This guide analyzes the Best Wallet Token price forecast from 2025 to 2030. We break down expert predictions and the key factors t...

Best Crypto to Buy Now: Top Picks for December 2024 Growth Potential

Last Updatedby Benjamin Njiri · 22 mins read

Altcoin season is underway, and there is renewed interest in DeFi, AI agents, and memecoins. Here are the key trends and coins in December 2024 with promising growth.

Key Takeaways

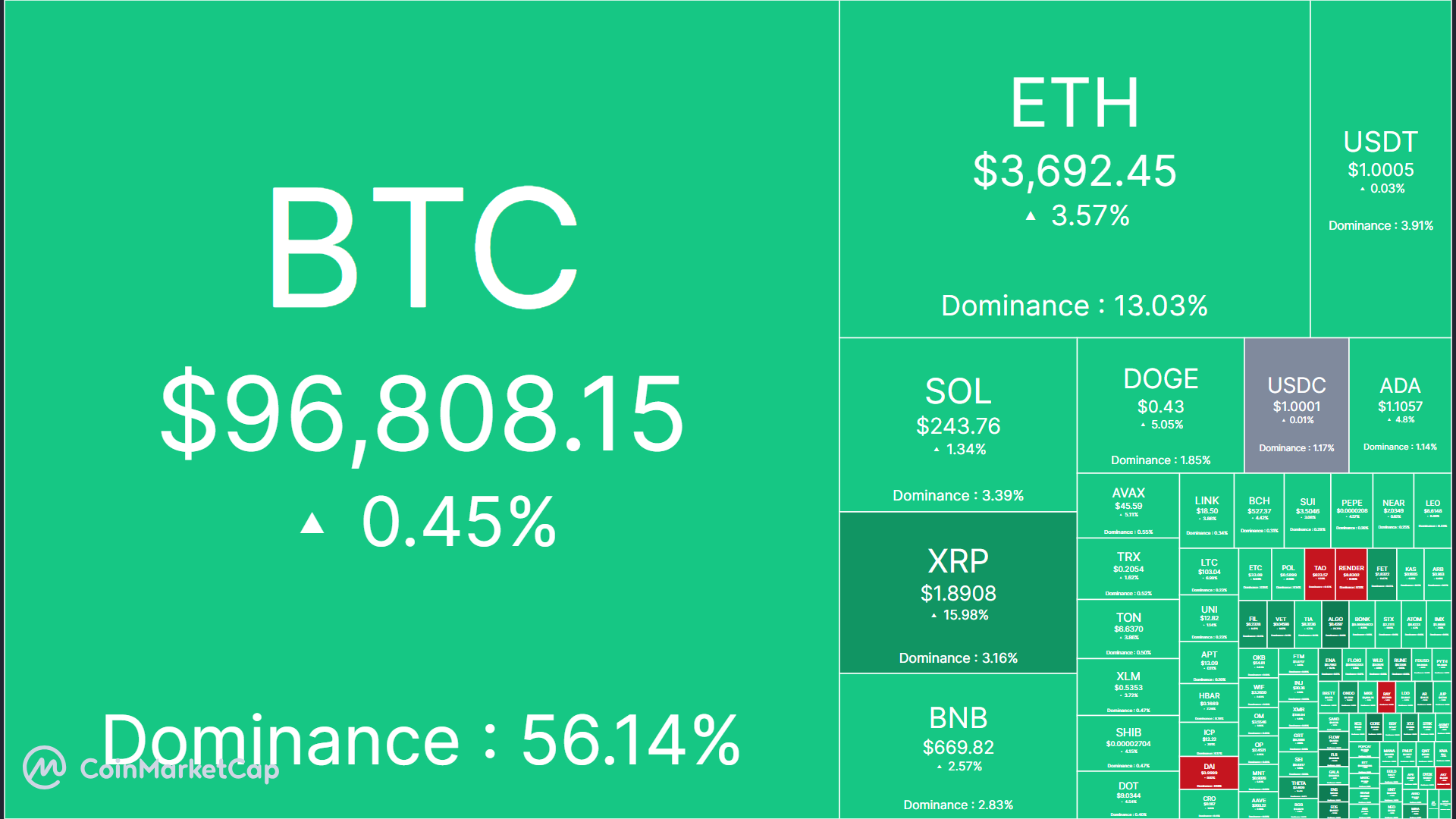

- Bitcoin’s rally to nearly $100K lifted the market, boosting major and mid-cap altcoins.

- The Altcoin season is back, but which are the top assets to bet on?

