Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

Discover the top exchanges for 1,000x leverage. Learn where to trade crypto derivatives with a 0.1% margin requirement, and what factors to consider before starting.

We evaluated the best online platforms for 1,000x leverage crypto trading. Our findings suggest that CoinFutures is the overall top choice in 2026. Backed by the CoinPoker group, CoinFutures requires a 0.1% collateral on simulated futures, and popular markets include Bitcoin, BNB, Solana, Ethereum, and Dogecoin.

Trading digital assets with 1,000x leverage boosts profitable positions by 1,000 times, and requires just $10 to open a $10,000 trade. This guide helps beginners learn how to trade leveraged cryptocurrencies in a risk-averse environment and where to get started with a safe exchange.

Key Takeaways

- When you trade cryptocurrencies with 1,000x leverage, you multiply the trading position by 1,000 times.

- Traders obtain leverage via derivative contracts, and the most popular instruments are futures and options.

- Alongside low margin requirements, leveraged markets let crypto traders go long or short.

- According to our research, the best 1,000x leverage platform is CoinFutures, which ranks highly for safety, user-friendliness, and supported markets.

- Remember that 1,000x leverage is extremely risky, as even a small volatility spike can result in instant liquidation.

Top Exchanges for 1,000x Leverage Crypto Trading: Our Top Picks

These are the top platforms for 1,000x leverage crypto trading in 2026:

- CoinFutures: Trade 1,000x Crypto Futures on a Safe and Beginner-Friendly Platform

- PancakeSwap: Top-Rated DEX With 1001x Leverage on BTC and ETH Perpetuals

- Rollbit: Budget-Friendly Trading Platform With a $0.01 Minimum Trade Requirement

- Opt.Fun: Purchase Call and Put Options via One-Minute Maturity Contracts

- Aark: Arbitrum-Based DEX With Risk-Free Demo Trading Features

- CoinUnited: Speculate on Meme Coins With a 0.05% Upfront Margin

- BumpinTrade: 1,000x Solana DEX With Isolated and Cross-Margin Markets

Detailed Reviews of the Best Platforms for 1,000x Crypto Leverage

Our methodology researched safe exchanges and trading platforms that offer 1,000x crypto leverage. We scored each platform by core criteria, including product types (e.g., futures), fee structures, funding cycles, listed assets, and payment processes.

Read on to explore our findings and make an informed decision.

1. CoinFutures: The Overall Best Futures Platform for 1,000x Crypto Leverage Trading

Overall, CoinFutures is the best place to trade cryptocurrencies with leverage. The platform scores highly for safety and legitimacy, since it protects customer funds with Fireblocks vaults, MPC technology, and published asset reserves. The fully licensed parent company is CoinPoker, which was established in 2017 and follows strict security industry standards.

CoinFutures offers a wide selection of markets, and traders go long or short without relying on liquidity. Its simulated futures track everything from Bitcoin and Dogecoin to BNB, Avalanche, and Litecoin. Futures are perpetual-style, as they never expire. Traders can cash out at any time, and the trade minimum is just $1.

Trade Bitcoin, Ethereum, Solana, and other altcoins with 1,000x leverage on the CoinFutures platform. Source: CoinFutures

With a margin requirement of 0.1%, users get 1,000x leverage on all pairs, which are dominated in USDT. CoinFutures offers a simple slider tool that lets users reduce leverage to more manageable amounts, alongside stop-loss orders to exit trades before liquidation. It also supports take-profit orders, where traders choose a profit target and automatically lock in their gains.

Regarding the onboarding experience, first-time traders open accounts with an email address, letting them avoid KYC verification. Traders deposit funds with cryptocurrencies or debit/credit cards and e-wallets. Public reviews confirm that CoinFutures processes most withdrawals instantly, so users receive their futures profits in minutes.

