This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

Best Low Cap Crypto in 2026: Top Undervalued Coins with Growth Potential

43 mins

43 mins Our analysis suggests that the best low cap crypto in 2026 is Bitcoin Hyper, a Layer 2 and DeFi solution for Bitcoin.

This project aligns with the continued institutional demand for BTC. The US government CLARITY and GENIUS Acts remove regulatory uncertainties, making DeFi an important sector for growth. Our research shows that FLUID stands out due to its use case of crypto borrowing and lending.

The ETH price has risen significantly, so growth for ERC-20 coins is likely. PEPENODE is a potential contender.

We selected these and other coins based on our detailed research methodology, which includes surveying over 60 coins, examining market signals, project communities, teams, tokenomics, use cases, and more.

Best Low Market Cap Crypto Coins to Watch in January 2026 – Top Picks

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Key Takeaways

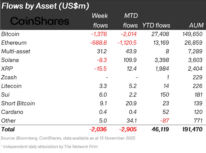

- Despite the October 11 sharp drop, crypto ETP inflows totaled $3.17B last week, according to CoinShares, suggesting no major fund outflows to worry low cap crypto investors.

- Bitcoin Hyper, a BTC Layer 2, has raised $30.21M, indicating growth potential, despite the recent decline in BTC BTC $91 844 24h volatility: 2.1% Market cap: $1.84 T Vol. 24h: $61.87 B .

- Maxi Doge and PEPENODE sit inside a meme sector worth $46.1B (Snapshot from CoinGecko, December 12, 2025), which has rebounded after the recent broader crypto market pullback.

- REI network and Hash AI are low-cap plays set to benefit from growing global adoption of AI, which has a CAGR of 35.9%, according to Founders Forum Group.

- To pick best low cap crypto focus on real use cases, audited smart contracts, and consistent community engagement, track unlock schedules, and verify liquidity locks on DEXs.

Top 11 Low Market Cap Crypto List in 2026

After analyzing the market and applying our detailed methodology, we have selected these 11 coins as promising for January 2026 and beyond. Well-timed investments and risk diversification are key.

- Bitcoin Hyper (HYPER) – BTC Layer 2 scaling solution using Solana’s virtual machine

- Maxi Doge (MAXI) – Low-cap Dogecoin spin-off dedicated to building a degen trading community

- BMIC (BMIC) – Quantum-secure Web3 wallet for long-term asset protection

- Fluid (FLUID) – DeFi platform offering lending, borrowing, and swaps

- PEPENODE (PEPENODE) – First mine-to-earn memecoin

- REI Network (REI) – Fast, gasless blockchain for everyday use

- ZetaChain (ZETA) – Blockchain that connects different networks without bridges

- Hash AI (HASHAI) – Crypto mining company using AI to boost efficiency

- SUBBD (SUBBD) – Web3 platform for creators and their communities

- Celestia (TIA) – Blockchain infrastructure for data and scaling

- ApeCoin (APE) – DAO token powering the BAYC and metaverse ecosystem

Best Low Cap Crypto Gems with Potential – Analysis and Reviews

Here are 11 of the best low-cap crypto that our analysis uncovered. These opportunities may be suitable for those seeking high-risk, high-reward, low-market-cap plays.

1. Bitcoin Hyper (HYPER) – First BTC Layer 2 Built on Solana

Bitcoin Hyper is a Layer 2 for Bitcoin based on Solana’s Virtual Machine (SVM). The project aims to reduce transaction fees and enable dApps, DeFi, and fast payments on BTCs. Holders can stake HYPER to earn APYs of 40%, participate in governance, and pay gas fees.

Our view (Julia Sakovich): Bitcoin Layer 2 has become one of the main trends of 2025 and this market cycle as a whole. HYPER aligns with that narrative and, in my view, offers genuine utility. Despite its strong potential, the risks remain high, as always in crypto.

A large portion of Bitcoin Hyper’s tokenomics is dedicated to treasury and marketing. Source: Bitcoin Hyper

Bitcoin Hyper details:

- Growth Factors: Over $118B is locked in DeFi, Bitcoin dominance at 59.2% (CoinMarketCap)

- Suitable For: BTC bulls, Layer 2 fans, DeFi and infrastructure plays

- Caveats: There are several BTC Layer 2s on the market, including Stacks STX $0.36 24h volatility: 4.9% Market cap: $655.60 M Vol. 24h: $27.31 M , which brings competition

| Category | Bitcoin Layer 2 / DeFi |

| Chain | Proprietary (Bitcoin Layer 2) |

| Audited? | Yes (Coinsult, Spywolf) |

| Market Cap | $30.21M raised |

| Community | >6.4k across Telegram |

| Price | $0.013545 |

| Next Increase | Loading...

|

2. Maxi Doge (MAXI) – Low-Cap Dogecoin Spin-Off Dedicated to Building a Degen Trading Community

Maxi Doge is a dog-based memecoin that satirizes the degen high-leverage trading culture. It draws on the narrative of established coins like Dogecoin DOGE $0.15 24h volatility: 2.4% Market cap: $24.89 B Vol. 24h: $2.22 B and Shiba Inu SHIB $0.000009 24h volatility: 4.6% Market cap: $5.29 B Vol. 24h: $228.85 M , but with a humorous gym-bro aesthetic. The MAXI token offers staking opportunities, with an APY of 72%.

Our view (Otar Topuria): Unlike NFTs, clicker games, and other short-lived trends, memecoins are here to stay. As usual, the main risk is their dependence on hype. I believe the Doge connection and humorous mascot will keep Maxi Doge popular, but investing in low cap tokens always comes with significant risk.