- Bitcoin and Ethereum are top assets to consider, but other alternatives have massive potential, too.

- DeFi, AI agents and memecoins were November’s hottest market trends; will they offer more gains in December?

Bitcoin’s rally towards $100K lifted the whole cryptocurrency market in November. Analysts expect the remarkable market performance to continue in December with a $100K-$200K price target in 2025, citing the possibility of the US forming a BTC strategic reserve.

Token holders of top large-cap and utility altcoins saw massive profits in November. Altcoins like Ethereum, Solana (SOL), Ripple (XRP), BNB, Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), Tron (TON), and Toncoin (TON) rallied double and triple digits gains.

Some soared to all time highs, but analysts are confident the uptrend isn’t over. If so, these top tokens still have immense investment potential if they soar in December and early 2025.

Additionally, DeFi (decentralized finance) had a resurgence amid major central bank interest rate cuts. So, DeFi tokens like ETH, Maker, Lido, Morpho, Aave, etc, should be in your crypto portfolio. Similarly, AI agents and memecoins have become the hottest key trends in the market.

That said, you can only buy or sell crypto using stablecoins like Tether’s USDT or Circle’s US Dollar Coin (USDC). These coins also act as a ‘safe-haven’ during violent price swings (volatility) and are a must-have before jumping into the crypto ecosystem.

What Are Cryptocurrencies?

Cryptocurrencies are digital currencies that operate smoothly without third-party or centralized traditional financial institutions. Their use cases continue to expand, but the most common ones include e-commerce, cross-border payments, trading, or investment.

Blockchain technology allows cryptocurrencies to achieve trustless transactions. The technology captures all transactions on a decentralized ledger. Given the ledger’s decentralized nature, no person or firm can control the blockchain network, improving security and transparency and reducing counterparty risk.

Why Are There So Many Cryptocurrencies?

There are so many cryptocurrencies because there are different crypto projects with several goals and mandates. As of September 2024, CoinGecko tracks over 14K crypto assets, while CoinMarketCap covers +2.4 million tokens.

Some operate strictly as currencies for transactions, e.g., USDT or Litecoin (LTC). However, others, like ETH or BNB, act as platform currencies to keep their ecosystems functioning.

Some cryptos also aid in infrastructure development or aid compliance. For example, Maker recently introduced a new stablecoin, USDS, to drive expansion. However, the firm was forced to include a freezing feature like USDC, to allow censoring of funds linked to illegal activities. This is part of the condition for getting US compliance approval.

Top Cryptocurrencies to Invest in December 2024

After the November rally, several large—and mid-cap altcoins hit new all-time highs with massive year-to-date (YTD) gains. Overall, market trends suggested the altcoin season was underway, and picking the best crypto to buy now could be more crucial.

Here are some of the best cryptocurrencies based on utility, investment potential, and market performance.

- Bitcoin: The original crypto, widely known for its global adoption and as store of value (‘digital gold’).

- Ethereum: Widely known as the home of DeFi for its smart contract capacity and vibrant decentralized applications.

- Solana: Popular for its low cost and high speeds, making it a top DeFi and NFT platform.

- XRP: It aims to solve cross-border payment issues with fast and low-cost alternative.

- Dogecoin: Started as a meme coin but is now being accepted for transactions.

- Toncoin: An emerging layer 1 blockchain and a top performer in 2024.

- Tron: Strive to build a decentralized internet and emerged as a cheap platform to send stablecoins (USDT).

- Cardano: Known for its rigorous scientific approach and governance structure.

- Avalanche: Provide high throughput with minimized lags for dApps.

- BNB: Native token to Binance and its robust and ever-growing ecosystem.

- Stablecoins: Tether (USDT) or USDC (or US Dollar Coin) are used as a flight to safety to preserve capital value during market volatility.

The data in this table is refreshed to guarantee the most precise and up-to-date information is available. The last update was made on December 1, 2024.

1. Bitcoin (BTC)

Bitcoin printed new all-time highs (ATHs) in November, with $100K remaining within reach. BTC is a decentralized peer-to-peer cryptocurrency with a fixed maximum supply designed to hedge against inflation and government control. It’s the world’s largest cryptocurrency, but its limited supply of 21 million coins has earned it the name ‘digital gold’ and made it a potential store of value rivaling physical gold and silver.

First introduced in 2008 by a pseudonymous person/group called Satoshi Nakamoto, the BTC network leverages blockchain technology to ensure verifiable and tamper-proof transactions. The network is secured through the mining process, or Proof of Work (PoW), where miners secure and verify transactions in exchange for BTC as rewards.

