What Will Bridge Bring to Crypto

Crypto is currently at the diving line between information attributes and financial attributes. Information attributes refer to the extent to which blockchain as a technology really affects the Internet. Can it change the long-term relationship between merchants, users, and middlemen? The financial attributes are currently in a booming situation, and the transaction volume of DeFi and return value are undoubtedly the right scene of on-chain finance. In the early days, our understanding of crypto finance was coin trading. Financing services were the largest application scenario of financial blockchain: IDO, STO and IEO all brought the first cash flow to various projects.

Layer 2 is gradually succeeding Layer 1. As the transaction volume on the chain increases, the security and speed requirements of the network are becoming more and more stringent. In the past, most of the DApps were highly hypothetical. It was assumed that users embraced the scenes imagined by the platform, that the technology was flawless, that the commercial barriers were extremely high, and that the traditional Internet could not solve the pain points raised by the application. When it really reaches more users, these fragile assumptions are difficult to be considered, and the technical strength is the same.

At present, the crypto world are facing a problem: except for the transfer of Layer 1 assets to Layer 2, how do assets on different chains circulate? What can be used to achieve intercommunication between different ecosystems, and can there be a unified standard?

Developers are used to comparing the importance of cross-chain with the TCP/IP of the Internet, precisely because TCP/IP provides a standard for different networks all over the globe. It has standardized how the data should be packaged, addressed, transmitted, routed, and received at the destination, so that global terminals are connected into one net, while local networks in the original structure can also exchange information and assets.

Are cross-net standards not suitable for cross-chain? Is the necessity of cross-chain urgent?

Fragmentation & Isolation

With the maturity of 5G , AI, VR, AR, and IoT, many circuits in the digital industry have shown their own abilities and have moved forward one by one. New technological scenarios of the traditional Internet are still in the early stages. There are still many scenarios between AI and IoT that are not yet connected, and the interaction between many applications with a daily activity of less than one million is almost zero. On-chain applications with AI or Games as the main prospects, their ecosystem is basically in a state of fragmentation. Each of them is like an isolated island.

The eco-fragmentation of the blockchain means that with the rapid development of the blockchain technology, the expansion of business models and transaction volume, and many problems will follow. Different public chains cannot be connected and interoperable due to technology, ecosystem, competition and other reasons. This has brought about the fragmentation of users, assets, applications, and data, forming an “Island Effect.”

Cross-chain has always been one of the difficult problems of the blockchain, because it involves multiple factors such as data intercommunication, consensus conversion, and governance coordination. There has been no unified standard for different blockchain systems in terms of communication protocol, identity management, consensus mechanism, etc. It also increases the difficulty of cross-chain intercommunication. In addition to technical standards, the consensus between different communities is also different, and the subject of assets is also different. Compared with cross-net, the problem that cross-chain needs to solve has one more dimension – asset transfer.

Quantitative Changes Brought by DeFi

According to data from DApp Radar, the amount of DeFi locked up in the past year has surged from around $10 billion to the current $112.1 billion, reaching a peak of $116.4 billion.

A set of data released by nonfungible.com recently shows that the transaction volume of NFT has also made a significant breakthrough in the past 6 months. The transaction volume of OpenSea exceeded $2 billion in September.

Motivated by liquidity mining, DeFi exploded on Ethereum. With the increase in transaction volume, the high transaction fee of Ethereum once became an important factor restricting its eco-development, which also objectively promoted the arrival of multi-chain era. Another reason is that different communities have different views on the development of the crypto market, and their beliefs are also different. Most community organizations advocate starting from zero, building a chain to “change the world”, and managing the crowd with tokens. This is DAO.

Crypto is not just a technology, it is also an Internet native economy, community DAO = DeFi infrastructure + NFT business model + contributors. The DAO is the native company structure of some crypto-economy, and its members gradually fit into the community and become an important element of the community. Members and tokens influence each other and are inseparable from the overall value of the platform. The platform gradually gains huge and long-term value.