Maxi Doge allocates 40% of its total token supply to marketing efforts. Source: Maxi Doge

Maxi Doge details:

- Growth Factors: Meme coins hold $41B market cap, Dogecoin alone exceeds $20B (CoinGecko)

- Suitable For: Meme coin traders, small cap flippers, Dogecoin investors, leverage traders

- Caveats: MAXI may keep its momentum or lose traction over time

| Category | Meme Coin |

| Chain | Ethereum |

| Audited? | Yes, according to the whitepaper |

| Market Cap | $4.43M raised |

| Community | Over 8K followers on X and Telegram |

| Price | $0.000277 |

| Next Increase | Loading...

|

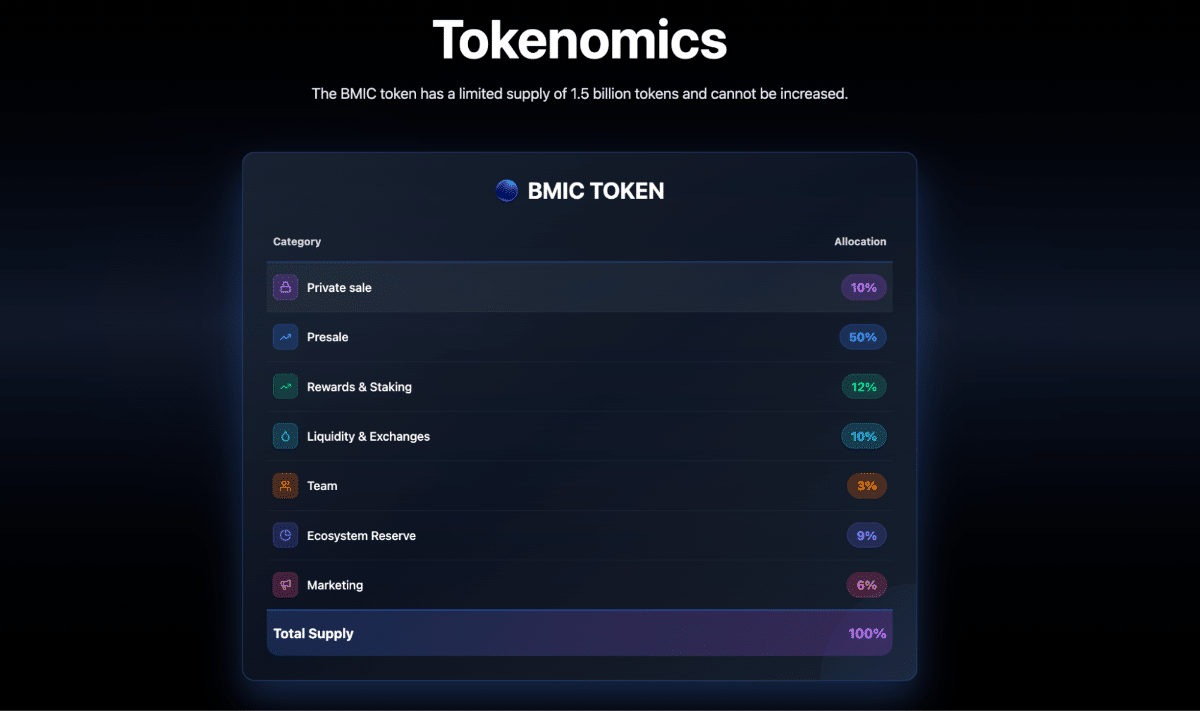

3. BMIC (BMIC) – Quantum-Secure Wallet with PQC Architecture

BMIC is a Web3 wallet that claims to have developed a solution to address the potential threat posed by quantum computers. BMIC’s whitepaper highlights its technical capabilities, stating how it will use “NIST-approved” algorithms and signature-hiding smart accounts to protect assets from potential quantum computing threats. Meanwhile, token holders can also stake BMIC tokens and eventually exchange them for compute credits to be used for quantum computing tasks.

Our view (Julia Sakovich): Quantum security is becoming a hot topic, and BMIC is positioning itself early in this sector. But most of the products haven’t launched yet, and the wallet’s alpha version isn’t expected until 2026. While the underlying idea is sound, the implementation does carry some risk given the current timeline.

Most BMIC tokens are allocated to the presale (50%), the rest go to rewards, staking, and liquidity. Source: BMIC

BMIC details:

- Growth Factors: The lack of competing quantum-secure crypto wallets on the market

- Suitable For: Those prioritizing security, infrastructure investments, and long-term strategies

- Caveats: A long development timeline

| Category | Crypto Wallet |

| Chain | Ethereum |

| Audited? | Yes (Virtual Caim) |

| Market Cap | About $300,000 |

| Community | more than 7,000 across X and Telegram |

| Price | $0.048881 |

4. Fluid (FLUID) – Multi-Chain DEX, Lending and Borrowing DeFi Protocol

Fluid is a multi-chain DeFi protocol that provides decentralized lending, borrowing, and a DEX. Users receive APYs for supplying assets. The FLUID token grants holders governance rights and rewards users who provide liquidity or stake assets. It is used for transaction fees, buy-backs, and burns to help stabilize the price.

Our view (Julia Sakovich): In my opinion, FLUID’s value mainly comes from two things: cross-chain lending and its DEX features. At the same time, the project faces real risks, including strong competition and upcoming token unlocks. There’s no guarantee it will grow much, but I personally see FLUID as a possible addition to a diversified portfolio.

Fluid offers a 5.06% borrow rate for the ETH/USDC trading pair. Source: Fluid

Fluid details:

- Growth Factors: FLUID has $3.4B in TVL (Defi Llama), DeFi lending attracted $53B in Q2 2026

- Suitable For: DeFi enthusiasts, traders

- Caveats: The price could drop when new tokens are unlocked

| Category | DeFi Protocol / Multi-chain DEX, Lending and Borrowing |

| Chain | Ethereum, Arbitrum, Polygon, Base, Solana via Jupiter Lend |

| Audited? | Yes, core contracts and liquidity layer are documented and designed for security |

| Market Cap | $311 million |

| Community | 37.7K X followers |

| Price | FLUID $3.03 24h volatility: 2.5% Market cap: $233.77 M Vol. 24h: $5.27 M |

5. PEPENODE (PEPENODE) – First Mine-to-Earn Memecoin

PEPENODE is a memecoin on Ethereum and a virtual mining crypto game that will launch after the TGE. Players will use PEPENODE to build custom mining rigs, earn rewards, and participate in airdrops. For now, it offers staking with 570% APY.