That said, its investor appeal lies in its scarcity and hedging capacity. BlackRock, the world’s largest asset manager, acknowledged BTC as a ‘unique diversifier’, especially amid growing global monetary stability concerns. In 2024, the asset saw more institutional interest with the approval of US spot Bitcoin ETFs. The recent approval of US spot BTC ETF options is set to drive adoption further.

BTC is the best cryptocurrency for long-term investment. Its cumulative price growth has been 807,000x over the past 14 years. More growth is likely, especially as the Federal Reserve easing cycle begins. Standard Chartered projected a 200K per BTC by year-end. After flirting with $100K in November, will it surge above it in December and 2025? Most market pundits believe so; hence, you should buy Bitcoin for the long run.

2. Ethereum (ETH)

Ethereum is a decentralized blockchain platform and the home of DeFi (decentralized finance). The key feature of the Ethereum blockchain is its smart contracts run by the Ethereum Virtual Machine (EVM). Smart contracts allow set agreements to be executed without a third party, underpinning DeFi applications. This has enabled numerous decentralized applications (dApps), NFTs (non-fungible tokens), and other cryptocurrencies, making it popular among developers.

Ethereum started on the power-intensive PoW consensus model like BTC but later changed to a Proof-of-Stake system (PoS) in 2022. This move reduced its power usage, making Ethereum a greener alternative to BTC. Compared to BTC miners, validators achieve Ethereum’s network security relatively cheaply.

Its native token, Ether (ETH), is the payment of choice for network gas usage and has benefited from its DeFi growth. ETH has seen massive price growth, rising from about $1 in 2016 to an ATH of $4000 in 2021 – a whopping 4000X returns.

However, ETH has performed poorly amid low investor demand for US spot ETH ETFs. Besides, it has faced intense competition from other smart contract platforms like Solana and Sui.

Despite underperforming its peers like SOL and BTC, analysts believe it could hit $5K-$10K by the end of this bull run. US spot ETH ETF flows turned positive in November, suggesting renewed institutional interest, which could push prices higher.

Besides, renewed hope of likely approval of staking rewards on US spot ETH ETFs could accelerate institutional interest and the altcoin’s value.

3. BNB (BNB)

Binance cryptocurrency exchange, the world’s largest by trading volume, has evolved into an incubation hub with several crypto projects. BNB started as the exchange token but has evolved into a utility token to support its massive ecosystem. Its robust system also includes the BNB Chain blockchain, an EVM-compatible network with lower transaction fees.

BNB holders enjoy automatic airdrops from several incubated projects by Binance through its Launchpad and Launchpool initiatives. Picture passive income when these tokens moon. All these have aided BNB’s value.

However, the US SEC sued the exchange in 2023 for violation of securities laws and US Bank Secrecy Act. Binance was later fined $4 billion in 2024 and the former CEO and founder, Changpeng Zhao (CZ), jailed for 4 months. The regulatory pressure muted BNB price but has lifted off. With CZ out of jail, the altcoin’s growth could be further boosted.

BNB is up 40000% since its inception in 2017 and 110% on a YTD basis.

4. Solana (SOL)

Solana hit a new all-time high of $264, tapping 138% in YTD returns. It’s considered one of the crypto’s Big Three and a competitor to Ethereum. Unlike Ethereum’s scalability issues and high gas fees pre-Blobs update, Solana is a highly scalable, low-cost smart contracts platform. It achieved this using its hybrid consensus model, which combines Proof-of-History (PoH) and Proof-of-Stake (PoS), reducing validation times.

The hybrid model has enabled Solana to ensure high transaction speed, processing thousands of transactions per second at low costs. This has made it a great chain for NFT and DeFi applications, attracting small-scale and institutional users.

However, the network has suffered several outages in the past. However, mitigation efforts have been made to tackle this, and it has not experienced an outage since March.

Additionally, its second validator client, Firedancer hit testnet in September with a whopping 1 million transaction per second capacity. This is a massive scaling and decentralization pivot.

That said, several potential issuers have filed US spot SOL ETF applications with the SEC after Trump’s victory. With a pro-crypto Trump administration, analysts believe a SOL ETF is a matter of ‘when’ not ‘if.’ New capital inflows could be net positive on SOL’s value in the long run. In short, SOL could still soar despite hitting a new all-time high (ATH) of $264.