Pros

- The safest and most reputable trading platform for 1,000x crypto leverage

- Futures markets include Bitcoin, Solana, XRP, BNB, and Ethereum

- The $1 minimum requirement amplifies to $1,000 in market exposure

- Trade without KYC when you deposit and withdraw crypto

- Most users receive their withdrawals in minutes

- Reduce risk with stop-loss orders

Cons

- Lacks support for crypto options or perpetuals

- Fiat deposits require basic personal information

2. PancakeSwap: On-Chain Perpetual Futures Trading with Max Leverage of 1,0001x

PancakeSwap is the de facto decentralized exchange (DEX) on the BNB Chain, where most of the network’s hot new presales and meme coins are traded. It’s primarily used for trading BEP-20 tokens, yet it also offers perpetual futures with huge leverage limits. The maximum leverage on Bitcoin and Ethereum markets is 1001x, although those limits are reduced to 75x on other altcoins like OFFICIAL TRUMP and Shiba Inu.

As a DEX, traders do not open accounts or provide KYC information. They connect a self-custody wallet to provide collateral in a supported asset like USDT, USDC, or BNB. Trading tools include TradingView integration, limit, stop-loss, and take-profit orders, and dozens of technical indicators.

PancakeSwap offers perpetual futures on-chain, and 1001x leverage on BTC/USDC and ETH/USDC. Source: PancakeSwap

While traders like PancakeSwap for its anonymous and non-custodial experience, on-chain trading remains complicated for beginners. Another drawback is the exchange’s fee policy. It charges market takers 0.08% per side, in addition to standard network fees. Each futures trade triggers a smart contract movement, which increases fees further.

Pros

- Trade Bitcoin and Ethereum with 1001x leverage

- Supports long and short markets via perpetual futures

- No requirement to open an account

- TradingView integration allows technical analysis

Cons

- Charges 0.08% per side on market orders

- On-chain trading isn’t a good fit for beginners

- Each trade incurs smart contract fees

3. Rollbit: Trade 60+ Simulated Crypto Markets from Just $0.01 per Position

Rollbit offers simulated crypto markets on over 60 digital assets, including top altcoins like Aave, XRP, Litecoin, Pi Network, and Hyperliquid. It also lists an extensive range of meme coins, from Mog Coin, Turbo, and Pump.fun, to Trump Coin, SPX6900, and Dogecoin.

All Rollbit markets offer 1,000x leverage with a minimum trade size of just $0.01. This gives traders access to significant exposure without risking consequential amounts. Beginners also like Rollbit for its simple trading system. They open long or short positions without orders, and the algorithmic pricing mechanism ensures fair trading conditions.

Rollbit users speculate on crypto prices on 60+ markets from just $0.01 per trade. Source: PancakeSwap

Rollbit provides social features that let traders share futures trading strategies with their platform peers. The public leaderboard, which shows the best-performing traders, allows users to compete with one another in a competitive environment.

Pros

- Small margin requirement of just $0.01

- Users get 1,000x leverage on meme coins like Turbo and Mog Coin

- The simple trading dashboard appeals to beginners

Cons

- Complicated pricing structure that lacks transparency

- The “advanced” chart offers limited analysis tools

- Prohibits users from the U.S., Germany, other countries

4. Opt.Fun: Non-Custodial Crypto Options Contracts with 60-Second Expirations

Opt.Fun lets traders speculate on call and put options with 1,000x leverage. It functions as a decentralized application (dApps) on the Hyperliquid blockchain, so users trade without accounts or centralized order books. After they connect a non-custodial wallet, they use USDT as collateral and open trades via smart contracts.

The on-chain system ensures transparency and prevents price manipulation, while allowing traders to remain anonymous. However, the options system supports one-minute markets only, which makes Opt.Fun unsuitable for most day trading strategies. It also supports just two markets: Bitcoin and Pump.fun.

Opt.Fun is a newly launched options trading platform on the Hyperliquid blockchain. Source: Opt.Fun

In terms of fees, traders pay 2% or 7% of the options premium, depending on whether they’re market makers or takers. The dApp also charges a small liquidation fee of 0.1%, and users cover network gas for each trade.

