Why Decentralized Derivatives are the Second Half of DeFi – SheepDex

The connotation of DeFi decentralized finance, in a narrow sense, is ‘using decentralized network to transform traditional financial products into disintermediated, trusted and transparent protocols’. We believe that DeFi’s more ambitious vision is to realize the so-called ‘Universal Market Access’. Allowing anyone in the world with access to the Internet to own or trade any financial asset openly.

From recent DeFi market we can see the big bang is very remarkable characteristics, from decentralized deal DEX, stable currency, leverage, synthesis of assets to the emerging insurance products, with strong liquidity can dig the potential energy, with one hundred times the speed of the real world DeFi are transforming the traditional financial products for the process in the form of agreement,More sophisticated, structured financial instruments are beginning to penetrate the DeFi market, but the DeFi space is still ‘Lego-like’, modular, and the underlying products and services are not yet complete enough to be called a ‘decentralized financial market’.

Similar to the characteristics of the development of traditional financial products, the current DeFi market boom is a typical expansion based on “cDOS”, including the very familiar overmortgage rate and liquidity mining often occur in layers of nested mining design, in the DeFi mechanism design that claims no need for trust,At present, we can only rely on overcollateralization to avoid the judgment of the credit of the main body. Therefore, cDOS are the most information insensitive financial product structure design in essence.

DeFi boom over the past two months, liquidity support mining assets in general can be divided into the basis of transaction fees, borrowing spreads income and governance tokens, nested types, we have been witnessing, once the basis of the underlying assets (or “productivity”) is not enough to support the credit boom, the risk of a similar “financial crisis” itself will appear.

So for the DeFi market to truly grow, the underlying assets with real cash returns remain the most important building blocks.

Both in traditional financial markets and decentralized financial markets, the demand for “safe” assets and liquidity is persistent and stable, also based on CDOS. In traditional financial market we can see that the short-term debt guaranty of monetary assets, long-term debt, based on the buyback or based on sovereign credit asset securitization of currency or MBS, ABS, such as assets, and on this basis, formed the scale, rich tool of financial derivatives market, to rise to the risk transfer, pricing, and strengthen the role of market liquidity, thus forming a whole systemic financial market.

Whether we expect the DeFi market to swallow the CeFi market or to see the merging of two parallel universes, the need for “safe” assets, liquidity and risk pricing from DeFi users is equally pressing.

In the current DeFi market, we can see that there are stable currency USDC or collateralized debt obligation position DAI as certain “safe” assets. Because crypto assets are more original and have unique asset attributes, aside from technical issues, only from the perspective of financial products,At present, basic financial instruments and pricing mechanisms such as income structure, interest rate structure and volatility structure in the entire DeFi market are still missing. In the process of mapping traditional financial market products, it is inevitable to meet the challenge of building decentralized financial derivatives.

DeFi that Lacks Derivatives Markets is Always Immature

From the perspective of DeFi ecological evolution, we watch the synthetic asset track position as a financial asset exposure, even synthetic asset itself is one of the types of financial derivatives tokens, and at the same time more bullish on decentralized derivatives markets for decentralized, primordial ‘safe’ assets processing, circulation and risk transfer, the core of the capital pricing function, to some extent,In order to realize the completion of the entire DeFi universe finance.

