Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Top 9 Crypto with Most Potential in 2026: Tokens with the Highest Growth Upside

31 mins

31 mins In our analysis of the leading crypto coins with the most growth potential in 2026, we found that Bitcoin Hyper (HYPER), Trust Wallet (TWT), and Decred (DCR) top the list.

HYPER comes in first, thanks to its custom implementation of the Solana Virtual Machine that boosts Bitcoin’s utility and scalability.

Native wallet coins are trending in 2026 with Rabby and MetaMask both teasing airdrops. Trust Wallet Token, which powers one of the most popular wallets in crypto, offers investors an opportunity to enter the market now. Privacy coins like Zcash and Decred are also experiencing a resurgence due to relaxed U.S. regulations. We focused on Decred because of its lower market cap.

Below, you’ll find everything you need to know about metrics, established coins, presales, and tools, to help you find and analyze cryptos with high growth upside.

Key Takeaways for Crypto with the Most Potential

- Choose between high-risk/high-reward early-stage projects if that suits your risk tolerance.

- Blue-chip cryptocurrencies have lower risk and growth potential.

- Narrative-driven coins like AI, privacy, or wallets benefit from trends.

- Follow X project accounts and important industry voices to learn about upcoming tokens and partnerships.

- Check metrics like on-chain activity, TVL, revenue, and active users to assess a protocol’s true popularity.

Crypto Projects with Growth Potential in February 2026 – Editorial Watchlist

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Top 9 Cryptos with the Most Growth Potential in 2026

This is our list of the cryptocurrencies we believe to have the highest growth potential in 2026, due to their market fit, maturity to market cap metrics, innovative technologies, and memes.

- Bitcoin Hyper (HYPER) – Layer 2 that enables DeFi and low fee swaps on Bitcoin

- Solana (SOL) – Speedy blockchain with deflationary SOL tokenomics

- Maxi Doge (MAXI) – Dog-themed meme coin with a growing social following

- Decred (DCR) – Autonomous currency and privacy coin based on Bitcoin

- Trust Wallet Token (TWT) – Popular Web3 multi-chain wallet acquired by Binance

- Toncoin (TON) – Native token of the TON blockchain, Telegram’s blockchain

- Rain (RAIN) – Polymarket competitor with $212M fundraising from Enliven

- SUBBD (SUBBD) – Blockchain-based content creation and social platform with AI

- Audiera (BEAT) – Cult rhythm and dance to earn game now trending on Web3

Crypto with Most Potential – Reviews & Analysis by Coin

Find out why we chose these coins and protocols, with important info about the projects and our analysis of their potential future growth.

1. Bitcoin Hyper (HYPER) – BTC Layer 2 Powered By the Solana Virtual Machine

Bitcoin Hyper is a Layer 2 designed to bring the speed and efficiency of Solana to Bitcoin. The goal is to scale Bitcoin and extend its utility with its own custom implementation of the Solana Virtual Machine (SVM). By inserting smart contract functionality, Bitcoin could soon harbor its own Decentralized Finance (DeFi) ecosystem with endless financial applications.

The project is in the final presale stage and has a large social following on X and TG (Over 16k combined).

Bitcoin Hyper’s components include a wallet, explorer, bridge, staking, and memes. Source: Bitcoin Hyper

- Why HYPER Has Potential in 2026: Bitcoin Hyper is going live shortly, after raising $0.01366500, suggesting that whale and retail investors are optimistic

- Suitable For: BTC utility expansion plays, investors seeking early exposure to the Bitcoin Layer 2 sector.

- Possible Risks: Security and stability of the canonical bridge implementation. Competition from rival Layer 2 projects such as Stacks and Rootstock.

| Project | Bitcoin Hyper (HYPER) |

| Category | Bitcoin Layer 2 |

| Narrative Alignment | BTC Utility, DeFi, BTCfi |

| Market Stage | Late Presale (Nearing TGE) |

| Social Momentum | High. Amount raised suggests market conviction for an SVM-coded BTC Layer 2 |

2. Solana (SOL) – Upstaging Ethereum with Meme Coins and DeFi

SOL is the gas token of Solana, one of the biggest blockchains by TVL, fees, and volume. Solana’s use of the Rust coding language and proof-of-history architecture sets it apart from EVM blockchains, with higher performance and a strong technological foundation. However, some Redditors report that Rust has a steeper learning curve than Ethereum’s Solidity.