5. XRP (XRP)

XRP is the native token of the XRP Ledger, developed by Ripple Labs. The network was designed to fast-track low-cost global payments. To achieve this, it uses a proprietary consensus mechanism (XRP Ledger Consensus Protocol) for quick and effective cross-border payments.

Additionally, Ripple leverages On-Demand Liquidity (ODL) service and XRP to solve liquidity issues and offer a faster alternative to the SWIFT platform, enabling instant conversions.

The firm has also ventured into RWA (real-world asset) tokenization by investing in OpenEden that enables firms to tap US Treasury bills on-chain. Ripple also unveiled a stablecoin (RLUSD) and could be officially launched anytime to aid its robust ecoystem, collectively driving utility for XRP.

That said, XRP value declined amid a prolonged SEC lawsuit against Ripple that began in 2020. The SEC accused the firm of violating securities laws by selling XRP tokens. However, there have been settlements, and the firm has secured a recent partial victory against the SEC.

The case could end soon, especially with the incoming pro-crypto administration. It seems the market has priced this after the token’s 240% rally in November, pushing XRP to 2021 highs of $1.9. This could reduce the expected upside potential in the mid-term. However, given its global remittance utility, it has a massive long-term growth potential.

6. Dogecoin (DOGE)

Dogecoin is one of the popular meme coins. It outperformed top tokens in November, including BTC, with 377% YTD gains. It was created in 2013 as a joke and quickly gained sensation and social traction thanks to its community-driven nature. However, unlike BTC, DOGE has an unlimited supply, making it massively inflationary.

Despite the inflationary pressure and playful debut, DOGE saw huge price growth, boosted by strong community support and endorsement from top public figures like Elon Musk. In the last market cycle bull run, DOGE rallied over 3500% in 2021.

However, DOGE endorsements by Elon Musk and Mark Cuban also fueled price manipulation allegations by some investors. Musk and Cuban’s tweets related to DOGE always triggered massive price volatility and value fluctuations, forcing some investors to sue them. However, Musk was cleared of the allegation.

That said, most analysts, including Ali Martinez, believe DOGE could cross $1 and target $10. If so, it might not be too late to enter DOGE at current levels.

7. Toncoin (TON)

Toncoin (TON) is the native token of The Open Network (TON) network, a layer-1 blockchain and smart contract platform that has emerged as one top performer in 2024.

Telegram initially developed it but transferred management to the TON Foundation. It is connected to the Telegram messenger app through the TON Space wallet, allowing users to carry seamless crypto transactions.

Like Ethereum, it uses a Proof-of-Stake consensus model, ensuring its environmental friendliness given its less intensive energy design. A Bitget research report projected more potential opportunities across its decentralized finance and the novel Tap-to-Earn sectors.

Besides, the blockchain was eating Tron’s stablecoin market share. Its relatively cheaper fees have made it a stablecoins (USDT) transfer contender. It crossed $1B USDT transfer volume, making it a direct competitor to Ethereum and Tron. Will these strong fundamentals boost TON’s value?

8. TRON (TRX)

Tron (TRX) is another blockchain platform that supports smart contracts and DeFi applications. Its goal is to create a decentralized internet. Tron also leverages a Proof-of-Stake (PoS) consensus mechanism like Ethereum. TRX is the utility token within its robust ecosystem, boosting applications and transactions.

TRX started as a token on Ethereum but later migrated to its blockchain in 2018 for higher scalability and better performance. The migration attracted massive market attention and wild price volatility for TRX in January 2018. It surged from around $0.04 to $0.21, posting +400% gains in less than two weeks.

Tron’s founder, Justin Sun, wanted to focus the platform on the entertainment applications and content-sharing sectors. To this end, he acquired and integrated BitTorrent, a file-sharing platform.

Due to its low fees, the platform has emerged as the second-largest market share in stablecoins after Ethereum.

However, Justin Sun has faced several legal challenges, including a pending SEC lawsuit. Despite these obstacles, the network’s ecosystem continues to grow. As of November 2024, TRX was up 90% on a YTD basis.

9. Cardano (ADA)

Cardano is another blockchain platform with smart contract capability founded by Charles Hoskinson, one of Ethereum’s co-founders. Its unique design borrows from both the Ethereum and Bitcoin networks. For example, its consensus model leverages Proof-of-Stake (PoS) within its Ouroboros protocol to maintain eco-friendliness.

It also uses a Bitcoin-like UTXO architecture (Unspent Transaction Output) to drive its smart contract capacity and dApp development. However, unlike Solidity, used in Ethereum’s smart contracts, Cardano leverages the Plutus and Marlowe programming languages to power its contracts.