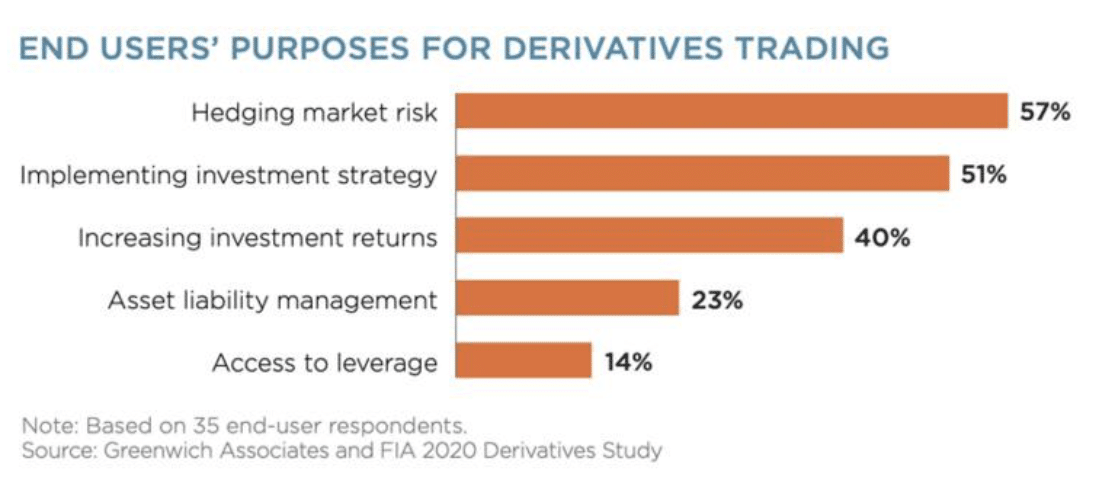

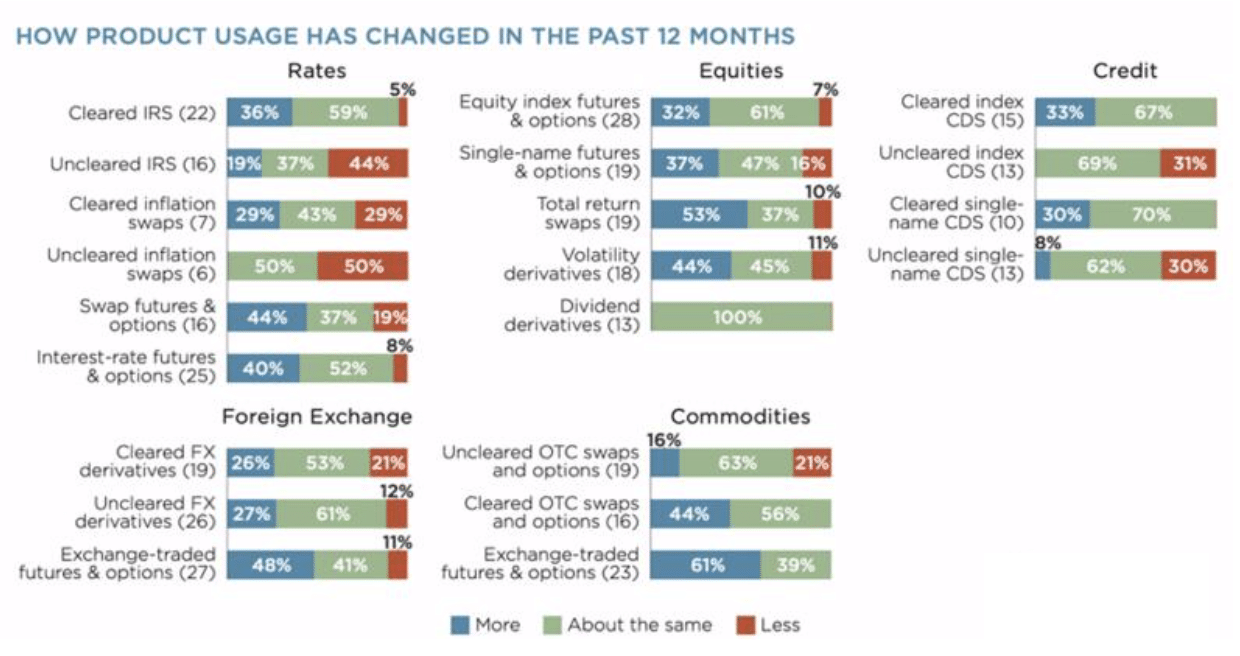

The concept of financial derivatives is actually quite broad, mainly including swap contracts, forwards, futures and options, etc. The underlying assets cover asset categories such as interest rate, equity, foreign exchange and commodities. They are widely used to balance position risk and investment management needs such as liquidity, hedging and leverage.According to BIS data statistics, the global financial derivatives market size is more than unimaginable, more than 10 times the global GDP, and the market size keeps growing rapidly.