Pros

- Offers 1,000x leverage crypto trading via options contracts

- Trades settle on-chain for enhanced transparency

- Users trade calls and puts without relying on centralized order books

Cons

- Options markets include Bitcoin and Pump.fun only

- Contracts settle after just one minute

- Traders need USDT on the HyperLiquid token standard

5. Aark: Learn How to Trade 1,000x Perpetuals on a Risk-Free Demo Platform

Launched in 2024, Aark is a decentralized futures platform that operates on the Arbitrum network. Traders access 1,000x leverage on over 100+ crypto pairs, including Bitcoin, Ethereum, XRP, Solana, and Dogecoin.

The trading ecosystem, which specializes in perpetual contracts, supports lightning-fast settlement times and zero gas fees. It relies on a reflective market maker system, where price movements mirror Binance and on-chain liquidity.

Aark is an Arbitrum dApp that supports gas-free perpetual futures trading on 100+ pairs. Source: Aark

First-time users may test the Aark platform with risk-free demo trading features. They get $500 in virtual funds and trade long and short without depositing collateral. Refreshing the page resets the demo balance, and there are no time restrictions. The demo tool helps beginners craft 1,000x crypto futures trading strategies and learn risk management tactics.

Pros

- Leveraged perpetual contracts back over 100 crypto pairs

- Operates on Arbitrum without gas fees and near-instant execution

- The demo feature lets beginners learn trading strategies risk-free

Cons

- Users must trade over $1 million to upgrade their account tier

- The platform doesn’t accept fiat deposits

- Limited liquidity depth results in wide spreads

6. CoinUnited: An Industry-Low 0.05% Margin Requirement on Crypto and Traditional Assets

With a maximum leverage limit of 2000x, CoinUnited users trade cryptocurrencies with an upfront margin of just 0.05%. The minimum deposit requirement is $50, which unlocks $100,000 in market capital. Accepted payment methods include Visa, MasterCard, Bitcoin, and major altcoins.

CoinUnited supports several leveraged asset classes, including crypto, commodities, forex, and stocks. Source: CoinUnited

CoinUnited lists a huge selection of markets, which includes hundreds of perpetual futures on small and large-cap cryptocurrencies. Traders also access traditional asset classes like U.S.-listed stocks, global indices, commodities, and forex. Platform users get exposure to all listed markets via a single trading account.

The maker-taker fee structure starts at 0.04% per side, and commissions are reduced as traders increase their VIP tier. The main drawback is funding, since users pay higher-than-average fees every hour. Funding rates rise when trading markets have weak liquidity.

Pros

- All supported markets have a 0.05% margin requirement

- Deposit methods include debit/credit cards and crypto

- Access crypto, stocks, and other traditional assets through a single account

Cons

- The $50 minimum deposit is higher than most leverage platforms

- Charges massive funding rates every hour

- Some users report poor customer service experiences

7. BumpinTrade: Trade Volatile Solana Meme Coins with 1,000x Leverage

BumpinTrade is a new DEX on the Solana blockchain that supports high-leverage trading. The on-chain ecosystem provides access to trending meme coins on Solana like Trump Coin, BONK, and dogwifhat, and charting tools include over 50 indicators such as the Parabolic SAR, Moving Averages, and Double EMA.

Despite its high-level analysis features, the trading platform is simple to use, and it clearly displays key data like borrowing rates and open interest. The DEX supports limit and market orders without centralized order books, as smart contracts execute positions from existing liquidity pools.

BumpinTrade is a Solana-based DEX that supports on-chain limit and market orders. Source: BumpinTrade

BumpinTrade also lets traders choose between cross and isolated margin, depending on their strategy and risk profile. To generate passive rewards, users provide liquidity and earn a share of trading commissions and funding fees.

