February 13th, 2026

The CBDC Taskforce has four primary functions which revolve around coordinating the exploration of the objectives, use cases, opportunities, and risks of a potential UK CBDC, guiding the evaluation of the design features and others.

The potential launch of a CBDC following the developmental work being carried out by the Riksbank may not be feasible under current banking laws.

The Central Bank of Japan has confirmed the phase 1 testing of its CBDC. This will see the Bank experiment with the environment and basic functions of the CBDC.

The Bank of Thailand has a harsh stance against the use of stablecoins in the country, and in March, the monetary authority issued a stern warning that it will begin penalizing the usage of any Thai Baht-backed stablecoins.

While a defined date of the digital yuan launch has not been revealed, the current stride of opening up the wallet application to the public is a step closer to achieving the country’s CBDC dreams.

China’s central bank is proposing global rules to synchronize the use of CBDCs worldwide and ensuring “a fair supply of digital currencies” for the greater financial stability of the international monetary system.

In a Reddit ask-me-anything session, Brian disclosed that any digital asset can find its way on their exchange as long as the listing standard is met.

The Bank of Thailand will penalize users for illegal use of stablecoins backed by the Thai Baht without actually taking formal approval from the central bank.

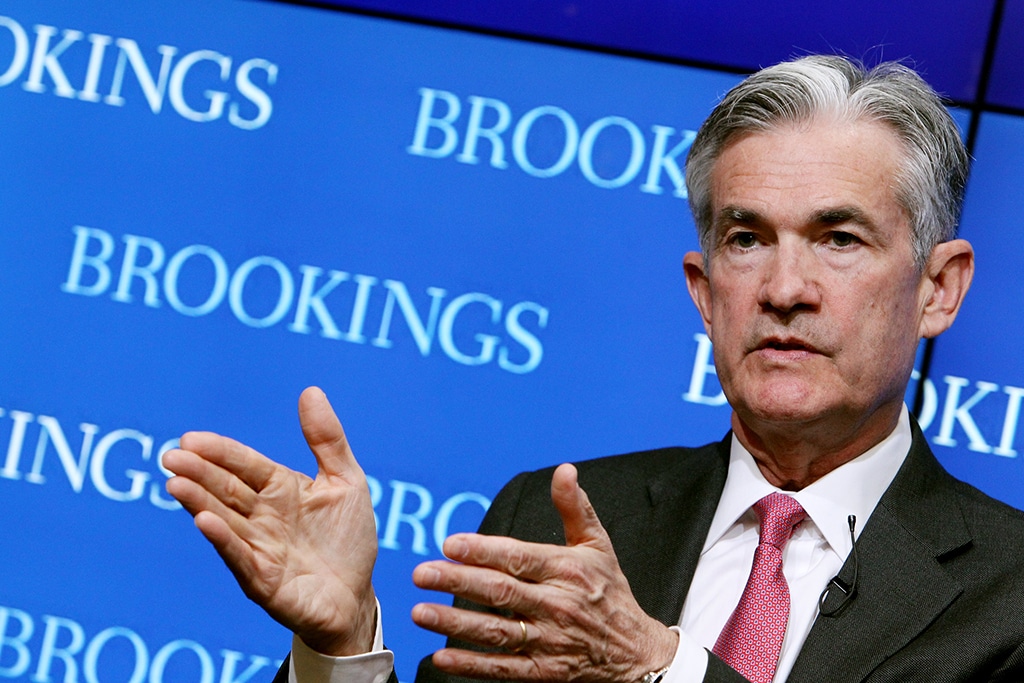

According to Powell, the Covid-19 crisis has not only accelerated the digital payment adoption but also shifted focus to redefine the global cross-border payment system.

Ripple mentions that the Private Ledger will ensure secured and fast transactions at low-costs.

The Federal Reserve chairman said that they would opt for a public-centric approach on cryptocurrencies, however, would proceed with the digital dollar developments only after weighing the risks it poses to the US financial system.

Some other services offered by the Fed were also disrupted some of which include, FedLine Advantage, FedLine Command, FedLine Direct, FedLine Web and FedMail.

The Chengdu lottery will have around 200,000 participants who will receive from $27 to $37.

The bank’s chief also mentioned that the apex bank was making considerable progress with its central bank digital currency (CBDC) project.

Participation in the digital yuan test will provide MyBank and WeBank with new opportunities.