British Petroleum (BP) Reports 70% Drop in Profit in Q2 2023, Raises Dividends by 10%

With falling commodity prices, BP and other oil giants faced significant headwinds taking a major hit on its profits during Q2 2023.

With falling commodity prices, BP and other oil giants faced significant headwinds taking a major hit on its profits during Q2 2023.

Amid lower fossil fuel costs, BP’s profits tanked in comparison to the bumper profits recorded in 2022.

The impressive revenue and profit report by Siemens is proof that legacy companies are seeing a return to normalcy around the world.

The humongous earnings from these oil giants have been criticized by a lot of activists including Amnesty International and Global Witness.

BP apparently saw significant growth across its top and bottom lines. The oil giant said its net debt in the fourth quarter was reduced from $30.6 billion to $21.4 billion.

BP was able to exceed analysts’ expectations in its Q3 2022 profits due to high commodity prices.

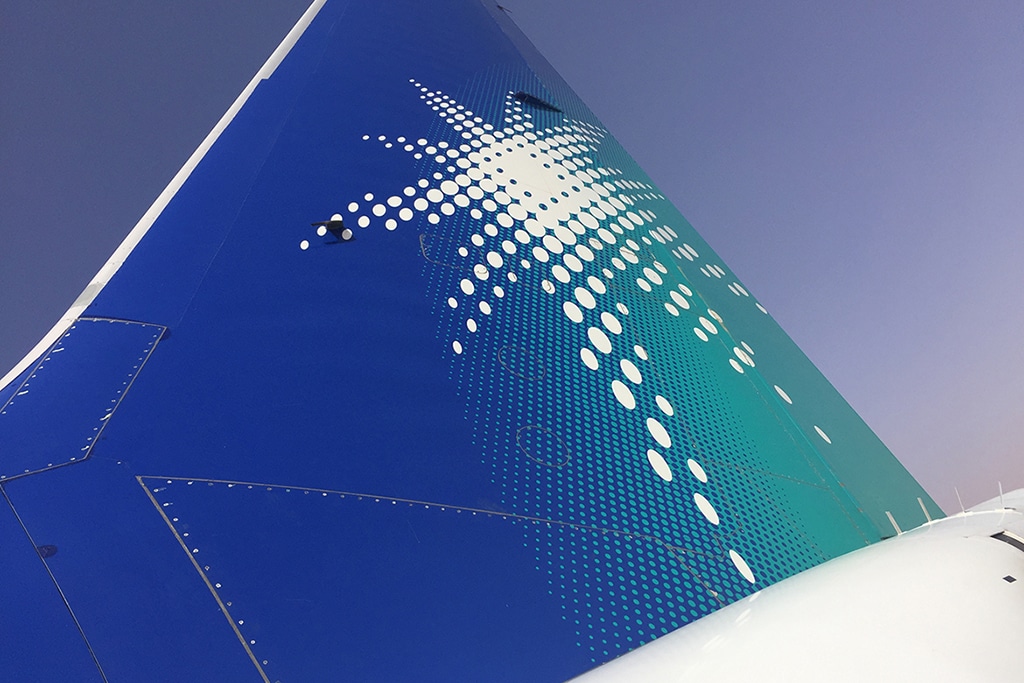

Middle Eastern oil giant Saudi Aramco projects oil demand to further rise following a commendable Q3 2022 report.

BP reported a profit of $9.3 billion, compared with a loss of $20.4 billion for the first quarter of 2022.

Saudi Aramco says its Q1 2022 net profit increased 80%, aided by rising crude prices, higher volumes sold, and improved downstream margins.

BP reported a headline loss of $20.4 billion for the Q1 2022 resulting from its exit from Russia.

Following significant losses in 2020, BP saw massive profits in 2021, recording an annual of $12.85 billion.

British oil company BP rakes in profit in recent quarterly earnings as oil market recovers from pressure exerted by the pandemic.

During the first three months of the year, BP reported that its net debt fell by $5.6 billion to $33.3 billion. Notably, the company hit its target of reducing net debt to $35 billion.

BP CEO said that with the mass rollout of the vaccine, his firm had a positive outlook for the coming year.

BT Group (LON: BT.A), a British Telecom Company has been said to have 47.2% upside potential, and ABN Amro Bank NV (AMS: ABN), a Dutch bank has been said to have an upside potential of 50.6%.