This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...

What Is Nexo? A Complete Guide to the Digital Asset Platform

Last Updatedby Tony Frank · 9 mins read

Learn how Nexo combines crypto lending, earning, and spending tools in one platform for both retail and institutional users.

Nexo is a global crypto platform offering lending, interest-earning, exchange, and everyday spending tools — all within a secure, all-in-one app. The NEXO token enhances user benefits through higher yields, lower borrowing costs, and tiered rewards, including up to 2% cashback and governance rights. With institutional-grade security, $375M in insurance, and regulatory compliance in over 200 jurisdictions, Nexo delivers trusted digital asset management for both retail and institutional clients.

Key Takeaways:

- All-in-One Crypto Finance Platform: Nexo offers an integrated suite of services — including crypto-backed loans, interest-earning wallets, asset exchange, and a crypto debit card — all within a single, user-friendly ecosystem.

- Utility-Driven Token Economy: The NEXO token enhances the user experience by unlocking higher interest rates, lower borrowing costs, cashback rewards, and governance participation through a tiered loyalty program.

- Security and Global Reach: With institutional-grade asset protection, comprehensive insurance coverage, and operations in over 200 jurisdictions, Nexo positions itself as a secure and compliant gateway to digital finance for both retail and institutional clients.

As digital finance continues to reshape the global economy, platforms that combine crypto innovation with real-world utility are gaining traction. Nexo is one such platform — a pioneer in crypto-backed financial services that bridges the gap between decentralized technology and traditional finance. With a global presence and a comprehensive range of features, Nexo enables users to earn, borrow, trade, and spend digital assets securely and efficiently.

This guide explores how Nexo operates, its key offerings, and what distinguishes it in the evolving digital asset management landscape.

Introduction to Nexo App — Driving the Next Generation

Founded in 2018, Nexo was one of the first platforms to introduce instant crypto credit lines, allowing users to borrow against their digital assets without selling them.

It bridges traditional finance with the decentralized world, offering:

- Instant access to liquidity

- Protection of crypto ownership

- Seamless global operations in 200+ jurisdictions

Nexo Logo. Photo: Nexo Official Website.

Through its robust infrastructure and all-in-one mobile ecosystem, Nexo empowers users to:

- Borrow, earn, and spend seamlessly

- Enjoy fast, fee-free swaps via the Nexo Exchange

- Use crypto like cash through the Nexo Card, Apple Pay, and Google Pay integrations

Serving the next generation across more than 200 jurisdictions, the Nexo platform exchange transaction model supports a broad range of fiat and digital currencies. With services including crypto-backed loans, an interest-bearing bank account alternative, and the dynamic Nexo Exchange, Nexo positions itself as a gateway to global markets.

It continues to impact global markets by offering secure, compliant wealth solutions for family offices and individual investors alike, all built on strong fundamentals and backed by a dedicated team that is available seven days a week to shape sentiment ahead of major shifts in the digital finance space.

Nexo vs. Competing Platforms

| Feature / Platform | Nexo | BlockFi (legacy) | Binance Earn | Crypto.com |

| Crypto-backed Loans | ✔️ Instant | ✔️ Delayed | ❌ Not available | ✔️ Available |

| Daily Compound Interest | ✔️ Yes | ✔️ Yes | ✔️ Yes | ✔️ Yes |

| Loyalty Program | ✔️ NEXO Token-Based | ❌ No | ✔️ Tiers (no token) | ✔️ CRO-based |

| Card with Cashback | ✔️ Up to 2% | ❌ No card | ✔️ Limited support | ✔️ Up to 5% |

| Global Availability | 200+ Jurisdictions | Limited (now closed) | Restricted in some | 90+ Countries |

Key Services by Nexo — Fundamentals Support Your Assets

Nexo’s full-stack suite of services includes:

- Crypto-Backed Loans: Borrow against your crypto without selling

- High-Yield Savings: Earn daily interest on idle assets

- Nexo Exchange: Swap assets instantly, fee-free (for top tiers)

- Nexo Card: Spend crypto globally, earn cashback in BTC or NEXO

Nexo offers a complete financial toolkit for the crypto world, combining convenience and utility under one roof. Central to this is its crypto lending service, allowing users to access liquidity through instant loans backed by digital assets, all while preserving ownership. This approach enables modern wealth solutions for both family users and institutional clients.

