Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

The True Trade Review (2026): Fees, Safety & Who It’s Best For

14 mins

14 mins The True Trade is a perpetual futures DEX on BNB Chain, aimed at traders who want order book-style trading with no KYC. This review examines the platform’s security, usability, and availability to help determine who it’s best suited for.

The True Trade is a perpetual futures DEX on BNB Chain, aimed at traders who want order book-style trading with no KYC. This review examines the platform’s security, usability, and availability to help determine who it’s best suited for.

The True Trade’s key features include high leverage (up to 1001x), transparent fees, and an optional gasless trading mode. Here, trades execute inside the DEX using an internal balance, rather than you signing every trade on-chain.

To evaluate The True Trade, we reviewed its documentation, examined on-chain activity, and tested the live interface. Read on to learn whether it fits your trading style.

The True Trade Quick Verdict

The True Trade is designed for traders who already use self-custody wallets and understand perpetual margin, liquidation, and leverage. Costs can be lower in gasless mode, but the gasless approach comes with different settlement and trust assumptions. Ultra-high leverage (up to 1001x) makes this DEX unsuitable for beginners or anyone trading money they can’t afford to lose.

The True Trade at a Glance

| Category | Details |

| Overall Rating | ⭐8/10 |

| Fees | 0.04% maker / 0.04% taker on standard trades, with a minimum fee of $0.30 on both sides. Gasless mode offers trading without gas fees, but uses an internal balance |

| KYC Required | No ID verification. You can connect a wallet or use an email login, but you’re not asked for ID |

| Supported Assets | Perpetuals only, focused on BTC, ETH, BNB, plus a selection of top altcoins |

| Availability | Accessible via wallets compatible with BNB Chain, but The True Trade technically restricts users from the United States, the United Arab Emirates, Canada, and North Korea |

| Best For | Experienced perpetual traders and scalpers |

| Not Ideal For | Beginners or anyone uncomfortable with extreme leverage |

Verdict Summary

The DEX suits DeFi-native traders who already self-custody and want access to perpetual futures without KYC. The trade-off is an anonymous team and limited operating history, which may be a concern for risk-averse users.

Who Is The True Trade Best For and Who Should Avoid It?

Best For

The True Trade is relevant for users who already trade perpetuals and are happy with self-custody. It fits traders who are comfortable connecting a wallet, managing margin manually, and thinking in terms of execution costs.

Scalpers and short-term traders are the clearest audience, especially those who place frequent trades, where fees and gas would normally eat into profits. It might also appeal to users who value privacy. Traders seeking anonymous crypto exchanges will find the no-KYC model familiar.

Not Ideal For

If you’re new to derivatives, this isn’t the place to learn. The combination of extreme leverage and smart-contract risk leaves little room for mistakes. The True Trade is also a poor fit if you rely on bank deposits or withdrawals, or if you’re looking to buy new cryptocurrencies with fiat.

It’s also important to note that The True Trade technically restricts users from the United States, the United Arab Emirates, Canada, and North Korea.

What Is The True Trade?

The True Trade is an on-chain perpetuals exchange built on the BNB Chain. Its core offering is leveraged perpetual contracts on assets like BTC, ETH, and BNB, alongside a smaller set of altcoins. Trading on The True Trade is non-custodial.

The exchange supports two ways to execute. In standard Web3 mode, you sign on-chain transactions via smart contracts. In gasless mode, eligible trades are executed on the DEX using an internal balance, eliminating blockchain network gas fees. Both the web and desktop apps are interfaces to this same DEX.

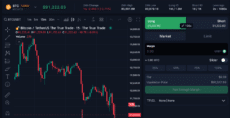

The True Trade exchange interface. Source: The True Trade

From a regulatory perspective, The True Trade positions itself as a no-KYC, non-custodial on-chain protocol that doesn’t support fiat. How regulators treat that model depends on jurisdiction.

The True Trade Fees Explained: Trading, Spreads & Withdrawals

The True Trade fees follow a flat maker/taker schedule, and the official docs don’t mention VIP tiers or volume-based discounts. The DEX also states zero funding fees and zero closing fees.

| Fee Type | Rate |

| Maker | 0.04% |

| Taker | 0.04% |

| Funding | 0% |

| Closing | 0% |

| Minimum fee (per side) | $0.30 |

The platform charges fees on position notional, not margin. For example, if you post 500 USDT margin at 10x, you’re opening a 5,000 USDT position, so the fee is calculated on 5,000 USDT.

Spreads and execution costs vary by market. The True Trade doesn’t publish fixed spreads, so real costs depend on pair and market conditions. Market orders (and aggressive limit orders) typically pay the bid-ask spread in addition to taker fees.

Fewer liquid pairs and volatile periods tend to widen spreads, a dynamic that tends to impact short-term traders more than long-term holders. Traders trying to minimize slippage usually stick to major pairs and use limit orders.

