Can Cloud Mining Replace Traditional Savings? A Look at ZA Miner

ZA Miner is a UK-based Bitcoin cloud mining platform offering AI-optimized contracts, green energy infrastructure, and daily payouts.

ZA Miner is a UK-based Bitcoin cloud mining platform offering AI-optimized contracts, green energy infrastructure, and daily payouts.

Web3 has vision and is short on business execution. Why the next wave of crypto success stories will be led by real business developers?

Ukrainian Max Hamaha claimed the title in a dramatic comeback, with his name lighting up the LED boards during El Clásico as the world watched.

With SOL and LINK poised for gains, XYZVerse’s unique sports-focused memecoin aims for massive growth, uniting fans and emphasizing community engagement in the 2025 bull run.

MEXC, the world’s leading cryptocurrency trading platform, announced the listing of the Ethena USDe (USDE) in the Innovation Zone and open USDE-related trading pairs.

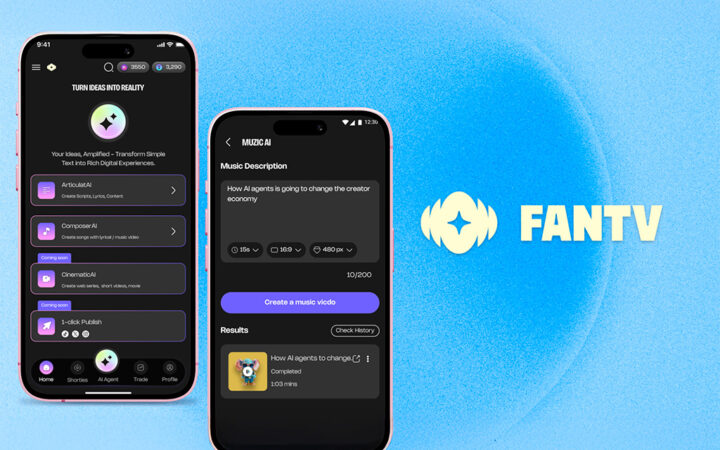

FanTV, the leading AI agent platform for Content on Sui, has raised an additional $3 mn in strategic investment from Mysten Labs, Cypher Capital, CoinSwitch Ventures and Illuminati capital to power its next phase of growth with AI Agents for Content Creation.

As decentralized finance (DeFi) continues to evolve, BrightHub Finance has reached a major milestone — the official launch of its node program.

Last week, the Cables team landed in Hong Kong for Consensus 2025, and the energy was unreal.

MEXC announced that it has purchased $20 million in USDe, Ethena’s synthetic dollar, in a move aimed at promoting broader use and adoption of innovative stablecoins and similar assets within the crypto ecosystem.

Matrixport, the world’s leading, and Asia’s largest one-stop crypto financial services hub, has announced the official launch of its exclusive USD corporate account to provide institutional clients with a smoother and more secure OTC trading experience.

MetaBitcoin Network has introduced Meta-Rollup, a groundbreaking Rollup technology designed for UTXO networks.

The 2025 edition of DigiTech ASEAN Thailand and AI Connect will take place at Hall 7 and Hall 8, IMPACT Exhibition and Convention Centre, Bangkok, Thailand from 19th to 21st November 2025.

MEXC, a leading global cryptocurrency exchange, is excited to announce the launch of its Zero-Fee Trading Zone, offering traders the chance to enjoy 0% Maker and Taker fees on hot trading pairs for a limited time.

XT.COM is excited to announce the listing of UCHAT (UIIC), a Web3 ecosystem token that bridges investors with high-quality startup projects.

MEXC, a leading global cryptocurrency exchange, is thrilled to announce the launch of its highly anticipated Futures Trading Competition, set to take place from February 12 to February 26, 2025.

Here are most trending press releases covering major news of crypto industry. Be the first to find relevant information about latest developments, newly created projects and important breakthroughs made in the sphere.