The Problem With Web 2.0

The web as we know it today is as easy to use as it has ever been. Services and apps are simple, accessible, easy to understand, and highly functional. We can connect with anyone, anywhere at any time, and best of all, these services are (mostly) free.

But there is a catch.

As elucidated by the recent Netflix documentary The Social Dilemma, If you don’t pay for the product. You are the product.

Web 2.0’s downfall is exactly this. The platforms, at least the big ones like Facebook and Google, survive off the ownership of your information. They are free to use, so they need to make money somewhere. And they would be nothing without users like you: creating content for them, growing followers, searching for things, posting daily, these are all activities that give services the ammo they need to sell ads at alarming rates that generate even more alarming revenues.

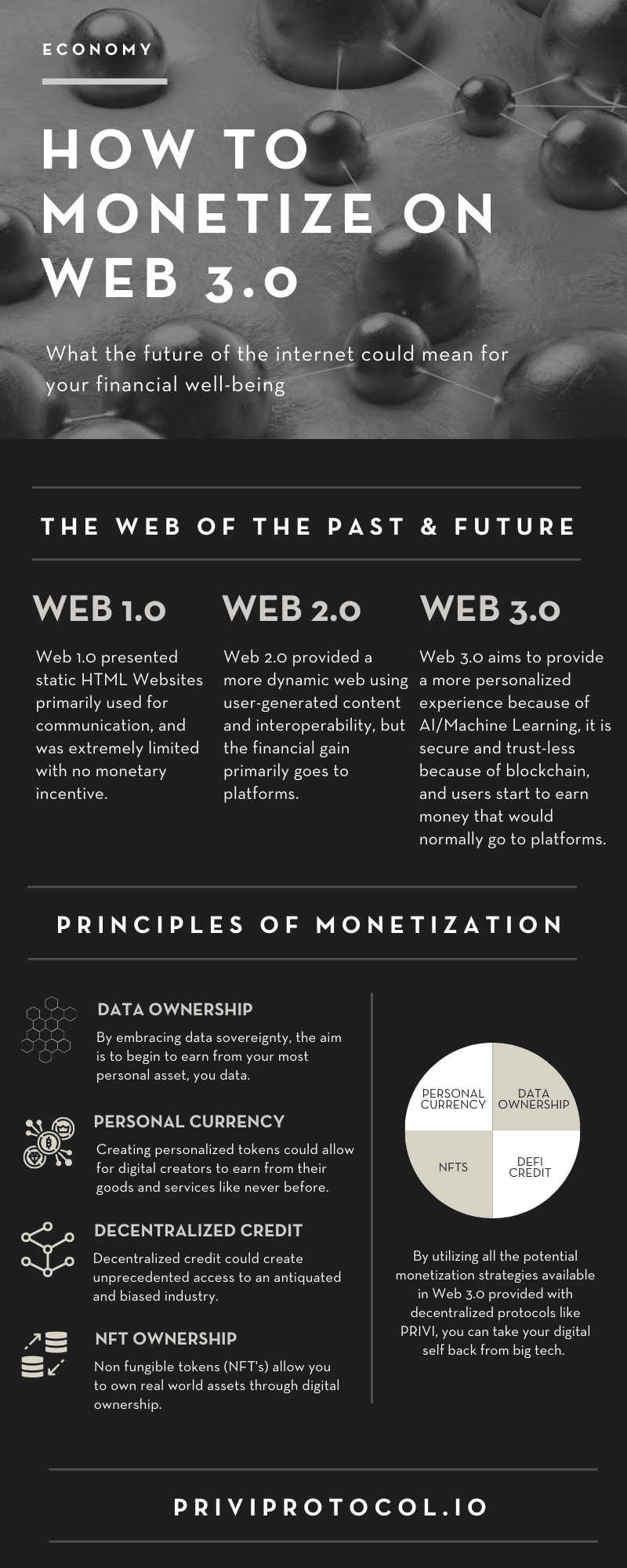

But the web is changing. Web 3.0 is building on the flaws of Web 2.0, and it promises to create more personalized experiences, and redistribute wealth opportunities from the platforms, to the users. Blockchain protocols like PRIVI aim to bring Web 3.0 into the hands of everyone this year.