Qualitative Changes Brought by MetaVerse & Web3

The game “Fortnite” developed by Epic Game is advancing entertainment activities similar to MetaVerse. Ariana Grande concerts are held in the game, attracting tens of millions of people from all over the world. The MeatVerse is the ultimate form of the Internet in the future. It may gradually weaken the role of human beings on the earth as described by [The Matrix], and gradually migrate the entire human civilization to the virtual world. Like [Free Guy] has imagined, the protagonist of the Internet is still humans, not AI. With the help of VR glasses, MetaVerse can run another set of things that cannot exist in the real world, or something has already gone in the real world. The MetaVerse may be all the forms currently supported by AI, AR, and VR, or it may be presented in other forms.

However, there is a question: can every building, every character, and every identity created in MetaVerse be copied and pasted at will? Is ownership unique? After the emergence of NFT, everything has an answer, and the asset attributes and uniqueness of digital works are marked through non-fungible-tokens. This is also one of the main reasons for the outbreak of the NFT market in 2021. However, the explosion of the MetaVerse finally took the crypto world to another level. The blockchain and the offline economy are now more deeply bound, and a new door is suddenly opened. The future of the crypto market is also expected to be Web 3.0.

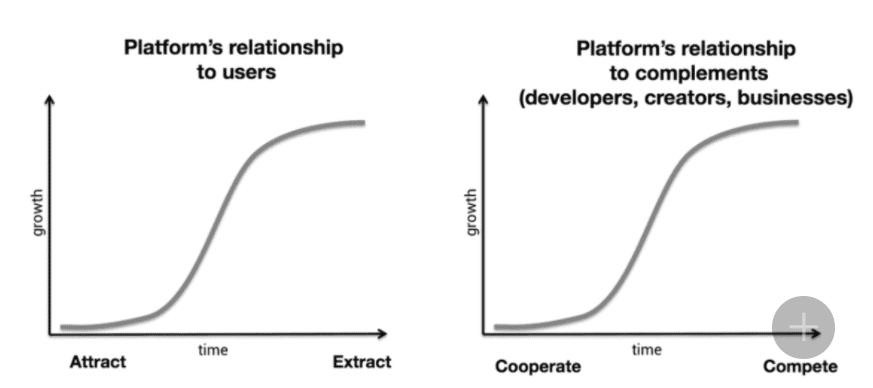

First of all, for the Web 1, Web 2 platform, that is, the traditional centralized Internet platform, Chris Dixon, a16z partner, once described it as follows:

“Centralized platforms follow a predictable life cycle. At first, they did everything possible to recruit users and third-party supplements, such as creators, developers, and companies.”

“As the parameters of the platform move on the adopted S-curve, the parameters of their control over users and third parties are also steadily increasing.”

“When they reach the top of the S-curve, their relationship with network participants will change from a positive-sum relationship to a zero-sum relationship. In order to continue to grow, they have to extract data from users and compete with (previous) partners.”

This contradiction is becoming more and more obvious. The well-known examples are: Microsoft vs. Netscape, Google vs. Yelp, Facebook vs. Zynga, and Epic Games vs. Apple Inc not long ago.

The obvious trend of the primary Web 3 platform is that users have very strong autonomy and attach great importance to the ownership and interests, which is not felt in the Web 2.0 era. We can see is the Web3 ecosystem led by the DAO organization: members contribute content, there is no fixed management organization, and all decisions are made by members voting. The current performance in the blockchain field is relatively prominent. Perhaps that time was also when MetaVerse deeply touces the audience. At present, many public chains such as Ethereum and Plian can be regarded as a decentralized global computer owned and operated by the community.

Web3.0 implements basic functions such as data storage, privacy protection, and identity authentication through the protocol layer. Web 3.0 is user-autonomous, and the motivation for all this is also because of the decentralized network, so that the maximum of digital assets belongs to creators and rights holders. Web 3.0 attempts to solve the problems of profit distribution and resource circulation accumulated in the period of Web 1.0 and Web 2.0. The breakthrough lies in users. Only when hundreds of millions of users begin to understand how to control their own information and rights, can the Internet truly gain order. Crypto just came out because of the same mission!