Daily interest earnings are available on various assets, with improved yields for those using the NEXO token. The Nexo platform exchange transaction tool — part of the native Nexo Exchange — offers fast swaps with no fees on select tiers, supporting real-time trading for eligible users.

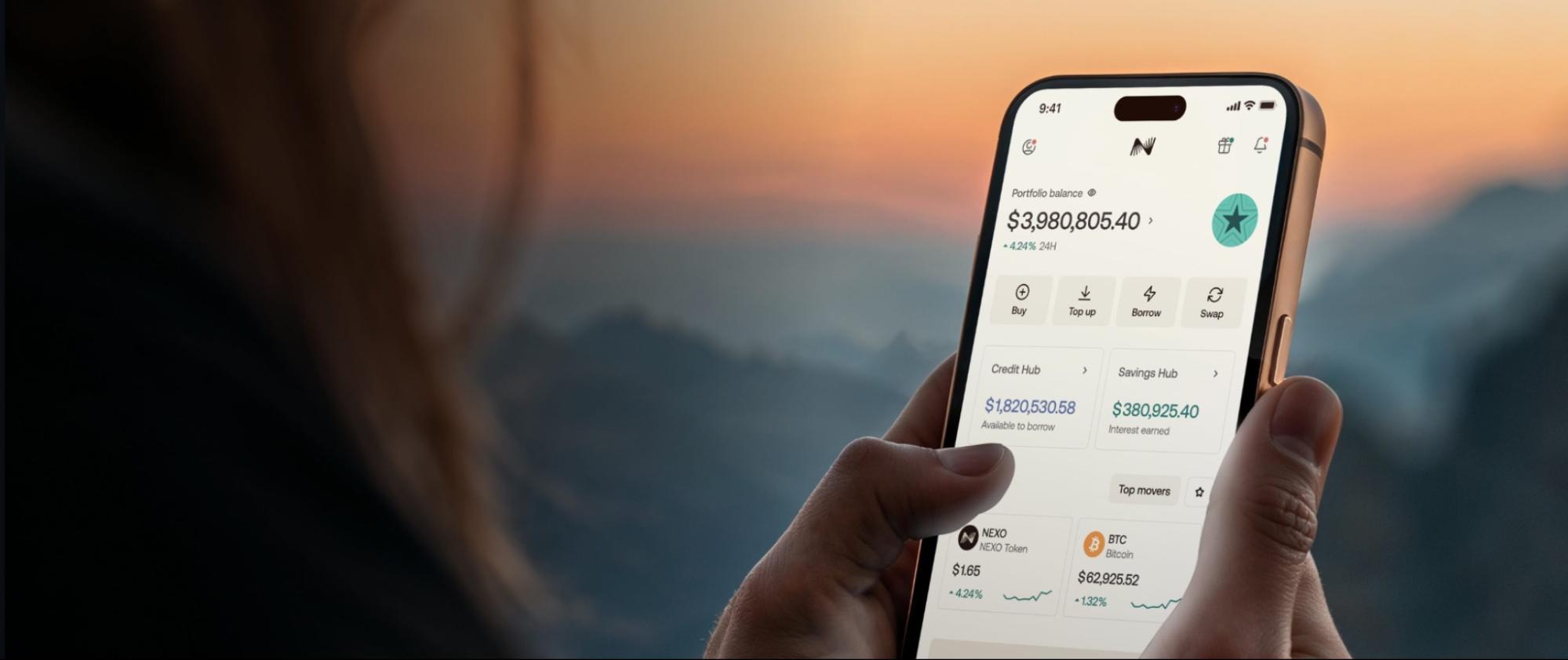

Nexo App. Photo: Nexo Official Website.

Everyday crypto spending is made more accessible with the Nexo Card, which integrates smoothly with Apple Pay and Google services. QR code makes payments frictionless. At the same time, the Nexo logo inside the app unites lending, earning, and spending into one experience, serving the next generation of digital finance users.