We are strongly bullish on the decentralized derivatives track, not only because of the profit opportunities from the short-term business perspective of decentralized derivatives projects and the share of the profits from the central derivatives giants such as Binance, FTX, BitMEX and Deribit. More importantly, from the perspective of long-term values, the decentralized derivatives market has huge potential in scale, occupying the core of DeFi’s ecological core and industrial chain. It will be the most difficult piece of “jigsaw” for DeFi to conquer and finally build, but also the “jigsaw” with the most lucrative dividends.

The Combination of Derivatives Agreements Creates Financial Products with Rich Risk-return Characteristics

The booming development of decentralized derivative agreements will break the “island” of DeFi agreements, and the combination of “Lego-style” and “modular” DeFi agreements will give birth to more promising trend opportunities. We believe we can soon see similar trends in the market:

MCDEX plans to launch structured products based on decentralized perpetual contracts, enabling users to gain trading profits from automated trading bots/social trading smart contracts.

FinNexus Option Agreement plans to launch to hedge UniSwap-LP against uncompensated losses in AMM market making;

The emergence of IRS (Interest Rate Swap) market (such as Horizon.Finance) can be combined with Option/futures contracts to replicate the classic OBPI (Option Based Portfolio Insurance) strategy in the traditional financial market. Provide enhanced fixed income products and structured products for DeFi market.

SheepDex is a decentralized cross-chain liquidity aggregation platform based on the integration of spot and derivatives on BSC (Binance Smart Chain). Unlike other decentralized exchanges that focus on spot, it is the first DEFI products where spot and derivatives coexist. Participating in SheepDex can obtain LP rewards and transaction mining rewards, while allowing liquidity providers (LPs) to deploy funds within a certain price range in trading pairs, and reward transaction fund providers, thereby improving the utilization efficiency of funds, further focusing on the depth of transactions, providing end users with better liquidity, and promoting the transaction and clearing of derivatives. Among SheepDex’s derivatives products, perpetual contracts with no funding rate are the core innovative products, and contract products such as leveraged tokens will continue to be launched. SheepDex aims to be a decentralized Binance.

These portfolios will map the ecological structure of traditional financial markets from the level of financial products, thus providing richer asset classes for the DeFi world and flattening the current volatile yield curve in the DeFi world

The Expertise and Sophistication of Decentralized Derivatives will Redefine the Business Model of Asset Management

The traditional financial market generally faces the principal agent, diligence and responsibility of investors and managers, and other problems. In DeFi and the non-custodian property of assets of decentralized financial derivatives, the business model of traditional financial institutions as asset managers and third-party custodians will usher in changes.

In the short term, as the current DeFi market’s machine gun pool strategy tends to be homogenized and the expected return rate declines, the machine gun pool will soon compete with each other for the strategic ability of financial products, and the machine gun pool project which is only limited to liquid mining will soon lose its market competitiveness. We see that DFI. Communities such as SheepDex is already discussing richer investment strategies and are planning to launch derivatives based strategies to provide clients with a richer risk-return matrix.

In the long term, the richness of financial products in DeFi market and the improvement of market depth will further enhance the demand of DeFi users for investment and wealth management tools and services. Decentralized active asset management protocols such as dHedge and Set Protocol and investment advisory protocols will also welcome great potential development opportunities.

The financial products that only map the traditional financial market in a decentralized way are not the true meaning of DeFi and decentralized agreements. The development of decentralized derivative agreements will be unprecedented, and the organizational relationship of asset management, which has been unchanged for more than 100 years, will be redefined in a trend.

To realize the vision of allowing anyone in the world with access to the Internet to freely own or trade any financial asset that we really want.

For more news and latest updates please visit SheepDex Telegram and Twitter accounts.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.