Jan’s Web3 Meltdown: Rising Threat of Exit Scams and Smart Contract Flaws

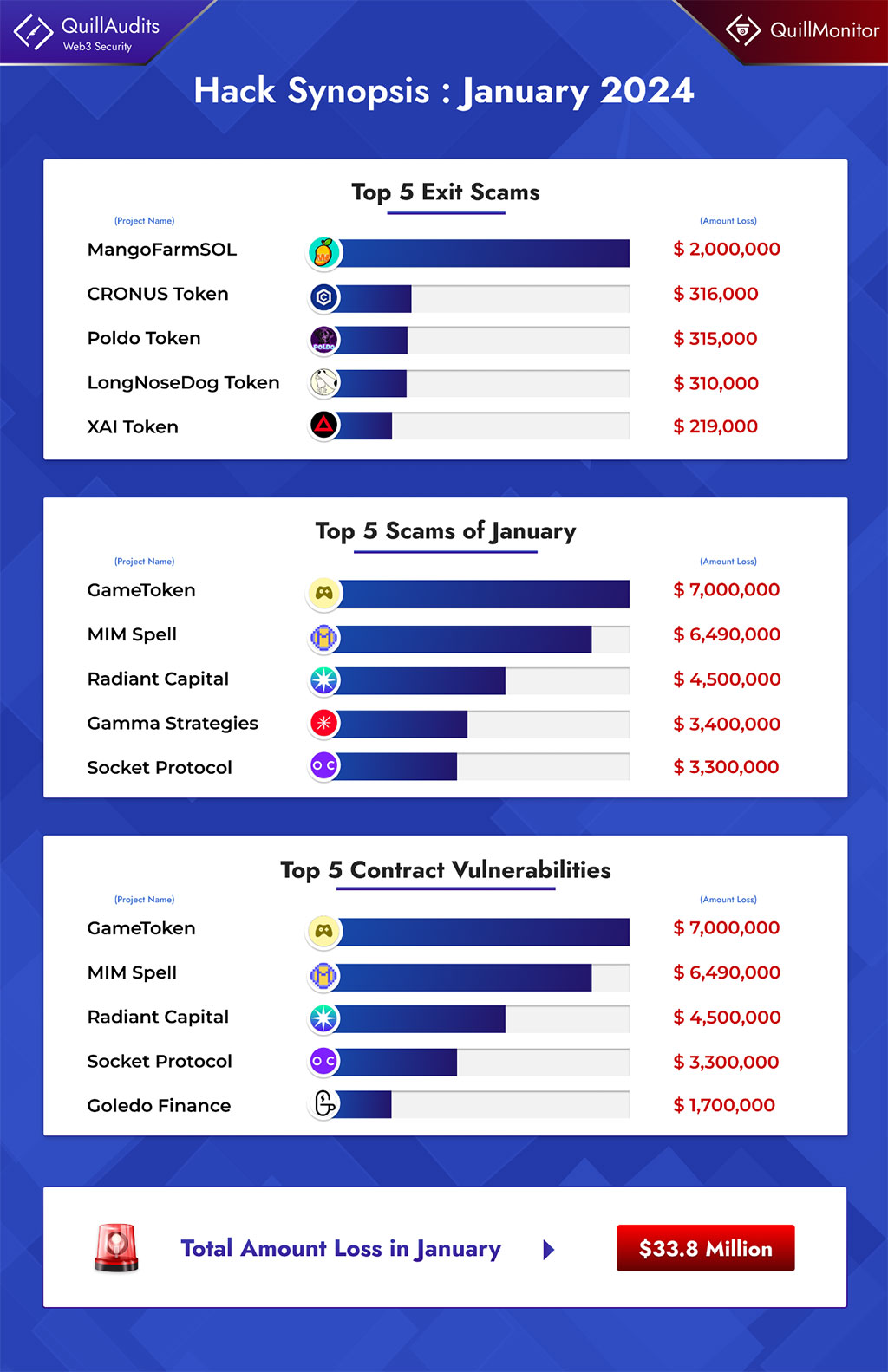

/QuillAudits/ – In January 2024, multiple hacking incidents caused significant crypto losses at the year’s start. Reports from QuillMonitor, an analytics platform focusing on web3 security breaches, indicate that the total losses amounted to $33.8 million across 19 attacks. However, the major impact came from an attack on the personal wallets of Ripple’s CEO, Chris Larsen, which resulted in a staggering $115 million loss.