The Cardano Foundation and the other two entities, IOHK and Emurgo, drive the Cardano network’s development. The Chang hard fork, which went live on September 1st, enhanced on-chain governance and smart contract capacity. With seamless governance and dApp development capability, Cardano also improved its decentralization.

ADA is Cardano’s network native and utility token. It rallied +200% during the first phase of this cycle, hiking from $0.24 to $0.8 between October 2023 and March 2024. If ADA attempts to retest its 2024 highs or even ATH, more gains could be likely. The recent integration with the Bitcoin network through the BitcoinOS bridge could aid ADA prospects.

In November, the altcoin hit a new cycle high above $1, about 64% away from its 2021 top of $3.1. ADA’s value potentially increasing by over 60% could be likely if the altcoin eyes 2021 highs.

10. Avalanche (AVAX)

Avalanche (AVAX) is another layer one blockchain with smart contracts capability for developing dApps (decentralized applications). It also positions itself as a rival and alternative to Ethereum. To do so, the network leverages high speed and security, as it can process 6,500 transactions per second without overwhelming scalability.

Additionally, Avalanche takes a unique approach to its consensus mechanism. Unlike the Bitcoin or Ethereum network, Avalanche uses three separate mini-chains to handle different mandates: token creation, smart contract/dApp development, and node/network validators. AVAX is the native token that drives utility throughout the ecosystem, including its DeFi sector.

AVAX surged +600% in the first phase of the current bull run, jumping from $9 to over $60. Although it erased its 2024 gains, it had a lot of room for growth and recovery.

11. Artificial Superintelligence Alliance (FET)

Artificial Superintelligence Alliance ( FET $0.80 24h volatility: 3.2% Market cap: $2.07 B Vol. 24h: $215.18 M ) is a decentralized network and a merger between three leading crypto AI networks (SingularityNET, Fetch.ai, and Ocean Protocol). The network is designed to build autonomous economic agents and rival traditional AI firms like OpenAI. The autonomous agents can handle diverse tasks, from optimizing trade set-ups to booking flights. They can also collaborate, learn from each other, and share valuable insights across several sectors or domains.

FET token is a crucial utility asset in the ecosystem, used for governance (voting rights) and payments (securing the AI agents). Besides, the AI hype in conventional markets, as seen with Nvidia, has boosted FET. Since the August 2024 sell-off, FET has bounced back over 130%, rallying from $0.7 to $1.6. It has upside potential as long as AI hype continues to dominate.

Other Notable Cryptocurrencies

The assets shared above are just the tip of the iceberg of an expansive altcoin sector. With increasing expert calls for an altcoin season, here’s a list of top stablecoins, DeFi tokens, and emerging blockchain platforms worth tracking;

- Stablecoins (USDT and USDC)

Stablecoins are digital assets pegged 1:1 to fiat currencies and act as ‘price stabilizers,’ especially during market volatility.

For example, if BTC drops harder, users would swap to stablecoins to preserve their funds from devaluation. When it starts pumping again, they will rush to buy discounted BTC with the stablecoins. This makes them crucial in volatile crypto markets.

Tether’s USDT USDT $1.00 24h volatility: 0.0% Market cap: $160.37 B Vol. 24h: $160.13 B and Circle’s US Dollar Coin USDC $1.00 24h volatility: 0.0% Market cap: $64.83 B Vol. 24h: $10.59 B are the most common stablecoins pegged 1:1 with USD. Since most asset’s trading pairs involve USDT or USDC, users can’t trade without them.

- Maker (MKR)

Maker [NC] is one of the pioneers of DeFi and a leading player in lending and stablecoins. Dai (DAI), one of its stablecoins, is one of the most popular stables in the DeFi space.

Its lending arm through SparkLend has also seen massive growth, boosting MKR, a native utility and governance token in the ecosystem. It recently rebranded to Sky to aim for a massive expansion that could further bolster MKR’s (or SKY) token value.

- Aave (AAVE)

Aave AAVE $323.5 24h volatility: 1.4% Market cap: $4.92 B Vol. 24h: $1.03 B is another massive and dominant lending player in DeFi and stablecoins. Like Maker, its ecosystem is powered by its native token, AAVE.

Bernstein analysts recently tipped DeFi’s resurgence and claimed that the falling US bank rates could make DeFi yields attractive. The analysts picked AAVE as one of the potential assets that would benefit from the likely demand. If so, AAVE and top DeFi tokens should be on your watchlist.