Our view (Otar Topuria): Every project wants to stand out, but PEPENODE actually manages to do it. The developers have combined GameFi and memecoins with a mine-to-earn system. The main threat to the project, I guess, is the rapid loss of player interest after launch.

PEPENODE’s mine-to-earn game is scheduled to launch right after the TGE. Source: PEPENODE

PEPENODE details:

- Growth Factors: Targeting the $46.1B memecoin and $6B GameFi markets (CoinGecko)

- Suitable For: Gaming enthusiasts, APY hunters, memecoin traders, and early-stage investors

- Caveats: Success will depend on keeping players engaged and attracting new miners

| Category | Memecoin / Virtual Mining |

| Chain | Ethereum (ERC-20) |

| Audited? | Smart contract-based transparent mechanics |

| Market Cap | $2.61M raised |

| Community | Over 7.5K followers on X and Telegram |

| Price | $0.0012161 |

| Next Increase | Loading...

|

6. REI Network (REI) – Fast Gassless Blockchain Targeting AI and High-Speed Applications

REI Network, formerly GXChain, is a PoS blockchain offering a lightweight, gasless solution for dApps, improving the way AI and crypto work together. It is designed to support high-speed industries that use micropayments, such as GameFi. REI holders can stake their tokens to help secure the network and earn up to 10% rewards, while also making on-chain transactions without gas fees.

Our view (Julia Sakovich): I was drawn to REI Network by its gasless transactions and AI integration. It seems the main risk lies in the development pace. However, if the testnet confirms the promised performance, it could turn out to be an excellent Layer 1 project.

REI Network plans a Block Acceleration testnet in Q4 2025 to reduce block time. Source: REI Network

REI Network details:

- Growth Factors: Targets the AI crypto sector with a market cap of $25B (CoinGecko)

- Suitable For: AI investors, Blockchain Layer 1 fans

- Caveats: This project has been in development for several years, but it remains at an early stage

| Category | Blockchain Token / AI / GameFi / DeFi / NFT |

| Chain | Proprietary (EVM compatible) |

| Audited? | Yes (Cyberscope) |

| Market Cap | $9.9M |

| Community | Active support with 127K X followers and over 45K Discord members |

| Price | [NC] |

7. ZetaChain (ZETA) – Blockchain that Connects Other Blockchains

ZetaChain is a Layer 1 blockchain built to help different networks work together. It lets apps interact with assets across chains like Bitcoin, Ethereum, and Cosmos without using bridges or wrapped tokens. In simple terms, it aims to make cross-chain apps easier and safer to build. The ZETA token is used for network fees, staking, and helping secure the blockchain.

Our view (Julia Sakovich): Interoperability as a niche is in high demand within the crypto industry, and ZetaChain aims to natively integrate Bitcoin into cross-chain DeFi without custodial bridges. However, competition in this segment is intense, with alternatives like LayerZero, Axelar, and others. As for me, ZetaChain’s success will heavily depend on broader ecosystem adoption.

ZetaChain claims that its community includes more than 1.8 million participants. Source: ZetaChain

ZetaChain details:

- Growth Factors: Crosschain sector TVL potential recovery to $5.3B ATH, currently at $360M (DefiLlama)

- Suitable For: Infrastructure investors, cross-chain DeFi users, developers building omnichain apps

- Caveats: Strong competition from other interoperability protocols; adoption depends on dApp traction

| Category | Interoperability / Layer 1 |

| Chain | ZetaChain (Cosmos-based) |

| Audited? | Yes (Hacken, CertiK) |

| Market Cap | $104M |

| Community | Over 1M followers on X |

| Price | ZETA $0.0784 24h volatility: 5.0% Market cap: $95.62 M Vol. 24h: $8.35 M |

8. Hash AI (HASHAI) – Crypto Mining Company Using AI to Maximise Short-Term Profit Opportunities

HashAI is a UK-based project focused on improving crypto-mining efficiency through AI-driven optimization and a rental model for rigs and nodes. It positions itself as a hybrid mining-plus-AI play, aiming to scale revenue by automating mining decisions and expanding hardware capacity.

Our view (Otar Topuria): In my opinion, AI is already deeply intertwined with cryptocurrencies. That’s why projects like HASHAI will play an increasingly important role in the crypto industry. Mining optimization is a valuable utility, but remember the risks tied to centralized control and physical infrastructure.

Hash AI users can choose from multiple nodes to utilize GPU power for their projects. Source: Hash AI

Hash AI details:

- Growth Factors: Potential to lead the AI crypto sector with $25B market cap (CoinGecko)

- Suitable For: AI and mining investments, RWA investors, high reward / high risk

- Caveats: Success depends on physical infrastructure under construction

| Category | AI / Mining / RWAs |

| Chain | Ethereum (ERC-20), Multi-chain Layer 1 Blockchains |

| Audited? | Yes (CertiK) |

| Market Cap | $13.5M |

| Community | Over 35K followers on X |

| Price | [NC] |

9. SUBBD (SUBBD) – AI and Fan Content Creator Platform

SUBBD is a SocialFi project that brings a Web2 network of content creators into blockchain and AI. The platform aims to keep fees low and make content production easier with AI tools, and it already includes 2,000 creators and 250K followers. The ecosystem runs on the SUBD token, which can be staked for APY.

Our view (Otar Topuria): SUBBD offers low fees, which is crucial for content creators. From my perspective, it’s a useful solution with the potential to attract the Web2 audience into the Web3 space. The main threat is user activity decline, so it’s worth weighing both the investment potential and the risks.

