Solv Ushers in the Next Era of Blockchain and DAO Fundraising through Convertible Vouchers

Solv Protocol takes the next step in helping crypto projects raise funds through its Convertible Vouchers. These vouchers address the illiquidity asset problem for many projects and DAOs, raising the bar of fundraising solutions in this innovative space.

Solv Protocol addresses a crucial pain point for crypto project teams looking to raise capital. Rather than forcing teams to sell their tokens directly or dealing with liquidation risks, the Solv Convertible Vouchers offer a breath of fresh air. The Voucher leverages a project’s native token while zero liquidation risk.

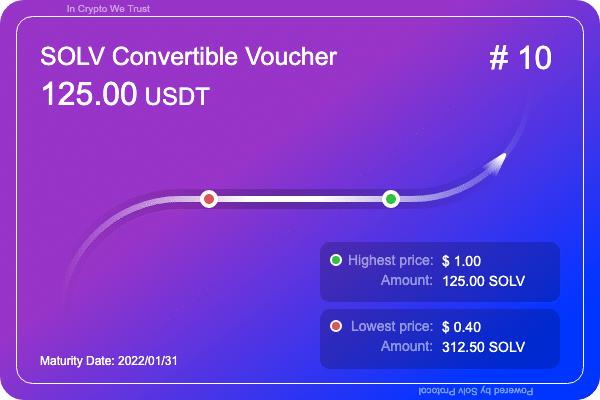

A SOLV Convertible Voucher on Solv Marketplace testnet. DAOs and startups can create an ERC-3525 token containing locked token assets through the Convertible Voucher. Those assets adhere to the maturity date, nominal token value, and bond range.

Once the settlement date for the Convertible Voucher comes up, the Voucher is executed like a bond would be, but only if the price of the native token falls into the bond range. For those holding a Convertible Voucher, it results in receiving a payout from the DAO or crypto startup through stablecoins equivalent to the nominal Voucher value.

However, suppose the native token falls outside of the bonding range. In that case, the investor can redeem the tokens whose amount is determined by calculating the Voucher’s nominal value ratio to either limit of the bonding range.

Solv co-founder Ryan Chow comments:

“Our working experience with many DeFi projects has made us realize a lack of liquid assets and cost-effective financing solutions remains an unresolved issue for those teams. That’s why our team created Convertible Voucher as a new fundraising tool that leverages the projects’ native token. For project teams with relatively illiquid treasury, Convertible Vouchers is an optimal fundraising model with zero liquidation risk, low financing cost, and without having to sell the tokens. As a growing number of DAOs emerge in the market, we believe Convertible Vouchers will fulfill their fundraising needs and thus unlock a potentially trillion-dollar-size market in the DeFi space.”

Through this approach, Solv provides numerous benefits to teams exploring the fundraising option:

- No need to directly sell tokens for DAOs

- No liquidation risk before settlement

- Lower financing costs with more flexible payout options for project teams.

Any project team can mint and issue Convertible Vouchers through the Solv financial NFT marketplace. More importantly, every Voucher can be split, merged, and traded before maturity.

Crypto project teams operating under a traditional Treasury-oriented approach often find themselves with limited liquid assets at their disposal. The Convertible Vouchers let teams leverage their tokens to raise funds. On the other hand, investors can invest in tokens with robust returns and benefit from the option of selling Convertible Vouchers before maturity.

The first project to incorporate Convertible Vouchers is Unslashed Finance, a decentralized insurance protocol. Come January 29; Unslashed will issue its Convertible Vouchers with the equivalent of $1 million as a nominal value. The Vouchers will be available through Solv’s financial NFT marketplace.

Solv continues to push the boundaries of how a crypto startup can raise funds in this modern era. Additionally, the Convertible Voucher is a new way to access funds without selling native tokens, borrowing funds without liquidation risk, and an opportunity for investors to obtain potentially bigger returns with the safety of a bond.

About Solv

Founded in 2020, Solv Protocol is a decentralized marketplace for minting and trading NFTs that represent financial ownership, also known as “vouchers.” Solv aims to resolve one of the most pressing problems in the emerging field of DeFi: the absence of an efficient and flexible tool to express complicated financial contracts. And by bringing vouchers to the table, Solv offsets that gap.

Solv’s team consists of blockchain evangelists, key opinion leaders, seasoned architects in fintech and blockchain, and a veteran DeFi and token researcher.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.