Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

Chainge Finance has officially become the most liquid web3 trading venue on the crypto market.

As the number of digital assets in the crypto market continues to experience unprecedented growth, decentralized exchanges [DEXes] continue to suffer from a central sticking point – the absence of liquidity. Not surprisingly, a few projects have emerged to resolve this colossal drawback and set the pace for a shift in how DEXes execute transactions. Unfortunately, most of the platforms are half-baked and incapable of simultaneously compounding liquidity from more than one chain.

Is there a solution to this problem? Absolutely!

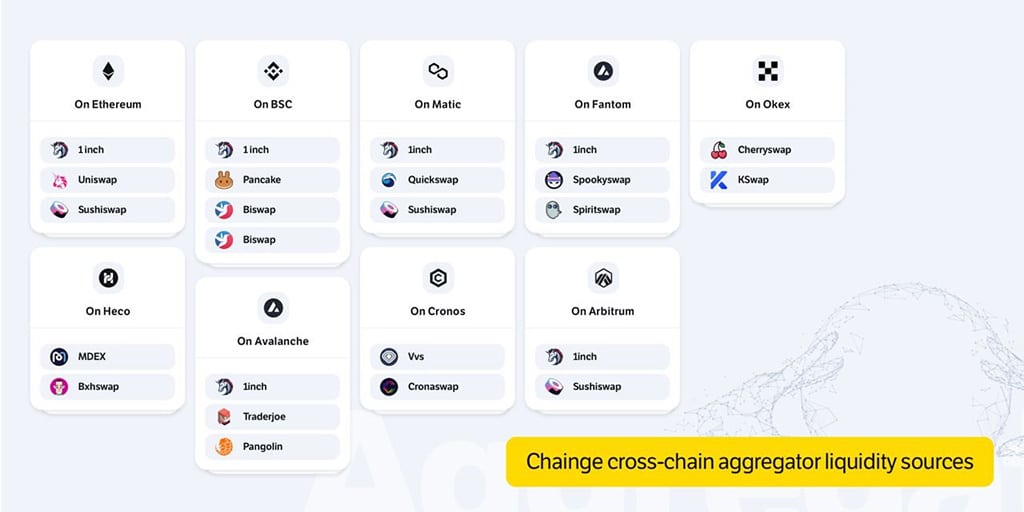

The Chainge app – a web 3.0 trading avenue that currently supports 200+ assets – has launched its liquidity aggregator covering over twenty active DEXes and 1 aggregator across 9 chains.

Aimed to address two significant obstacles – the inability to aggregate liquidity from multiple chains at the same time and the lack of an intuitive user interface – Chainge Finance compounds liquidity from many DEXes and chains through its newfangled liquidity aggregator. Eliminating the need to connect an array of wallets to the aggregator or use bridges before swapping, Chainge Finance delivers an all-in-one solution that doubles as a user-friendly wallet and a cross-chain DEX with various management tools and assets.

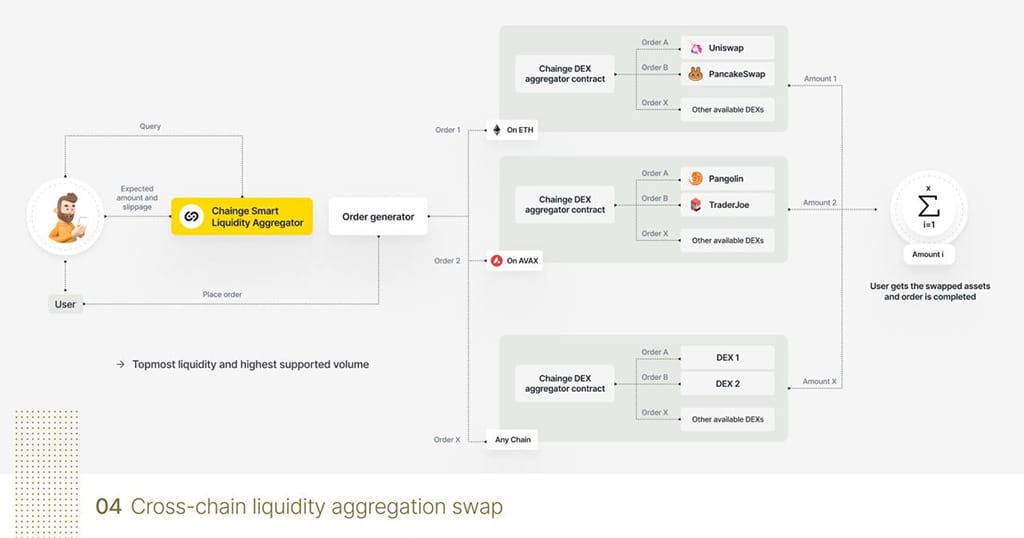

Chainge Finance leverages the aspectacular DCRM technology and cross-chain algorithm to facilitate cross-chain swap orders. In essence, Chainge, through the implementation of cutting-edge technology, crawls through multiple DEXes in search of the best transaction rates for users’ pair swaps and mechanically splits the order between them [DEXes] across several chains.

