To grow decentralized finance into a global phenomenon, barriers to entry need to be lowered. Any project looking to make an impact needs to follow a smart strategy, similar to what YOP has done. Its ecosystem spans multiple tools that will benefit every token and pool, yet their approach of no large initial fundraise is novel and began developing infrastructure before launching a token.

Building Superior DeFi Infrastructure

The year 2020 has seen a strong focus on decentralized finance, an industry currently valued at over $25 billion. It provides an alternative to traditional financial solutions by cutting out the intermediaries. Even so, there are a few shortcomings to resolve. Introducing a new infrastructure layer is crucial if this industry wants to remain relevant for the years to come.

The time has come to begin transitioning to DeFi 2.0 solutions. One-dimensional decentralized finance solutions may become a thing of the past. Moreover, there have been far too many ventures that want to raise vast amounts of capital before their infrastructure is ready. That way of thinking needs to end as well, as investors want to see capable teams, rather than those who make empty promises.

YOP Paves Way

To date, YOP remains a project with a very small market cap. Valued at just over $8 million, one may argue the project has flown under many people’s radar. Optimizing the DeFi industry will not happen overnight, yet the foundation for a better ecosystem is already developing. YOP Founder Atif Yaqub has bootstrapped this project, ensuring there was a concrete project that warrants an external investment.

That investment occurs through the distribution of the YOP token. With a supply of 88,888,888 tokens, only 12% of the supply has been sold through a private sale, while holding back the larger allocation for a future raise. Several partners have been announced so far, including Pires Investments PLC – listed on the London Stock Exchange – and Magnus Capital. Such early success shows the project is attracting attention from high-profile individuals.

Following the private sale, YOP launched using the Polkastarter platform and Uniswap. The team has ensured a smooth and fair distribution of the token to prevent whales from obtaining a more significant share of the tokens. The remaining balance of the tokens will be distributed through a future token sale, airdrop, YOP in-app rewards, and so forth.

It has to be said; the Polkastarter listing has been somewhat surprising. More specifically, over 70,000 users asked to be whitelisted, resulting in all pools on Polkkastarter filling up in mere seconds from opening. A similar success is visible on Uniswap, with $15 million in initial volume and a price increase of over 2900%.

Importance of Cross-Chain Support

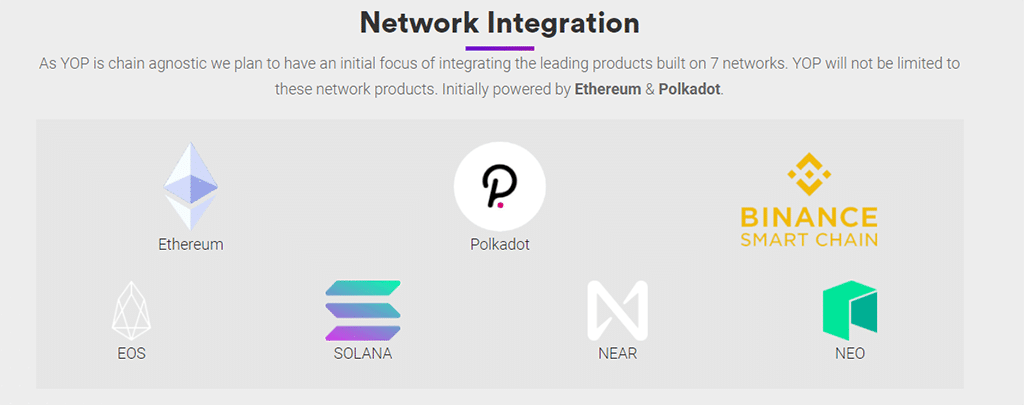

In the current DeFi landscape, there are far too many one-dimensional projects and one-trick ponies. It is crucial to look beyond “just one blockchain” to build engrossing decentralized finance products and services. Taking YOP’s yProtocol as an example, it works across all blockchains, including Ethereum, Polkadot, Binance Smart Chain, Solana and others.

This serves as another example of how development should come first, and worrying about attracting capital needs to be a secondary objective. Going about this the other way around is often a death knell for new DeFi projects, as they will never achieve long-term visibility.

Successful MVP Warrants the Next Step

Once the Minimum Viable Product is launched successfully, and no major bugs have been encountered, teams can look toward the future. If the developers cannot pull off this significant milestone, there is no reason for anyone to take the project seriously or invest in it.

Similar to what YOP is doing, DeFi 2.0 projects may want to begin catering to VCs and strategic growth partners after the MVP launch. Building community engagement within and outside of the cryptocurrency industry is the only way to take a project from “niche” to “appealing”.

Combined with the MVP launch, developers need to maintain a long-term roadmap to enhance the product and offer new features.

As can be seen on YOP’s roadmap, features will roll out gradually to gather user feedback and streamline the underlying infrastructure further, rather than over-promising and under-delivering in the first phase.

Conclusion

It is refreshing to see a DeFi project that acknowledges this industry is not about focusing on one product or a single blockchain. DeFi needs to evolve into DeFi 2.0 and move beyond “just Ethereum” swiftly. That doesn’t mean Ethereum has no place, as YOP still considers this a primary ecosystem, alongside Polkadot. Its is important to provide users with more breadth in the product. YOP is including important tools such as market data and integrated wallets alongside the Swap dex and DeFi market place.

Building the next potential DeFi unicorn requires an all-encompassing approach like this one. Creating an ecosystem before raising capital is a smart and professional approach. It is now up to the YOP team to make their vision come true and adhere to the roadmap.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Founder and editor at BTC PEERS. Andrey writes about financial experiments, DeFi, cryptocurrency, and blockchain.