With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Spot Bitcoin exchange-traded funds have seen steady trading volumes in April after reaching a peak in early March, maintaining solid activity around $215 billion.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

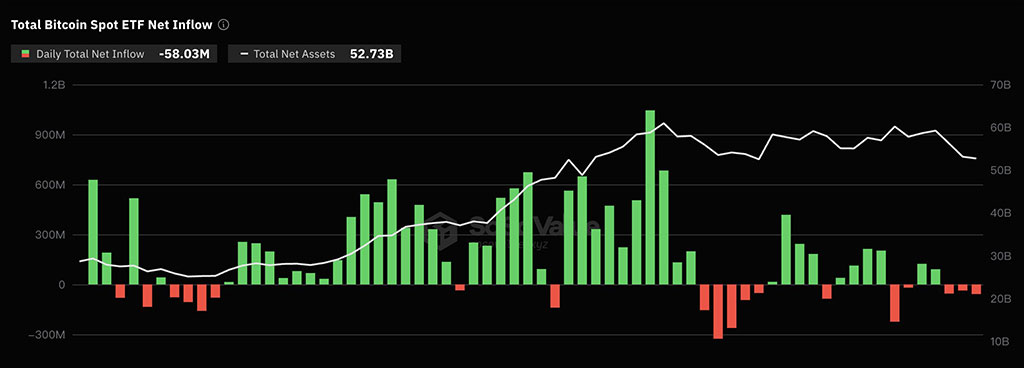

After a period of steady inflows, Bitcoin exchange-traded funds (ETFs) in the US faced withdrawals over three consecutive days. The outflow, largely driven by the Grayscale Bitcoin Trust (GBTC), totaled $58 million. This shift signals to change investor sentiment amid bitcoin price declining over 8% in the last week.

The overall net inflow for Bitcoin spot ETFs remains positive at around $12.43 billion, according to SoSoValue data. However, around $79.4 million exited GBTC yesterday. This trend aligns with a decline in GBTC’s holdings, which have dropped by roughly 50% to approximately 309,871 Bitcoin as of April 16th disclosures.

Experts suggest that the substantial 1.5% management fee for the Grayscale Bitcoin Trust significantly discourages investors. This fee exceeds the 0.12% fee offered by competitors like BlackRock’s iShares Bitcoin Trust (IBIT), making GBTC comparatively unattractive.

Concerns regarding insufficient funds inflow US Bitcoin ETFs have been dismissed by Bloomberg analyst James Seyffart. He highlights that most ETFs, including thousands based in the US, see zero inflows on many days – a typical occurrence. He explained that new inflows only happen when a substantial imbalance between the supply and demand for ETF shares arises.

“On any given day, the vast majority of ETFs will have a flow number of ZERO – this is very normal. There are ~3,500 ETFs in the US. Yesterday 2,903 of them had a flow of exactly zero,” said Seyffart.

While BlackRock’s Bitcoin ETF was the only product to experience inflows during the April 12-15 period, Seyffart clarifies that this does not negatively impact the other offerings. ETFs trade in large creation units, typically blocks thousands of shares. Only a significant supply-demand imbalance triggers the creation or destruction of new shares.

However, spot Bitcoin exchange-traded funds have seen steady trading volumes in April after reaching a peak in early March, maintaining solid activity around $215 billion, as reported by The Block. Additionally, the inflow and outflow of funds for bitcoin ETFs have balanced since March, suggesting a steadying of investor sentiment.

With the block-reward halving event just three days away estimated for April 20th, it remains to be seen how this historical event will impact investor behavior. While Bitcoin’s price currently sits at $63,557, it has experienced some volatility in the past week due to geopolitical tensions. However, it remains significantly up year-to-date.

The coming days will be crucial in understanding investor sentiment towards spot bitcoin ETFs. While GBTC faces challenges, the broader market seems to be finding its footing. The launch of Hong Kong’s ETFs, coupled with the Bitcoin halving event, adds intrigue to the near future of the cryptocurrency market.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.