Mint Your Own Personal Currency With Web 3.0

Nearly one in four Americans today make a living online. In today’s digital environment, these individuals can leverage varying platforms to achieve a coordinated communication strategy to elevate their brand, and sell products or services. We post on Instagram, retweet the post and share it on Facebook, for example. The value of this exercise however, in today’s centralized off-chain digital environment, is predominately captured by the platforms.

These internet behemoths, whose survival utterly depends on the activities of their users and the followers they have, are set to be disrupted as Web 3.0 crashes onto the scene. In Web 3.0, if people can utilize an exact same service, say something like Instagram, but instead of the platform owning everything, the users own everything, why would anyone still use Instagram?

In this Web 3.0 multiverse, people and creators will now be able to monetize off their un-captured value they create on a daily basis.

How? Through Personal Tokens.

Personal Tokens, like the ones PRIVI aims to allow users to mint and distribute for free, are a personal currency for individuals. The value of the currency is directly dependent on the value a human creates. This exists today on Web 3.0, however nascent the industry is today, the promise of the technology in protocols like PRIVI is trailblazing. Personal tokens have unlimited uses, unlimited potential, create a way for people to monetize off the un-captured value they create on a daily basis, and could re-design how people make a living online.

To illustrate, let’s say you have a friend and his name is Jacob, he is a software developer and he regularly produces some nifty code. Jacob uses PRIVI enabled apps, and mints 100,000 $JACOB tokens for free. Jacob assigns a minuscule value to these 100,000 $JACOB tokens (Now, if Kim Kardashian mints tokens she’ll probably want to assign them a higher value).

Jacob has 40 followers, and decides to distribute 10 $JACOB tokens to all 40 people at no cost. Days later, Jacob creates some ground-breaking code and broadcasts to his followers what he’s done. Attached to the announcement is an image of his code that these followers can view if they own 20 $JACOB tokens (followers need only to own that amount of coins, they do not need to “spend” that amount). Some of his followers, intrigued, buy 10 more $JACOB tokens to view this image. Now, every time $JACOB tokens are bought, sold or transferred, the price of $JACOB tokens start to increase in value.

This form of monetization is truly innovative for two primary reasons. One, Jacob owns hundreds of thousands of $JACOB tokens. What if he produces ground-breaking code regularly? His followers increase, he distributes and sells more $JACOB tokens, and along the way, the value of his hundreds of thousands of tokens increases. Two, not only does Jacob benefit, but those who got in early with $JACOB tokens start to benefit from the increase in value of the coin. So they are incentivized in sharing Jacobs work to people because they know they would monetize off $JACOB tokens increasing in value.

While this might seem like a concept of the future, it is in fact not far off at all.

Personal tokens are being used right now. However the problem is that it is very niche, and most products that are out there are not easy-to-use for the everyday user, more specifically, not friendly to use for any non-native crypto people. But this again, is changing. As we continue to develop better products for Web 3.0, more and more people will realize the impact personal tokens can have on their financial well-being.

Control And Make Money Off Your Data (finally) With Web 3.0

The online services that we have come to use on a daily basis farm huge amounts of our personal data. On average, people spend nearly 6 hours and 42 minutes online each day. However it wouldn’t be all bad if we made money from the data we create while spending hours and hours online, but unfortunately, that is not the case today. It is said that the average user could make around $444 a year from their personal data, but thanks to how Web 2.0 is set up today, this reality is far fetched. Online behemoths, think Facebook, Google, Amazon, see your data as their own and they make billions (maybe trillions) off your data.

And what do you make from your data? $0.

We use these products because they are free. As elucidated in Netflix’s recent documentary The Social Dilemma, if you don’t pay for the product, you are the product. Big Tech, like Facebook and Google, own what you create, browse, and share on their platform. That is the embodiment of Web 2.0. and a core reason as to why these companies will never change course. They will never return ownership of data to the rightful owner, because they are beholden to shareholders who demand year-over-year growth. And the only way these companies meet these growth targets for their shareholders is to treat your data as their own.

