and order book data, but feels constrained for multi-market activity. Desktop is the most practical option for active trading.

Kraken mobile apps. Source: Kraken

Deposits, Withdrawals & Account Limits

Kraken supports multiple fiat funding methods, with region and verification level determining availability, processing times, and limits.

Fiat Methods (Region-Dependent)

- UK: Faster Payments (GBP)

- EU: SEPA bank transfers (EUR)

- US: ACH and Fedwire (USD)

- Global: SWIFT/wire transfers; PayPal in select regions

Card payments are available through Instant Buy, but they carry higher processing fees and are typically subject to additional limits.

Processing Times

- Faster Payments/SEPA: Same day or next business day

- ACH: Typically 1-5 business days; withdrawals may be temporarily restricted after deposits settle

- SWIFT/Wire: Often 1-5 business days, with higher fees

- Crypto Withdrawals: Kraken submits these promptly once approved. Final settlement depends on how congested the network is and how many confirmations it needs

Limits by Verification Level

- Lower Tiers: Crypto-only access with limited functionality

- Mid-Level Verification: Enables fiat deposits and withdrawals, with daily and monthly caps

- Higher Tiers: Increased limits for users requiring larger transfer volumes

Exact limits vary by residency and asset type. Some deposit methods (particularly ACH) may trigger temporary withdrawal holds after funds clear.

Customer Support: Availability, Speed & Common Issues

Kraken’s customer support runs 24/7 via live chat and email, with support from a detailed online help center. Voice support is only available through the Kraken mobile app in select situations, when the “Call us” option appears.

For routine issues, live chat responses are often prompt, with many users reporting connections within minutes. Email and ticket-based support can take much longer. Kraken does not publish guaranteed response times; basic chat queries are often handled faster than escalated cases that require manual review.

Kraken support center. Source: Kraken

User complaints cluster around KYC delays, account restrictions, and withdrawal reviews. For escalated cases, resolution can take several days due to additional compliance checks.

Kraken vs Alternatives: Which Platform Should You Choose?

Kraken vs Binance

Comparing Kraken vs Binance, fees are the main differentiator. Binance’s spot fees start at 0.10%-0.10% (maker-taker) for regular users, with deeper discounts through VIP tiers and paying fees in BNB. In the UK, the FCA has stated that no entity within the Binance Group holds UK authorization to conduct regulated business, which may be relevant to users who prioritize regulatory oversight.

- Choose Kraken if fiat infrastructure, compliance posture, and region-specific access matter more than the lowest spot fees.

- Choose Binance if spot fee minimization is the primary goal.

Kraken vs Coinbase

The Kraken vs Coinbase debate often comes down to cost versus compliance posture. Coinbase is a public company listed on the Nasdaq stock exchange and emphasizes complying with regulators, including MSB registration and standard KYC/AML controls. On the Coinbase Exchange platform, entry-tier fees are shown as 0.40%-0.60% (maker-taker), which can be higher than Kraken Pro for similar activity levels.

- Choose Kraken if lower trading costs and an order-book-based interface are the priority.

- Choose Coinbase if US-facing compliance posture matters more than fees.

Kraken vs Bybit

Bybit focuses on derivatives trading, but it explicitly restricts access in several jurisdictions, including the UK and the US.

- Choose Kraken if spot trading, staking, and bank funding matter more than derivatives.

- Choose Bybit if derivatives are the core use case, and it’s permitted where you live.

How We Tested Kraken

We created and verified a Kraken account in December 2025 by completing Intermediate-level KYC using a government-issued ID and proof of address. Then we tested funding via ACH transfer and card payment using the Instant Buy flow.

We tested spot trading on both the Kraken app and Kraken Pro, set up staking on supported assets, and completed a fiat withdrawal to a US bank account. Following that, we compared Instant Buy pricing directly with order-book execution on Kraken Pro for the same asset and trade size.

We did not test derivatives, margin trading, or xStocks due to regional restrictions, nor did we test OTC services or phone-based customer support.

Final Verdict – Should You Use Kraken?

Our Kraken review found it’s best suited to users who trade regularly and are comfortable using an order-book-based exchange to keep fees down. Kraken Pro’s maker-taker pricing is competitive at higher volumes, and the platform’s long operating history without publicly reported breaches strengthens trust.

But the main trade-off is the price gap between Instant Buy and Pro. Users who rely on Instant Buy face higher effective fees than those trading on Kraken Pro, a gap that catches first-time buyers off guard. Availability also varies by region, and residents of New York and Maine cannot access Kraken.

FAQ

Is Kraken safe and legit?

What are the real fees on Kraken?

Is Kraken available in the US?

Does the Kraken cryptocurrency exchange require KYC?

Does Kraken provide futures trading?

Can I withdraw from Kraken to a bank account?

Does Kraken charge spreads?

How long do Kraken exchange withdrawals take?

Is Kraken good for beginners?

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

18 mins

18 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.