SUBBD roadmap highlighting the transition to phase 2. Source: SUBBD

SUBDD details:

- Growth Factors: The SocialFi sector has reached a $2.2B market cap (CoinGecko)

- Suitable For: AI-powered plays, Content/Fan business models

- Caveats: Competition from social media is huge. Success will rely heavily on marketing

| Category | AI / Creator Economy / Web3 |

| Chain | Ethereum |

| Audited? | Yes (SolidProof and Coinsult) |

| Market Cap | $1.42M raised |

| Community | Over 82K followers, 2,000 top influencers |

| Price | $0.0574 |

| Next Increase | Loading...

|

10. Celestia (TIA) – Modular Blockchain for Data Availability and Rollups

Celestia is a blockchain that focuses only on data availability. Instead of doing everything on one chain, it lets other blockchains handle execution while Celestia takes care of the data. This makes it easier for developers to launch lightweight rollups. The TIA token is used to pay for space on the network and for staking to help secure it.

Our view (Julia Sakovich): Celestia was one of the first big projects to push the idea of modular blockchains, and, in my opinion, that has changed how a lot of people look at crypto. I think its future depends heavily on how fast rollups keep growing. Demand for TIA could go up over time, but it’s also worth keeping in mind that projects like EigenLayer are real competitors.

Celestia offers node-running options for beginners, intermediate, and advanced users. Source: Celestia

Celestia details:

- Growth Factors: Remains a leading modular blockchain, trading 98% below its ATH with potential for recovery (CoinGecko)

- Suitable For: Infrastructure investors, rollup builders

- Caveats: Faces competition from Ethereum-based data solutions and other modular projects

| Category | Modular Data Availability / Infrastructure |

| Chain | Celestia |

| Audited? | Yes (CertiK, Cyberscope) |

| Market Cap | $528 million |

| Community | Around 400K followers on X and Telegram |

| Price | TIA $0.58 24h volatility: 3.5% Market cap: $502.21 M Vol. 24h: $54.41 M |

11. ApeCoin (APE) – DAO-Governed Token Powering the Bored Ape Ecosystem

ApeCoin is the main token used in the Bored Ape Yacht Club ecosystem. People who hold APE can vote on DAO decisions and get access to certain events, games and services. The token is also used in different Web3 apps built by other teams, which helps it stay relevant beyond just one NFT project.

Our view (Otar Topuria): ApeCoin was designed as a logical extension of the Yuga Labs ecosystem and the popular Bored Ape Yacht Club NFT collection. Considering it’s 99.1% below its all-time high (Snapshot from CoinGecko, December 12, 2025), I see it as a potential opportunity for strong upside. However, it’s important to remember that the NFT sector has already gone through a crash, and its recovery pace remains uncertain.

Buying ApeCoin is a way to join the hyped BAYC ecosystem through a low cap crypto. Source: BAYC

ApeCoin details:

- Growth Factors: BAYC remains a strong Web3 brand with $3.3B in all-time sales volume (CryptoSlam)

- Suitable For: People interested in NFTs, virtual worlds, and DAO governance

- Caveats: Interest in NFTs has slowed down, so price growth may take longer

| Category | DAO / NFT / Metaverse |

| Chain | Ethereum (ERC-20) |

| Audited? | Yes (CertiK; on-chain transparency reports) |

| Market Cap | $344M |

| Community | Around 470K followers on X |

| Price | APE $0.22 24h volatility: 4.7% Market cap: $201.76 M Vol. 24h: $27.78 M |

Tested by Editors

The Coinspeaker editorial team compared the best low cap crypto in 2026 across three factors: brand recognition, utility, and team credibility.

Maxi Doge stands out for its strong brand visibility. The market cap of dog-themed coins is $28.5 billion (Snapshot from CoinGecko, December 11, 2025), highlighting sustained investor demand for this category. Other highly recognizable projects include Bitcoin Hyper and PEPENODE, which in part capitalize on the popularity of Bitcoin and the Pepe meme, respectively.

Another highly recognizable shitcoin is ApeCoin, supported by the BAYC ecosystem. Over the past 30 days, the NFT collection recorded $5.7 million in sales volume (Snapshot from CryptoSlate, December 11, 2025), showing that BAYC remains a strong brand and, by extension, so does ApeCoin.

Bitcoin Hyper offers real utility through its Bitcoin L2 design, unlike Maxi Doge, which is a pure meme, and PEPENODE, which centers on a crypto-gaming narrative. Utility-focused DeFi protocol Fluid also stands out with its functioning DEX built on Ethereum.

Against the backdrop of anonymous presale teams (including Bitcoin Hyper, Maxi Doge, PEPENODE, and others), ZetaChain deserves particular attention. It is one of the most transparent shitcoins in our ranking, backed by a public team of developers who previously worked at Coinbase, ConsenSys, Google, and other major companies. The project maintains an open GitHub, a grants program, and detailed documentation on the website.

| Project | Brand recognition | Utility | Team credibility |

| Bitcoin Hyper | High | Bitcoin L2 for fast, cheap transactions | Anonymous presale team |

| Maxi Doge | High | Pure meme | Anonymous presale team |

| BMIC | Low | Quantum-secure crypto wallet | Anonymous presale team |

| Fluid | Low | Lending, borrowing, on-chain swaps | Partially public DeFi team |

| PEPENODE | High | Mine-to-earn game | Anonymous presale team |

| REI Network | Low | Gasless, high-speed blockchain | Public team (ex-GXChain) |

| ZetaChain | Medium | Native omnichain messaging and DeFi | Public team (Google, Coinbase, ConsenSys) |

| Hash AI | Low | AI-optimized crypto mining | Limited team disclosure |

| SUBBD | Low | SocialFi payments for creators | Anonymous presale team |

| Celestia | Medium | Data availability layer for rollups | Public team led by Mustafa Al-Bassam |

| ApeCoin | High | DAO governance in BAYC ecosystem | Community-run DAO structure |

Taken together, these projects show how differently brand strength, real utility, and transparency can align in the low cap segment.

What Users Say

Retail traders on Reddit often talk about low cap crypto as high-risk bets. They are cheap to buy and can jump fast, but they are also easy to dump because liquidity is thin and mood changes quickly. Most discussions are about possible triggers, how easy it is to enter and exit, token unlocks, and how active the community is, not about deep fundamentals.

- ApeCoin: Some Reddit users advise against buying ApeCoin, complaining about lost investments and even calling it a “dead coin”. Others, however, believe that APE “could make a surprising comeback when the alt season starts”.

