Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Best Penny Crypto to Buy in December 2025 – Top 10 Low-Priced Coins

24 mins

24 mins Bitcoin Hyper tops our best penny crypto to buy watchlist for December 2025, with over 1B+ tokens staked, signaling real interest in Bitcoin Layer 2 experiments.

Two alternatives worth watching are Maxi Doge, a leverage-trader meme token, and PEPENODE, a mine-to-earn game on the Ethereum blockchain.

This guide ranks the best penny cryptos to buy in 2025 using a transparent methodology that explains how we score projects across presale traction, tokenomics, builder activity, and verified community data.

Top 10 Penny Crypto List 2025

According to our research, the best penny crypto to watch in 2025 include:

- Bitcoin Hyper (HYPER) – Meme coin built to boost Bitcoin’s speed

- Maxi Doge (MAXI) – Doge-inspired coin for high-leverage traders

- PEPENODE (PEPENODE) – New mine-to-earn crypto token

- Shiba Inu (SHIB) – Billion-dollar meme ecosystem with community power

- Dogecoin (DOGE) – The original meme coin with real-world use

- SUBBD (SUBBD) – AI-driven platform for creators and innovators

- Bonk (BONK) – Solana’s flagship meme token

- Polygon (POL) – Ethereum Layer-2 for fast and cheap transactions

- LiquidChain (LIQUID) – Layer 3 utility token with cross-chain liquidity

- Kaspa (KAS) – Scalable DAG-based blockchain with fast confirmations

Editor’s Picks – Penny Crypto to Buy Now

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Top Penny Crypto to Invest In – Reviews and Analysis

After analyzing dozens of low-priced cryptocurrencies, we’ve identified the most promising options based on their use, community strength, technical innovation, and growth potential.

1. Bitcoin Hyper (HYPER) – Meme Coin Built to Boost Bitcoin’s Speed

Bitcoin Hyper is a Bitcoin-focused Layer 2 built for quick confirmations and small fees, so you can pay, trade, and tap directly with BTC instead of swapping over to a different token.