Because of Solana’s low fees and speedy transactions, it has increasingly boosted its market share as traders flee from ETH’s congestion. The network offers similar utility, including SOL liquid staking, giving it a strong chance of overtaking ETH eventually.

Pictures and stats about some of Solana’s developer events. Source: Solana

- Why SOL Has Potential in 2026: Solana ETFs continue to be approved, meaning TradFi investors can receive staking rewards, mirroring stock dividends.

- Suitable for: Long-term investors, those looking to stake for APYs of approximately 6-8.5%, blockchain bulls.

- Possible Risks: Solana’s unique architecture may be overtaken by newer blockchains. If memecoin trading trends drop, SOL’s price may follow.

| Project | Solana (SOL) |

| Category | Blockchain |

| Narrative Alignment | Fast Layer 1 |

| Market Stage | Mature |

| Social Momentum | High. 3.6M followers on X |

3. Maxi Doge (MAXI) – Dog and Degen Themed Meme Coin

Maxi Doge (MAXI) is a humorous ERC-20 meme coin in its presale stage. Its “gym-bro” brand is exemplified by its slogan, “max leverage, no stop loss”, targeting degen crypto trading culture.

MAXI positions itself as a community coin and an alternative to big dog tokens like Shiba Inu and Doge. While it isn’t planning a massive amount of utility like SHIB, MAXI aims to incentivize community collaboration with weekly trading competitions after TGE. Its tokenomics include a Maxi Fund (25% of supply) to finance major CEX listings and prize pools.

Maxi Doge’s meme mascot trading whilst other crypto meme characters play outside. Source: Maxi Doge

- Why MAXI Has Potential in 2026: Maxi Doge offers an asymmetrical risk-reward profile. If the coin can secure a tier 1 listing, ROI could be substantial.

- Suitable for: High-risk-tolerant investors, those looking for the potential next best meme coin to buy, community coin plays, early-stage coin collectors.

- Possible Risks: Memecoins are inherently volatile. Its utility may not be enough to sustain consistent growth unless its viral potential shines through.

| Project | Maxi Doge (MAXI) |

| Category | Meme Coin |

| Narrative Alignment | Doge/Degen Trader / Memes |

| Market Stage | Presale/Early |

| Social Momentum | $4.55M raised. 8k+ followers on Telegram and X |

/su_table]

4. Decred (DCR) – Bitcoin-Inspired Hybrid POS and POW Privacy Coin

Decred is intended to be a superior version of Bitcoin. It’s based on Bitcoin’s Proof-of-Work code and supply, but with a hybrid Proof-of-Stake mechanism for voting and making changes. This mechanism makes it more adaptable because it’s easier to improve the code. Decred also claims to be quantum-proof, whereas Bitcoin is not.

The team’s privacy focus is matched by their commitment to helping create a truly decentralized and autonomous web, aligning with cypherphunks and decentralization advocates. DCR can be staked for a 5% APR, and is disinflationary.

Decred’s website is simple but contains a wealth of technical information. Source: Decred

- Why Decred Has Potential in 2026: Decred is now officially recognised as a privacy coin. Decred DCR $18.16 24h volatility: 4.5% Market cap: $313.41 M Vol. 24h: $12.08 M has a lower market cap than Zcash ZEC $304.4 24h volatility: 10.4% Market cap: $5.03 B Vol. 24h: $663.10 M and Monero XMR $464.1 24h volatility: 0.9% Market cap: $8.55 B Vol. 24h: $244.81 M .

- Suitable For: Privacy coin investors, decentralized web advocates, quantum-proof coins, store of value, digital gold narrative.

- Possible Risks: Changing regulations in the U.S. and worldwide, other privacy coins like Zcash, may outperform the competition.

| Project | Decred (DCR) |

| Category | Hybrid PoW/PoS / Privacy |

| Narrative Alignment | Privacy Coin, Quantum-Proof, |

| Market Stage | Lower market cap (relative to rivals like XMR/ZEC). |

| Social Momentum | Medium. Recent re-classification as a privacy coin and a sector-wide rally have driven price and volume up. |

5. Trust Wallet (TWT) – Multi-Chain Self-Custody Wallet

Trust Wallet is a self-custody crypto wallet designed to make trading across different blockchains easier. It has over 50 million downloads in the Play Store and a rating of 4.5/5 stars (snapshot December 17, 2025). It offers staking options and other ways to earn (with standard associated DeFi risks) in the app. The wallet’s native token, TWT, gives holders extra benefits in the wallet, including fee discounts, rewards, and voting power.

