Gemini Crypto Credit Card for US Users: Earn Up to 4% Back in Crypto with No Annual Fee

Popular crypto exchange Gemini has updated its crypto rewards credit card, now offering up to 4% back on eligible purchases for its US clients. Unlike traditional credit cards, where you earn points or cash, the Gemini Credit Card lets you earn rewards in over 50 cryptocurrencies you choose, including BTC, XRP, and ETH.

To sweeten the deal, this crypto credit card has no annual fee, making it affordable for everyone. With rewards on everyday purchases credited to your account instantly in crypto, this could be an excellent addition to your wallet.

Reward Tiers Explained

The Gemini Credit Card offers rewards across several categories:

- 4% back on gas, EV charging, and transport (transit, taxi, rideshare) up to $300 each month, 1% thereafter, resetting back to 4% on the first day of the following month

- 3% back on dining

- 2% back on groceries

- 1% back on all other purchases

Unlike traditional credit cards with cashback rewards that earn USD, the Gemini Credit Card pays out its bonuses in Bitcoin or more than 50 other supported coins, which are instantly credited to your account balance.

Benefits and Key Features

Earning up to 4% back in crypto on select purchases isn’t the only feature offered by the Gemini Credit Card. You also get:

- No annual or foreign transaction fees. This card can be an excellent choice when traveling abroad, as you still earn rewards without paying any foreign transaction fees. On top of that, there is no annual fee.

- Welcome bonus. New cardholders can earn $200 in crypto when they spend $3,000 in the first 90 days after getting their card.

- Choose your reward currency. Get your rewards in over 50 supported cryptocurrencies, including BTC, ETH, SOL, and XRP.

- Integration with Gemini’s platform. Within one account, you can store and trade the crypto coins you earn as a reward for your purchases.

- Mastercard World Elite Perks. Being a Mastercard World Elite card comes with native benefits like Priority Pass with access to 1,700 airport lounges worldwide and special offers and discounts in the terminal on dining, retail, and spa; a complimentary 24/7 concierge agent for your travel needs; theft protection and Mastercard Zero Liability protection against unauthorized transactions; and more.

Earning and Managing Your Crypto Rewards

In most cases, users receive their crypto rewards instantly. However, in some cases, such as purchases made at online merchants, it may take up to 72 hours for the transaction to clear and for you to receive your rewards. The reason for having to wait for rewards on this type of purchase is that merchants charge pre-authorization, which can differ from the actual purchase price until the transaction is settled.

Note, not all transactions qualify for crypto rewards. Gift card purchases, traveler’s checks, precious metals, casino chips, crypto purchases, lottery tickets, or cash equivalents do not qualify for rewards under the Gemini Rewards Program Terms. This is a standard procedure even with traditional rewards cards.

Users can manage their crypto rewards within their Gemini account, either on desktop or mobile. These rewards can be used for trading, for holding, or can be sold whenever you want.

Everyday Spending Meets Investment Potential

The benefits for everyday users and crypto investors come in many forms, which offer practical and long-term advantages.

For example, you can earn crypto by simply using your card for your everyday spending habits, including groceries, coffee, and transportation. By choosing the cryptocurrency for your reward, you get to build and diversify your portfolio passively.

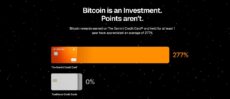

Gemini Credit Card users who received their rewards in Bitcoin and held them for at least one year have seen their rewards appreciate an average of 277%. Such potential appreciation isn’t available with traditional credit cards.

Why the Gemini Credit Card Stands Out

Unlike cards like the Nexo Credit Card or the Crypto.com Visa Card, which require that you either pay an annual fee, hold a certain cash balance, or hold a certain amount of the platform’s native tokens, the Gemini Credit Card is available without an annual fee or any other fee to unlock the card’s perks.

Moreover, users aren’t locked into earning the platform’s native token as a reward. Instead, Gemini Credit Card users can choose from 50 cryptocurrencies as their rewards.

Gemini is one of the oldest and leading crypto exchanges, having been active since 2014. During this time, the platform has never experienced hacks or theft incidents, showing that user fund safety is a top priority.

What to Keep in Mind

While the Gemini Credit Card can be an excellent companion for every crypto enthusiast, there are some considerations to consider.

Traditional cashback cards offer returns in USD, meaning you know exactly what you get on your spending: 3% on your $200 bill is $6, no matter how you spin it.

With the Gemini Credit Card, however, your actual reward depends on the performance of the crypto you choose. If you get your rewards in BTC and its value goes up by 30%, your $6 will become $7.8. But it can also drop if BTC loses value.

Additionally, there’s a cap on the 4% reward tier of $300 each month, reverting to 1% thereafter until the new month begins. This means that if you spend $500 monthly on transport, you will earn $14 worth of crypto rewards in total ($12 for the $300 and $2 for the remaining $200).

Because of crypto’s volatility, this card may not be a suitable option for every user. But for those who want to move away from traditional banking and earn crypto passively on every purchase they make, the Gemini Crypto Card could be an excellent choice.

The Future of Crypto Spending

Combining Mastercard as a traditional card issuer and the crypto rewards earned with everyday spending, the Gemini Credit Card bridges traditional finance and crypto. With no annual fees and no foreign transaction fees, this crypto rewards credit card is available to anyone in the US based on their credit score.

As financial institutions and countries build their treasuries around crypto, the Gemini Credit Card could be an excellent opportunity to passively increase your crypto holdings by simply making everyday purchases.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.