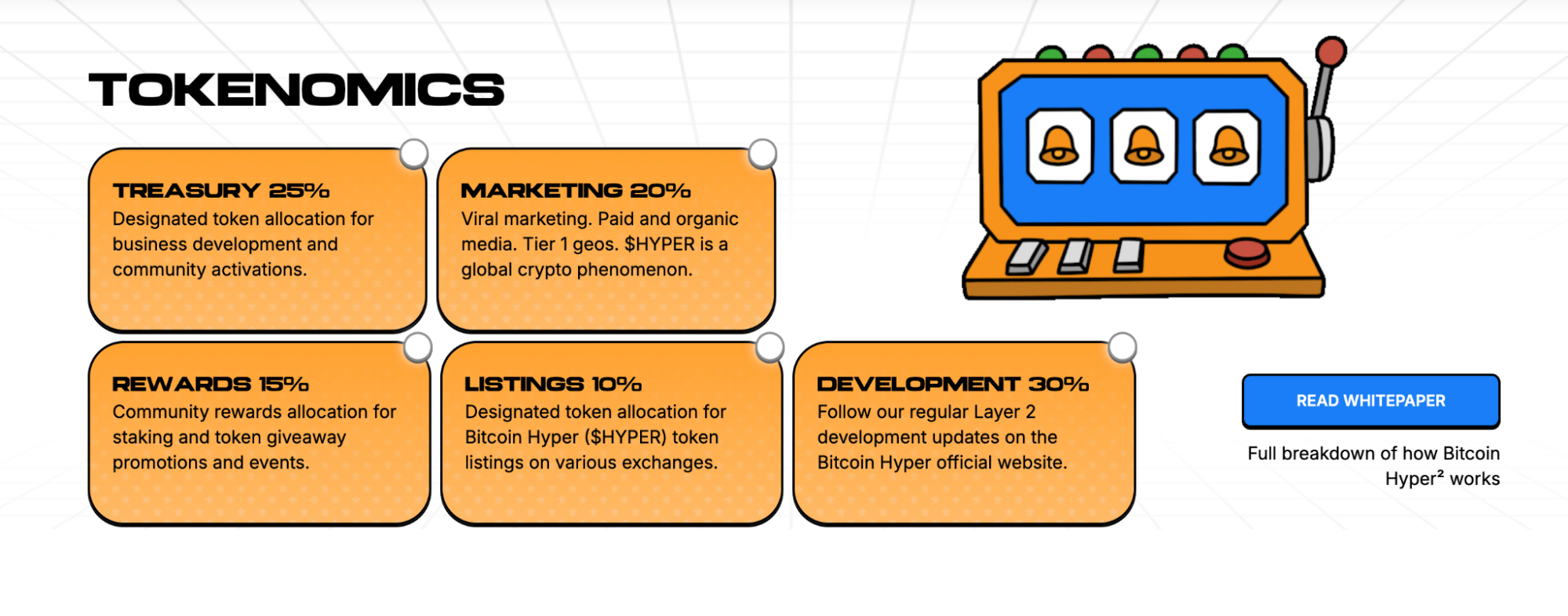

Bitcoin Hyper tokenomics chart. Source: Bitcoin Hyper

HYPER powers the network. You pay fees in it, stake it to help secure the chain and earn rewards, and use it for votes as governance rolls out. That ties token demand to real activity rather than hype alone.

Editor’s Take: Early in a competitive Bitcoin L2 field, real adoption and shipping speed remain the swing factors that can make or break HYPER.

| Project | Bitcoin Hyper |

| Chain | Ethereum |

| Market Cap | Still in presale with $29.72M raised. |

| Launch | TBA (Q4 2025) |

| Exchanges | Major exchange listings are anticipated, but still to be confirmed. |

| Max Supply | 21,000,000,000 HYPER |

| Current Price | $0.013475 |

2. Maxi Doge (MAXI) – DOGE-Inspired Coin for High Leverage Traders

Maxi Doge is a meme project on Ethereum designed for traders who appreciate high-energy, gym-inspired branding. The idea is to give active traders a clear, viral identity and maintain high engagement through frequent community activities.

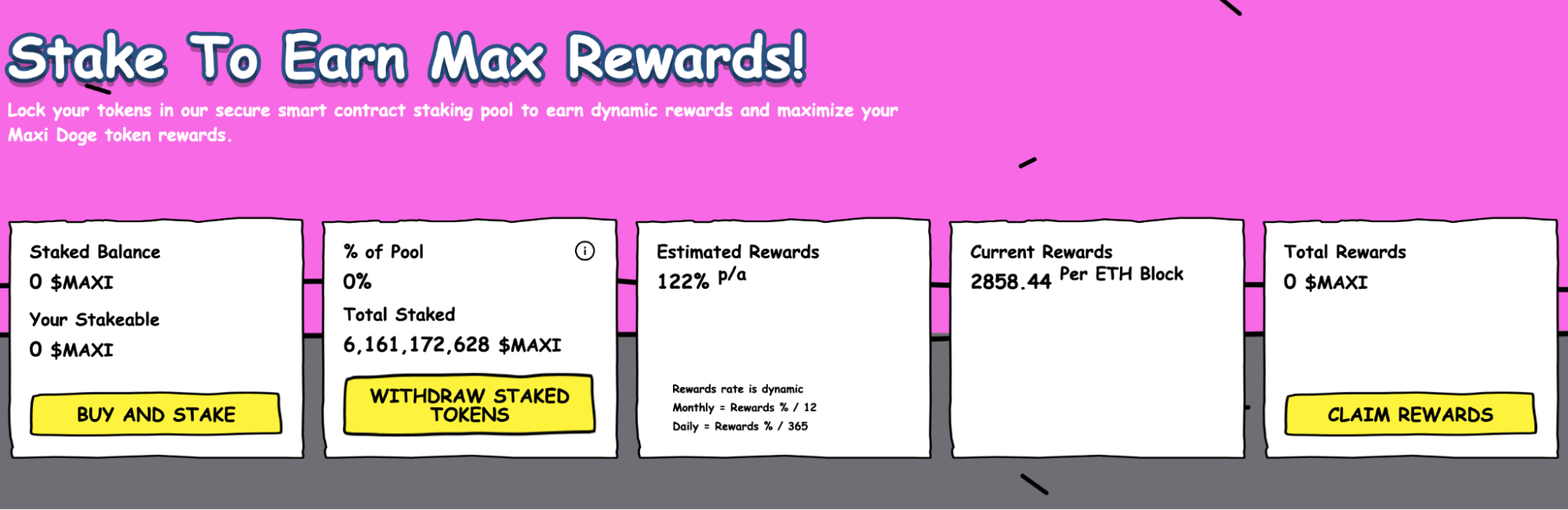

Maxi Doge’s staking dashboard showing 6B+ tokens staked with estimated rewards. Source: Maxi Doge

MAXI serves as an entry point to ROI-focused contests and rewards. Its holders stake it for daily smart-contract distributions, and a MAXI Fund is reserved to support potential partnerships with futures platforms. The presale runs at $0.0002745, with a fixed supply of about 150B.