Trust Wallet mobile interface for staking various coins. Source: Trust Wallet

- Why Trust Wallet Has Potential in 2026: Trust Wallet was acquired by Binance, and taps into the “fat wallet thesis”. For more, read our best crypto wallets guide.

- Suitable For: Investors following Delphi Digital playbooks, wallet fans.

- Possible Risks: TWT’s price action has generally been positive, but they may need to add new features like MPC technology to stay relevant.

| Project | Trust Wallet |

| Category | Web3 wallets |

| Narrative Alignment | Delphi Digital’s ‘Fat wallet thesis’ |

| Market Stage | Mature |

| Social Momentum | High, over 200M users |

6. Toncoin (TON) – Gas Token Powering Telegram’s Blockchain

TON (aka The Open Network) is a Layer 1 blockchain that integrates with the social media chat app Telegram. In 2025, Telegram announced it had exceeded 1 billion users.

This partnership could present a huge opportunity for TON to introduce new people to crypto, and make sending money and using Web3 and GameFi easy and accessible. The success of TON mini-app games like Notcoin shows the potential of TON.

Notcoin mini app running on TON, with NOT’s trademark slogan ‘probably nothing’. Source: Notcoin

- Why Toncoin Has Potential in 2026: The TON Foundation aims to onboard 30% of Telegram’s users in the next 3 years.

- Suitable For: Mass adoption bulls, Social media investors, Layer 1 blockchain plays.

- Possible Risks: Telegram CEO Durov reaffirmed alignment with TON in the 2025 Blockchain Life Conference, but if that were to change, TON would lose its unique selling point.

| Project | Toncoin (TON) |

| Category | Layer 1 |

| Narrative Alignment | Mass adoption, social platform mixed with blockchain |

| Market Stage | Established |

| Social Momentum | Aim to onboard 300M of Telegram’s non-Web3 users |

7. Rain (RAIN) – Predictions Market with Financial Backing from Enliven

Rain is a decentralized predictions market that is built on the Layer 2 blockchain, Arbitrum. In November, Enlivex Therapeutics announced its intention to raise $212 million to create a digital asset treasury (DAT), with RAIN as the main reserve currency.

Following the news, the currency rallied by over 110%, due to speculation about the implications of a partnership with a biopharmaceutical company. Potential investors may wish to wait until the price action settles before investing.

A Rain prediction about the price of Bitcoin on January 1st. Source: Rain

- Why RAIN Has Potential in 2026: Rain’s investment from Enliven suggests institutions are seriously considering its potential.

- Suitable For: Prediction market fans, high-risk/high-reward plays, following investments from ‘smart money, real-world utility.

- Possible Risks: Future potential changes in legislation around prediction markets.

| Project | Rain (RAIN) |

| Category | Prediction Markets |

| Narrative Alignment | Polymarket success |

| Market Stage | Early/Mid |

| Social Momentum | Medium. 41k followers on X. |

8. SUBBD (SUBBD) – Creator Platform Enabling Fan and AI Collaboration

SUBBD is a Web3 social and influencer platform in the making that aims to make content generation more rewarding and easier. Its AI integration will help creators speed up their processes while enabling users to co-create with their favorite creators. The idea is to help influencers make more money than on other social media platforms and allow fans to get more content and even earn rewards.

SUBBD can be staked in presale for 20% APR.

SUBBD’s value proposition with creator numbers and follower counts. Source: SUBBD

- Why SUBBD Has Potential in 2026: SUBBD claims to have attracted thousands of existing creators, with a combined estimated social reach of 250M.

- Suitable For: SocialFi traders, Content creators, Social Media users, AI-related investments

- Possible Risks: SUBBD faces stiff competition in the social content creator market.

| Project | SUBBD |

| Category | Social Media |

| Narrative Alignment | Moving Web2-Web3 |

| Market Stage | Presale |

| Social Momentum | 2000+ creators |

9. Audiera (BEAT) – Dance and Earn AI Game Based on Established IP

Audiera is a gameFi protocol, based on the Audition ecosystem of games, adding a large existing base. There are multiple ways to earn BEAT tokens, including a mobile tap-to-play rhythm game and special dancing smart mats.