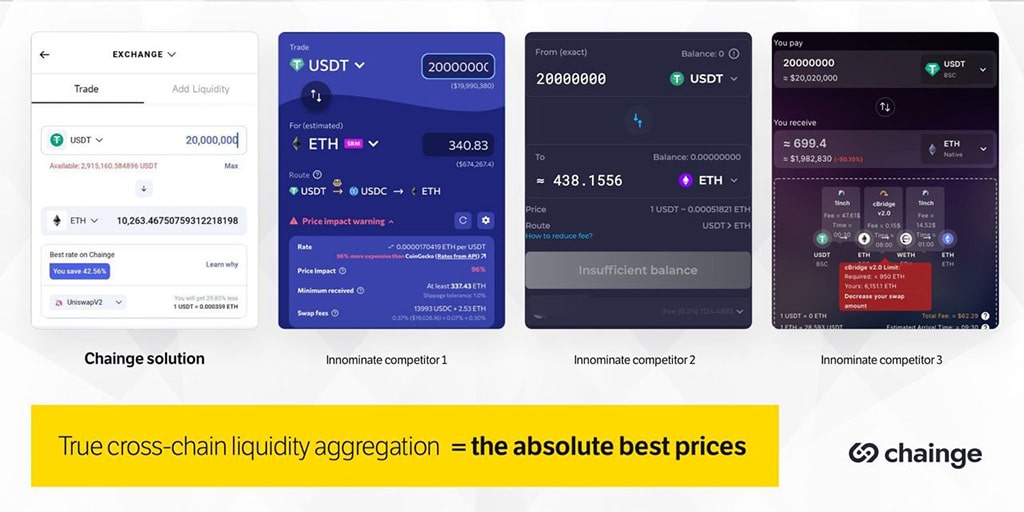

Currently, Chainge Finance is the most liquid DEX on the market, guaranteeing users the best prices for their trades.

While some aggregating emerging projects claim to offer similar services as Chainge Finance, the latter is the only platform that embodies the true meaning of cross-chain. Users do not have to connect multiple wallets to a liquidity aggregator to execute transactions, use bridges and have at their disposal liquidity across several chains for each swap, while other aggregators can only aggregate liquidity from one SINGLE chain per swap . This consolidates Chainge’s stance as the only genuine cross-chain liquidity aggregator in the trillion-dollar crypto market.

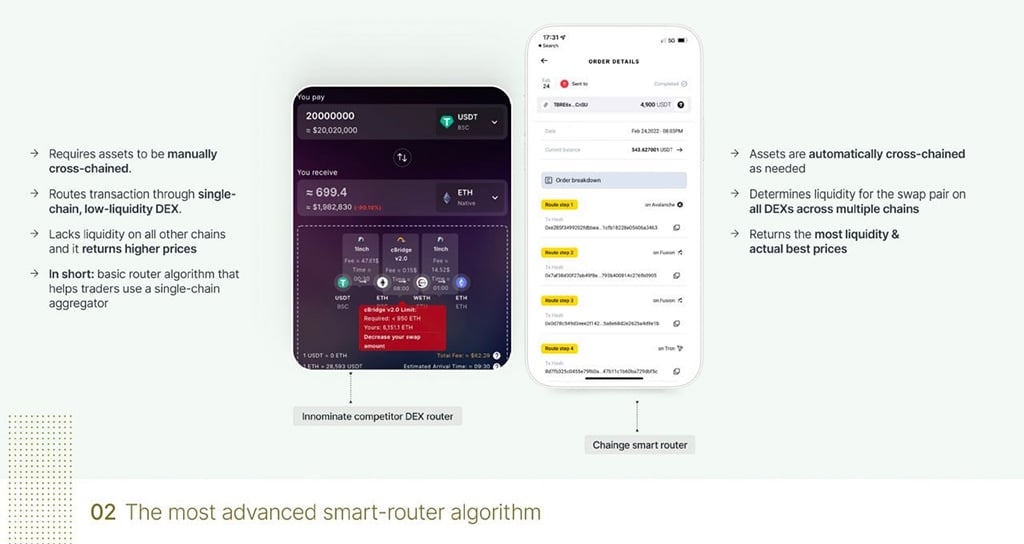

Chainge Finance offers the highest liquidity and best prices on the market. Unlike their competitors, Chainge boasts the integration of the most advanced aggregating smart router capable of conveniently splitting transactions across both DEXes and chains.

Chainge Finance completely dispels the need to cross-chain assets in order to trade.

For example, if you’re swapping USDC for Ethereum on Chainge Finance, the DEX algorithm searches a local database containing all decentralized exchanges with the supported USDC/ETH pair.

The algorithm finds the DEXes with the lowest rates for the trading pair, then decides the best chain(s) to execute the transaction on.

Chainge automatically sends the assets to the target chain(s), and the previously outlined amount of USDC is split using the advanced smart router and then swapped. Thus, the trader receives the highest possible number of ETHs his USDC can buy.

Promising convenience and faster transaction times with minimal fees, the Chainge liquidity aggregator outranks any existing aggregator.

When juxtaposed with similar projects, Chainge Finance is miles ahead. Its better price offering, higher liquidity, cross-chain capabilities, faster transaction throughput, and adoption of advanced technology sets it apart from the others. However, the unavailability of a desktop app limits Chainge Finance’s overall control of the market, as some users would prefer to handle high capital transactions on a desktop app.

Nonetheless, the mobile app is running and currently has over 400k users with $160 million in total value locked [TVL] from Liquidity Providers as well as a total aggregated liquidity exceeding $40 Billion.

All-in-all, Chainge Finance has officially become the most liquid web3 trading venue on the crypto market.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.