Editor’s Take: There’s undoubtedly presale traction with rising X and Telegram engagement, especially across crypto and fitness circles, but large supply and unconfirmed partnerships can dilute the product.

| Project | Maxi Doge |

| Chain | Ethereum |

| Market Cap | Still in presale with $4.36M raised |

| Launch | TBA (Q4 2025) |

| Exchanges | Presale (Official Website) |

| Max Supply | 150,240,000,000 (fixed) |

| Current Price | $0.0002745 |

3. PEPENODE (PEPENODE) – New Mine-to-Earn Crypto Token

PEPENODE is an Ethereum meme token that turns staking into a “mine to earn” experience. Participants deposit at $0.0012112 to reserve a spot in the rewards pool. Once the protocol goes live, rewards begin accruing continuously.

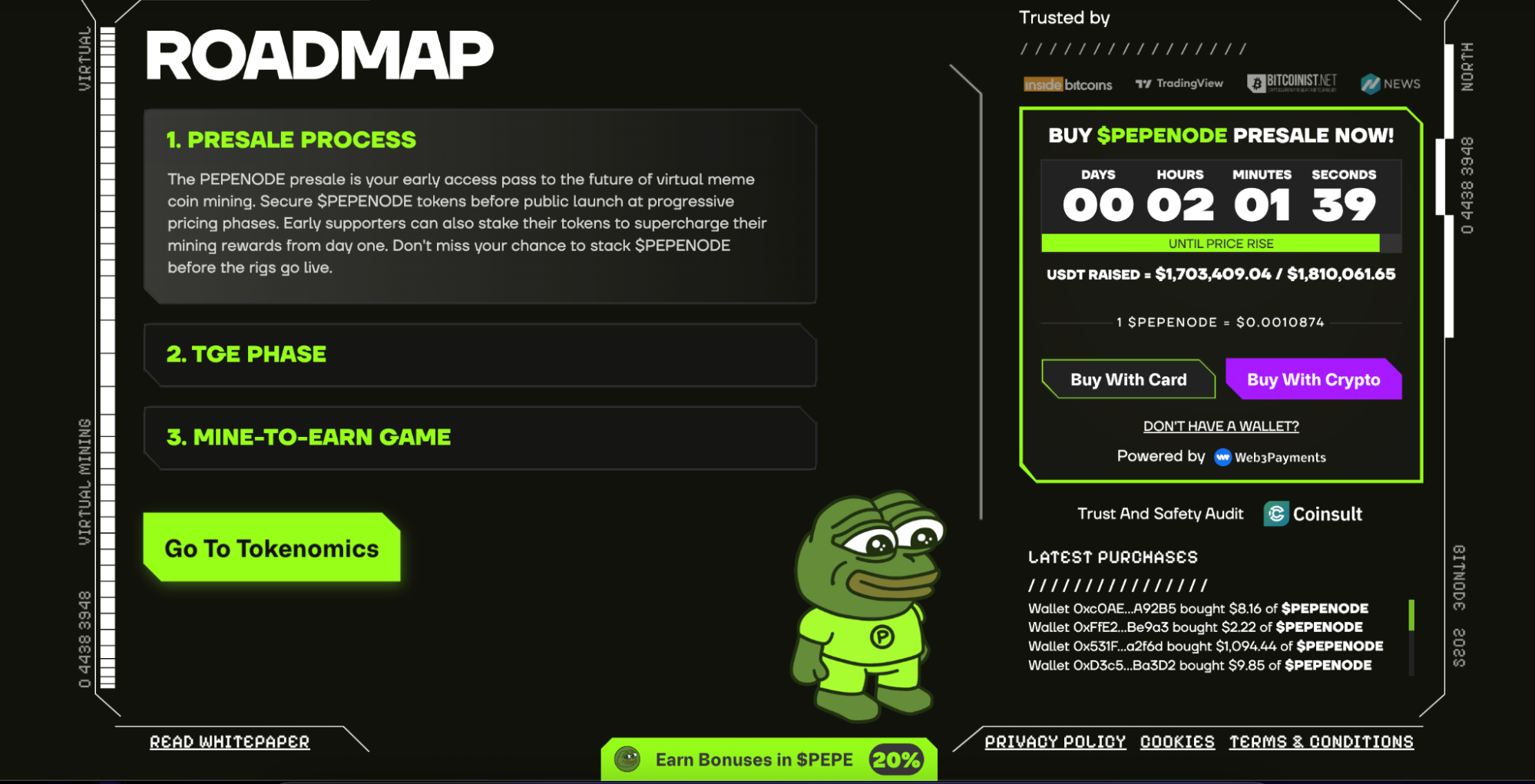

PEPENODE Cryptocurrency Presale Roadmap Showing Presale Process, TGE phase, and Mine-to-Earn Game. Source: PEPENODE

Rewards scale with how much users stake and how long they lock, and there is no vesting. Stakers can track yields in real time, with APY currently showing 570%.