Pros

- A popular choice for trading Solana meme coins with 1,000x leverage

- Supports cross and isolated-margin facilities

- Earn passive rewards when providing platform liquidity

Cons

- Traders cannot reduce leverage below 500x

- Limited customer support channels

- Just 2,000 traders currently use the platform

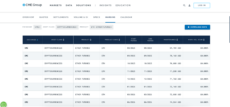

Top Global Crypto Exchanges with 1,000x Leverage Compared

Here’s how the best 1,000x leverage platforms compare for key metrics:

| Tradable Leverage Markets | Derivative Type | Ecosystem Structure | Max Leverage Limit | Initial Margin | Reduced Limits for Non-Major Pairs? | KYC Verification | |

| CoinFutures | 11 | Simulated futures | Centralized trading platform | 1,000x | 0.1% | No | No |

| PancakeSwap | 35+ | Perpetual futures | BNB Chain dApp | 1001x | 0.099% | Yes | No |

| Rollbit | 60+ | Simulated futures | Centralized trading platform | 1,000x | 0.1% | No | Yes |

| Opt.Fun | 2 | Options | Hyperliquid dApp | 1,000x | 0.1% | No | No |

| Aark | 100+ | Perpetual futures | Arbitrum dApp | 1,000x | 0.1% | No | No |

| CoinUnited | 19,000+ | Perpetual futures, delivery futures, options | Centralized trading platform | 2000x | 0.05% | No | Yes |

| BumpinTrade | 20+ | Perpetual futures | Solana dApp | 1,000x | 0.1% | No | No |

How Does 1,000x Crypto Leverage Work? Learn the Basics

Leverage trading is a popular tool that amplifies profits and losses. It enables crypto traders to speculate on price movements with far more than they deposit. The initial stake, known as the “margin”, is boosted by the chosen leverage multiple.

At 1,000x, this means a $10 margin increases to $10,000. If the trade generates a profit, those gains are magnified 1,000 times. Although leverage also increases risk, most platforms cap potential losses to the initial margin. This risk-reward framework helps traders target substantial returns without risking more than they can afford to lose. However, trading with such high leverage can lead to liquidations in mere milliseconds, especially if you’re trading small or new cryptocurrencies.

Understanding the basics of crypto derivatives is essential before trading with 1,000x leverage. Various derivative types exist, including perpetuals, simulated futures, and options. They provide market exposure without traders owning or controlling cryptocurrencies, as derivative contracts track price movements only.

In addition to high leverage, traders can go long and short on derivative markets, so regardless of crypto sentiment, trading opportunities exist.

Why Do Crypto Traders Use 1,000x Leverage? Key Advantages

Traders frequently use leveraged products to boost their capital, target much higher profit margins, and capitalize on falling crypto prices. They also use derivatives to hedge against risk and take advantage of market inefficiencies.

Learn more about the benefits of 1,000x leverage crypto trading, and why this marketplace generates billions of dollars in daily volume.

Magnify Trading Profits by 1,000x

Traditional brokerages typically offer margin accounts with a 50% cap. This limits investors to 2x leverage and restricts them from opening large positions.

In contrast, 1,000x leverage platforms require traders to meet an initial margin of just 0.1%. They let users control buy and sell orders worth $100,000 with a small $100 deposit, so casual investors gain institutional-level market exposure with minimal funds.

Consistently predicting future price movements correctly can generate sizable profits, even on small-margin positions. A day trader may target 0.5% gains per session, yet with a 1,000x multiplier, those margins increase to 500%.

Avoid Interest Rates on Ultra-Short-Term Trades

Leverage requires financing, which means traders pay additional fees on the capital they receive. The best crypto futures trading platforms charge funding fees every eight hours, which hinders swing trading strategies that rely on longer-term trades.

Short-term strategies like scalping avoid those fees because positions rarely remain open for more than a few minutes. This pricing structure is cost-effective for 1,000x traders with quick entry and exit points.

