ENS Soaring, Web 3 Hot, How Can LendMi Catch the Next Wealth Password?

Up to now, the hot ENS airdrop has risen to a maximum of $81. Based on the airdrop of 25 million tokens, the current market value of ENS can reach a maximum of $205 million. At the same time, the explosion of ENS also brought the new social gameplay of Web 3 to the whole industry, as well as the new governance mechanism DAO.

There is no doubt that the Web 3 concept is gaining more and more attention and attracting a wide range of businesses and teams. In the midst of this sweeping technological change, LendMi, Filecoin lending platform, is ambitious.

ENS Ignites Web 3

This year’s revelry, from a project called ENS.

This is an OG project in the industry for many years, Ethereum domain name, since the NFT avatar can make sense in Metaverse story, then in Ethereum network closest to the true Metaverse, the domain name is also a representative of identity, and has its own value.

And the wealth effect caused by this OG airdrop is really amazing.

As long as you have previously registered ENS domain name, you can qualify for airdrop, while communities, contributors and other people involved in ecological construction can get more substantial airdrop. The airdrop covered 138,000 addresses, and it was another revelry.

The star effect of ENS is one reason for this huge revelry of riches, but the value of Web 3 behind ENS is even more important.

At least, the airdrop of ENS airdrops catapulted the concept of Web 3 into the public consciousness. The industry’s exploration of Web 3 is still in its early stage, but that doesn’t stop us from planning ahead for projects with high quality and potential.

In other words, the explosion of ENS accelerated the popularity of the Web 3 concept and made more people aware of this novel concept.

In fact, the concept of Web 3 is very broad, and ENS is just one area. In addition, the Web 3 section covers social, identity, Metaverse, distributed storage, etc.

It is important to note that distributed storage is one of the offsets of the Web 3 concept and is the cornerstone of the entire Web 3 concept.

After all, as concepts like Metasverse expand, the amount of data people need to store will increase exponentially.

However, if these data are stored in a single server in the way of Web 2, the privacy of users cannot be reasonably maintained.

In fact, server providers leak user privacy, which is almost unstoppable.

However, the rise of distributed storage, lead by Filecoin and AR, provides a secure storage space for massive user information.

At present, it is not perfect to rely only on the public chain of smart contracts. Because most public chains are actually only the upper chain of transaction records and cannot store other data, even DeFi, which is perfectly implemented, is often criticized as “not enough decentralized” due to the front-end deployment of applications on “centralized servers”.

Therefore, the concept of distributed storage is getting more and more attention.

The most important leader in this area is Filecoin.

Recently, Near, a decentralized blockchain protocol, partnered with distributed storage leader Filecoin to offer developers a $300,000 grant. Any project that demonstrates or supports integration between Filecoin and NEAR is encouraged to apply, and all eligible projects will receive funding for further development.

The news announced, immediately caused the interest of many developers to signed up.

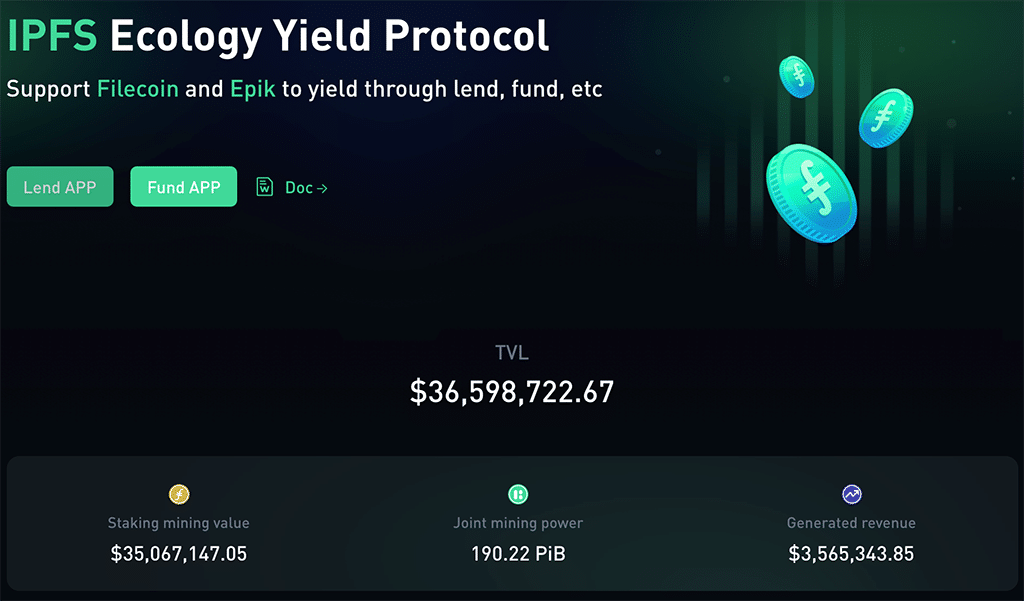

One project that deserves our attention is LendMi, focus on Filecoin ecosystem lending platform.

What Is LendMi?

LendMi is a lending platform for FILECOIN ecosystem. Through DeFi, LendMi can open up the mining circle and coin circle funds, and get higher coin-margined returns for investors.

LendMi doesn’t have multiple lending products at the same time like Compound or Cream, HFIL is only one of them.

LendMi is more focused on its strengths, focusing on Filecoin ecosystem and refining it further. They offers a variety of options, including 30-day, 90-day fixed and current options on Filecoin lending area, which are tailored to each user’s needs. Filecoin allows participants to participate in the lending and investment process more scientifically.

LendMi uses a fixed-rate model for lending and mining products.

As we all know, the vast majority of lending products in the market today, such as Compound, Fortube, Cream, etc., use a floating profit model, so that the true annualized rate of return of participating users is affected by liquidity, market trends, and currency prices.

LendMi’s liquidity is more reliable than other lending products.

We know that DeFi lending products currently rely almost entirely on liquidity provided by players and funds, and when a user redeems an asset, the redemption cannot be done if there is not enough liquidity in the contract.

LendMi collects FIL and HFIL in the form of decentralized lending, lends them directly to Filecoin big nodes (big pools) to mining, and distributes the rewards to investors.

Since the output is stable, it is the confidence of LendMi to adopt the fixed-rate model, which can ensure that investors can enjoy fixed income. On the other hand, in order to ensure the effectiveness of the pledged assets of nodes, the community will elect large nodes (with high value) and require nodes to pledge their private keys to ensure the control of nodes (which can be verified by Miner signature).

The biggest advantage of LendMi over traditional lending products is that LendMi has established VFIL Foundation.

As we all know, at present, there are only two ways to participate in FIL investment in the market: on-chain and off-chain.

The off-chain is Filecoin mining and buying mining machines or cloud computing power, which is a heavy investment for ordinary investors, and it is difficult for the majority of investors to participate in the general.

The on-chain investment, except above FIL lending products, LendMi has also created a new VFIL fund based on Filecoin entity lending mining.

VFIL fund which refers to that LendMi by converting the equity tokens that entity Filecoin lending mining into VFIL. For each VFIL, there is a FIL token pledged in the mining machine, and all the FIL pledged in the mining machine are generating stable income, continuously pouring the mined value into the net value of the fund.

For now, there are only few products that can truly support Filecoin ecosystem and the development of Web 3.

But we can make sure that as Filecoin circuit becomes popular again and Filecoin ecosystem becomes more completed, there will be more room for the distributed storage sector in the future.

In the future, Filecoin lending products, such as LendMi, may see even greater growth opportunities as the market expands.

For the participants, it means a rare accumulation of wealth.

LendMi socials: Twitter, Telegram.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.