Editor’s Take: Will this game be any good? Never mind the rewards – PEPENODE’s success really depends on whether it can get its virtual mining game off the ground, and whether it will be any fun to play.

| Project | PEPENODE |

| Chain | Ethereum |

| Market Cap | Presale active – $2.39M raised |

| Launch | TBA (mining activities post-presale) |

| Exchanges | Not yet announced |

| Max Supply | 1,000,000,000 PEPENODE |

| Current Price | $0.0012112 |

4. Shiba Inu (SHIB) – Billion-Dollar Meme Ecosystem with Community Power

Born as a riff on Dogecoin, SHIB is held up as the flagship example of a meme coin that successfully made the crossover to real utility. Its low-fee network, Shibarium, now makes transactions cheaper and faster than the Ethereum mainnet, and the ecosystem, which includes ShibaSwap and SHIB: The Metaverse, incorporates an automatic burn that ties usage to supply reduction.

Editor’s Take: SHIB is one of crypto’s largest meme communities with deep CEX and DEX liquidity. It’s a safe bet for holders who want to have their cake and eat it too, giving them meme exposure with working infrastructure and a path to utility.

| Project | Shiba Inu |

| Chain | Ethereum & Shibarium |

| Market Cap | $5.9B |

| Launch | August 2020 |

| Exchanges | Binance, Coinbase, KuCoin |

| Max Supply | 589.50T SHIB |

| Current Price | SHIB $0.000007 24h volatility: 2.1% Market cap: $4.13 B Vol. 24h: $90.46 M |

5. Dogecoin (DOGE) – The Original Meme Coin with Real-World Use

Dogecoin is the original meme cryptocurrency focused on everyday payments and tipping. It runs on its own blockchain, is widely listed on major exchanges, and aims to make small transfers simple and cheap. DOGE DOGE $0.13 24h volatility: 3.0% Market cap: $21.38 B Vol. 24h: $898.75 M , the network’s currency, is used to pay transaction fees and send value, while miners earn new coins as block rewards.

Editor’s Take: The fact that DOGE issues 5 billion tokens every year takes care of supply issues but can dilute holders if demand doesn’t grow. And let’s face it, it’s the longest-running meme coin ever, so whoever was going to buy DOGE has probably done so already.

| Project | Dogecoin |

| Chain | Independent blockchain |

| Market Cap | $29.4B |

| Launch | 2013 |

| Exchanges | All major platforms |

| Max Supply | No max supply |

| Current Price | DOGE $0.13 24h volatility: 3.0% Market cap: $21.38 B Vol. 24h: $898.75 M |

6. SUBBD (SUBBD) – AI-Driven Platform for Creators and Innovators

SUBBD is a SocialFi platform that lets creators get paid directly by fans with low fees and publish faster. Built-in AI tools make quick work of production and posting, while fans get access to exclusive content and interactions.

SUBBD token benefits overview. Source: SUBBD

SUBBD is the in-app currency for tipping, paywalled content, and creator subscriptions. It also funds engagement rewards and can be staked for yields at a steady 20% APY.

Editor’s Take: OnlyFans reported pre-tax profit of $684 million, up 4% for its 2024 fiscal year, so creator-to-fan business is definitely booming. But will the platform and others like it be willing to hand over the financial reins to a newcomer like SUBBD?

| Project | SUBBD |

| Chain | Multi-chain |

| Market Cap | Still in presale with $1.4M raised. |

| Launch | Presale |

| Exchanges | Presale (Official Website) |

| Max Supply | 1 Billion tokens (capped) |

| Current Price | $0.057275 |

7. Bonk Coin (BONK) – Solana’s Flagship Meme Token

Bonk is a Solana-native meme currency built for fast, low-fee transfers and everyday use. It has moved beyond a joke through burns, Solana Pay acceptance, and integrations across Solana DeFi.

BONK BONK $0.000008 24h volatility: 3.1% Market cap: $643.15 M Vol. 24h: $50.45 M is used for tipping, small payments, and app incentives. Holders often provide liquidity or stake in partner pools to earn yields, while ongoing burns tie activity to a gradual supply reduction.

