October 23rd, 2025

The crypto market continues unimpressive performance as Bitcoin consolidates below $20k and Ether dips further following post Merge sell-off.

Armstrong said that it is important for Coinbase to be part of crypto advocacy which is an effective tool to increase economic freedom.

Nikhil Wahi got access to confidential information of token listing through his brother Ishan Wahi who was working at Coinbase. Nikhil purchased the assets before the Coinbase listing and made heavy profits as the token value surged.

Fidelity plans to offer brokerage customers Bitcoin exposure as institutional clients maintain BTC interest despite the bear market.

Per the job description, the specialist would be responsible for lining up new corporate clients for the likes of transactional FX, liquidity and treasury services, escrow, and the rest of the payment products.

Now, six users of Tornado Cash are accusing the Treasury Department of violating their constitutional rights, and Coinbase is funding the case.

The new approach is reportedly a strategic way of generating revenue from idle assets on MakerDAO’s balance sheet.

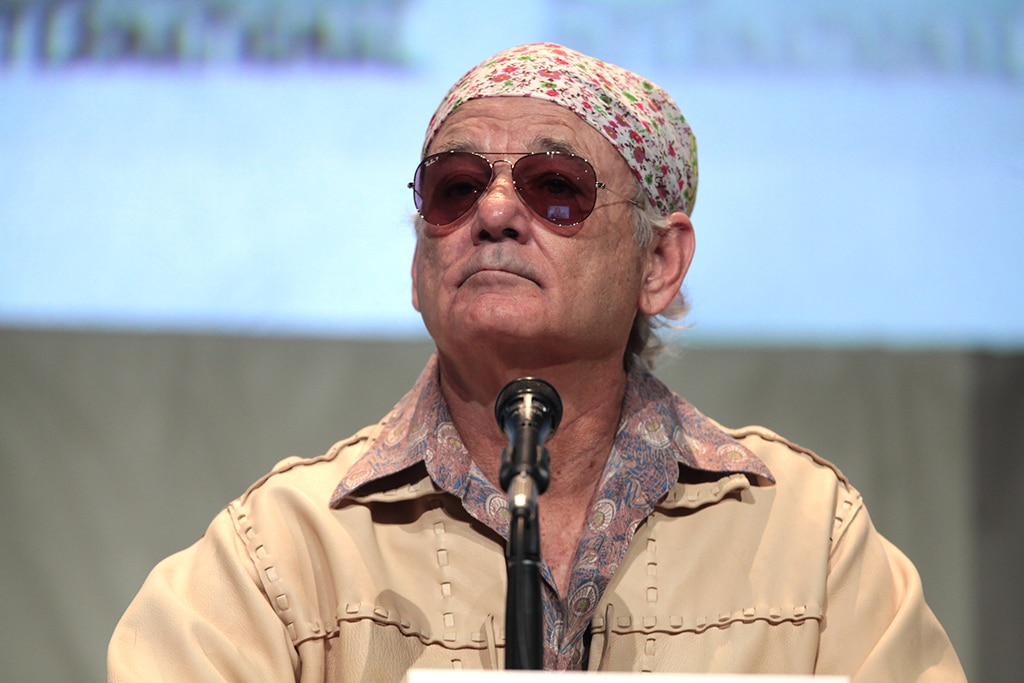

As per reports, the attackers managed to steal NFTs even from Bill Murray’s personal wallet which had more than 800 NFTs.

The Meta-X-Connect (MXC) token is playing a crucial role in the evolution of the decentralized Internet of Things system.

Pursuant to the SAB-121 requirements by the SEC, Credit Suisse has disclosed the amount of “digital assets” in custody but didn’t give the break up of the particular crypto assets.

Coinbase is launching its second derivatives product – the nano ether ETH futures on its derivatives exchange in the coming week.

The crypto exchange and NFT marketplace were beaten for the top spots by payments company Stripe in the first place.

Coinbase believes that its recent voter registration and education initiative will help its users to vote for candidates having strong outlook for crypto initiatives.

With Binance and FTX exchanges now in the mix, things have gotten more interesting in the bid to buy Voyager’s assets.

The cbETH token will give customers the option to sell, transfer, spend, or otherwise use their staked-ETH while it remains locked.