Asset Activity

Most public chain assets that we are familiar with can be exchanged at real-time prices, and there is not much contact, let alone interaction. This attribute of NFT assets is also very strong. In the initial stage, each NFT can only be regarded as a digital collection, and its value will not be affected due to any changes in the community. After the popularity of Loot, everyone saw the creative passion of DAO, with community building as the main driving force, and left the development direction of the platform and the value growth of individual works to the community members to decide. And every NFT work is connected, and they form a complete system.

This is not just an innovation in a business model, but also a change in the consciousness of the crypto world. That is to say, in addition to each community member’s initiative to contribute to the community and build a MetaVerse for themselves, there is also a very important point — whether it is a NFT or a fungible token, they do not need to be isolated islands, but can interact each other.

This goes back to what was mentioned at the beginning of the article. Is the cross-network standard not suitable for cross-chain? Is the necessity of cross-chain urgent?

What Will Bridge Bring to Us

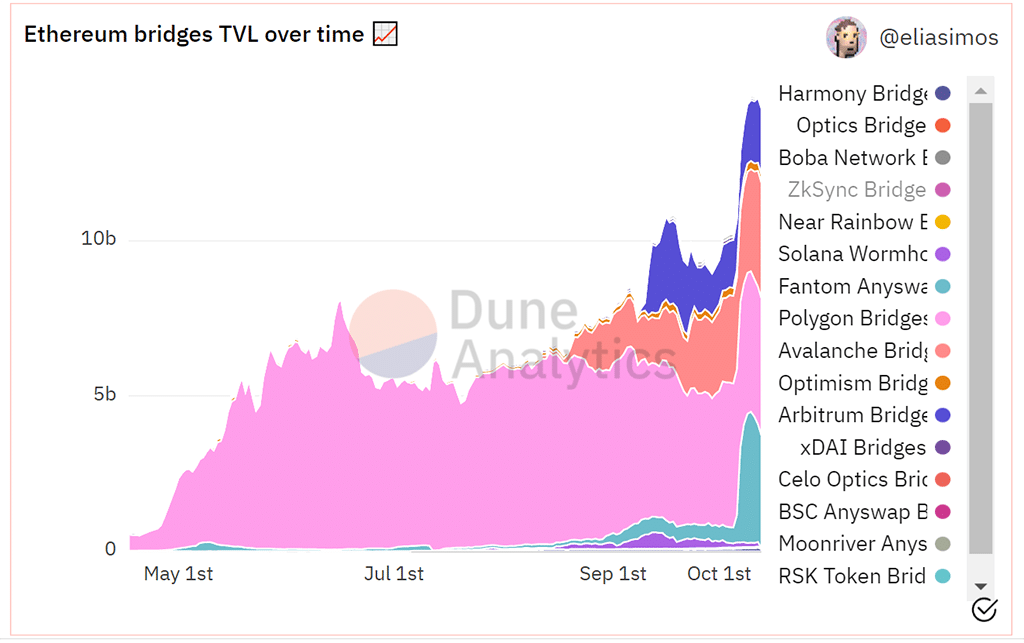

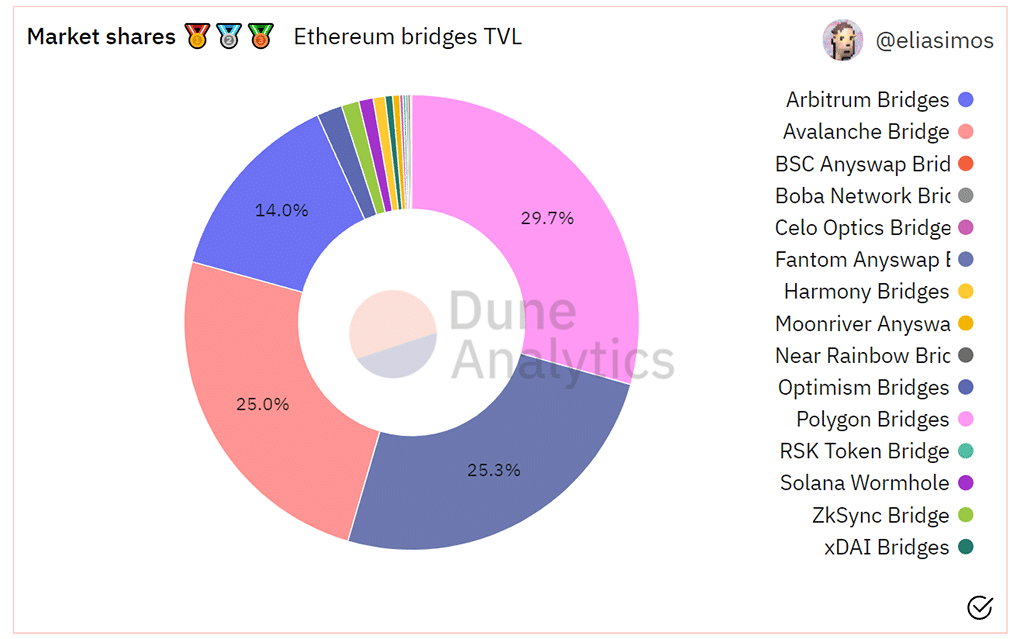

You can see a set of data comparisons from Dune Analytics

- The recent development of cross-chain bridges is so fast, and the TVL amount in the last 30 days has increased by more than 35%;

- The current TVL amount of 14 cross-chain bridges has reached approximately $13.18 billion, which is currently about 6.26% of TVL amount of DeFi;

- The total TVL volume of the Ethereum Bridge has soared in the past 6 months, with the TVL of Polygon Bridges being the most prominent;

- When it comes to specific market shares, several top projects account for half of the country.

This is indeed the TVL amount of the crypto bridge, indicating that users are more inclined to choose the Ethereum bridge when it comes to asset issues. On the one hand, cross-net standards are not suitable for cross-chain, because the bottom layer of the chain is completely distributed, and it is difficult to use centralized standards to standardize decentralized net.