- Uniswap (UNI)

Uniswap UNI $9.96 24h volatility: 11.3% Market cap: $5.99 B Vol. 24h: $1.22 B is arguably one of the most popular DEXs (decentralized exchanges) based on Ethereum. The platform has conducted over $2 in trades and supports most trading pairs. Its native token, UNI, is used for governance (voting rights). Although UNI has upside potential, the SEC plans to bring enforcement action against the DEX for violating securities laws.

- Ethereum L2s

The top Ethereum L2s, like Arbitrum ARB $0.46 24h volatility: 5.6% Market cap: $2.38 B Vol. 24h: $720.91 M , Optimism OP $0.75 24h volatility: 7.2% Market cap: $1.31 B Vol. 24h: $438.33 M , and Polygon MATIC $0.25 24h volatility: 7.3% Market cap: $355.56 M Vol. 24h: $3.19 M , are also worth exploring. These top scaling solutions for Ethereum could benefit from the DeFi resurgence. After underperforming in early 2024, ARB and OP recorded strong traction in November and could extend into December.

- Aptos (APT)

Aptos APT $5.40 24h volatility: 4.6% Market cap: $3.54 B Vol. 24h: $393.51 M is a layer one blockchain that aims to rival Ethereum and Solana as the home of DeFi and a platform for dApps. Thanks to its modular transaction processing, it has high scalability and performance. APT is the network utility token and could benefit from the platform’s growing DeFi.

- Sui (SUI)

Sui SUI $4.02 24h volatility: 2.1% Market cap: $13.83 B Vol. 24h: $2.22 B is a layer one blockchain network, and market observers have likened it to Solana’s early stages. Its unique angle lies in its high performance and developer-friendly features. This makes it a platform with huge potential for the next generation of dApps and DeFi solutions. SUI is the token that powers its ecosystem and has seen significant traction recently.

- Kaspa (KAS)

Kaspa KAS $0.0985 24h volatility: 7.3% Market cap: $2.59 B Vol. 24h: $145.02 M is another blockchain network that offers Bitcoin security features through a PoW (Proof-of-Work) mechanism. Unlike Bitcoin, it is faster and highly scalable, thanks to its GhostDAG protocol. The protocol enables the co-existence of multiple blocks and maintains consensus across the entire network.

As a result, Kaspa is fast and scalable, features that are best for payment/transactions or data processing functions. In fact, most top BTC miners, like Marathon Digital, added Kaspa to their mining operations as part of diversification efforts.

