By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis: Bitcoin price has started growing.

- On Binance DEX, the BTC has fallen to 100 USD.

- Germany has acknowledged the BTC as a financial instrument.

On W1, the quotations are testing the support area at 50.0% Fibo in relation to the previous uptrend. Growth to the main resistance area and the level 11500.00 USD is not excluded. However, on the MACD and Stochastic, the dynamics are descending, which indicates the possibility of a decline to the target levels: 76.0% (5700.00 USD) and the low at 3121.90 USD.

Photo: Roboforex / TradingView

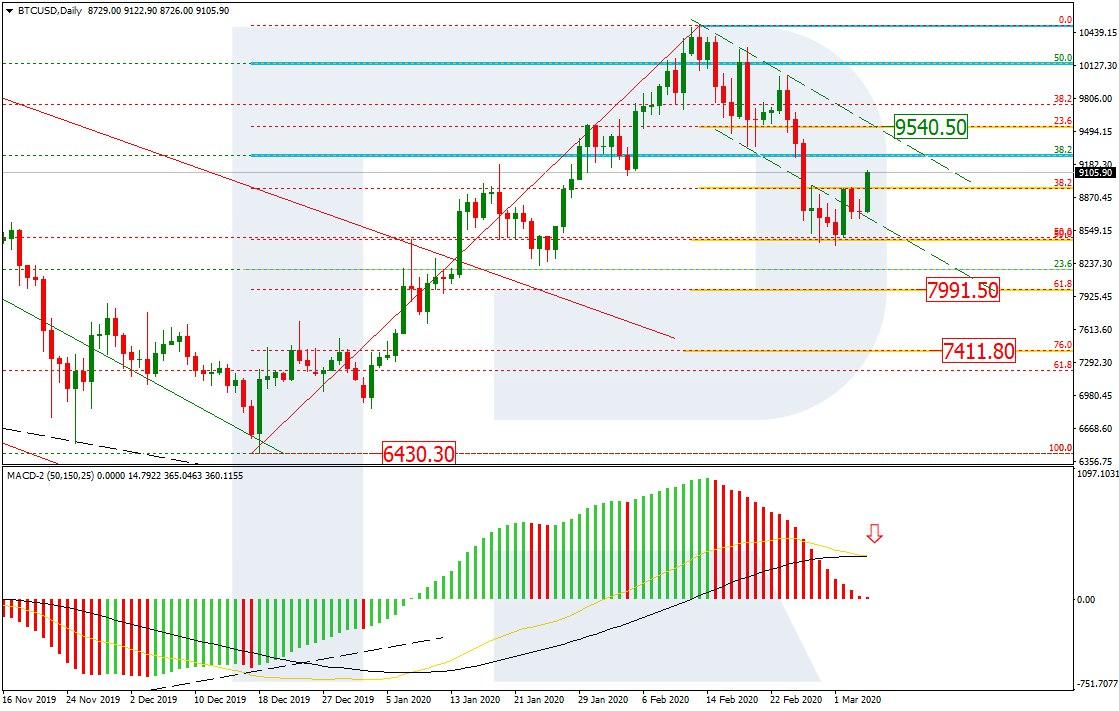

On D1, the quotations are returning inside the previous descending channel after a breakout of its lower border and a test of 50.0% of the correction. The current growth is aiming at the resistance line and 9540.50 USD. At the same time, on the MACD, there is a Black Cross preparing to form. This may mean that the growth is short-term and the decline will continue to 61.8% (7991.50 USD) and 76.0% (7411.80 USD) Fibo and the fractal minimum of 6430.30 USD.

Photo: Roboforex / TradingView

On H4, there is an ascending correction going on. The scenario of further growth is supported by the ascending dynamics of the Stochastic. In this timeframe, the aim for growing Bitcoin price is 9674.20 USD.

Photo: Roboforex / TradingView

This week, the BTC rate has fallen to 100 USD – but only on one exchange, Binance DEX. The falling occurred in the pair with the USDS; the decline of the BTC amounted to 98%. Later, the issue was explained by the technical maintenance of the main platform as well. Apart from this reason, the exchange and the rate could be influenced by low liquidity.

For the first time, German authorities let themselves call the BTC a financial instrument. The Federal Financial Supervisory Authority (BaFin) defined the status of the cryptocurrency as a financial instrument, referring to the fact that several institutions have the same definition of the BTC. Hence, the cryptocurrency may be used as a means of payment and exchange, transferred, traded, and stored in digital form.

In the BaFin statement, it is also mentioned that the cryptocurrency is a digital value not issued by any state or Central bank and not necessarily connected to any currency. Simultaneously, the BTC does not have the status of a currency or a financial means but is accepted for payments and other operations.

The decision of the German authorities must have become the result of the requests from 40 major German banks for the permission to make operations with the BTC. In fact, the banks also have the so-called EU fifth directive, by which financial entities may carry out operations with digital money provided that they avoid money laundering and financing suspicious actions of frauds and terrorists (Anti-Money Laundering, or AML policy).

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.