Leverage Enables Bearish Traders to Short-Sell Cryptocurrencies

Bear cycles historically last for extended periods, with most cryptocurrencies shedding significant value from their all-time highs. Bitcoin, for instance, peaked at $68,000 in 2021, only to decline 75% to $16,500 just 12 months later. Unlike traditional spot trading, leverage lets users capitalize on bearish price action.

Traders short-sell derivative products like perpetual futures simply by placing sell orders. They make profits if the crypto pair drops in value, and magnify those returns by the chosen leverage multiplier.

Suitable for Various Market Timeframes

Although most derivative products attract funding rates, some instruments provide alternative methods for longer-term trades.

One example is delivery futures with monthly, quarterly, and annual expiration dates. Traders do not pay funding fees on these contracts, which lets them hold futures until maturity. This investment structure suits swing traders who seek leverage without timeframe restrictions.

Risk Management Tool Against Market Uncertainty

Experienced traders often use 1,000x leverage crypto trading platforms to mitigate portfolio risk. If they anticipate a potential market correction due to adverse geopolitical or macroeconomic developments, derivatives protect existing positions.

On CoinFutures, traders short-sell XRP via simulated futures products. Source: CoinFutures

For example, an investor holding XRP may have concerns about regulatory amendments that could impact the token price. Rather than cash out and face potential tax obligations, they short-sell XRP futures. While those contracts remain open, the investor offsets the risk of unfavorable XRP price movements.

Hedging isn’t possible on traditional crypto exchanges, as market dynamics support long positions only.

What Are the Risks of Crypto Trading with 1,000x Leverage?

Traders can lose money when they trade with leverage, just like any other investment product. However, high leverage limits increase those risks considerably, particularly when traders lack clear strategies or risk management controls.

The main risk to be aware of is margin liquidation. Crypto margin acts as collateral, similar to paying a small deposit on a secured loan. To manage risk, exchanges close leveraged positions when they drop below the trader’s maintenance margin. This forces traders to exit the market and forfeit their original stake.

While the liquidation system is essential to reduce the platform’s risk exposure, it becomes more likely on a 1,000x trade. At 1,000x, traders cover a tiny margin of just 0.1%. If their futures trade drops in value by around 0.05% to 0.1% (varies depending on the platform), they’re immediately liquidated.

Research shows that high leverage trading causes psychological risks. Common symptoms include stress and anxiety, as even a marginal volatility spike can lead to liquidation. Too many losses often result in overtrading, as traders chase those losses with higher stakes.

1,000x leverage also promotes an all-or-nothing mindset. Some experts argue that the concept resembles gambling more than trading.

Is 1,000x Crypto Leverage Right for You? Pros and Cons to Consider

To assess whether 1,000x crypto leverage is suitable for your investment goals and risk appetite, consider these pros and cons:

Pros

- Open large trading positions with collateral of just 0.1%

- Magnify crypto profits by 1,000 times

- Use leveraged instruments to hedge against risk

- Leverage supports long and short trading

- Traders limit potential losses to the upfront margin

- Maximize gains during both bullish and bearish cycles

Cons

- Some nationalities are banned from using leverage

- Platforms sometimes increase margin requirements on non-major markets

- 1,000x leverage vastly increases the probability of liquidation

- High-leverage trading causes stress, anxiety, and other psychological risks

- A deep understanding of derivative contracts is crucial

Important Information to Know Before Using 1,000x Leverage

If you’re new to 1,000x leverage crypto trading, this section explains key factors to know before getting started.

Initial vs Maintenance Margin

The best crypto exchanges provide two margin figures when setting up a leverage trade: initial and maintenance.

The initial margin is the upfront collateral to open the position. It reflects the amount of money the trader needs in percentage terms, based on the total market exposure. On a 1,000x crypto trade, the initial margin is 0.1%. Therefore, to place a $5,000 buy or sell order, you’d need $5 upfront.