Editor’s Take: BONK will always have a special place in the Solana community’s heart thanks to the role it played in the blockchain’s recovery after the infamous collapse of FTX, but this also means that it has hitched its wagon inevitably to Solana’s star, making it incredibly volatile.

| Project | BONK |

| Chain | Solana |

| Market Cap | ~$1.1B |

| Launch | Dec 2022 |

| Exchanges | Binance, Coinbase, Gate, and others |

| Max Supply | 88.8 T BONK |

| Current Price | BONK $0.000008 24h volatility: 3.1% Market cap: $643.15 M Vol. 24h: $50.45 M |

8. Polygon (POL) – Ethereum Layer-2 for Fast and Cheap Transactions

Polygon is an Ethereum scaling network built to make transactions faster and more affordable. It processes large volumes of transactions while maintaining Ethereum-level security by using a modular Layer 2 design with zero-knowledge (ZK) technology. POL POL $0.11 24h volatility: 1.8% Market cap: $1.11 B Vol. 24h: $46.66 M , which replaced the old MATIC token, is used to pay transaction fees, stake for network validation, and participate in governance.

Editor’s Take: Developers and users seeking cheaper, faster Ethereum transactions could find Polygon useful, but competition from other Layer-2s like Arbitrum and Optimism may slow adoption.

| Project | Polygon |

| Chain | Ethereum Layer 2 (PoS & zkEVM) |

| Market Cap | $1.9B |

| Launch | 2017 |

| Exchanges | All major platforms |

| Max Supply | 10.5B POL (replacing MATIC) |

| Current Price | POL $0.11 24h volatility: 1.8% Market cap: $1.11 B Vol. 24h: $46.66 M |

9. LiquidChain (LIQUID) – Layer 3 Cross-Chain Liquidity Engine

LiquidChain is an emerging multi-chain infrastructure project that aims to act as a Layer 3 liquidity layer connecting major ecosystems like Bitcoin, Ethereum, and Solana. Instead of shifting assets through separate bridges, LiquidChain’s design intends to let value and liquidity flow more seamlessly across these networks. It does so by using a unified layer that reduces the friction for developers and users.

The native $LIQUID token offers staking, governance, and participation in the network’s incentives. It is still early in its presale/launch phases, but the project emphasizes deep liquidity pools and predictable fees.

Editor’s take: LiquidChain is ambitious in tackling one of crypto’s biggest pain points – cross-chain fragmentation. That said, the project is still in its early cycle and carries the typical presale risks. Thorough research and caution are essential.

| Project | LiquidChain (LIQUID) |

| Chain | Layer 3 interoperability network |

| Market Cap | Not listed/early presale |

| Launch | 2025 |

| Exchanges | In presale |

| Max Supply | 11.8 B LIQUID total supply |

| Current Price | Presale price varies |

10. Kaspa (KAS) – Scalable Layer 1 with Fast Transactions

Kaspa is a proof-of-work (PoW) cryptocurrency built on a novel BlockDAG structure that lets multiple blocks be created and confirmed simultaneously. This design aims to solve the traditional bottleneck in crypto. It does so by enabling near-instant transaction confirmations and much higher throughput (compared to classic chains like Bitcoin).

Kaspa currently processes blocks about every second and maintains low fees, making it appealing for microtransactions and everyday use. Kaspa was fair-launched with no pre-mine or ICO. The native KAS fuels the network, covering miner rewards and transactions across the ecosystem.

Editor’s take: Kaspa’s technology is investing, particularly its scalability and speed compared to older chains. Still, the project is early in adoption and still lacks broad exchange support. More importantly, it doesn’t yet host a big DeFi ecosystem. This means that potential investors should weigh hype vs real usage.

| Project | Kaspa (KAS) |

| Chain | Decentralized Layer 2 blockchain using BlockDAG |

| Market Cap | Around $1.2B |

| Launch | November 7, 2021 |

| Exchanges | Available on many exchanges |

| Max Supply | 28.7B KAS |

Best Penny Crypto to Invest In Key Takeaways

- Bitcoin at BTC $86 928 24h volatility: 0.9% Market cap: $1.73 T Vol. 24h: $45.48 B recently reached an ATH above $125K in early October 2025, and new multi-million-dollar presales are pushing liquidity into sub-$1 coins.

- Bitcoin Hyper remains our top pick for the best penny crypto to invest in, with 1B+ tokens staked and Layer 2 infrastructure targeting DeFi expansion for Bitcoin scalability.

- Shiba Inu’s SHIB $0.000007 24h volatility: 2.1% Market cap: $4.13 B Vol. 24h: $90.46 M established $6B ecosystem and automatic burn mechanics make it a relatively safe bet in the world of penny crypto.

- Maxi Doge and PEPENODE offer early exposure to two interesting crypto niches, namely leverage trading and GameFi mining.

- 90% of penny crypto projects fail; only invest what you can afford to lose and keep speculative tokens to 5-10% of your portfolio.

What Are Penny Cryptocurrencies?

