Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

But as the Chinese authorities continue to ramp up their anti-crypto activities, it’s reasonable to expect more miners to explore their options elsewhere.

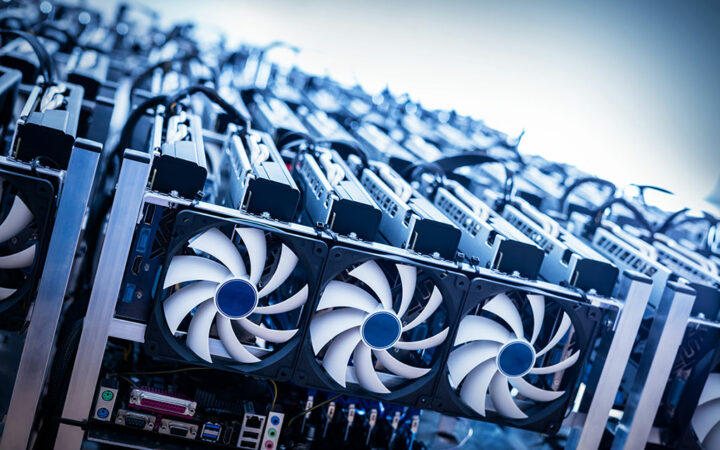

For some time now, China has remained the undisputed capital of the cryptocurrency mining industry. And there are good reasons for that. First, the country’s massive semiconductor industry made it the premier producer of cutting-edge ASIC mining hardware. Second, it has an overabundance of cheap – albeit dirty – energy production. And third, regulations surrounding the practice of crypto mining were virtually nonexistent.

And even though the government had made some halting steps in the past aimed at bringing the crypto industry to heel, not many had a lasting effect. But this week it appears that China’s war against cryptocurrency – and mining operations in particular – has kicked into high gear. After taking steps to curb the activity of mining operators in several provinces, the government has started looking to root out clandestine mining operations still believed to be operating within the country.

And almost simultaneously, officials in the semi-autonomous region of inner Mongolia announced that they, too, would begin hunting for crypto miners within their borders. In other words, it appears that China’s run as the center of the crypto mining world is about to end. And that can only mean one thing. That another country will soon emerge as a crypto mining powerhouse. Here are three of the options major mining operators are considering.

In the months since China began its crackdown on crypto, it has shed mining power regularly. And one of the places the displaced miners have shown up is in neighboring Kazakhstan. This began on June 25th, when Kazakhstani President Kassym-Zhomart Tokaev signed off on a new law that made crypto mining legal nationwide. Since then, major Chinese operators like BIT Mining LTD. have pulled up stakes and relocated there.

The moves catapulted Kazakhstan from 1.4% of global mining activity to 8.2% – and the number is still growing. In the last few months, additional firms have announced plans to begin opening facilities there, including Shanghai-based The9. This would seem to indicate the continued growth of Kazakhstan as a crypto mining center for the foreseeable future, barring any further regulatory intervention.

Another favored destination for crypto miners is Iceland, which was once responsible for as much as 8% of global mining activity. That share dwindled as miners launched large-scale facilities in China, but could see a resurgence now that the tide has shifted. Already, IBC Group announced that it would be relocating some of its Chinese operations there, joining multiple other firms already eyeing the Nordic nation.

Relative newcomers like PEGA Mining have already made Iceland a major base of operations, drawn there by the country’s abundant supply of cheap, renewable energy sources. And critically, 100% of the nation’s electricity generation comes from hydro and geothermal power plants, making Iceland one of the few places where it’s possible to run entirely green mining facilities.

The final major destination attracting attention from displaced miners is Texas. Long known as an oil-driven economy, the state is attempting to parley its low electricity costs into a means of attracting high-tech industries. And the crypto mining industry is among its first targets, with major mining facilities already under construction all over the state.

Chinese mining operator Poolin was among the first to make the move, and they’re not alone. The aforementioned BIT Mining LTD. and Bitmain soon followed, with both announcing multimillion-dollar investments in facility upgrades with the state. The only hurdle that’s keeping Texas from making bigger strides within the crypto industry are the questions surrounding the reliability of its electrical grid, which faltered under heavy demand earlier this year.

It’s far too soon to know which destination will absorb the greatest share of China’s fleeing crypto mining operators. But one thing that’s clear is that there’s still a long way to go before China relinquishes its title as the king of crypto mining. At the time of this writing, it still represents 46% of all global mining power, which is almost triple the size of its next closest rival, the United States.

But as the Chinese authorities continue to ramp up their anti-crypto activities, it’s reasonable to expect more miners to explore their options elsewhere. And as they do, it will represent a fundamental shift in the crypto mining industry that few saw coming. One of the locations detailed here – or perhaps a combination of them – will reap the benefits of this major shift. And cryptocurrencies, as always, will carry on regardless.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.