The True Trade fee structure. Source: The True Trade

Deposits and withdrawals depend on the mode. In Web3 mode, you’re not depositing into a custodial account, but you do still make on-chain deposit/withdraw transactions via smart contracts. You also pay the regular BNB Chain gas fee.

In gasless mode, funds sit in a platform balance, and the platform processes withdrawals. You can withdraw USDT via BNB Chain or Tron, and The True Trade automatically deducts a small network fee. In practice, The True Trade withdrawal fees are just that network cost – Web3 mode is regular BNB gas, while gasless withdrawals deduct a small fee automatically from your USDT.

Real Cost Example

Let’s assume a 5,000 USDT BTC/USDT perpetual using a market order:

- Taker fee: 5,000 × 0.04% = 2.00 USDT

- Spread/slippage: depends on liquidity; estimate ~0.25–1.00 USDT on a liquid market

- Close with a limit order: Maker fee = 5,000 × 0.04% = 2.00 USDT

- Withdraw 1,000 USDT from gasless mode: a small network fee is deducted automatically (varies by chain and conditions).

- Total estimated round trip: ~4.25–5.00 USDT (plus network fee).

The True Trade Products & Features

The True Trade is deliberately narrow in scope, focusing on leveraged derivatives rather than a complete exchange suite.

- Perpetual futures are the core product. The DEX supports 50+ perpetual markets, centered on majors like BTC, ETH, and BNB, with a smaller selection of altcoins. Traders can place market and limit orders and use built-in take-profit and stop-loss controls. There’s a “Simple” mode, alongside a more advanced “Pro” view with a real-time order book.

- Spot trading is not offered. You can’t buy or hold assets outright on the platform, which limits its usefulness for long-term investors.

- Cards, payments, and fiat services are not supported. The True Trade is crypto-only, with no bank integrations or payment tools.

The True Trade App vs Exchange – Key Differences

There isn’t a separate “app” and “exchange” experience on The True Trade. All versions (web, mobile, and desktop) are simply different interfaces connecting to the same non-custodial perpetual DEX on BNB Chain.

The choice comes down to how you prefer to trade. Browser and mobile access are more relevant for quick entries and monitoring positions, while the desktop client offers more screen space. None of these interfaces adds extra features; they’re skins on the same DEX.

| Feature | Web/Mobile App | Desktop Client |

| Function | Wallet connection, order placement, position management | Same core functionality |

| Backend | Same DEX protocol (BNB Chain) | Same DEX protocol (BNB Chain) |

| Features | Full access to Web3 and gasless modes | Full access to Web3 and gasless modes |

| Best For | Quick access, mobile devices | Extended charting and multi-tab workflows |

Note: If you see similarly named apps, use the official links from The True Trade site/help center to avoid lookalikes.

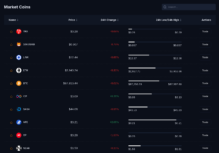

What Cryptocurrencies Are Supported on The True Trade?

The True Trade supports a narrow set of perpetual futures markets, currently around 50 active pairs, though the list changes over time. The focus is on larger crypto assets such as BTC, ETH, and BNB, as well as a selection of large-cap altcoins. Don’t expect the best meme coins here.

The DEX denotes all margin in USDT. In Web3 mode, USDT on BSC (BEP-20) is used; in gasless mode, you deposit and withdraw in USDT via BSC or Tron. Other stablecoins appear in some flows, but USDT is the base for most trades.

The True Trade supported assets. Source: The True Trade

Access is technically permissionless via a compatible wallet, but local regulations can still apply. Users in sanctioned or tightly regulated jurisdictions should be aware that access may be limited.

Is The True Trade Safe and Legit? Security & Trust Breakdown

The True Trade is a real, functioning perpetual DEX with published documentation and a live trading interface. But whether it’s safe depends on which mode you use and how much risk you can tolerate.

Asset Storage & Controls

In Web3 mode, smart contracts execute deposits, withdrawals, and trading actions on-chain, with BNB Chain providing transparency. On-chain settlement removes the classic CEX custody failure mode, but it does not remove smart-contract risk or user-error risk (e.g., bad approvals, signing the wrong transaction).

In gasless mode, you deposit funds into an internal “gasless wallet” balance and later withdraw them. The internal-balance approach removes network (gas) fees, but it adds potential friction to withdrawals compared with pure self-custody.

Compliance & Regulation

The True Trade positions itself as a non-custodial, no-KYC product, and its Terms of Use put the responsibility on users to follow local rules and reserve the right to restrict activity.

Transparency/Proof of Reserves

The True Trade is legit in the sense that Web3 activity can be verified on-chain via BNB Chain explorers. Gasless balances are not the same thing as on-chain Proof of Reserves, and nothing in The True Trade’s documentation guarantees exchange-grade reserves or insurance.