Nexo Card. Photo: Nexo Official Website.

Benefits of Using Nexo:

- Zero origination fees on loans

- Instant funding with no credit checks

- 24/7 customer support

- Seamless integration with Apple Pay and Google Pay

The Role and Utility of the NEXO Token

The NEXO token is central to the platform’s utility. Here’s how holding NEXO benefits users:

- Higher interest on crypto deposits

- Lower borrowing costs

- Governance voting rights

- Free withdrawals and faster support in higher tiers

- Up to 2% cashback with Nexo Card

The NEXO token powers Nexo’s ecosystem by enabling user incentives and supporting platform functionality. Holding the token can provide access to improved interest rates and lower borrowing costs, offering an alternative approach to managing digital assets.

Current price of NEXO is NEXO $1.21 24h volatility: 0.3% Market cap: $1.21 B Vol. 24h: $8.62 M .

NEXO Price Chart. Photo: TradingView.

Through Nexo’s loyalty program, users climb tiers by increasing NEXO holdings, unlocking perks such as discounted loan rates, free withdrawals, and faster service. This structure reinforces consumer confidence while offering meaningful benefits.

Loyalty Tiers:

- Base: <1% NEXO allocation — basic benefits

- Silver: ≥1% — +25% interest bonus

- Gold: ≥5% — +50% interest bonus, lower borrowing rates

- Platinum: ≥10% — best rates, free withdrawals, top cashback

The token also plays a role in spending: Nexo Card transactions offer up to 2% cashback in BTC or NEXO. Each purchase can be linked to a QR code with Nexo.

As part of its governance model, NEXO holders can shape the platform’s direction, helping it further impact global markets and serve the next generation of crypto users.

NEXO Token Utility at a Glance

| Utility | Description |

| Loyalty Tiers | Determines interest rates, borrowing costs, and perks |

| Cashback Rewards | Up to 2% in NEXO or BTC for Nexo Card purchases |

| Governance Participation | Vote on platform decisions and product updates |

| Staking Benefits | Enhanced earnings on fixed-term deposits |

| Platform Discounts | Reduced loan APR and free crypto withdrawals for top tiers |

Security Measures and Regulatory Compliance

Nexo prioritizes the security of user assets through a multilayered approach that combines advanced technology, institutional-grade custody solutions, and strict regulatory adherence.

The platform partners with trusted custodians, including BitGo, Fireblocks, and Ledger Vault, all of which offer secure storage infrastructure and multi-signature wallet systems to protect client funds.

Nexo’s security approach is institution-grade:

- Custody partners: Fireblocks, BitGo, Ledger Vault

- Wallets: Multi-signature, cold storage systems

- Insurance: $375M coverage via top insurers

- Compliance: Full KYC/AML, operates legally in 200+ jurisdictions

To further safeguard assets, Nexo maintains a comprehensive insurance policy covering up to $375 million through a syndicate of leading insurers. This coverage provides an additional layer of protection against potential breaches or unforeseen incidents involving digital asset custody.

On the regulatory front, Nexo operates with a commitment to full legal compliance across the jurisdictions it serves. The platform implements robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, continuously collaborating with legal experts to ensure adherence to evolving cryptocurrency regulations. This proactive stance helps Nexo maintain its credibility as a trusted provider in the digital finance space.

How to Get Started with Nexo — Designed for the Forward-Thinking Investor

Getting started with Nexo is a straightforward process designed to make digital asset management accessible to users of all experience levels. To begin, users must create an account by signing up on the Nexo platform through the website or mobile app. Registration requires only a valid email address and a secure password.

Once registered, users must complete identity verification (KYC) to unlock the platform’s full functionality. This involves submitting government-issued ID and, in some cases, proof of address, following global regulatory standards.

Nexo Sign Up Form. Photo: Nexo Official Website.

After verification, users can add funds to their account by depositing supported cryptocurrencies or using traditional payment methods. Nexo supports seamless fiat onboarding through bank transfers, as well as instant purchases via Apple Pay and Google Pay.