- Hash AI: According to Reddit users, HASHAI is described by some as an “undervalued runner for the super cycle”, while others call it “pure garbage”. There are also threads discussing issues with withdrawing the token on Poloniex.

- Fluid: One Reddit user said he wants to use Fluid for DeFi because it looks like an interesting project. Other users replied that they are already borrowing cbBTC through Fluid and described it as a solid protocol.

Community opinions can be useful to understand short-term mood, but they change fast and often contradict each other. What people expect on Reddit does not always match what the market actually does, so these discussions are better seen as background, not as reliable signals.

Why 2026 Is Big for Low Cap Crypto

In the first days of November, Bitcoin hovered near $110,000 before slipping into a consolidation trend. It dropped under the key $100,000 mark on November 5, and by November 18 it had dipped below $90,000 for the first time since April 2025.

Bitcoin’s market share remains elevated, but BTC dominance is hovering below 60%, a level that historically precedes rotations into low cap crypto when it starts to roll over.

Bitcoin’s dominance is decreasing on the weekly chart. Source: TradingView

In April 2025, the SEC approved Ether ETF options, which opened access to more products and altcoin exposure. Since then, institutional interest has stayed solid. In November, U.S. spot Bitcoin ETFs shifted to heavy mid-month outflows (Snapshot from SoSoValue, December 12, 2025).

High outflows for Bitcoin spot EFTs in mid November 2025. Source: CoinShares

Venture money is coming back into crypto. Galaxy reports that crypto VC funds put about $1.9 billion into projects in Q1 2025, which is the biggest quarter since 2023. At the same time, retail traders are paying more attention to Telegram bots, DeFi, and Layer 2 networks. DeFi usage has also picked up, with total value locked climbing back above $170 billion by the middle of the year.

Alt-season setups form when BTC dominance stalls and new liquidity flows down the risk curve. For low cap crypto investors, that means both higher volatility and higher upside, but only for projects with credible teams, tokenomics, and real on-chain traction.

Early Signs of Low Cap Crypto with High Potential

There are several recurring signals that a low-cap crypto may have breakout potential. Below are the ones we monitor, with real-world examples and links to support each.

Trending Narratives

When a narrative begins appearing across multiple channels (Google Trends, Messari, TradFi reports, and social media), it usually signals rising interest. At that point, users typically start looking for new crypto projects or simply crypto under $1.

A Bigger Cap Coin with a Similar Idea Is Mooning

When a larger token within the same theme starts rallying, traders often search for the best cheap crypto to buy and the next crypto to explode. Such tokens can show daily volatility of 20% or more, especially as trends around Bitcoin and other coins strengthen.

Big Partnership or Hints at Institutional Adoption

A low-cap project gaining institutional or mainstream partnerships can radically increase legitimacy and visibility.

For example:

Circle and Fireblocks recently announced a partnership aimed at boosting institutional USDC adoption via infrastructure integration.

Ripple is expanding into Bahrain with Fintech Bay, signaling institutional and regional adoption moves.

Regulatory Issues or Changes

Rules and laws can hurt some crypto projects, but they can also help them. A good example is XRP. Long court cases in the US slowed it down for years. Now, as US regulators talk more about clear crypto rules and stablecoin laws, projects like XRP may get new chances to grow again.

High Community Engagement

Sometimes, a project takes off at the right moment. Suppose a project experiences strong community growth on social media or is consistently mentioned in crypto groups. This can be a sign that a low-cap crypto has high potential. Be aware of shillers who promote for money rather than belief.

Platform / Token Use Case

A token that has real utility (e.g., governance, fee burns, staking, revenue sharing) and sound tokenomics is more likely to sustain rallies. Among the best micro cap crypto picks, there are projects that are not just hype, they also emphasize functional utility, tokenomics, and development progress.

Low Market Cap Crypto That Exploded in the Past and What We Can Learn?

Looking back at small crypto coins that later exploded in price, some patterns stand out. Meme coins often attract huge interest from retail traders and move very fast. For example, PEPE jumped more than 62,000%, and BONK rose over 54,000% from launch to its top. At the same time, some tech-focused projects also made massive gains. Kaspa, for instance, grew by more than 110,000%, mainly because people believed in its technology.

Historical data from CoinGecko and CoinMarketCap show that tokens with both Tier-1 exchange listings and active communities tend to outperform peers, though timing remains highly unpredictable.

| Token | Launch Price (approx.) | Peak Price (approx.) | ROI (Launch to Peak) | Key Catalysts |

| Pepe (PEPE) | $0.000000001 (Apr 2023) | $0.00002803 (Dec 2024) | 62,070% | Tier-1 exchange listings, strong community, deflationary supply |

| Bonk (BONK) | $0.000000001 (Dec 2022) | $0.00005825 (Nov 2024) | 54,080% | Solana integration, large airdrops, major exchange listings |

| Kaspa (KAS) | $0.0001699 (Nov 2021) | $0.2076 (Aug 2024) | 110,000% | GHOSTDAG protocol, high throughput, decentralization focus |

| SPX6900 (SPX) | $0.001318 (Aug 2023) | $2.05 (Jul 2025) | 115,449% | Satirical branding, strong community engagement, deflationary tokenomics |

| Dogwifhat (WIF) | $0.001 (Nov 2023) | $4.83 (Mar 2024) | 488,900% | Solana ecosystem growth, rapid CEX adoption |

Time: Most took time to reach their all-time highs. PEPE peaked 19 months after launch, BONK after 23 months, and SPX6900 after roughly 23 months.

New Concept: Kaspa showcased the upside of genuine innovation, using DAG-based tech to support small-scale miners, a move that drove adoption and significant post-listing growth.

Overall, the biggest gainers were either meme tokens with viral energy or projects introducing new technical frameworks. In both cases, listings on tier-1 and tier-2 CEXs consistently acted as major catalysts for price appreciation.