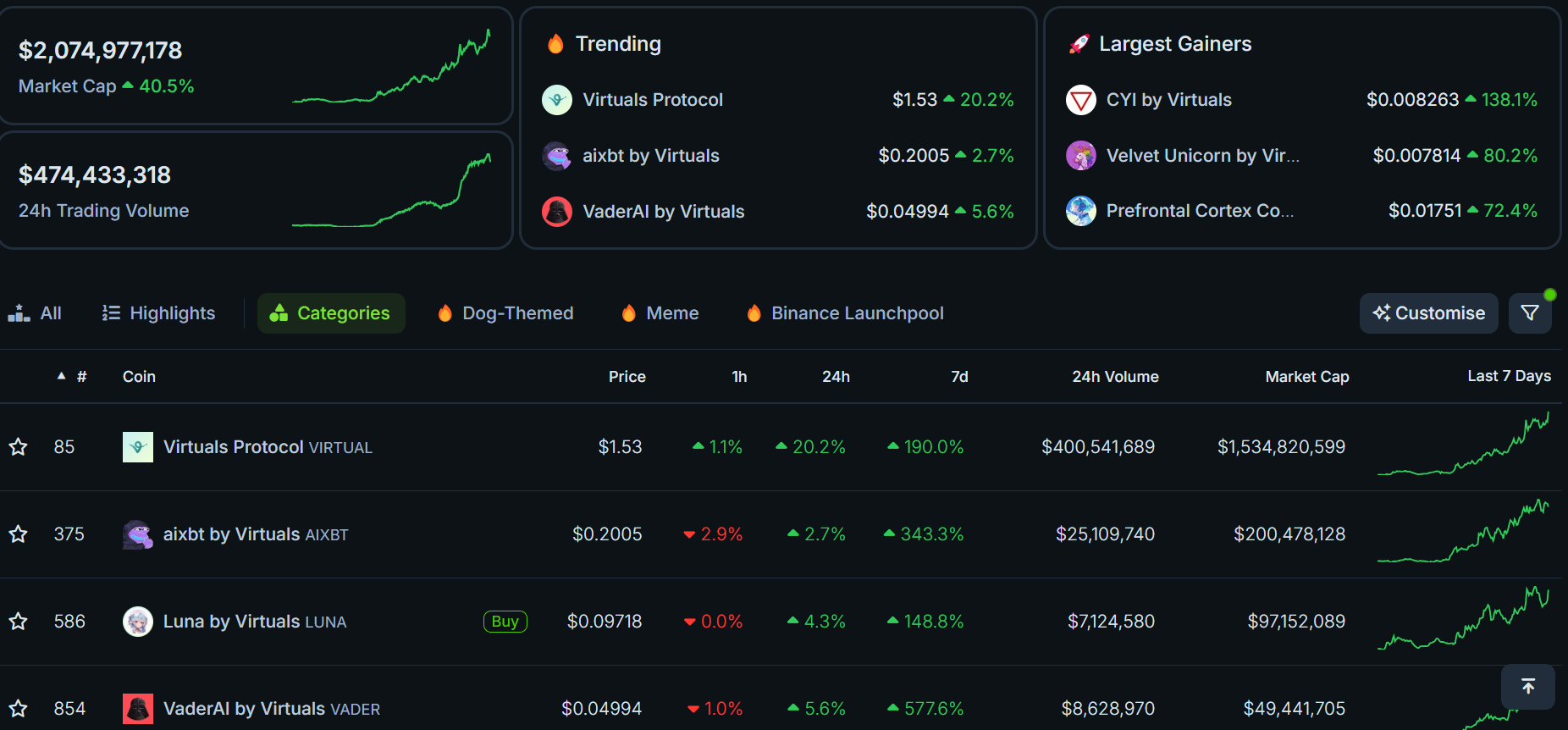

- AI agents and memecoins

AI agents and memecoins have become one of the hottest market trends in November. Autonomous AI bots capable of doing on-chain analysis, trading, and social media influencing have flooded the market. Analysts project increased dominance in 2025 with the hype around AGI (Artificial General Intelligence).

If so, top platforms incubating AI agents should be on your watchlist. Virtual Protocols (VIRTUAL), the Pump.fun for AI agents on Base, recently crossed $1B in market capitalization. Individual AI agents/memecoins within the Virtual ecosystem, like AIXBT, SEKOIA, VADER, etc., have all also rallied triple digits.

Grass (GRASS) is another AI agent launcher and Virtual Protocol alternative on Solana. Other AI memecoins that have seen massive traction, like Goatseus Maximus (GOAT) and Act I: The AI Prophecy (ACT), could also be added to the watchlist.

While this category could yield massive returns in the short term, it is risky, speculative, and unsuitable for long-term investment.

How to Choose the Best Crypto to Invest In

Like traditional investing, picking a crypto asset requires a careful balance between investment goals, risk profile, and appetite. Are you in for short-term gains, a long-term overhaul, or just seeking investment diversification? These questions gauge your crypto investment objectives.

Next, evaluate your risk tolerance and appetite because crypto market volatility can be your best friend or worst enemy. That said, potential investors must do their due diligence to understand the potential investment project to avoid getting into scams or pyramid schemes. Evaluate the blockchain project use case, including whether there are working products, market growth potential, team and development plans, and other things, before investing.

Finally, market cap and liquidity are also key factors. They help gauge the project’s adoption rate and capacity to enter or exit trade positions with few slippages (losses). A high market capitalization and liquidity on exchanges are deemed ideal for investment. However, less liquidity makes it challenging to enter and exit trade positions.

How to Invest in Cryptocurrency

After selecting your top crypto assets to invest in, the next step is to make the actual investment.

First, pick your preferred crypto exchange or brokerage that offers crypto trading. Before opening a trading account with the exchange or brokerage firm, read the user agreement and understand the terms and conditions, including trading fees.

Next, complete the KYC (Know Your Customer) details, including identity verification and 2FA (two-factor authentication) for security and platform compliance. Then, link your credit card, bank account, or whatever options are enabled for funding trading accounts on the platform.

You can buy and sell crypto with a funded account and pocket the difference. This can also be done directly through some crypto wallets like Phantom. However, potential gains on the assets might also depend on your choice of trading strategy. For long-term holding, users just keep their assets locked away for an extended period before selling for a profit.

However, for those eyeing short to medium gains, swing trading is the preferable strategy. It involves buying low, holding the asset for a few days or weeks, and taking profit when prices surge.