- After the Chris Larsen Wallet Attack, the total losses for January soared to $148.4 million, marking a 47.3% rise from the previous month’s figures.

- Exit scams and smart contract vulnerabilities were the main factors, with exit scams comprising roughly 36.84% and smart contract hacks about 47.37%.

This highlights a persistent security risk arising from smart contract vulnerabilities, highlights the urgent need for enhanced smart contract security measures and thorough audits.

Apart from this, the month witnessed a range of incidents, from phishing scams to compromised private keys, resulting in considerable losses for various projects.

Talking About the Threat of Exit Scams This Month

Exit scams posed a major challenge to Web3 last year as well, raising doubts about digital asset integrity and reliability. An exit scam involves projects disappearing with investors’ funds, often occurring after or during the ICO period, when promoters fraudulently vanish with the money.

Among them the top exit scams in January were:

- MangoFarmSOL – $2M

- CRONUS Token – $316k

- Poldo Token – $315k

- LongNoseDog Token – $310k

- XAI Token – $219k

These projects gathered substantial investments before suddenly disappearing with investor’s funds, emphasizing the importance of vigilance and careful research among investors.

Determining the Red Flag? How to Spot Them?

To protect against these exit scams, individuals should be cautious and thoroughly research before investing in any project. Resources like QuillCheck can aid in evaluating token reliability and market credibility. Utilizing such resources allows for early detection of potential scam tokens, preventing substantial losses for investors.

Millions Lost: The Impact of Smart Contract Vulnerabilities

Nevertheless, January also contributed its fair share of losses to vulnerable codes, amounting to $23 million. Here are the top hacks in January resulting from smart contract vulnerabilities:

- GameToken – $7M

- MIM Spell – $6.5M

- Radiant Capital – $4.5M

- Socket Protocol – $3.3M

- Goledo Finance – $1.7M

Analyzing Smart Contract Weaknesses

Among the smart contract vulnerabilities prevalent last year, several key patterns were observed this month as well, resulting in notable breaches such as,

Inadequate Input Validation: The validation of user inputs vulnerability in a smart contract occurs when the contract fails to properly validate the inputs provided by users, allowing attackers to exploit this weakness. The Socket Protocol exploit resulted from incomplete user input validation in the WrappedTokenSwapperImpl contract’s performAction function, allowing the theft of $3.3 million.

Rounding Off Issue in Smart Contracts: The rounding off issue in smart contracts refers to a vulnerability that arises from the improper handling of non-whole numbers, leading to unexpected results due to rounding errors.

Security Approach to Coping Up?

To combat the intricate landscape of smart contract vulnerabilities, a multi-layered approach to security becomes imperative:

- AI-Assisted Auditing:AI auditing tools, can serve as built-in security by analyzing code during development, thus boosting protocol security from the start.

- Multiple Audits: Frequent and continuous audits are crucial for ensuring the security and integrity of Web3 protocols by detecting and fixing vulnerabilities at different phases.

End Thoughts

This significant crypto losses in January 2024 highlights the critical need for robust security measures within the Web3 space. It is evident that comprehensive and thorough smart contract audits are essential to safeguard against vulnerabilities and ensure the integrity of digital assets. Firms specializing in smart contract auditing, such as QuillAudits, play a vital role in enhancing the web3 security and protecting investors from potential threats.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.