Penny cryptocurrencies are digital coins that trade for less than a dollar. They are often less well-known than established coins, come at a low cost, and, in many cases, they are overlooked.

Because their prices are so low, even minor movements in price can turn into big gains for investors. For instance, a coin can jump from $0.001 in presale to $0.01 once it hits exchanges, giving investors a tenfold return. This is rarely seen with bigger and more established cryptocurrencies.

Penny crypto is especially appealing to new investors who want to experiment in crypto without making a major investment. But it’s important to remember: the potential for big gains also brings big risks. Since they can swing so wildly in price, this makes them more volatile than mainstream cryptocurrencies.

Why is Penny Crypto Booming in December 2025 – Market Snapshot

Crypto risk appetite has kicked up a gear. In mid-October, Bitcoin set a new all-time high above $125K, then cooled to the low-$110Ks as spot BTC ETFs swung back to net inflows, led by Fidelity’s FBTC with $132.7M on September 2. Ethereum also printed fresh highs in late August. Together, these moves typically pull liquidity down the risk curve into small caps and presales.

Under the hood, two structural drivers stand out. First, exchange activity is brisk: August closed with a year-to-date peak in centralized spot volumes and a jump in DEX turnover to roughly $369B, with Uniswap far ahead. Second, Layer-2 usage keeps climbing; recent analytics show L2s now handle the lion’s share of transactions, with Base emerging as a leader. These pipes make it cheaper and faster to launch, trade, and bootstrap communities around sub-$1 tokens.

Looking ahead, institutions remain a tailwind. Coinspeaker has covered forecasts calling for higher cycle targets in BTC and renewed ETF expansion, alongside ETH scenarios that put $5K–$10K on the map if momentum persists.

Why Invest in Penny Cryptocurrencies?

Penny cryptocurrencies might not grab the headlines like Bitcoin or Ethereum, but they’ve become a favorite for new investors or those who like the “hidden opportunities”, the chance to explore new projects and potentially score big gains. Let’s take a look at the top reasons why investors pick penny cryptocurrencies.

Massive Growth Potential

One of the biggest draws of penny cryptocurrencies is their potential for major gains. Established coins like Bitcoin or Ethereum might double or triple during a bull run, but penny cryptos can sometimes deliver 10x, 100x, or even 1000x returns if the project really takes off.

Low Entry Barriers

Penny cryptos are accessible to nearly anyone (some regional restrictions may apply). You don’t need thousands of dollars to get started. You don’t need to buy a small chunk of a coin if you have a limited budget. Usually, you can invest as little as $10, $50, or $100, depending on the project, and buy a bunch of tokens, especially in crypto presale phases. This makes them perfect for beginners who are just testing the waters, or even more seasoned investors who want to experiment with smaller positions.

Portfolio Diversification

Even experienced crypto traders often dedicate a small slice (5-10%) of their portfolio to penny cryptocurrencies. Why do they do this? These low-cost coins can act as a high-risk, high-reward addition and balance out more stable investments. If you make a few successful choices, this can boost your overall returns. Diversification can be a smart play if you invest in the right coins.

Penny Crypto That Delivered Real Growth in the Past

Some penny cryptocurrencies have made headlines with grand returns. They are very different, but they usually share some common traits you could look for. For starters, they often launch in fast-growing sectors. Think meme coins, DeFi platforms, or Layer 2 scaling solutions. On top of that, they build strong communities and deliver working products or clear utilities early on.

Here are five penny cryptocurrencies that achieved major success in the past:

| Token | Initial Price | Peak ROI | Key Drivers of Growth |

| Shiba Inu (SHIB) | <$0.00000001 | Over 1,000,000% | Meme virality, major exchange listings, ecosystem expansion |

| Polygon (POL) | ~$0.0026 | ~54,000% | Layer 2 scaling solution, strong dev adoption, institutional interest |

| Pepe (PEPE) | ~$0.0000001 | Over 10,000% | Meme-driven hype, community engagement, CEX support |

| Solana (SOL) | ~$0.22 | ~30,000% | High-performance Layer 1, ecosystem growth, strong VC backing |

| Dogecoin (DOGE) | <$0.0002 | ~30,000%+ | Meme culture, celebrity endorsement, payment utility |

Now, these success stories are exciting and make you want to invest in small coins. However, they should also serve as a reminder that such outcomes are rare. It usually comes down to doing your research, staying patient, and remembering that high rewards come with high risk.

Where to Buy Penny Cryptocurrencies

Finding the best exchange and safe crypto wallet is crucial when investing in low-priced cryptocurrencies. The platforms you choose affects everything from available token selection to trading fees and security.

