Author

1451 posts

On January 2, Bitcoin was trading at about $30,300. On Sunday morning, it surpassed $34,000 for the first time ever, which put the gain this year at almost $5,000.

As Wall Street predicts, the upcoming 2021 will be fruitful for Apple. Analysts expect the company’s revenue to increase to 15% in fiscal 2021 from 6% in 2020. Further, and profit growth is projected to double to 20%.

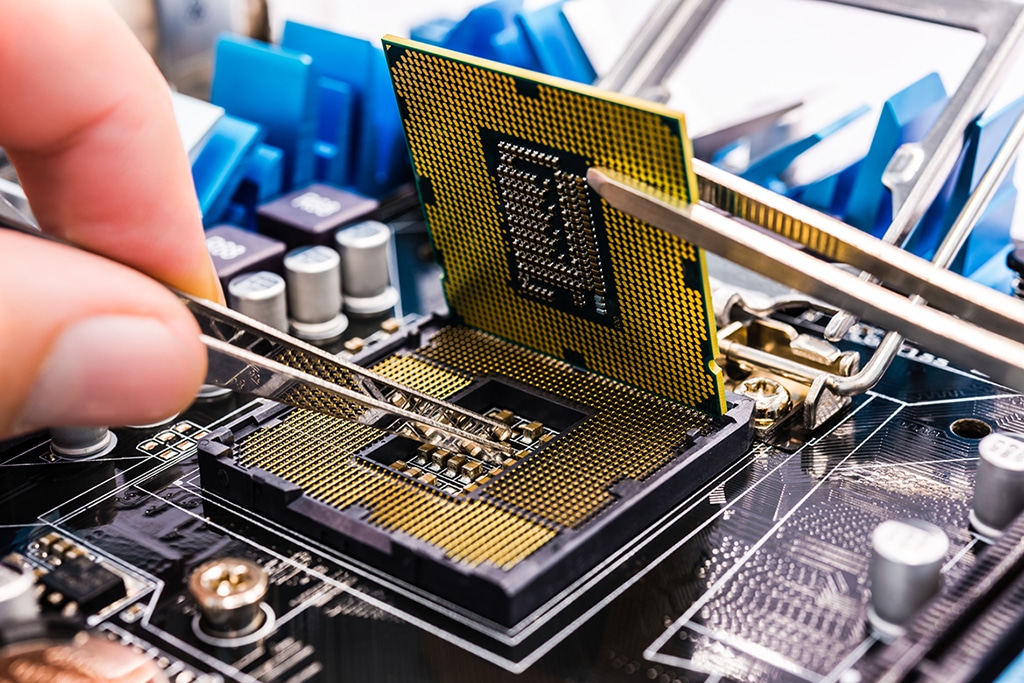

With the money from Series E Round, the total funds raised by Graphcore total over $710 million. The company is expecting to have over $440 million of cash on hand post-closing to support future growth.

Meanwhile, funds that trusted oil and gas, suffered losses. In particular, the Direxion Daily S&P Oil&Gas E&P 2X ETF lost 97.3% this year. The Direxion Daily Junior Gold Miners Bear 2X ETF plunged 95.5% in 2020.

As the analyst has explained, Apple has not yet finalized the specifications for the vehicle. Besides, Apple has not decided on the suppliers.

Monetization will be driven by additional functions for business teams and users with expanded needs. Some of the functions will be data-greedy, that’s why they will require additional fees.

Currently, Facebook is also facing a legal suit from the Federal Trade Commission and a coalition of 48 US states. They are accusing Facebook of engaging in anticompetitive behavior and abusing its market position to liquidate potential rivals.

SoftBank SPAC IPO will be overseen by SoftBank Investment Advisers which also runs the Vision Fund. Besides, Goldman Sachs Group and Citigroup will underwrite the deal.

There are lots of factors that can drive FAANG and other tech shares in 2021. The most interesting of them include developments in gaming, cybersecurity, 5G, edge computing, and data analytics.

Nasdaq 100 will include stocks of Marvell Technology, Okta, and Atlassian. Besides, it will add American Electric Power, Match Group, and Peloton Interactive stocks.