Is The True Trade Easy to Use? A Look at the User Experience

In our test, getting started took under two minutes. You connect a decentralized crypto wallet (such as MetaMask), choose between Web3 or gasless mode, and can place trades immediately. There’s no KYC, even if you access the interface via Google or Telegram.

The True Trade features. Source: The True Trade website

The True Trade’s interface will feel familiar to anyone who has traded perpetuals on a CEX. The interface lays out core elements such as order types, leverage controls, and position management, though the range of leverage options can intimidate beginners. Desktop offers more room for charts and multitasking, while mobile works for monitoring and quick execution.

Deposits, Withdrawals & Account Limits

The True Trade is crypto-only. Fiat deposits and withdrawals aren’t available, so users must fund a wallet via a separate on-ramp before trading. In Web3 mode, you don’t deposit into a custodial account – but you do still approve on-chain deposit/withdraw transactions to add or remove margin. Users can also transfer USDT between Web3 and gasless balances.

In gasless mode, the platform credits funds after a small number of blockchain confirmations, with timing depending on the network used. Gasless mode usually processes withdrawals (with a small network fee) in minutes, but large or flagged withdrawals can take 1-6 hours for review.

Our The True Trade review found there’s no tiered account structure or verification-based limits. Practical constraints include minimum thresholds (gasless deposits start at 10 USDT, and gasless withdrawals have a 20 USDT minimum), plus extra review on unusually large withdrawals.

Customer Support: Availability, Speed & Common Issues

Support is provided via a Help Center with basic guides and FAQs. You can also submit requests through in-app support or contact the team via email. Phone support and a public Discord don’t exist, typical for non-custodial trading platforms.

The True Trade advertises support around the clock, but there’s no published service-level guarantee. Response times vary by issue, with account access and security-related requests taking longer than general questions.

The True Trade help center. Source: The True Trade

Common support topics relate to security checks rather than trading mechanics. Also, risk controls can temporarily restrict transfers or activity, usually for a “cooling off” period.

The True Trade vs Alternatives: Which Platform Should You Choose?

The True Trade vs Uniswap

Uniswap is a spot AMM for token swaps, with pool fee tiers ranging from 0.01% to 1% (plus gas and slippage). It does not offer perpetual futures or shorting.

- Choose The True Trade if you want perpetual futures with leverage and a CEX-like trading interface.

- Choose Uniswap if you want spot swaps and don’t need derivatives.

The True Trade vs dYdX

dYdX runs an order-book perps exchange with volume-based fee tiers and clear restrictions in its software terms.

- Choose The True Trade if you prefer flat fees, a BNB Chain workflow, and the option to trade via gasless mode.

- Choose dYdX if you want tiered fees that reward volume and clearer guardrails around restricted users/jurisdictions.

The True Trade vs GMX

GMX offers perps with open/close fees shown in its docs (0.04%-0.06% per side) and price-impact dynamics tied to liquidity conditions.

- Choose The True Trade if you prioritize maker/taker pricing and the option of gasless execution.

- Choose GMX if you prefer GMX’s perps model and are comfortable with its fee mechanics.

How We Tested The True Trade

We connected MetaMask to BNB Chain and navigated The True Trade interface. We opened the BTC/USDT perpetual order ticket and entered an order size to review the fields shown before submission, including leverage selection, order type controls, and the estimated fee line displayed in the order panel.

BTC/USDT perpetual order ticket. Source: The True Trade

A screenshot was captured at this stage, with the order ready to be placed, to document what the interface shows to users before a live trade. We did not submit a live order for this review, so we did not measure realized fees, slippage, or profit and loss from fills.

The fee schedule and mode-specific mechanics described in this article were cross-checked against the platform’s documentation. Last tested: December 2025.

Final Verdict – Should You Use The True Trade?

The True Trade review makes sense if you’re already comfortable with self-custody, you understand perpetual futures mechanics, and you want perpetuals trading without KYC. Scalpers and high-frequency traders can maximize their gains because gasless mode removes blockchain network fees.

However, the trade-off is trust. You’re trading on a relatively new protocol with limited public info about the team and ultra-high leverage. Those risks may be acceptable for users who size positions carefully and treat this as one tool among many, but this isn’t the place to learn futures for the first time.

Regional users have no regulatory safety net. If something breaks, there’s no ombudsman and no licensed entity to complain to. That’s the price of permissionless access.

FAQ

Is The True Trade safe and legit?

What are The True Trade’s real fees?

Is The True Trade available in the US?

Does The True Trade require KYC?

Can I withdraw from The True Trade to a bank account?

Does The True Trade charge spreads?

How long do The True Trade withdrawals take?

Is The True Trade good for beginners?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 35 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.