Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- BlackRock deposited significant crypto holdings to Coinbase Prime, suggesting potential market-making activities or reserve adjustments.

- ETF flow data conflicts with on-chain movements, showing mixed signals between institutional demand and actual crypto transfers.

- Analysts remain bullish despite apparent sell pressure, citing Federal Reserve rate cut expectations and Tether's recent $2B minting activity.

BlackRock is the world’s largest asset manager and the leading institution in Bitcoin BTC $89 401 24h volatility: 1.8% Market cap: $1.79 T Vol. 24h: $49.78 B and Ethereum ETH $3 006 24h volatility: 2.6% Market cap: $362.90 B Vol. 24h: $28.95 B exchange-traded funds (ETFs), offering via iShares products IBIT and ETHA, traded on Nasdaq. Differently from TradFi, part of BlackRock’s activities can be seen on-chain, with BTC and ETH moves to (deposits) and from (withdrawals) Coinbase Prime accounts, usually representing sales and purchases, respectively.

On that note, Lookonchain and other on-chain analytic tools have been monitoring BlackRock activity, spotting recent likely sell-offs in the past two days, with significant deposits to Coinbase.

Asset Manager Moves $640M in Crypto Assets Over Two-Day Period

On September 9, BlackRock-owned accounts deposited 44,774 ETH, worth $195.29 million, and 900 BTC, worth $101.67 million, to Coinbase Prime, based on Lookonchain’s post. Before that, on September 8, the asset manager was seen depositing 72,370 ETH, worth $312 million, and 266.79 BTC, worth $29.88 million.

BlackRock just sold 44,774 $ETH($195.29M) and 900 $BTC($101.67M) again.https://t.co/bcKGkl1VXE pic.twitter.com/xyubPNpGjK

— Lookonchain (@lookonchain) September 9, 2025

ETF Flows Show Conflicting Signals With On-Chain Activity

BlackRock’s market-making activities are a direct reflection of the ETFs’ net capital flows. They should represent the real-world adjustment and settlement of the ETFs’ holdings to match investor demand for shares, bridging traditional finance (TradFi) trading on Nasdaq with the crypto market. Nevertheless, the deposits and withdrawals are not necessarily representing all the sales and purchases in real time—simply reserve adjustments.

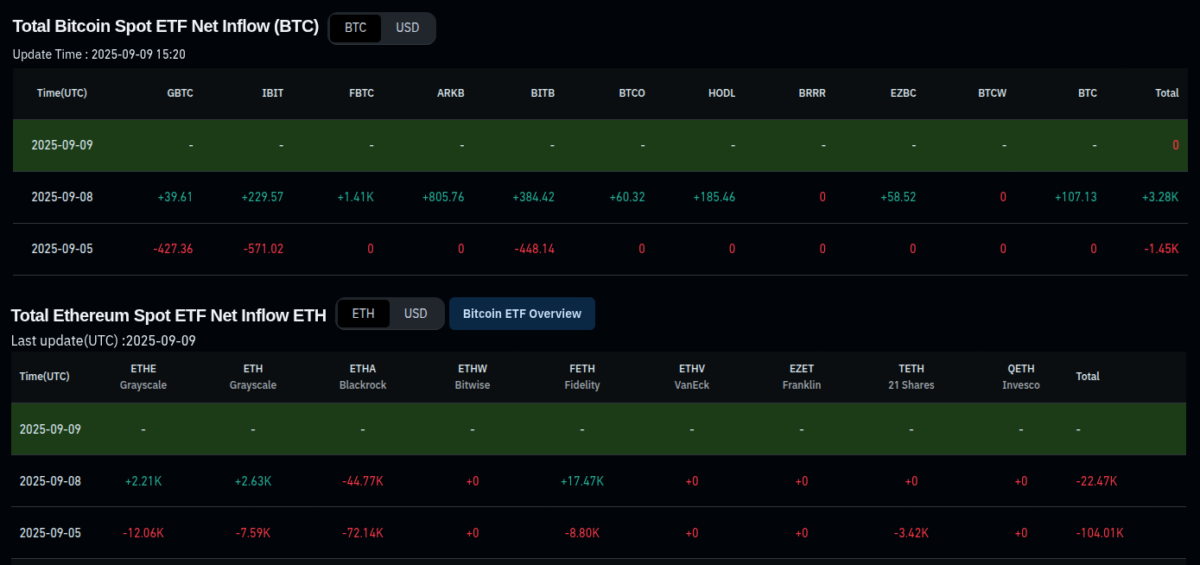

For example, on September 8, IBIT and ETHA saw net flows of +229 BTC, worth $25.50 million, and -43,770 ETH, worth $192.70 million, respectively, according to data from Coinglass. On September 9, however, IBIT added 227 BTC. Lookonchain reported this movement in the September 9 update, showing similar numbers that conflict with the recently observed on-chain activity.

Total Bitcoin and Ethereum spot ETF net inflows | Source: Coinglass

Both assets had massive outflows last Friday, on September 5, which may have required the reserve adjustments on Coinbase Prime, as seen earlier today from the Lookonchain report, causing large deposits and sell-offs. Or, institutions are positioning in advance of a yet unknown pricing event, as smart money like BlackRock can be seen as a market canary.

Crypto Analysts Signal Potential Bull Rally Despite BlackRock Sell Pressure

Now, the price charts appear to be forming a bullish structure for Bitcoin, Ethereum, and other cryptocurrencies, potentially signaling a recovering institutional interest, again conflicting with the signal from Wall Street whales.

Additionally, Arkham has reported BlackRock is “buying more” cryptocurrencies, reaching over $100 billion in total reserves.

BLACKROCK NOW HOLDS OVER $100B IN CRYPTO

AND THEY’RE BUYING MORE pic.twitter.com/7eRAzJ0fod

— Arkham (@arkham) September 9, 2025

CrypNuevo, a prominent Bitcoin analyst with a relevant accuracy rate, believes BTC is poised for a bull rally in the following days, hunting upward liquidity in the expectation of a Federal Reserve interest rate cut.

$BTC Sunday update:

10 days until the first Interest Rate cut this cycle, and the chart is undecided with choppy Price Action.

Uptrend structure is intact but sentiment is bearish in this pullback and many are calling it a sell the news event.

How am I playing this?

🧵↓(1/7) pic.twitter.com/h1Y4DhFXK7

— CrypNuevo 🔨 (@CrypNuevo) September 7, 2025

Other indicators, like Tether minting 2 billion USDT during a market dip, very similar to what happened in December 2024, could also suggest it is time to buy and not sell, as seen in BlackRock’s recent activities.

All that only evidences the volatility and complexity of short-term speculation, which is affected by a lot of nuance and different factors, together with big players’ movements.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.