The game features AI idols that players can interact with, receive NFT drops, and more. Audiera also hosts virtual parties where players can meet and interact.

Gameplay from Audiera featuring an anime-style character. Source: Immutable

- Why BEAT Has Potential in 2026: Audiera reports around 1M monthly active users, and Binance highlighted them for being in the top 30 dapps on BNB in November.

- Suitable For: Gamers, those looking for exposure to Asian fit products, Play and Earn investments.

- Possible Risks: GameFi tokenomics rewards system creating sell pressure.

| Project | Audiera |

| Category | GameFi |

| Narrative Alignment | Music and rhythm games in web3 |

| Market Stage | Early (but established fan base) |

| Social Momentum | High, Audiera is trending on CoinGecko and BNB Chain |

Upcoming High-Potential Crypto Presales and Launch Timeline

Some of the most high-risk, high-reward coins of 2026 are still in their presale stages. Here’s a timeline of upcoming coins that could have the most potential in the coming weeks and months.

| Coin | Stage | End Date | Launch Platform | Utility |

| Bitcoin Hyper | Presale, late-stage | Q4 2025 | Tier 1 CEX/DEX | BTC layer 2 / meme coin |

| Maxi Doge | Presale, mid-stage | Q1 2026 (Target) | Tier 1 CEX/DEX | Staking rewards / meme coin |

| SUBBD | Presale, mid to late stage | Q1 2026 (Target) | DEX/CEX | AI tools for creators / SocialFi |

Which High-Potential Crypto Fits Your Strategy?

To understand which types of cryptocurrencies best fit your investment style and strategy, check the data below to help you determine what kind of investor you are, and which kinds of coins match your style, risk, and time horizon.

| Investor Profile | Risk Appetite | Ideal Tier | Example Coins |

| Blue-chip/Long-term holder | Low | Tier 1: Long-term growth | Bitcoin, Solana |

| Growth-focused Trader | Medium | Tier 2: High-adoption infrastructure | Zcash, Bitcoin Hyper, |

| High-Conviction Speculator | High | Tier 3: Narrative and Culture | PEPE, Maxi Doge |

Why 2026 Could Be the Year of High-Potential Crypto

2025 has been a surprising year for crypto, bringing fresh all-time highs and defying historical trends, including a green September, a disappointing ‘Uptober’, and a market-wide red November and a sideways December.

The US government shutdown had broader impacts on liquidity, and the delayed rate cuts and latest US/China tariff fears caused a broader crypto sell-off. Due to the high leverage used in crypto, billions of dollars were wiped out of the market in October and November amid record liquidations.

Although short-term volatility is still likely, the fundamentals for crypto are still present, and so a market pullback presents potential buying opportunities while the market is in extreme fear.

In terms of trends, top cryptocurrencies with ETFs have performed well, except for the recent sell-off. Currencies like Solana, Bitcoin, and Ethereum, or those tied to the health of those ecosystems, such as Bitcoin Hyper, could reap the benefits of rising institutional inflows.

Privacy coins have come back into vogue following looser regulations, and Zcash is entering its four-year halving cycle. Meanwhile, prediction markets and wallets are teasing token releases, which could be bullish for both industries.

Meme coins continue to be one of the top-performing sectors in crypto in 2025, often making the sharpest moves in both directions. Profit potential is maximized, but so is the risk of losses. Presales have been another high-performing sector in 2025, and HYPER offers dual access to these paradigms as a presale memecoin with utility.

Here’s what could trigger an upswing for high-potential crypto in 2026:

- The Fed cutting rates more than is currently priced in

- The U.S. government resuming quantitative easing through a $2000 stimulus check

- Resumed institutional inflows via ETFs, staking, and crypto treasury funds

- Development and adoption of Layer 2 solutions, improving Web3 usability

- PayPal’s new “Pay with crypto” option and other PayFi solutions increasing retail adoption

Our Process for Evaluating High-Potential Crypto Projects (Methodology)

We define potential based on various factors, including market cap versus utility, activity, and overall market fit. Coins with larger market caps typically have lower growth potential, but other factors like rising user numbers and dapp development can balance it out. We also consider lower-cap coins from newer and smaller projects, which carry higher risk but also higher upside potential.

Our evaluation criteria include:

Market capitalization and valuation – 20%

We analyze a project’s market cap relative to its stage, usefulness, and similar projects. Established Layer 1s like Bitcoin have high market caps, which usually translates into lower risk but more modest returns than a newer project.