Ethereum CME futures have significantly higher margin requirements than traditional crypto exchanges. Source: CoinFutures

The maintenance margin is always lower than the initial margin, often around 50% of it, but it varies by the platform. If the trade value declines, losses reduce the trade equity. Exchanges liquidate positions if the equity drops below the maintenance margin level, which means traders lose their initial stake.

The best practice is to focus on the exact liquidation price, rather than percentage declines or maintenance levels. CoinFutures updates the liquidation price as traders adjust the leverage multiple. This system helps users understand the market risk and how much buffer they have against liquidation.

Linear vs Inverse Contracts

Most crypto traders use futures to magnify positions by 1,000x. Knowing whether those futures contracts are linear or inverse is critical, because it directly influences the risk-reward.

Unless you’re a seasoned derivative trader with a proven track record, linear contracts remain the most suitable choice. By trading linear instruments, you cannot lose more than the initial margin, which caps your losses on liquidated trades. This makes 1,000x crypto trading more risk-averse, since you could make substantial profits while limiting the downside.

The other contract type, inverse futures, amplifies the risks and rewards. As the contracts margin and settle in the underlying crypto, adverse price movements impact both the collateral and financial losses. Liquidation may impact other futures positions, extending losses to the entire account.

Understand Funding Cycles and Rules

In crypto, exchanges use funding mechanisms to align futures and spot prices. It creates market parity while ensuring correlation between the derivative and real crypto markets.

Each platform has its own funding cycle, which averages eight hours. However, some exchanges, such as CoinUnited, implement those funding fees hourly.

Irrespective of the timeframe, 1,000x leverage crypto exchanges charge funding to one side of the market. Either longs pay shorts, or vice versa, depending on the market imbalance. For instance, if the majority of traders short Bitcoin in the current cycle, those shorts pay funding fees to longs.

After each funding cycle, account balances update to reflect payments, which can impact maintenance margin.

Master Risk Management Before Proceeding

Leveraged traders mitigate risk in various ways, such as setting limit, stop-loss, and take-profit orders. These three order types ensure traders execute entry and exit positions at a specific price. They determine order prices based on support and residence levels, and technical readings like the MACD, RSI, and Moving Averages.

The stop-loss order is particularly important, since it instructs exchanges to close the position at the stated price. Put otherwise, stop-losses help crypto traders avoid liquidation and reduce losses to more manageable amounts.

Beginner’s Walkthrough on How to Trade Crypto with 1,000x Leverage

The final section of this guide helps beginners trade cryptocurrencies with 1,000x leverage. We explain how to trade long or short at CoinFutures, and cap risk to just 0.1% of the overall trade value.

Step 1: Open a CoinFutures Account

It takes a few seconds to open a CoinFutures account. Just visit the CoinFutures website, click “Register”, and input an email address and password. Make sure you confirm the email to finalize the registration process.

CoinFutures offers futures trading accounts without requiring personal information or KYC verification: CoinFutures

CoinFutures requires users to download its mobile or desktop software. Choose the operating system and once installed, sign in to your new account.

Step 2: Make a Deposit

Go to the cashier dashboard and choose a deposit method.

Most CoinFutures users deposit crypto to remain anonymous and avoid transaction fees. Similar to crypto exchange payments, transfer coins or tokens to the provided wallet address, and the system updates the balance once they arrive.

Crypto payments at CoinFutures are fast, private, and fee-free. Source: CoinFutures

To use fiat money, enter some personal information and select a purchase method from Google/Apple Pay, Visa, MasterCard, or PIX.

Step 3: Choose a Market and Decide Whether to Go Long or Short

Click “Crypto Futures” and select a trading market. CoinFutures supports the best cryptocurrencies to trade, including XRP, Bitcoin, Solana, and Ethereum.

The next step is to decide between an “Up” (long) or “Down” (short) trade. This relates to whether you’re bullish or bearish on the pair.