In The Social Dilemma, Jaron Lanier points towards a future where this trend could be reversed by altering financial incentives. Web 3.0 does exactly that. Since Web 3.0 is built on blockchain, whose platforms are governed by the people, Web 3.0 protocols, like PRIVI, aim to return data ownership back to the rightful owner, and make it possible for anyone to capture and monetize their data on a daily basis.

Web 3.0 Could Allow A Farmer In Delhi To Buy 1% Of A Paris Flat

The better question might be, why not?

A flat in Paris is highly likely to appreciate in value over time, making it a sustainable long term investment. But do you think someone in Delhi, with Web 2.0, currently has easy access to such an investment? I’ll save you the trouble from looking around online, because the answer is likely not.

Let’s start with this simple fact: the majority of the world’s wealth lies in real world assets, like property.

And these appreciating assets are not created equal over the world. A similar sized property in Paris is much more valuable than in Delhi. These real-world assets create lucrative wealth opportunities for their owners. However they are limited in who can buy them simply due to lack of accessibility. Someone from one part of the world (unless they are quite wealthy) cannot take part in buying percentages of property in safe, likely to appreciate, neighborhoods around the world. If you ask creators and innovators of Web 3.0, like PRIVI, that is immensely unfair.

Web 3.0 will create opportunities for people in developing countries to purchase percentages of property in far off places that have stable and appreciating property values. All in a matter of clicks, and with low minimum amounts. This same person will have, in a few clicks, the ability to insure it by a decentralized insurance pool, because after

all, they won’t be in Paris to look after it on a regular basis. They will, in a few clicks, be able to easily communicate with the other owners of that Paris flat and discuss what should be done to it. They can take part in the decision making process, and decide to rent it out, make improvements, or put it on the market. And in a few clicks, they can sell their ownership at any time they please.

Web 3.0 will make this possible through the technology of non-fungible tokens (NFT’s), which is the practice of tokenizing assets that are not fungible, like houses, cars, or collectibles.

Web 3.0 Will Make Credit More Accessible And More Fair

Since the modern financial industry was created, banks have largely been the sole decision maker of who gets access to credit. Yet, the credit approval system used by banks is incoherent, unaccessible and unfair. For instance, the Economic Well-Being report released by the Federal Reserve in 2019 suggests that the criteria used by banks to approve access to credit is highly discriminatory. The report found that non-white Americans were more likely to experience an adverse credit outcome compared to white Americans.

Not only are current credit systems innately biased, they are very costly. The average American has 3 credit cards, with average debt equaling to $5,500. That debt will cost them nearly $1,250 a year in credit interest and fees. All the while, Big Banks, like JP Morgan Chase, scuppered up $39bn in credit card revenues in 2019 alone.

Does all this sound fair to you?

Sure, people are more ill-advised than ever before on how to effectively use credit, but that does not mean they should be heavily punished for it. To PRIVI, and to many others building Web 3.0 solutions, Big Banks need to be disrupted.

So what if there was an innovative credit system that connects people looking to receive credit, with decentralized (as opposed to centralized, like JP Morgan Chase) credit pools?

These credit pools would be a group of lenders who customize how much they wish to lend and what amount of interest they are interested in accumulating. These credit pools could then be able to make a good amount of interest, nothing as high as what Big Banks make, but a good amount, all the while, giving people all over the world fair access to credit.

To reward good behavior of borrowers, and invite providers (aka merchants) into using the system. Web 3.0 has the tools to build a decentralized credit system where risk and incentives could be distributed amongst the network; rewarding good behavior of borrowers, helping merchants sell items for higher prices, all the while minimizing the risk of credit pools.

Conclusion

By creating a universal digital ID on decentralized protocols like PRIVI, the goal is for anyone in the world to access the financial benefits that will be available with Web 3.0, and use them to improve their financial well being, and own their digital identity. Web 3.0 isn’t coming, it has arrived.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Susan has been working in TokenMinds as a content manager and copywriter for over three years. She is quite passionate about crypto, blockchain, and fintech. Her focus is on providing accurate and timely information. Along with presenting top stories, Susan has an interest in educational content for newcomers in the digital asset space.