Tokenomics – 20%

Good tokenomics are essential for positive price action. We look at the token allocation to see if it is fair and sensible for the project goals, and a well-distributed coin, through various holders. We track vesting unlocks to assess sell pressure and look for projects that have long-term sustainability as their goal.

Narrative fit – 15%

If projects are on trend, such as AI, DeFi, Layer 2s, or Real World Assets, they are much more likely to secure funding from big investors and receive attention from regular traders.

Total Value Locked (TVL) and metrics – 15%

For DeFi projects, TVL is an excellent metric to see how much money is invested or supplied to a protocol. For blockchains like Solana or HyperEVM, we measure metrics such as the number of active users and builders, and fees and revenue.

Risk/reward ratio – 15%

We look for various risks and safety measures, including regular smart contract audits and regulatory standing if applicable. Team experience and transparency factors in, as does the length of time the project has been successful.

Backing and funding – 10%

VC backing, or good funding, can be the difference between a project becoming a success or fading into oblivion. We analyze funding amounts, important partnerships and institutional backing.

Stage of project – 5%

We monitor the project, from planning and development, to fully fledged ecosystems, and account for that in our complete analysis of how well the project is doing and what the most common risks are.

What Makes a Crypto High Potential? + Key Metrics

A cryptocurrency is considered high-potential if it is relatively small and has a good market fit, or is more established with lots of demand. Smart and fair tokenomics are vital, and a good roadmap with a committed team, while marketing, community, and listing potential are other important factors.

Tokenomics

Green flags in tokenomics include a sensible distribution among the team, marketing, and rewards if relevant. Other green flags are practical buy-back and burn schemes.

Market Cap vs Fully Diluted Valuation

Tokens with a low market cap compared to fully diluted valuation (FDV) are amber flags. This is because it means that there are various token unlocks to come, which, if done badly, can cause the price to dump.

Make sure to compare each token’s market cap to its FDV on CoinGecko or CoinMarketCap, and check token unlock details at the Tokenomist. Red flags include a high percentage of tokens allocated to the team or VCs. The better distributed the token, the better for price action.

Documentation and Realistic Goals

Roadmaps and whitepapers are often useful resources when assessing a protocol’s promise. Green flags include a clear whitepaper and roadmap with achievable goals. On the other hand, the lack of a whitepaper or absurdly ambitious goals is a major red flag.

Project Team

Little or no team transparency can be another red flag, though this is quite normal in the crypto market and especially in presales. For better-known apps and coins, you can usually check the team details and see what other projects they’ve worked on. High-profile devs and team are a green flag that can increase a crypto’s potential.

Community Size and Activity

Projects with high levels of genuine community interaction are a green flag for potential, especially if you can get in early. Social media that is flooded with bots is never a good sign.

CEX Listing Potential

Listing potential is another thing to watch out for. Are there other similar projects that have been listed on tier 1 and 2 exchanges? Does this one have a good reputation? If so, that’s a green flag as coins often pump after a Coinbase or Binance listing, for example.

| Project | Utility | Narrative Fit | Exchange Listings | Community Growth | Upside Driver |

| Bitcoin Hyper | BTC Layer 2 | BTC Utility | Presale | High $31.16M raised | Successful mainnet launch |

| Solana | Blockchain gas token | Fast Layer 1 | Binance, Coinbase, etc. | Very high (3.6M followers on X) | Continued ETF investment |

| Maxi Doge | Staking rewards | Meme Coin | Presale | High $4.55M raised | Tier 1 CEX listing |

| Decred | Private transactions | Privacy Coin | Binance, Coinbase, etc. | Moderate (Cult following) | Sector-wide privacy coin rally |

| Toncoin | L1 with Telegram integration | Mass Adoption | Binance, Coinbase, etc. | Very High (1B+ potential users) | Onboarding more of Telegram’s users |

| Trust Wallet | Self-custody, Swaps, Staking | Web3 Wallet | Binance CEX/DEX listings | High | Premium features adoption and TWT utility growth |

| SUBBD | AI tools for creators | SocialFi | Presale | Moderate, $1.47M raised. | Converting massive creator reach into a strong user base |

| Rain | Rewards community | Predictions Market | MEXC, BitMart, Uniswap | Moderate (Post-rally interest) | Increased platform usage |

| Audiera | AI music creation, Dance-to-Earn gaming | GameFi, AI, Fitness | Binance, OKX, KuCoin, PancakeSwap | Moderate )500k Monthly Active Users | Sustained engagement with AI music and Dance-to-Earn mechanics |

Historical Examples of Cryptos that Achieved High Potential

Here are some examples of coins that have achieved high growth in the past. We’ll analyze any commonalities to help you identify potentially big and new crypto coins.