How We Picked These Low Cap Crypto Projects – Our Methodology

We looked through over 60 low cap crypto before we made this list. Most of our picks are under about a $50M market cap, but we kept a few bigger names too. Then we scored every project using the same checklist. The total score is 100%. For a deeper dive into our scoring rules and update cadence, see the Coinspeaker methodology.

Low Cap + Liquidity (25%)

A low market cap is not enough by itself. We also need the coin to be tradable. We checked the real circulating supply, how big the liquidity pools are, and how bad slippage gets on normal-sized buys. We also looked at whether liquidity is locked, and whether one wallet or one pool controls too much of it.

Community and Real Attention (20%)

We don’t just count followers. We look for signs that people actually talk about the project. We check growth on X, Telegram, and Discord, plus basic engagement like replies, reposts, and unique accounts joining in. If it looks like bot traffic or paid hype, the score goes down.

Tokenomics and Unlocks (15%)

We read the token supply, allocations, vesting schedules, and unlock dates. We also check how big the team and treasury wallets are, and how fast new coins will hit the market. If a project has big unlocks coming soon, we treat it as a real risk and score it lower.

Narrative and Timing (15%)

Low caps often move because of trends. So we asked a simple question: Does this project fit what people are buying right now? We gave more points to coins tied to strong themes like Bitcoin L2, AI, DeFi, Base/Solana ecosystems, and other narratives that already have momentum.

Product and Progress (10%)

We prefer things that work today, not just coming soon. A live app, a working dashboard, a real staking page, an active bot, or a usable protocol helps a lot. We also look for steady updates over time, not one big announcement and then silence.

Safety Checks: Audits and Basic Security (7%)

If a project has audits, we note who did them and whether key issues were fixed. We also look for basics like multisig wallets, bug bounties, and clear contract info. No audit does not always mean “bad”, but it does raise the risk.

Where Can You Buy It (5%)

We checked how easy it is to get exposure. That includes DEX liquidity, whether aggregators route trades well, and whether the token is listed on any CEXs. If it’s hard to buy or hard to sell, it loses points.

Transparency and Docs (3%)

We reward teams that explain things clearly. Good docs, clear risk notes, real on-chain addresses, and basic team info all help. If everything is vague, or the site is mostly marketing, the score goes down.

After scoring, we compared the results and picked the projects with the best overall mix of upside and credibility. We also re-check the list regularly, because low cap crypto can change fast.

What Is a Low Market Cap Crypto?

Low market cap cryptocurrencies are coins that are still small in size, with a total value under $1 billion. Many new projects start here, such as early Layer 2 networks, AI coins, and meme tokens with active communities. People often look at these coins because they can grow a lot if more users discover them later.

To understand market cap, you simply multiply the token’s circulating supply by its price. For example:

10 billion tokens × $1 = $10 billion

1 million tokens × $1 = $1 million

This metric helps investors compare the relative size and maturity of different projects.

What is the price range of a low-cap crypto?

A low-cap crypto can trade at any price, from fractions of a cent to double digits. Price does not determine market cap; supply does.

While many low-cap tokens trade under $1, others with smaller supplies can have higher prices and still remain below the $1B market cap threshold. The defining feature is size, not price.

Projects under $1B are considered early-stage because they have room to grow, but they also face higher volatility and execution risk.

How do low market cap coins compare to traditional finance?

Market capitalization in crypto is similar, though not identical, to company valuations in traditional finance. The same balance between risk and reward applies:

Smaller, sub-$1B crypto projects resemble young or niche companies in the stock market.

They tend to have fewer users, limited liquidity, and lower public awareness.

However, they may also offer meaningful growth potential if the team executes well.

Like small-cap stocks, low-cap crypto assets can experience sharp price movements following news such as a major partnership, technological breakthroughs, exchange listings, unexpected community or narrative momentum.

But many projects peak early and fail to recover; there are no guarantees. Low-cap coins are typically more volatile than large, well-established assets and respond quickly to market sentiment.

Risk/Reward Tolerance with Low Capitalization Coins and Companies

Bigger companies, such as NVIDIA, and cryptocurrencies like XRP have produced high yields and proven products that are in demand. Like any business model, they are sensitive to risks, such as competition. However, they are more likely to hold or even accrue value than to lose it, unlike many smaller, newer businesses.

This makes them a possibly safer bet than small-cap cryptocurrencies, or at least a lower risk-to-reward ratio. Due to their large valuations or market caps, the growth potential for high-cap investors is significantly smaller than for low-cap investors who entered at discounted prices during crypto ICO and investor rounds.

This is often why crypto gem hunters seek low-cap coins – they believe they can see undervalued potential.

With big-cap coins, there is another risk: many investors entered at a lower price, which can create selling pressure. While the growth potential can be lower, it can be more reliable. Any trading comes with risk, and price action is unpredictable, but these stocks are considered blue-chip.

Risks and Rewards of Low-Cap Crypto in Trading

low-cap crypto offer investors the chance to bet on promising companies and crypto platforms that could have the potential to grow substantially over a relatively short period.

However, the risk is higher, as they may be unproven or have a small community and small market share.

They may also face stiff competition from other cryptocurrencies in the market.

They do offer a potential for greater reward if their project is successful, for early backers. Up to 100x is possible with a low-cap crypto that explodes.

Why a Low-Cap Crypto Can Explode

Many low-cap crypto projects will be new ventures, with their future technology still in development. Others may be up-and-coming projects that are beginning to mature in the market, gain attention, or have recently pivoted into a new space, such as low- to mid-cap COTI, for example.

COTI has shifted from a payments chain and released a new privacy-focused Layer 2 using garbled circuits, bringing it in line with the trending regulatory compliant privacy narratives of 2026.

These kinds of statuses and developments can be a way for a low-cap crypto to gain attention and potentially explode.

Volatility

Newer low-cap crypto coins with a smaller holder base can be easily subject to dramatic fluctuations in price, both up and down. If a large holder decides to sell, then that can bring down the cost. However, if the token and platform gain new adoption, this can lead to a massive price increase.

Medium-sized buys can have a big impact on tokens with a market cap of less than $50M, for better or worse.

