Alexandra is a software engineer who specializes in core banking systems development for financial and IT spheres. Taking strong interest in blockchain, cryptocurrencies, and IoT, Alexandra got deep understanding of the emerging techs believing in their potential to drive the future.

The crypto sphere has changed a lot since the moment it came into existence. What started as a completely independent project is now a big concern for the governments all over the world. While some of the crypto companies prefer to ignore the mounting pressure of regulations, Coinbase makes a step towards the governmental initiatives. The San Francisco-based startup has approached the United States Securities and Exchange Commission (SEC) about registering as a licensed brokerage firm and electronic-trading venue.

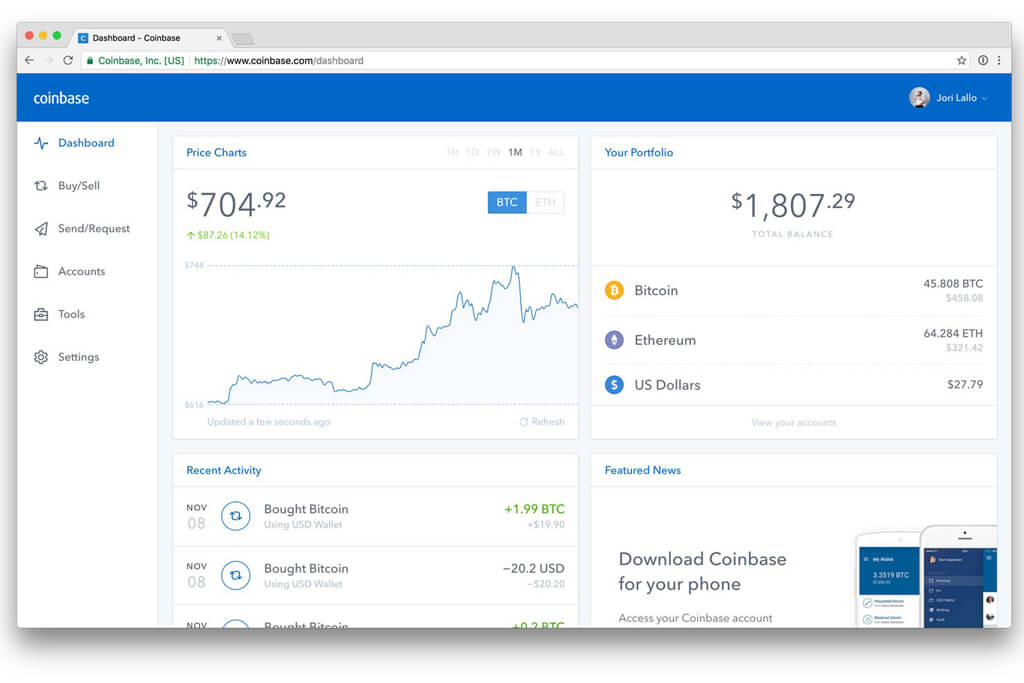

Coinbase may be not the biggest cryptocurrency exchange in the world, but its measured approach to exchange definitely played an important role in the rise of Bitcoin popularity among people who do not have strong technical background. The $1.6 billion cryptocurrency exchange is not into risky business. At the moment there are only four coins listed on the Coinbase exchange – Bitcoin, Ethereum, Bitcoin Cash and Litcoin. These cryptocurrencies are representing four out of five cryptos by market capitalization according to CoinMarketCap. The company is also making promising steps in the other directions: for example, just a few days ago Coinbase announced the launch of an early-stage venture fund.

The initiative of Coinbase of becoming a licensed brokerage firm and electronic-trading venue may benefit the company in many ways. The most evident advantage is the possibility to widen the list of traded currencies without risking its reputation. The official status can also help Coinbase to get a strong competitive edge. Official status from SEC may dramatically increase the trading volumes as new ICOs are conquering the world.

SEC is still in the process of creating the full stack of regulations of the crypto sphere. The specific guidelines are still to be given, but it can already be said that the digital tokens will be treated as securities, at least most of them will. This approach of SEC has caused some criticism as the wide spread of this kind of regulations may seriously damage the fragile sphere of cryptocurrencies causing the massive market downfall. One more tough question for regulators is the internal tokens of the projects which are extremely popular among the ongoing ICOs.

Coinbase’s President Asiff Hirji told said: ”We are on the right side of where the regulations are. You cannot then list things for which there are regul uncertainty because that doesn’t fit with our mission. The assets that we do list have all had some amount of regulatory certainty. As soon as there is more regulatory clarity than there currently is you would expect us to start listing more assets.”

Even though Coinbase is now doing its best to get official registration from SEC, this company cannot claim to have crystal reputation while dealing with regulators. The crypto sphere remembers the confrontation between Internal Revenue Service and Coinbase. The long-lasting process ended up with Coinbase revealing the info of approximately 13,000 customers. Hopefully, the story of Coinbase and SEC will prove that this company can play ball with the regulators.