Past Winners:

| Coin | Category | Launch Method | Initial Price | All-time high (ATH) | ROI from Initial to ATH |

| Bitcoin (BTC) | Pioneer L1 | Mining | $0.0008 | $126,080 | 15,760,000,000% |

| Ethereum (ETH) | Smart Contract L1 | Initial Coin Offering (ICO) | $0.31 | $4,891 | 1,577,742% |

| Dogecoin (DOGE) | Original Memecoin | Mining | $0.00 | $0.7376 | 862,980% |

| Solana (SOL) | High-Speed L1 | Initial Exchange Offering (IEO) | $0.22 | $260.06 | 118,209% |

| XRP | B2B PayFi | ICO | $0.00 | $3.3 | 117,857% |

| PEPE | Cultural Memecoin | Liquidity Pool Launch | $0.00 | $0.00002836 | 4,726% |

| Zcash (ZEC) | Privacy L1 | Mining | $15.87 | 744.13 | 4,688% |

| SPX6900 | Parody Memecoin | Liquidity Pool Launch | $0.05 | 2.28 | 4,332% |

| HYPE (Hyperliquid) | Perpetual DEX | Airdrop | $3.20 | 59.457 | 1,858% |

From the data above, we can see that pioneer projects originally launched through mining or IEO/ICOs performed best historically and continue to hold value, while still being quite volatile. However, we must be aware of survivorship bias and note that for every successful new project, most fail.

More recently, memecoins like PEPE and SPX6900 have continued to provide high ROIs, as have Layer 1 coins and related technologies. Payment solutions like XRP have also shown high growth, as have DeFi platforms like HYPE with airdrops and high user counts.

Early Signals of Crypto with the Most Potential

To find a crypto with high potential, but a low or good value entry point, we need to look for early signals. These matter, and give you an edge because many top coins showed strong on-chain and social signals well before they gained mass attention.

Narrative Fit and Potential

Crypto often moves in cycles, and selecting coins that are in a trending sector can be a great way to make a bet on a given trend. Trending coins can be found on platforms like CoinGecko, but also through social media and news. If one token in the area performs very well, such as the privacy coin Zcash, then you can look for other similar coins with a lower market cap and greater potential, like Decred.

Strong Community Growth

Genuine community spirit can build a dedicated user base, which is often essential for sustained growth. Look at social media accounts to see how active they are, and whether the interactions look real or like bots. Making friends in communities could help you find new opportunities faster, though it’s also important to watch out for ‘groupthink’.

Major Partnerships and Fundraising

If VCs and other institutions are raising funds for projects, it could be a sign that smart money is interested and wants to help them grow by deploying capital. Similarly, keep an eye out for meaningful partnerships like Enliven’s $212M deal with the prediction market RAIN.

Smart Tokenomics

Tokenomics are an essential part of picking a high-growth crypto. Look out for distributions that seem sensible, allocating tokens to necessary functions like development, marketing, staking, and liquidity. Evaluating the team’s token rewards is also important, as large allocations with little or no time locks could be a sign of a pump-and-dump. You can also look for tokens with strong buy-back and burn mechanisms because they can help boost prices by introducing scarcity.

Active On-Chain Developer Activity

Most crypto projects with substantial potential (excluding most pure meme coins) are always in a state of development. But you don’t need to just trust Tweets and announcements from the team. Check GitHub yourself to see how often they update the project and how many developers they have working on it.

Real Protocol Usage (TVL and Active Addresses)

Some protocols have measurable metrics that you can see to assess their popularity, such as Total Value Locked (TVL), active users, fees, and revenue generated. A sudden or dramatic uptick in volume or users, or even slow but sustained growth, can signal a cryptocurrency with room to grow.