Social Virality

Social virality and community support are important ways for early-stage low-cap coins to grow. And community members may become very loyal and vocal on social media.

New ideas, technological breakthroughs, and strong community engagement can attract new users and influencers to promising low-cap crypto, bringing more attention to potentially undervalued projects. If potential buyers see a lot of positive social mentions, they can feel incentivised to invest their capital.

Staking Rewards

Many new and early-stage coins and protocols offer high staking rewards, which is a way of increasing the size of your holdings. These are often provided for by a share of the tokenomics. The value, of course, depends on the coin’s future price action.

Token Burns

Token burns can help support or even increase the price of cryptocurrencies by reducing the supply. Both small and large projects often employ token burns, such as BNB or SHIB. But for smaller-cap coins, the effect is more dramatic.

Exchange Listings Impact

Many low-cap coins and ICOs launch on Web3 first, due to the lower barrier of entry. The price can fluctuate depending on market conditions, tokenomics, and various other factors. The ideal scenario is that the coin of choice rises due to increased demand and effective marketing, as new entrants discover the project; however, the result varies widely, with some coins rising dramatically and others falling dramatically.

The Coinbase and Binance Effect

When a coin starts getting noticed, a listing on a big exchange often pushes the price up fast. Traders call this a “listing pump”. Getting listed on platforms like Coinbase or Binance usually makes a project look more legit and gives it access to more buyers and liquidity.

That alone can cause a quick jump in price and trading volume. Still, this does not mean the coin will keep going up. Many coins rise on the news and then fall back later.

For example, when Binance announced the listing of Pump.fun (PUMP) on September 11, 2025, the price jumped by almost 5% within minutes. When Coinbase added KAITO to its perpetual futures, the token went up around 40%, and trading volume grew by more than 120%.

A similar thing happened with POPCAT and PENGU. After Coinbase said transfers were enabled and trading would come later, POPCAT rose by over 20%, while PENGU gained about 7%. These cases show how strong the price reaction to exchange listings can be.

How to Find Low Cap Crypto

The best way to find low cap crypto is by checking new listings on CoinGecko, CoinMarketCap, DEXTools, or Jupiter Alpha. As they are decentralized, DEXtools and Jupiter will display more fresh pairs, but also some honeypot scam coins.

The new cryptocurrencies page on CoinGecko. Source: CoinGecko

Another option is to use a bot, which can provide details of new coins and even assist you in buying safely (but ensure you trust the bot and use a new wallet).

Many Telegram channels utilize bots that list new pairs, some of which are free. You could even make your own TG channel and have new pairs get listed.

You can also find crypto presales that will have a low market cap at launch.

How to Buy Low Cap Crypto

After you pick a coin you want to try, make sure your crypto wallet has some funds in it. You can use a wallet like Best Wallet, MetaMask, or any other wallet you trust. If your balance is empty, you can add money by buying crypto on an exchange or through the wallet itself.

Before you buy anything, only connect your wallet to sites you know and trust. Many small coins are traded on decentralized exchanges, and some of them can be risky. If you are dealing with a brand-new token, it’s safer to use a new wallet with a small amount of money.

Always double-check the token’s contract address. Get it from a trusted site like CoinGecko or CoinMarketCap and copy it from there. This helps you avoid fake tokens. You can also use simple tools like TokenSniffer or GoPlus to check for warning signs before buying.

Review liquidity levels before entering a position. On-chain tools like DEXTools show liquidity pool size, lock status, and recent trading activity. Low-cap tokens often suffer from thin liquidity, which can make buying or selling more difficult.

Even if a token appears safe based on initial checks, remember that new and low-cap assets carry elevated risks, including volatility, low liquidity, and potential contract exploits.

Where to Buy the Best Low-Cap Crypto

Buying low-cap cryptocurrencies typically occurs through decentralized exchanges (DEXs), often before they are listed on larger centralized exchanges (CEXs).

Decentralized Exchanges

DEXs are the main place where new and small tokens first show up. You trade directly from your wallet, without an intermediary. To use them, you need a crypto wallet like MetaMask or Phantom and a bit of the network’s coin to pay fees.

- On Ethereum, people often use Uniswap, SushiSwap, or Balancer.

- On Solana, popular options include Raydium, Jupiter, Orca, and Phoenix.

- On BNB Chain, many trades happen on PancakeSwap or ApeSwap.

- Polygon users usually turn to QuickSwap or Uniswap.

- On Avalanche, Trader Joe and Platypus Finance are common choices.

Tier 1 Centralized Exchanges

These are the biggest and most liquid exchanges in crypto. Small projects rarely start here, but getting listed on one is a big step and often brings more attention and volume. Well-known examples are Binance, Coinbase, Kraken, Gemini, Crypto.com.

Tier 2 Centralized Exchanges

These exchanges sit in the middle. They often list new projects after the DEX stage, but before the coin reaches the largest platforms. Examples include MEXC, Bybit, Margex, BloFin, OKX, Gate.io, KuCoin.

Discovery Tools

Identifying promising low-cap projects early is vital. Here are some tools to make that easier.

DEXTools – Provides real-time charts, trading data, and analytics for DEX listings, including contract safety assessments.

CoinGecko – Useful for tracking prices, market capitalization, and discovering emerging projects via its “Recently Added” and “Trending Coins” sections.

What Are the Risks of Investing in Low Cap Crypto?

Low cap crypto can bring big gains, but the risks are high. Prices can swing fast, liquidity can dry up, and some projects simply fail. There are also scams, broken smart contracts, and problems with exchanges. Below are the main risks and some simple ways to think about them.

Volatility

Small tokens move fast. Even a normal buy or sell can push the price up or down a lot. If a large holder sells, the price can crash in minutes.

How to avoid: Don’t go all in. Use small amounts, enter and exit slowly, and set limits to protect yourself.

Liquidity problems

Many low cap coins are hard to trade in size. There may not be enough buyers when you want to sell, or the price can drop sharply while you try.

How to avoid: Check how much liquidity the token has and see how the price reacts to normal trades. Make sure liquidity is locked or spread out.

