Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

Apple stock hit its new ATH driven by increased iPhone sales and the launch of a competitive Vision Pro VR headset last week.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

Apple Inc (NASDAQ: AAPL) shares closed Monday trading around $183.79, up 1.56 percent from the day’s opening price. The $2.85 trillion valued tech giant has experienced increased demand for its products, thus motivating investors to double down on its stock market. As a result, the AAPL shares surpassed the prior ATH last week and the market is currently headed to a price discovery phase.

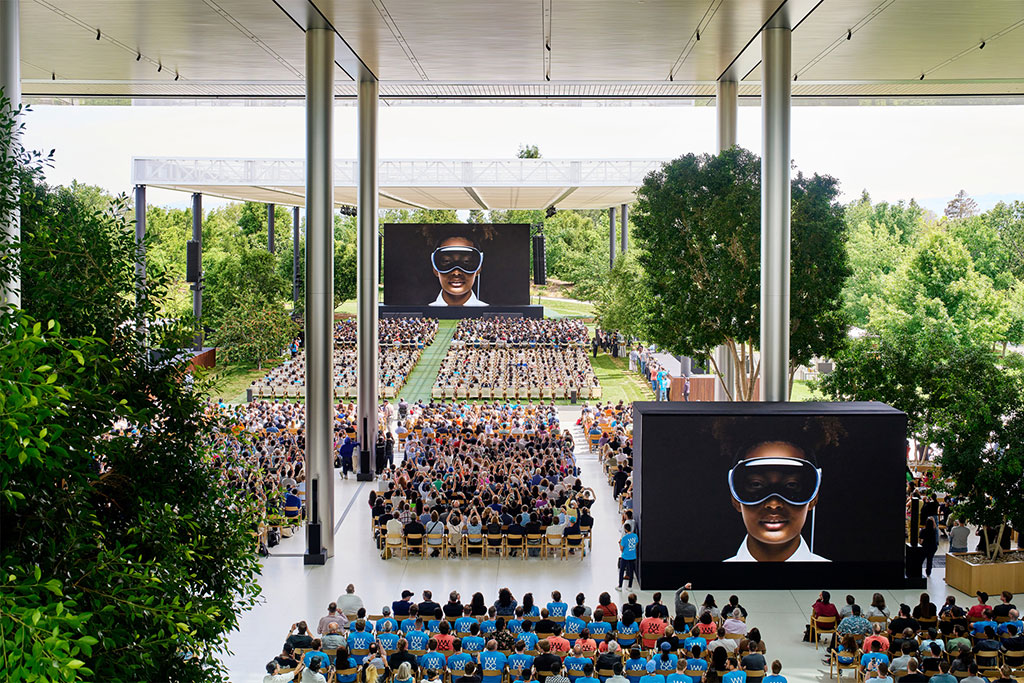

The incredible performance has directly been attributed to the launch of the Vision Pro VR headset to compete with similar products from different companies like Meta Platforms Inc (NASDAQ: META). Additionally, the bullish outlook coincided with Apple’s Worldwide Developers Conference last week where the company unveiled its new product – the Vision Pro VR headset.

Additionally, the company also announced a new bigger MacBook Air laptop coupled with a high-end desktop that is well suited for 3D designers and programmers. As for the iOS operating system, Apple announced several updates to suit the iPhone, iPad, and Apple Watch.

The products are expected to increase Apple sales although Apple CFO Luca Maestri suggested the current quarter could record a decline of about 3 percent in revenue on an annualized basis. During the fiscal 2023 second quarter that ended on April 1, 2023, Apple reported a revenue of about $94.8 billion, down 3 percent YoY.

Currently, Apple is undertaking a $90 billion share repurchase program after generating more than $28 billion in cash flow and returning over $23 billion to shareholders during the first three months of the year.

The growth of Apple during the past few years is significantly attributed to the global geopolitical differences that have significantly choked Chinese tech companies due to the lower supply of semiconductor chips. Additionally, the company has also launched 5G-enabled smartphones amid the network rollout in Europe, Asia, and North America. As a result, the company expects its current quarter to perform in a similar manner as the prior one of the macroeconomic factors remain unchanged.

“We expect our June quarter year-over-year revenue performance to be similar to the March quarter assuming that the macroeconomic outlook does not worsen from what we are projecting today for the current quarter,” Maestri noted.

According to market data provided by MarketWatch, AAPL shares have gained approximately 41 percent YTD thus most analysts issuing an average recommendation of Overweight. Having been rated by 42 analysts, AAPL shares received an average price target of about $186.27. For instance, analysts at Wedbush maintained a buy rating on Apple shares with a price target of between $205 and $220.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!