Pros and Risks of Investing in High-Potential Crypto

There are various upsides and downsides to investing in high-potential crypto, which can vary based on the project’s maturity. Make sure to keep your own risk tolerance in mind when you pick coins so that you don’t invest more than you can afford to lose.

| Maturity Stage | Pros | Cons |

| Presale | Low entry price, high upside potential, early adopter bonuses or perks. | Capital locked until TGE / vesting, rug pull and scam risks, the protocol / token is unproven. |

| Early Stage | High growth potential, can trade instantly, investors can test the protocols. | Can be highly volatile, smart contract / security risks, success is reliant on marketing efforts. |

| Well-Established | Proven market strength, user activity and dev support, medium level volatility. | Potential upside is moderate, may underperform in a bear market. |

| Blue Chip | Institutional grade trust, lower volatility and better long-term prospects. | Lower potential returns, market saturation as ETFs become more common, early investors selling. |

Where to Buy High-Potential Cryptos Safely in 2026

To buy high-potential crypto safely, you must choose the right platform for the type of coin that you are trading. Presales, new coins, and established coins aren’t all available on the same apps or exchanges. Here’s what you need to know about each category.

1. Best Platforms for Presales

Project website / Direct purchase

- Access Method: Connect directly via a Web3 wallet to the project’s official presale page. For a list of active opportunities, check our crypto presales calendar.

- Suitability: Presale coins can usually only be purchased through their official website or through a launchpad until after they launch.

- Risk and Reliability: This is one of the highest-risk options. Safety depends on the team’s integrity and the security of the smart contracts. Trusted launchpads may provide more protection against pure scams, but not for price action, which can be extremely volatile.

- Security History: Each project will be different; look for audits and make sure you are on the genuine website.

- KYC Required?: Most presales do not require KYC.

2. Best for Early and Mid-Stage Altcoins (Web3)

Decentralized Exchanges (DEXs)

- Access Method: Connect your Web3 wallet to a trusted DEX (e.g. Uniswap, PancakeSwap).

- Suitability: Best for accessing new or smaller altcoins immediately after launch that may not be listed on a major CEX. Also useful for privacy-minded users who want to avoid KYC.

- Risk and Reliability: Moderate. While swaps with trusted protocols are usually fine, all DeFi protocols carry smart contract risks. Altcoins carry medium to high volatility risk.

- Security History: DEXs can be hacked, and while this is more likely to affect liquidity providers, it could also place traders at risk.

- KYC Required?: No.

Another option for early-stage crypto with high growth potential is Tier 2-3 CEXs like KuCoin, MEXC, and Gate.io, which tend to add newer coins before Tier 1 CEXs like Coinbase.

Summary table:

| Platform Access Method | Recommended Sites | KYC? |

| Presale Site | Offical site | Varies (Often no) |

| DEX | Uniswap, PancakeSwap, 1inch, Jupiter, Velora | No |

| CEX – Tier 2/3 | KuCoin, MEXC, Gate.io | Yes |

| CEX – Tier 1 | Coinbase, Kraken, Binance | Yes |

3. Best for Blue-Chips (CEXs)

This is for established, highly liquid assets like Bitcoin and Ethereum, and high-cap blockchains like Solana and major listings of Toncoin.

Centralized Exchanges (CEXs)

- Examples: Coinbase, Kraken, Binance, OKX.

- Access Method: Traditional account login, order book trading, and fiat on-ramp by card.

- Suitability: Best for large fiat on-ramps, high liquidity, and user-friendly experiences.

- Risk and Reliability: Low risk. Exchanges can be hacked or fail due to mismanagement or fraud, but established CEXs like Binance and Coinbase are under a lot of scrutiny. Blue-chip coins are not immune to big crypto crashes but are more likely to recover.

- Security History: Generally strong. (apart from Mt Gox and, more recently, FTX).

- KYC Required?: Yes. KYC is mandatory for all CEXs in the U.S. and most other regions

High-volume traders can pay a subscription on Coinbase to get zero trading fees and more. Source: Coinbase

Best Tools to Track High-Potential Crypto

To track high-potential cryptocurrencies, we recommend using a mix of tools for monitoring on-chain analytics, social sentiment, and community growth, and resources to help you find new coins and protocols. Here are our top crypto tool recommendations.

On-Chain Analytics

Token Terminal

- What it does: Shows tokenomics, token unlocks, protocol fees, and revenues, and user metrics. Allows you to track your favorites.

- Ideal for: Beginner and intermediate researchers.