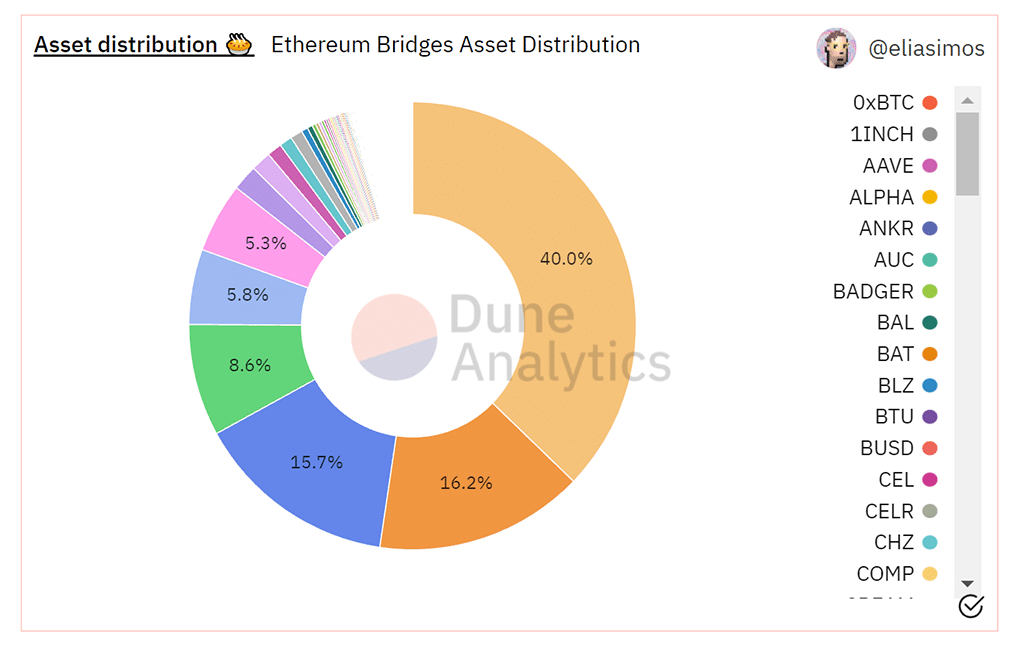

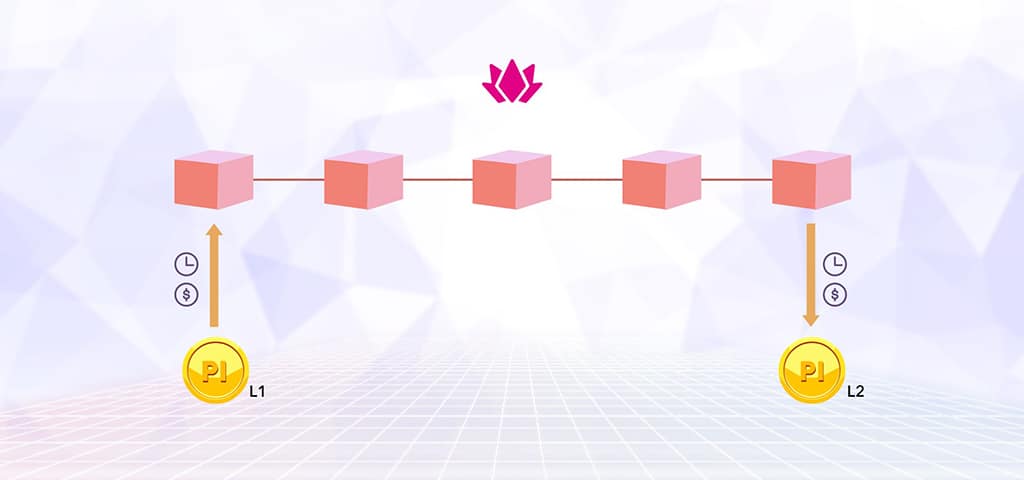

Many Layer 1 blockchains need to use bridges to connect to any other system. Cross-chain bridges occupy an important position in asset extradition and are therefore very valuable. The cross-chain bridge is to provide a channel between 2 different chains to host the original assets on this bridge. At the same time, one chain can obtain the asset transaction status on the other through the oracle function, mapping according to the ratio of 1:1 to another chain. The effect of cross-chain bridge formation is to allow 2 chains to circulate the same asset. The assets crossing the chains are mapped from the original assets. For example, BETH is the mapping asset of ETH crossing to BSC through Binance Bridge. Usually the Layer2 team will provide official cross-chain bridges, and security is the biggest advantage.

The bridge should meet the following basic conditions to help projects, public chains, wallets, etc. to cross the chains and then achieve decentralized circulation between different ecosystems:

- support the cross-chain and circulation of ecological assets of any heterogeneous chain and homogeneous chain

- compatible with various cross-chain technologies and standards

- realize the interoperability of blockchain applications between different chains

Interaction between Chains