Day trading and scalp trading also offer short-term gains. For day trading, speculators make several trades daily, while scalping involves seeking small profits from several trades across the day. Aggregated returns from scalping and day trading can be huge.

The above strategies are great for beginners and crypto enthusiasts. However, other strategies, including direct purchases, early-stage investing in new projects, crypto options, complex yield products, etc., are available for seasoned institutional investors.

Pros and Cons of Cryptocurrency Investment

Investing in cryptocurrencies can be rewarding but has risks, too. Here’s a comparative look at the pros and cons.

| Advantages | Disadvantages |

|---|---|

| Potential gains. Especially during massive bull runs, as seen in late 2023 and early 2024. SOL exploded from $8 to +$200 and offered 25x gains. BTC also surged from $30K to $73K. | Market risks. Extreme volatility can quickly wipe out your crypto portfolio and cause steep losses in a single market day. Besides, scams and hacks can also expose users to huge losses. In H1 2024, the market lost $1.56 billion per Peckshied report. |

| Decentralization. Most crypto assets, like BTC, are on a decentralized network, which minimizes government influence and ultimately gives users more freedom. | Regulatory uncertainty. Since it is a new asset class, most governments are trying to understand it before formulating regulations for the sector. Nevertheless, some players have faced regulatory crackdowns, such as those in the US. |

| Diversification. Cryptocurrencies are an emerging asset class with huge potential. BlackRock called BTC a ‘unique diversifier’ against fiscal debts and inflation but with relatively high returns. | Limited consumer protection. The lack of a strong regulatory framework also exposes investors to scams or fraud without proper channels for recovering lost funds. Although this is improving, as seen by FTX victim repayments, some fraud cases go unsolved. |

| Accessibility. Cryptocurrency offers round-the-clock access from anywhere in the globe. | Limited acceptance. Although crypto payments have increased as adoption has expanded, acceptance remains limited to specific businesses or services. |

Not to mention security risks like phishing attacks, which can be overwhelming, especially for beginners. So, crypto investments are not for everyone, and as a rule of thumb, only invest money you’re comfortable losing.

Reporting Cryptocurrency on Taxes

In most jurisdictions, cryptocurrencies are deemed capital assets during tax filings. As such, any gains from crypto trading must be subject to capital gains tax. Every crypto trading profit or purchase you make might have a tax obligation attached to it. In fact, some brokerages must share these details with regulators, such as in the US.

Excellent record-keeping of your crypto gains and losses is crucial to avoid friction with your tax regulator. So, keep accurate records of your crypto transactions alongside key details like amount and dates.

Based on the transactions, calculate your crypto gains and losses using your cost and selling prices. But most importantly, remain updated on any local cryptocurrency tax rules and updates.

Conclusion

Cryptocurrency investments can be highly exciting and rewarding but risky. Besides, there are several crypto projects and new hot trends which can be confusing to new crypto investors.

However, the report has selected some of the best cryptocurrencies, hot trends, and risk aspects to consider for your crypto portfolio.

FAQ

Which is the best crypto to invest right now?

Bitcoin (BTC), Ethereum (ETH), BNB, and Solana (SOL) have dominant market share and remarkable historical gains, making them the best crypto to buy.

Which coin will boom in 2024?

Popcat (POPCAT) and Dogwifhat (WIF). Amid massive resurgence in speculative activity, memecoin dominance could propel POPCAT and WIF as top performers.

Which crypto can give 1000x in 2024?

Cat in dogs world (MEW). MEW has seen increased speculative traction like WIF and POPCAT and could post wild returns if memecoins dominance continues during this cycle.

What is the next cryptocurrency to boom?

Bitcoin will be the next crypto to boom following the overall global easing cycle and incoming ‘cheap money.’ Standard Chartered bank predicted BTC could hit $250K by end-2025.

Which crypto to buy today for long-term?

Bitcoin. As the original and most recognized cryptocurrency with a fixed supply, it stands to benefit more as a better alternative to gold amid rising inflation.

Which crypto to buy today for short-term?

Dogecoin (DOGE), dogwifhat (WIF), Popcat (POPCAT), or cat in dogs world (MEW). Memecoin hype has returned and could offer short-term windfall for these top viral gems.

This guide explains how to buy MemeClip, a new blockchain project that blends meme elements with P2E gaming. Learn how to join the...

This guide explores the best cheap stocks to invest in, according to analysts. We reveal undervalued equities that could outperfor...