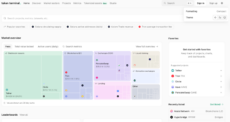

Token terminal dashboard showing fees generated within a pleasant user interface. Source: TokenTerminal

DeFiLama

- What it does: Shows metrics like Total Value Locked (TVL) and fees across hundreds of blockchains and protocols.

- Ideal for: Beginners, expert researchers, moderately experienced investors.

Arkham Intelligence

- What it does: Tracks and identifies people and institutions behind whale-sized wallets.

- Ideal for: Researcher, advanced trader, investors trying to track ‘smart money’.

Social Sentiment and Community Growth

LunarCrush

- What it does: Analyzes sentiment and engagement data from social media sites X, Reddit, and YouTube, using AI.

- Ideal for: Retail trader, narrative fit hunter.

Santiment

- What it does: Measures social metrics, developer activity, and on-chain behavior, mixing computer-generated insights with human researchers.

- Ideal for: Data-driven analyst, researcher.

Santiment dashboard for free users, with metrics and an AI summary. Source: Santiment

Google Trends

- What it does: Tracks the searches for keywords over time and by country, and can be a way to find out if things are gaining in popularity before they become mainstream.

- Ideal for: Beginner, general investor.

Price Alerts and Finding Promising Coins

DexTools

- What it does: A DEX for trading with detailed charts, often the place to find new or relatively unknown coins.

- Ideal for: Trader, DeFi user, degen.

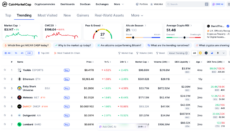

CoinMarketCap (CMC) Lists

- What it does: Tracks crypto prices, market capitalization, and volume. Has trending lists and lists separated into categories, like ‘meme’ or ‘AI’, or ‘recently added’.

- Ideal for: Beginner, general investor, gem hunter.

CoinMarketCap’s ‘Trending’ list on December 4th, with helpful market and trading metrics. Source: CoinMarketCap

Telegram Coin Listing Bots

- What it does: Can be configured to provide real-time price and contract alerts, to help users find and snipe new coins.

- Ideal for: Advanced trader, degens, high risk/reward.

Final Thoughts on High-Potential Cryptocurrencies in 2026 (Conclusion)

There are several types of high-performing cryptocurrencies to keep an eye on. Established coins and Layer 1s like BTC and SOL tend to hold more value even in a crash in the crypto market, and are also more likely (but not guaranteed) to rise again to new highs.

Higher growth potential is found in early-stage projects. They are much more likely to fail than blue-chip coins, but they can also bring in vastly higher returns if they succeed. For even higher growth and risk, you might want to consider ICOs and presales. Many, if not most, will fail within months or weeks of launching, but the handful that take off can make early investors millions.

Search for promising coins using tools such as Token Terminal, blogs, and social media, then consider your risk appetite and invest accordingly. Be prepared for high volatility, especially with early-stage projects and presales. Diversification can help reduce these risks and give you a better chance of finding a high-potential coin early.

Be strategic with your investments and try not to be swayed by FOMO. Carefully determining smart entry and exit points is usually better than making rash, emotional decisions. Keep these tips in mind and always remember the risks when you are trying to find and identify high-potential cryptocurrencies in 2026.

FAQ

How can I find new crypto coins with high growth potential?

What crypto has the most potential in 2026?

What are the biggest risks of high-potential crypto?

What is the cheapest crypto with the most potential?

References

- Bitcoin: The first four years of the world’s most popular cryptocurrency – Financial Times

- Dogecoin’s incredible history from joke to massive market cap – Forbes

- The price of Ethereum during the 2014 ICO was $0.31 In – Binance Square

- Binance Acquires Trust Wallet – A Secure Mobile Crypto Wallet – Binance Official Announcement

- The Fat Wallet Thesis – Robbie Petersen, Delphi Digital (compiled by BlockBeat)

- GameFi Market Size, Applications, Demand 2033 – The Brainy Insights

- Privacy Coins & Regulation: How the Law is Changing in 2025 – Altrady

- Layer 2 Networks Adoption Statistics 2025: Surprising Growth Trends – CoinLaw

- TON Ecosystem: October 2025 – The Open Network (TON) Foundation Report

- Stablecoins, Financial Stability, And Treasuries: What’s Next For Money And Safe Assets? – S&P Global Ratings

- How Tariffs Impact Crypto: A Beginner’s Guide – OSL

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 37 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.