Bitcoin Is Good Hedge in Current Geopolitical Tensions, Says Paul Tudor Jones

Amid the macro developments and geopolitical tensions, Bitcoin has continued to outperform the rest of the crypto market.

Amid the macro developments and geopolitical tensions, Bitcoin has continued to outperform the rest of the crypto market.

While funding is geared at expansion and having enough liquidity for operations, the projected Gemini Exchange funds raised are billed to be used to power its growth plans, as the chances for acquisitions are not being ruled out.

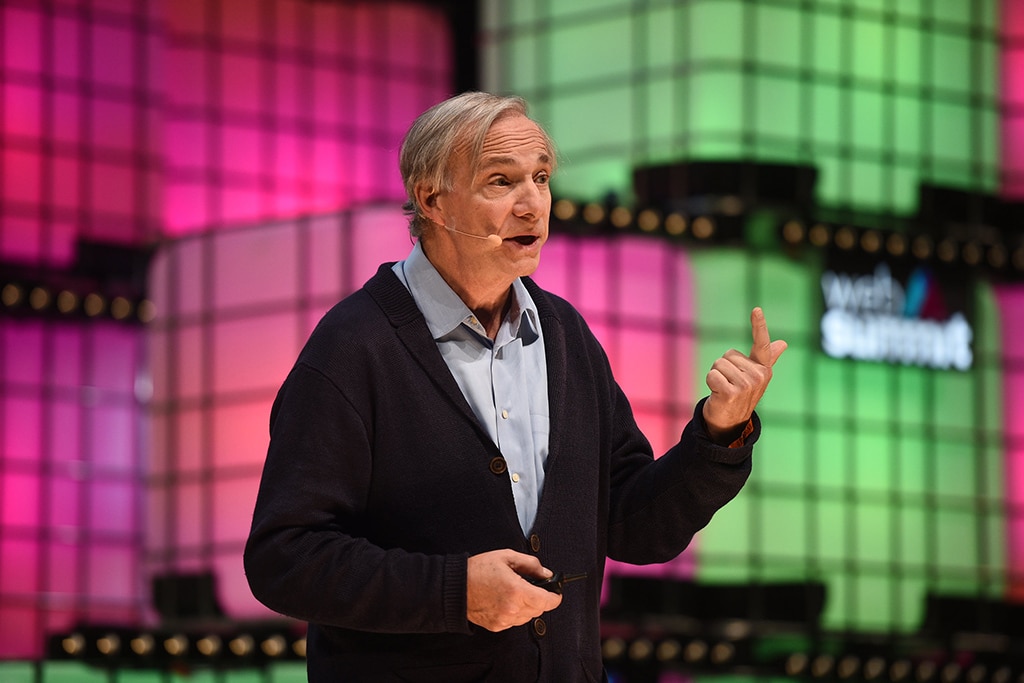

While anticipations are high, billionaire hedge fund manager Paul Tudor Jones warns that a wrong move or comment from the Fed Chairman Jerome Powell could spark a sell-off in risk assets.

The billionaire hedge fund manager also noted that he would go “all-in” on crypto if the US Federal Reserve remains nonchalant about the rising inflation and consumer prices.

The new VC crypto fund managed by Glenn Hutchins has already raised $72 million with investments coming from popular personalities of diverse industries. So far, the fund has already invested in seven startups within the space.

The twins believe that this current rally is sustainable, unlike the previous one which saw the price experience series of falls.

According to the report, Grayscale had about $5.9 billion in assets under management. Interestingly, this has recorded a massive surge to over $10 billion.

Dalio says that Bitcoin’s volatile nature leaves it with fewer use cases as a medium of exchange. He added that he would prefer Gold over Bitcoin.

The banking giant said that Bitcoin is smartly consolidating its strength against the yellow metal and emerging as a potential alternative.

BTC is an asset that appears to be attracting a lot of attention to a specific class of investors. The millennials, mostly, are recognizing the pioneer cryptocurrency as an alternative safe-haven asset.

While Tyler Winklevoss has highlighted the positive tilt of Powell’s policy turnaround as favorable to Bitcoin (BTC), analysts believe the plan to shore up inflation may be good for the economy now.

CoinShares’ total managed funds have now hit $1 billion, with the volume rising to reflect the growing global interest in cryptocurrency.

Bitcoin may surpass a market capitalization of $1 trillion provided that institutional investors join the market and invest a low-single-digit portfolio percentage to BTC.

Bitamp allows to create a new Bitcoin wallets with a click. The company has a lengthy privacy policy that promises not to store or use client data without permission.

Binance.US has launched its own OTC trading desk that can facilitate large value orders without creating volatile price swings and without affecting the normal trading movements.