The initial purpose of cross-chain is to solve the problem of eco-islands that has been emphasized in this paper, and to open up the data isolation state between various public chains. Assets can’t be exchanged on the chain, resources can’t flow, and even the same person has different identities in different ecosystems. On the one hand, this will increase the bubble in the crypto industry; on the other hand, the asset activity will continue to decline until the end of the economic system collapse, because the assets on the chain will not have continuous resources, ideas, and comprehensive information input.

At present, most of the cross-chain bridges on the market are mostly 2-layer extended cross-chain bridges, and they are mainly built on Ethereum. In addition, there are some chain-specific cross-chain bridges, which are mainly aimed at achieving interconnection with Ethereum.

Cross-chain of DeFi Assets

The most important part of cross-chain business is cross-chain of tokens. Especially in the DAO era, not only the structure of the currency system or trading platform is gradually decentralized, but also the group organization is slowly becoming weaker. When centralized management is completely weakened, the demand for DeFi will become higher and higher. The applicable fields include NFT transactions, games and LP swaps. With the increase in transaction volume, the transaction fees of a certain public chain will rise, and the security and speed will be weakened. Regardless of whether it is due to the the share of pressure or cutting the market pie, the trend of multi-chain advancing is inevitable, and the proposition of cross-chain will become bigger and bigger.