Centralized Exchanges

For established budget-friendly cryptocurrencies like SHIB, DOGE, ADA, and TRX, Binance stands out with support for all our top picks and competitive 0.1% trading fees.

KuCoin earns its reputation as “The People’s Exchange” by frequently listing promising projects like VET and ZIL before larger platforms.

MEXC and OKX specialize in emerging tokens for even earlier access, often being the first major platforms to list high-potential penny crypto.

Decentralized Exchanges

DEXs provide access to the newest low-priced cryptocurrencies without intermediaries.

Uniswap remains the primary destination for Ethereum-based tokens, offering permissionless trading with simple liquidity provision.

Solana-based projects deliver fast transactions with minimal fees. Jupiter aggregates multiple Solana DEXs to find the best prices across the ecosystem.

Presale Opportunities

Penny crypto is often available directly through presales before exchange listings, often with more favorable entry prices before mainstream exchange listings drive prices higher. When participating in presales or using DEXs, always verify contract addresses from official sources and be wary of impersonation scams.

How We Picked These Top Penny Cryptocurrencies

We evaluated over 100 low-priced tokens using a five-tier weighted framework, allowing us to identify penny cryptocurrencies with the strongest foundations for sustainable growth.

Technology & Innovation (30%)

We prioritized projects solving measurable problems with verifiable technical advantages. Bitcoin Hyper, for example, leverages the Solana Virtual Machine (SVM) to create a high-speed Layer 2 environment for Bitcoin, moving beyond whitepapers into working products with growing traction.

Real-World Utility (25%)

We favored tokens demonstrating concrete adoption over speculative narratives, such as Shiba Inu, which expanded beyond memes with Shibarium, its Layer 2 blockchain supporting DeFi and NFTs.

These projects show measurable progress toward mainstream usage, distinguishing them from purely hype-driven coins.

Tokenomics & Value Mechanisms (20%)

Projects with transparent supply mechanics and tangible scarcity models scored higher. Projects like Hyper incentivize holders with up to 40% APY during presale and future staking mechanics tied to community growth.

Team Credibility & Development Activity (15%)

We evaluated the development team’s credentials and ability to deliver on roadmaps. PEPENODE’s independent security audits from Coinsult and Solidproof indicate professional execution.

Community Engagement & Growth (10%)

While important, we weighted community metrics lower than technical fundamentals. We focused on quantifiable metrics like Shiba Inu’s 1.5 million token holders, verified by Etherscan.

Risks of Investing in Penny Crypto

While the upside potential is enormous, penny tokens carry significant risks that investors must understand:

High Volatility

Penny crypto can swing wildly in price, often 30-50% in a single day. This volatility creates opportunity, but also means you could lose half your investment overnight.

Liquidity Challenges

Many sub-dollar tokens have thin trading volumes, making it difficult to buy or sell large amounts without a significant price impact, or exit positions quickly during market downturns. Always check daily trading volume before investing; under $100K is a red flag.

Scams and Rug Pulls

The penny crypto market is full of scams targeting investors. Coordinated pump and dump schemes artificially inflate prices before insiders sell their holdings, while rug pulls occur when developers abandon projects after raising funds, often disappearing with millions. Last year, these scams collectively drained over $800 million from unsuspecting investors, primarily through penny cryptocurrencies with their lower liquidity and oversight.

Limited Regulation

Most low-priced tokens operate in regulatory gray zones without the protections investors might expect, and when projects fail, investors typically have no path to recovery. Extraordinary due diligence from those entering this market segment is a must.

Pros and Cons of Best Penny Crypto Investing

Penny cryptocurrencies are a high-risk, high-reward segment. Let’s compare the risks versus the rewards and see which side comes out stronger.

Pros

- Potential for high returns

- Accessible entry points ($10-50 positions)

- Early access to emerging blockchain technologies

- Community participation in project governance

- Portfolio diversification with minimal capital

Cons

- Extreme price volatility (25-50% daily swings)

- High project failure rate (90% eventually fail)

- Limited liquidity during market downturns

- Prevalence of scams and fraudulent projects

- Regulatory uncertainty and investor protection gaps

How to Evaluate a Penny Crypto Project Before You Buy

Before investing in any low-cap or penny crypto project, make sure you take time to assess the fundamentals and transparency of the project.

Start by reviewing the project’s whitepaper and official documentation. This should clearly outline the token’s purpose, mechanics, and roadmap. Next, examine the team (if public), the level of community engagement, and whether the project has undergone any third-party audits. Look for signs of credibility: working demos, open-source code, or partnerships with known entities can help validate the project’s legitimacy.

Here’s a checklist to guide your research:

- Read the whitepaper. Is it clear, detailed, and realistic?