Rug pulls

Some teams remove liquidity and disappear, leaving the token worthless. This still happens a lot in small projects.

How to avoid: Always check the real contract address, see if liquidity is locked, and be careful with projects that have no known team or no audit.

Project failure

Even projects that look strong at the start can fail. Teams may run out of money, build too slowly, or lose key people. This is not rare. Startup data shows that about 70% of new businesses fail between years two and five, and around two-thirds do not survive 10 years. Crypto projects are not an exception.

How to avoid: Look for steady progress, clear plans, and real updates over time. It’s usually safer to wait until a project proves it can keep building.

Smart contract bugs

Smart contracts can break. A single bug or exploit can wipe out funds very fast. In the first quarter of 2025 alone, crypto security incidents caused losses of more than $2 billion, according to Web3 security firm Hacken. One clear example happened on June 6, 2025, when the Stacks-based ALEX Protocol was hacked for about $8.3 million.

How to avoid: Stick to projects with known audits and test things with small amounts first.

Exchange risks

Centralized exchanges are not risk-free. They can get hacked or suddenly remove a token from trading. On February 21, 2025, Bybit was hacked for around $1.5 billion, which US authorities linked to North Korea. It was one of the biggest crypto thefts ever.

How to avoid: Don’t keep everything on one exchange. Move funds to your own wallet when possible and spread risk across platforms.

Pros & Cons of Best Low Cap Crypto Coins Explained

When looking at low cap crypto, it’s important to see both the upside and the risks. Here are the main points in a clear and simple way.

Pros

- Big growth potential – small amounts of new money can push prices up fast if a project gets attention.

- Early access – you get in before a project becomes popular or widely used.

- Strong community effect – active users can help spread the word and support growth.

- Fast development – small teams can move quicker and change direction faster than large projects.

Cons

- Sharp price swings – prices can jump or crash quickly, especially with low trading volume.

- Harder to trade – low liquidity can make it difficult to buy or sell without moving the price.

- Higher scam risk – pump-and-dumps, rug pulls, and weak projects are more common at this stage.

- Uncertain future – many projects are new, untested, and may fail due to tech, funding, or rules.

In short, low cap crypto offers high upside, but the risks are just as real.

Is It Legal to Invest in Low Cap Crypto in 2026?

In most places, buying low cap crypto is allowed. Still, the rules depend on where you live and which platform you use, so it’s always smart to check local laws.

United States

Owning and trading crypto is legal. Some tokens are treated as securities by the SEC, while others fall under commodity rules from the CFTC. Certain states, like New York, require special licenses for crypto companies, but regular users do not need one.

United Kingdom

You can buy and hold crypto, but advertising and promotions are heavily controlled. Since October 8, 2023, crypto promotions must follow FCA rules, including clear risk warnings and approval from authorized firms.

European Union

The EU now follows a shared set of crypto rules under MiCA. Stablecoin rules started in mid-2024, and by December 2024, only approved providers are allowed to offer crypto services across EU countries.

Asia

- In China, crypto trading and related businesses are banned.

- In India, investing is legal, but exchanges must follow registration and anti-money-laundering rules.

- In Singapore, retail users can access crypto through licensed providers that follow strict safety and consumer protection standards.

Do You Pay Taxes on Low Cap Crypto in 2026?

Yes. In most countries, crypto activity is taxed in some form.

When taxes usually apply

- Selling, swapping, or spending crypto can create a taxable gain or loss.

- Staking rewards, mining income, and airdrops are often taxed as income when you receive them.

- Some countries offer tax breaks for long-term holding. For example, Germany may exempt gains after one year.

Tax rules by region

- In the US, crypto is treated as property, and both trades and income are taxable.

- In the UK, Capital Gains Tax applies, and some rewards count as income.

- In Germany, long-term holdings can be tax-free under certain conditions.

- In Australia, crypto falls under capital gains tax rules.

- In the UAE, there is no personal income tax, though business taxes or VAT may apply.

Keep clear records of all transactions, separate income from trading gains, and track activity across wallets and exchanges. If you’re unsure, it’s best to speak with a tax professional.

This information is for general guidance only and is not legal or tax advice.

Final Verdict – Is Low Cap Crypto Worth It in January 2026?

Low cap crypto sits at the early stage of the market. These tokens are small, less known, and can move fast if interest grows. That also means prices can swing hard, and liquidity can disappear just as quickly.

For January 2026, Bitcoin Hyper (HYPER) stands out as a Bitcoin Layer 2 trying to make BTC more useful for everyday apps and DeFi. Other picks tell different stories. Maxi Doge (MAXI) leans on meme culture and trading hype, while Fluid (FLUID) focuses on real DeFi use like lending and swaps.

Low cap crypto can offer big upside, but the risk is high. Keep positions small, spread risk, pay attention to real usage and safety, and only invest money you can afford to lose.

FAQ

What is the best low cap crypto to invest in 2026?

Which low cap crypto has the most potential?

Are low cap coins riskier than large caps?

Where can I buy low market cap crypto?

How do I find promising low cap tokens?

What’s the difference between penny crypto and low cap crypto?

What does “microcap” mean in crypto?

Are low-cap AI tokens a good bet in 2026?

Reference

- Fluid Project Profile (Messari)

- Trending Cryptocurrencies (CoinGecko)

- Total Value Locked (TVL) Protocols (RWA) (DeFiLlama)

- Crypto Venture Capital Q1 2025 Report (Galaxy Research)

- US Crypto Policy Tracker: Regulatory Developments (Latham & Watkins LLP)

- Crypto Week: Market Insights (Betashares)

- What Is Bitcoin (BTC) Dominance? Chart Explained (Gemini Cryptopedia)

- H.R.3633 – 119th Congress (2025–2026): Digital Asset Market Clarity Act of 2025 (Congress.gov)

- AI Statistics 2024–2025: Global Trends, Market Growth & Adoption Data (Founders Forum Group)

- Top Meme Coins by Market Cap (CoinGecko)

- Volume 255: Digital Asset Fund Flows Weekly Report (CoinShares)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 30 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.