Bitcoin Hyper Reaches $24M Presale as BTC Eyes $250K in 76 Days

Managing Partner and Head of Research at Fundstrat Global Advisors, Tom Lee, has once again doubled down on his bold prediction for Bitcoin (BTC), saying the $250,000 target is still possible before the year ends.

Meanwhile, excitement is building around Bitcoin Hyper (HYPER), the fastest Layer-2 network built for Bitcoin, which has just secured another major milestone – hitting $24 million in total presale funding.

Early investors appear to be connecting the dots between the two. For BTC to hit the kind of price target Lee envisions, it will need new sources of demand – and that’s exactly what Bitcoin Hyper aims to deliver.

By introducing large-scale utility demand on top of Bitcoin’s store-of-value narrative, the project could unlock an entirely new layer of growth potential for the crypto market.

The ecosystem is being built around the Solana Virtual Machine (SVM) – one of the fastest blockchains in the industry. The result could be high-speed applications anchored to Bitcoin’s unmatched security, with BTC serving as a central component in every transaction.

The Bitcoin Hyper presale continues to attract strong interest from investors seeking early exposure to the network, as highlighted by a series of whale purchases over the past week. The current round is priced at $0.013125 per token, with only 8 hours remaining before the next price increase takes effect.

Bitcoin $250K Target Backed by Lee, Newton, and Hayes amid Shifting Economic Winds

Throughout the year, Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, has remained one of the most vocal Bitcoin bulls. In a September 24 interview during Korea Blockchain Week in Seoul, Lee stated that he expects Bitcoin to trade between $200,000 and $250,000 by the end of the year.

TOM LEE JUST SAID #BITCOIN IS GOING TO $250,000 IN THE NEXT 75 DAYS

IT’S COMING 🚀 pic.twitter.com/UdYHoRQ71O

— Vivek Sen (@Vivek4real_) October 16, 2025

He attributes this outlook to the Federal Reserve’s policy pivot, which has shifted from an aggressively hawkish stance to a more dovish tone. According to Lee, this reversal acts as a strong tailwind for Bitcoin and aligns with the technical charts of Fundstrat’s Head of Technical Strategy, Mark Newton, who has highlighted strengthening cyclical setups that support a year-end rally.

In a more recent October appearance on Bankless, Lee reaffirmed his $250,000 target with about two and a half months left in the year, adding that Ethereum (ETH) could also climb to between $10,000 and $12,000. Joining him on the same program, Arthur Hayes, co-founder and former CEO of BitMEX, shared Lee’s outlook, noting that Bitcoin’s run may be far from over, while setting his ETH target at $10,000.

$200–$250k BTC and $10–$12k ETH by year-end?

Tom Lee ( @fundstrat ) and Arthur Hayes ( @CryptoHayes ) share their price predictions, and why they think ETH could do a 2.5x in just 2 months.

2 Legends. Same ballpark. Are we ready for these levels by Dec 31? 👀 pic.twitter.com/DaMuzO2LdE

— Bankless (@BanklessHQ) October 14, 2025

While the optimism may seem distant, with BTC dipping to $107,000 on Thursday after a tepid recovery from last week’s flash crash, historical data still supports the possibility. October and November have consistently been among Bitcoin’s strongest trading months, and with another rate cut potentially on the horizon, the setup for a sharp rebound remains intact.

Yet the biggest catalyst for long-term demand may still be waiting in the wings. As capital continues to flow toward innovation rather than speculation, one project appears ready to power Bitcoin’s next phase of utility demand – Bitcoin Hyper.

Why Bitcoin Was Built for Security First – and What the Future Holds

Bitcoin’s base layer was intentionally designed with minimal programmability, prioritizing security and decentralization over functionality.

Satoshi Nakamoto built it to serve as sound money – a monetary network that’s reliable, decentralized, and resistant to corruption or control. That philosophy gave rise to the enduring narratives of decentralized money and digital gold, which fueled Bitcoin’s climb to multi-thousand-dollar valuations – and still underpins the bullish forecasts from Lee and Hayes.

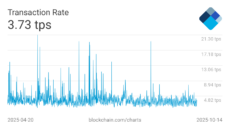

However, for Bitcoin to achieve true global adoption and function as a digital medium of exchange, scalability becomes essential. In practice, the network processes only around three to four transactions per second – well below the theoretical maximum of seven – and far short of what’s needed for large-scale commerce.

And because Bitcoin was never meant to be programmable, it can’t natively support complex applications or DeFi ecosystems at scale. Several attempts have been made to expand its capabilities, but none have reached mainstream adoption.

Stacks, for instance, adds smart-contract functionality to Bitcoin but isn’t optimized for speed. It operates more like a secure companion chain than a high-performance execution layer. RSK, on the other hand, introduced DeFi and EVM-compatible contracts to Bitcoin but remains limited in growth and decentralization – functional, yet far from scalable.

Now, Bitcoin Hyper enters as the next evolution. With SVM integration, it delivers both speed and programmability, enabling Bitcoin to serve not only as sound money but as a true medium of exchange for efficient, high-throughput applications.

How Bitcoin Hyper Works

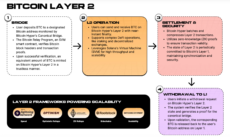

Bitcoin Hyper’s ecosystem enables developers to create applications that leverage Solana’s high throughput and cost-efficient processing, combined with the security backbone of Bitcoin.

Users who wish to engage with these applications can simply lock their BTC from the base chain into Bitcoin Hyper’s canonical bridge, where a wrapped version of BTC is minted.

This wrapped BTC is always redeemable – users can burn it on Bitcoin Hyper to release the original BTC back to the main chain. Within the ecosystem, however, this wrapped version functions as the medium of exchange across applications spanning DeFi, gaming, and even real-world use cases.

In effect, Bitcoin Hyper transforms BTC from a passive store of value into an active, circulating asset – one that retains its incorruptible foundation while gaining new economic velocity.

This evolution doesn’t replace Bitcoin’s role as sound money; it fulfills it, giving BTC both the security of digital gold and the utility of digital cash.

Bringing Bitcoin’s Sound Money Vision to Life Through HYPER

Investors have now contributed more than $24 million to the presale, securing a token that plays a key role in helping Bitcoin fulfill its vision as sound money – that token is HYPER.

Every transaction within the Bitcoin Hyper ecosystem requires a gas fee, and HYPER powers those payments.

Beyond that, it will also feature governance capabilities, allowing holders to contribute to shaping the network’s evolution. Right now, users can stake HYPER to build their holdings ahead of Bitcoin Hyper’s rollout using the project’s native protocol that yields a dynamic 49% APY.

To join the presale, investors can purchase HYPER directly through the Bitcoin Hyper website using SOL, ETH, USDT, USDC, BNB, or even a credit card.

For the best experience, Bitcoin Hyper recommends Best Wallet, one of the best crypto and Bitcoin wallets in the market. HYPER is already listed under its Upcoming Tokens section, making it easy to buy, track, and claim once live.

Stay connected with the Bitcoin Hyper community on Telegram and X for the latest updates.

Visit the Bitcoin Hyper website for full details

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.