Navigating the CoinFutures platform is seamless, especially when choosing a market to trade. Source: CoinFutures

If you’re still undecided, the platform offers basic charting tools to help analyze and predict price movements, and you can change the candlestick timeframe from five seconds to five minutes.

Step 4: Apply 1,000x Leverage, Enter Wager, and Evaluate the Bust Price

Move the leverage slider to 1,000x and enter your wager in USD. If your futures trade is liquidated, you forfeit the wager, so ensure you risk affordable amounts only (the minimum is just $1).

Traders place “Down” bets on CoinFutures if they predict falling Bitcoin prices. Source: CoinFutures

Before you proceed, we suggest evaluating the current and bust prices. You will notice the two prices are close to one another, which highlights the high liquidation risks on 1,000x trades. If you prefer trading with less risk, consider reducing the leverage.

Step 5: Set Stop-Loss and Take-Profit Features and Place Trade

Futures traders set stop-loss prices before they execute trades. If the futures pair rises or falls to that price, you automatically exit the position. In the “Auto” mode section, enter your stop-loss level.

Risk-averse traders also set take-profit prices, which close trades when their profit goals are reached.

Setting both stop-losses and take-profits ensures you exit the market with a pre-planned strategy. It also promotes a disciplined trading mindset and eliminates the stress of chart monitoring

Mitigate trading risks on CoinFutures with stop-loss and take-profit features. Source: CoinFutures

In our example, the stop-loss closes the trade if its value declines by $50. The take-profit triggers if the trade increases by $1,000.

Once you’ve reviewed the trade parameters and evaluated the risk, place the futures trade.

To summarize, traders who apply 1,000x crypto leverage take significant risk, yet by following best practices like predetermined entry and exit points, they can mitigate the potential losses. Since leverage suits short-term strategies, learn how to analyze charts and identify support and resistance levels to trade effectively.

Our research shows that beginners often use CoinFutures to trade with 1,000x leverage. It supports Bitcoin and major altcoin markets with a small $1 minimum and simple stop-loss features. CoinFutures doesn’t rely on exchange liquidity, so orders are executed instantly at the real-time market price.

FAQ

Is there a crypto exchange with 1,000x leverage?

Is it better to trade with higher leverage?

How much do I need for leverage crypto trading?

What happens when you get liquidated in crypto?

Do you owe money if you get liquidated?

What crypto can you trade with 1,000x leverage?

References

- Understanding Leverage Trading in Crypto (Coinbase)

- Margin: Know What’s Needed (CME Group)

- Psychological challenges of trading (Fidelity)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

24 mins

24 mins

Julia Sakovich

Senior Editor, 1251 postsI’m a content writer and editor with extensive experience creating high-quality content across a range of industries. Currently, I serve as the Editor-in-Chief at Coinspeaker, where I lead content strategy, oversee editorial workflows, and ensure that every piece meets the highest standards. In this role, I collaborate closely with writers, researchers, and industry experts to deliver content that not only informs and educates but also sparks meaningful discussion around innovation.

Much of my work focuses on blockchain, cryptocurrencies, artificial intelligence, and software development, where I bring together editorial expertise, subject knowledge, and leadership experience to shape meaningful conversations about technology and its real-world impact. I’m particularly passionate about exploring how emerging technologies intersect with business, society, and everyday life. Whether I’m writing about decentralized finance, AI applications, or the latest in software development, my goal is always to make complex subjects accessible, relevant, and valuable to readers.

My academic background has played an important role in shaping my approach to content. I studied Intercultural Communications, PR, and Translation at Minsk State Linguistic University, and later pursued a Master’s degree in Economics and Management at the Belarusian State Economic University. The combination of linguistic, communication, and business training has given me the ability to translate complex technical and economic concepts into clear, engaging narratives for diverse audiences.

Over the years, my articles have been featured on a variety of platforms. In addition to contributing to company blogs—primarily for software development agencies—my work has appeared in well-regarded outlets such as SwissCognitive, HackerNoon, Tech Company News, and SmallBizClub, among others.