With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Capriole Investments notes a critical link between hash-ribbon weakness and corrective price movements in Bitcoin.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

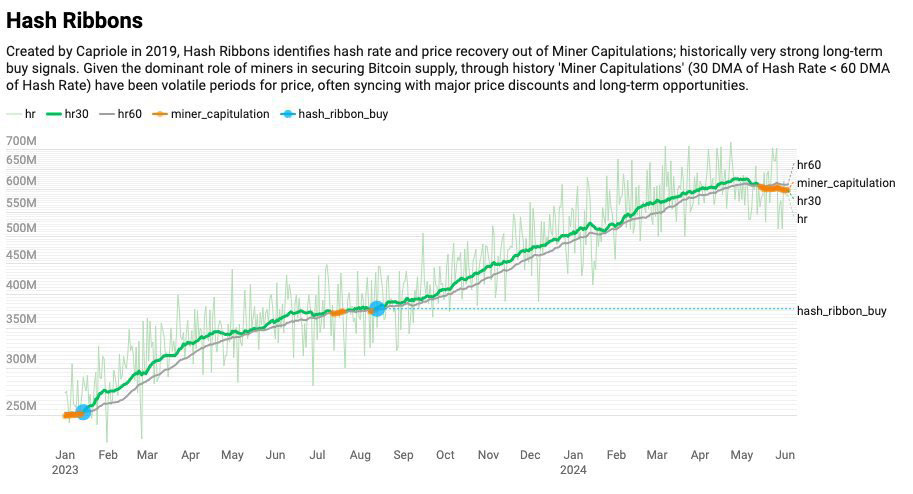

Bitcoin (BTC) bulls may be poised for a comeback, with a key technical indicator hinting at a potential price surge. On June 4th, 2024, quantitative cryptocurrency investment firm Capriole Investments highlighted a “tempting” buy signal flashing from the Hash Ribbons metric.

The Hash Ribbons metric is used by some analysts to assess potential turning points in Bitcoin’s price history. The buy signal suggests that current market conditions could be favorable for a price increase.

This signal comes as Bitcoin miners face challenges due to the April 2024 block subsidy halving. The halving, which reduces miner rewards by 50% every four years, has forced miners to adjust their operations. This adjustment is evident in the Bitcoin mining hash rate, which measures the network’s processing power.

After reaching all-time highs in March 2024, Bitcoin’s mining hash rate has entered a consolidation phase, currently at lower levels. According to Capriole founder Charles Edwards, this is a natural adaptation by miners to the new economic environment.

Photo: Charles Edwards

“Bitcoin’s Hash Ribbons have entered a new ‘capitulation’ phase,” Edwards stated, referring to a historically significant buy signal for BTC. “Hash Ribbons is back,” he emphasized, highlighting the indicator’s potential importance.

The Hash Ribbons metric compares the 60-day moving average of the hash rate with the 30-day moving average. When the shorter average falls below the longer one, it signals a slowdown in hash rate growth, often seen as miner capitulation.

“You will often see Miner Capitulations sync with shuttering of miner operations, bankruptcies and takeovers,” Edwards explained. “As in the current instance, they also often sync with the Bitcoin Halvings.”

The halving event makes older, inefficient mining hardware unprofitable due to increased mining difficulty. These rigs are usually phased out several weeks after the halving, leading to a temporary decline in hash rate.

Capriole Investments notes a critical link between hash-ribbon weakness and corrective price movements in Bitcoin. Historically, these periods have led to extended bull runs. The last capitulation event in August 2023 saw BTC prices around $25,000.

“Hash Ribbon signals are either loved or ridiculed. Every occurrence brings some debate about their relevance today, or why the current signal perhaps doesn’t count,” said Edwards. “This also happened in 2023, but price was also trading in the $20Ks when the last Hash Ribbon buy signal occurred.”

He also points out a similar scenario in 2023, where the last Hash Ribbon buy signal appeared with BTC around $20,000. This suggests the metric might still have predictive power.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.