These options allow users to quickly access Nexo’s services, whether they’re looking to earn interest, secure a crypto-backed loan, or spend digital assets using the Nexo Card.

To start using Nexo:

- Sign up on the Nexo website or app

- Verify your identity with KYC documents

- Deposit crypto or fiat via bank transfer or Apple/Google Pay

- Start earning, borrowing, or spending crypto immediately

Nexo’s Position in the Crypto and Digital Finance Markets

Nexo has carved out a distinctive position in the competitive landscape of digital asset platforms by combining user-friendly tools for retail investors with tailored financial solutions for family offices and institutional clients.

Unlike many platforms that focus solely on trading or lending, Nexo offers a full-stack crypto banking experience — from interest-earning accounts and instant credit lines to a native exchange and crypto-backed payment cards.

Its commitment to regulatory compliance and secure asset custody has helped build trust among both retail users and larger financial entities. For institutional clients, Nexo provides services including over-the-counter (OTC) trading, asset management, and bespoke credit solutions, positioning itself as a reliable bridge between traditional finance and the decentralized economy.

As the digital finance ecosystem continues to evolve, Nexo plays a critical role in shaping how individuals and organizations interact with crypto assets. By focusing on accessibility, security, and innovation, the platform remains a key player in the global shift toward blockchain-based financial infrastructure.

Conclusion

Nexo stands out as a comprehensive digital finance platform that brings together core crypto services — including lending, interest earning, asset exchange, and real-world spending — within a secure and user-centric ecosystem. Its use of the NEXO token to enhance platform benefits, combined with strong security measures and regulatory compliance, reinforces its position as a trusted provider in the crypto space.

By serving a global user base that spans from everyday investors to institutional clients, Nexo significantly contributes to the mainstream adoption of blockchain-based finance. As the digital asset landscape continues to mature, Nexo is well-positioned to play a key role in shaping the future of decentralized financial services and expanding the utility of crypto in the global economy.

Disclaimer: This article is for informational purposes only and does not provide financial, trading, or investment advice. Cryptocurrency prices can fluctuate wildly, so always do your own research (DYOR), assess risks, and consult a professional before making financial decisions. The author and team are not responsible for any losses from using this information.

FAQ

What is Nexo, and how does it operate?

Nexo is a digital asset platform that offers crypto-backed financial services, including lending, earning interest, exchanging assets, and spending crypto via its integrated ecosystem.

How can users earn daily compound interest on crypto assets through Nexo?

Users can deposit supported cryptocurrencies, stablecoins, or fiat currencies into their Nexo account and earn daily interest, with higher rates available for fixed terms or payouts in NEXO tokens.

What cryptocurrencies can be used on the Nexo platform?

Nexo supports a wide range of assets, including Bitcoin, Ethereum, Solana, USDT, USDC, and many others, with new tokens regularly added based on demand and market trends.

How does the Nexo Card work, and where can it be used?

The Nexo Card allows users to spend the value of their crypto without selling it, offering up to 2% cashback. It can be used anywhere Mastercard is accepted, both online and in physical stores.

What advantages does holding the NEXO token offer?

Holding NEXO unlocks benefits like higher interest rates, lower borrowing costs, cashback rewards, and access to the platform’s loyalty and governance programs.

Is Nexo available worldwide or in selected regions?

Nexo is available in over 200 jurisdictions, though certain services may be restricted in specific countries due to local regulations.

How does Nexo ensure the security of digital assets?

Nexo partners with top custodians like Fireblocks and BitGo, implements multi-signature wallets, and maintains insurance coverage up to $375 million for added asset protection.

What are the borrowing options and interest rates offered by Nexo?

Users can take out instant crypto-backed loans with competitive interest rates that vary based on loyalty tier and repayment preferences, starting as low as 0% APR.

Can institutions, family offices, and corporates use Nexo's services?

Yes, Nexo offers tailored services for institutional clients and family offices, including OTC trading, asset management, and structured credit solutions.

Pepe Coin surged in popularity after its 2023 launch. This article covers market trends, price forecasts, technical signals, and h...

Looking for the best play-to-earn crypto games in 2025? Start with fan-favorites like Axie Infinity and Harry Hippo - and discover...