- Check the smart contract address on a blockchain explorer

- Look for independent audit reports (e.g., from CertiK, Hacken)

- Assess community activity on platforms like Telegram, X (Twitter), and Discord

- Review tokenomics – supply, vesting, and allocations

- Investigate the team or anonymous developers’ past projects

- Confirm whether there is a working product or TestNet

- Scan for exaggerated claims or aggressive marketing tactics

Careful evaluation doesn’t eliminate risk, but it significantly improves the odds of making informed investment decisions.

Is It Legal to Invest in Penny Crypto in 2025?

The legality of investing in penny cryptocurrencies varies across different regions.

USA

Penny crypto investments are legal in the United States with oversight from the SEC and CFTC. In September 2025, these agencies clarified that registered exchanges can facilitate trading of spot crypto asset products.

Status: Legal ✅

United Kingdom

Investing in penny cryptocurrency is legal under the evolving regulations. The Property (Digital Assets) Bill, introduced in 2024, provides legal recognition for crypto assets.

Status: Legal ✅

Europe

Penny cryptocurrency investments are legal under the Markets in Crypto-Assets (MiCA regulation framework, which took full effect in December 2024. Starting January 2025, CASPs must obtain licenses to operate, establishing uniform rules across all 27 EU member states.

Status: Legal ✅

Asia

Asia has the most diverse regulations for penny cryptocurrency investments, with approaches ranging from complete acceptance to total prohibition across different nations.

- Japan recognizes cryptocurrencies as legal property with FSA oversight. Citizens can freely invest in penny cryptocurrencies through registered exchanges.

- Singapore is a leading crypto hub with legal but highly regulated trading under strict AML and CFT requirements.

- China prohibited cryptocurrency trading and mining in 2021

Status: Varies from one country to another ⚠️

Do You Pay Taxes on Penny Crypto in 2025?

Simply put, yes, you owe taxes on penny cryptocurrency transactions. Let’s find out more:

Common taxable events

- Selling penny crypto for fiat generates short-term (under a year, taxed 10-37%) or long-term (over a year, taxed 0-20%) capital gains.

- Trading one penny token for another counts as a disposal and triggers capital gains.

- Earning staking rewards creates taxable income at fair market value when received, then capital gains when sold.

- DeFi activities like providing liquidity, claiming yield, or governance participation create potential tax events.

Regional tax rules:

- In the US, IRS treats crypto as property; brokers must report sales via Form 1099-DA starting January 2025.

- In the European Union, most countries tax gains (France at 30%, Italy at 26%); Germany and Belgium exempt holdings over 1 year.

- In Asia, Singapore exempts capital gains (17% on business income); Japan up to 55%; India flat 30% with 1% TDS.

Conclusion: Final Thoughts on Investing in Penny Cryptocurrencies

Penny cryptocurrencies are accessible entry points and have explosive upside potential that established coins can’t match. Catalysts like Solana ETF approval and continued institutional buying could trigger another meme coin season in Q4 2025.

For penny crypto presale opportunities, Bitcoin Hyper (HYPER) stands out with its Bitcoin Layer 2 infrastructure and 984M+ tokens already staked, solving BTC’s DeFi limitations. Also, Shiba Inu (SHIB) leads with proven infrastructure, Shibarium, ShibaSwap, and automatic burns, backed by a $7.1B market cap and multi-cycle survival. Both offer clear utility beyond speculation, but HYPER carries higher execution risk while SHIB provides more stability with lower multiples.

Remember that penny crypto swings 30-50% daily, and 90% of projects eventually fail. Only invest what you can afford to lose completely, keep penny tokens to 5-10% of your portfolio, and always verify smart contract audits and tokenomics before buying. The next 100x winner could be here, but so are dozens of projects that’ll drop 90% and disappear.

FAQ

What is the best penny crypto to buy today?

Are penny crypto coins a good investment?

Can you buy penny crypto on Coinbase?

How do you find a penny crypto before it explodes?

Is crypto under a penny worth it?

References

- Shibarium Block Explorer (Shibarium)

- Solana Network Performance (Solana)

- Crypto Trading Bots Data (Dune Analytics)

- Cryptocurrency Price & Market Data (Coingecko)

- Crypto Crime Report 2024 (Chainanalysis)

- Penny Stocks Definition (CFI)

- TRON Blockchain Data (Tron Scan)

- Ethereum Block Explorer (Ether Scan)

- Pump and Dump Schemes (SEC Investor Alerts)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

We’ve spent weeks analyzing LivLive’s whitepaper, presale data, and community sentiment to come up with our honest take on where L...

In this article, we examine whether Super Pepe is a legitimate opportunity or a potential scam, highlighting its charity-focused m...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 28 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.