At present, many cross-chain bridges use the smart contract model. Due to the security vulnerabilities of smart contracts, hacker attacks frequently occur. Smart contracts may be a good solution for small cross-chain scenarios, but there are many situations where you still need to choose public chain cross-chain. When users need to transfer chain assets between chains, multi-signature is a quite right solution.

Each user’s address is independent, the transaction and fund details of the Pbridge cross-chain process are completely visible on the chain, and the cross-chain process of any asset is completely transparent to ensure the safety of user’s assets and nothing centralized process.

At the same time, the NFT project initiated in 2021 tends to create NFT on Layer 2. NFT is only used to mark the right and value of digital creations. If it stays at the auction stage, the problem is not big. But when it comes to the secondary market, L2 NFT can’t migrate to L1, which leads to the problem of NFT islands, and the importance of cross-chain bridges is conspicuous once again.

About PBridge

PBridge is a cross-chain bridge officially launched by Plian Layer2, which are mainly used to solve the problem between Plian L1 chain and L2 chain(internal), as well as between Plian and other chains (external, such as BTC, Ethereum, Binance smart chain, Dfinity, etc.). The circulation of assets between them and cross-chain interoperability are all linked by PBridge. According to the classification of mechanisms for verifying cross-chain transactions, PBridge is a native verification. The biggest advantage of PBridge is high security. The technical architecture of belongs to the Sidechain/Relayer mechanism. At the same time, it has pioneered the integration of Sidechain and Relayer, while reducing message communication and the loss rate of cross-chain, and improving the overall cross-chain performance.

PBridge is developed based on Cosmos-sdk and inherits cosmos’s native IBC cross-chain protocol, which can seamlessly connect to the Cosmos network and support lightweight adaptation to various heterogeneous blockchain networks. The PBridge adopts a variety of pluggable cross-chain message signature confirmation mechanisms (supports multi-signature, secure multi-party calculation, etc.), which is fast and safe. It also supports multi-currency protocols (ERC20, ERC721, ERC1155, etc.) to meet the characteristics of asset information interaction, security and compatibility with the protocols, applications, and transactions on various public chains.

There are 2 DApps on Plian: decentralized exchange Paiswap and NFT trading platform Pizzap. After Paiswap launching, many users have encountered technical problems around assets transfering between L1 and L2. The core reason is that, in addition to the current technology limitation of crypto, cross-chain user education is actually a problem worthy of careful consideration. At the same time, the scale of cross-chain assets is also getting larger and larger, and it has become the favorite target of hackers. In August of this year(2021), a cross-chain application was hacked by a security incident– O3 Swap was stolen 160 million dollars, which caused panic in the entire industry. In comparison, PBridge’s technical support will always pay most attention on security.

In the later period of Paiswap, in addition to the PBridge, the aggregation protocol will also be used to realize the liquidity of assets between different chains. Through the cross-chain protocol to create a cross-chain transaction pool, Paiswap Hub, users can realize the transaction of different blockchain assets through it, or they can choose to provide liquidity for the cross-chain pool to obtain PNFT rewards. When users actually “cross the chain”, most cross-chain protocols can only realize the circulation of the same asset between different chains. But Paiswap can realize the circulation of different assets between different chains, that is, token X is transferred out of A network, and token Y is received on B network.

End

In 2020, the explosion of the DeFi market has brought new strengths to public chains: user confidence, gameplay, traditional financial market resources, and decentralized players’ brainpower. In 2021, the prosperity of NFT trading and the popularity of MetaVerse have given blockchain practitioners a lot of new ideas: DAO is forming a new economy, and the game’s economic system is appropriately migrating to the MetaVerse. A unified message is that the capital market has been sparing no effort in the crypto market.

Just like the thinking brought by DeFi, more funds, more transaction volume, and more crypto members joining means a greater test of security and speed, as well as the consequent increase in transaction costs. It is the reason why cross-chain is beginning to get attention. Reversely, when the cross-chain bridge solves the problems of security, speed, and Asset Activity for the public chain, will it be possible to usher in a new round of explosions for the crypto market? Maybe many new stories will happen from the application side.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.