This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

The crypto market is filled with new projects, but only a few show the fundamentals and momentum needed for major 1000x growth.

If you manage to invest in a crypto right before it explodes, it can yield enormous profits, especially if you recognize its potential early on. Still, finding the gems in a crowd of thousands of new coins can be incredibly difficult, especially because many coins ultimately fail to live up to their advertised promises.

So, how do you determine which coins will boom in 2026? We can tell you for sure, straight up, that no coin is ever guaranteed to 1000x. But in this post, we will share our extensive experience in the high-risk, high-reward market, detail our picks for the top 1000x cryptos based on real data and credible sources, and help you pick coins with the most potential for yourself.

Editor’s Picks – Next 1000x Crypto

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Next 1000x Crypto with High Potential for 2026

- Bitcoin Hyper (HYPER) – Scaling Bitcoin With Solana-Powered L2

- Maxi Doge (MAXI) – Refreshed Version of Dogecoin

- BMIC (BMIC) – Quantum-Proof Wallet Ecosystem for Web3

- LiquidChain (LIQUID) – Layer 3 Unified Liquidity for BTC, ETH, and SOL

- PEPENODE (PEPENODE) – Mine-to-Earn Meme Coin

- EigenLayer (EIGEN) – Innovating Restaking on ETH

- Merlin Chain (MERL) – zk-Bitcoin Solution

- SUBBD (SUBBD) – AI Creator Economy Token

- BlockchainFX (BFX) – Multi-Asset Trading Super App

- Solv Protocol (SOLV) – Tokenizing Yield-Bearing Assets

- Vortex FX (VFX) – AI-powered Forex Trading Platform

Reviewed: The Next 1000x Crypto

These low-cap altcoin gems with 1000x potential, could, in a best-case scenario, deliver very high returns. Still, it is important to note that they also come with significant risk, as we will discuss in each review.

1. Bitcoin Hyper (HYPER) – Scaling Bitcoin with a Meme-Powered L2

Bitcoin Hyper is a Layer 2 project on a mission to transform the Bitcoin blockchain into a more functional and scalable network. It states that it aims to bring low fees and smart contract capabilities to the blockchain, making sure that dApps, DeFi, trading, and meme coins can be built on Bitcoin.

Bitcoin Hyper presale dashboard. Source: Bitcoin Hyper

The project claims to use advanced technology by bringing the Solana Virtual Machine (SVM) to the blockchain. Solana has a superior coding language, which, in combination with the Proof of History consensus mechanism, can improve the transaction speed that Bitcoin currently has. Thanks to its added functionality and its low price during the presale, HYPER looks like a great candidate for the next 1000x crypto.

Why Our Editors Think Bitcoin Hyper Could 1000x

Bitcoin Hyper could stand out if it actually delivers on its promise to turn Bitcoin into a functional, smart contract-ready network. Layer 2 solutions are gaining momentum, and by using the SVM, HYPER has a big challenge ahead. If developers start building meaningful apps and communities adopt their platform, early token holders could see great upside.

2. Maxi Doge (MAXI) – The New Dogecoin for Degen Traders

Maxi Doge aims to become “the ultimate version of Dogecoin” by building a community of degen traders united by viral memes, special trading contests, and staking opportunities.

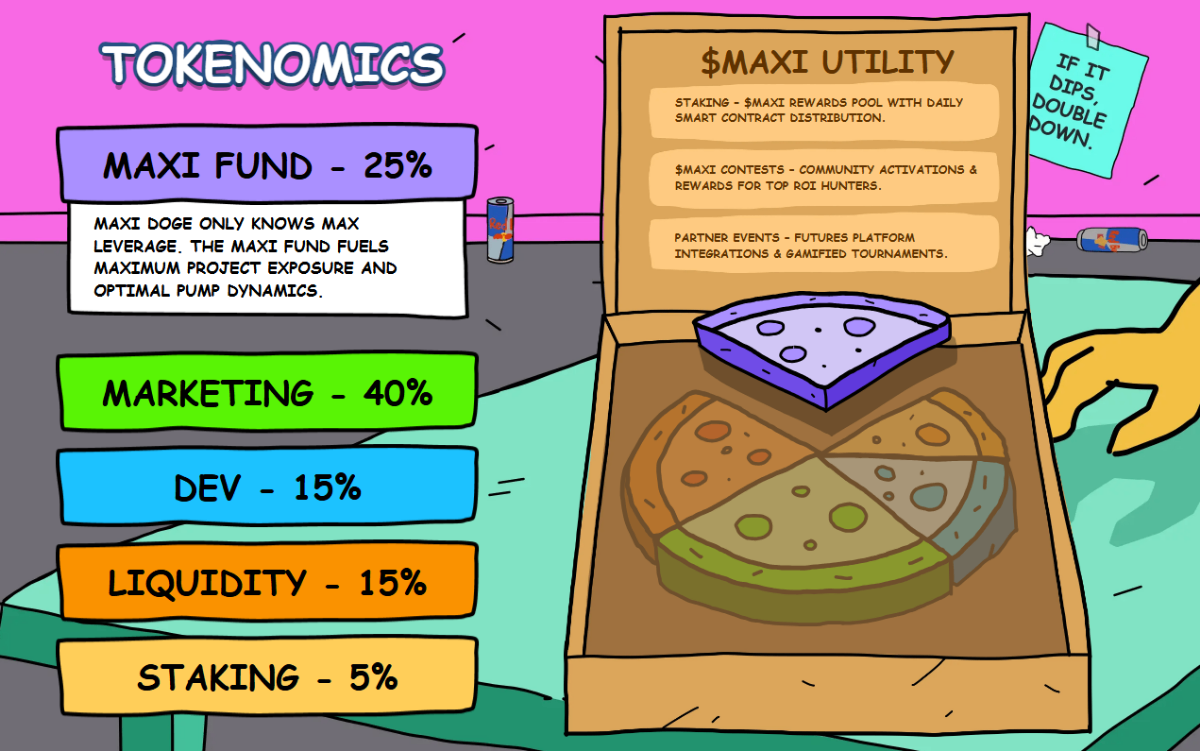

Maxi Doge tokenomics. Source: Maxi Doge

Like its predecessor, Maxi Doge isn’t attempting to build out complex utility for the token, but its focus on community building and virality makes it one of the most promising new meme coins on the market.

Why Our Editors Think Maxi Doge Could 1000x

Meme coins are still driven by community energy and viral momentum, and Maxi Doge is leaning directly into that formula with staking, trading contests, and nonstop meme culture. Since it maintains strong engagement on social media and keeps attracting degen traders, it has a real shot at explosive upside.

3. BMIC (BMIC) – Quantum-Proof Wallet Ecosystem for Web3

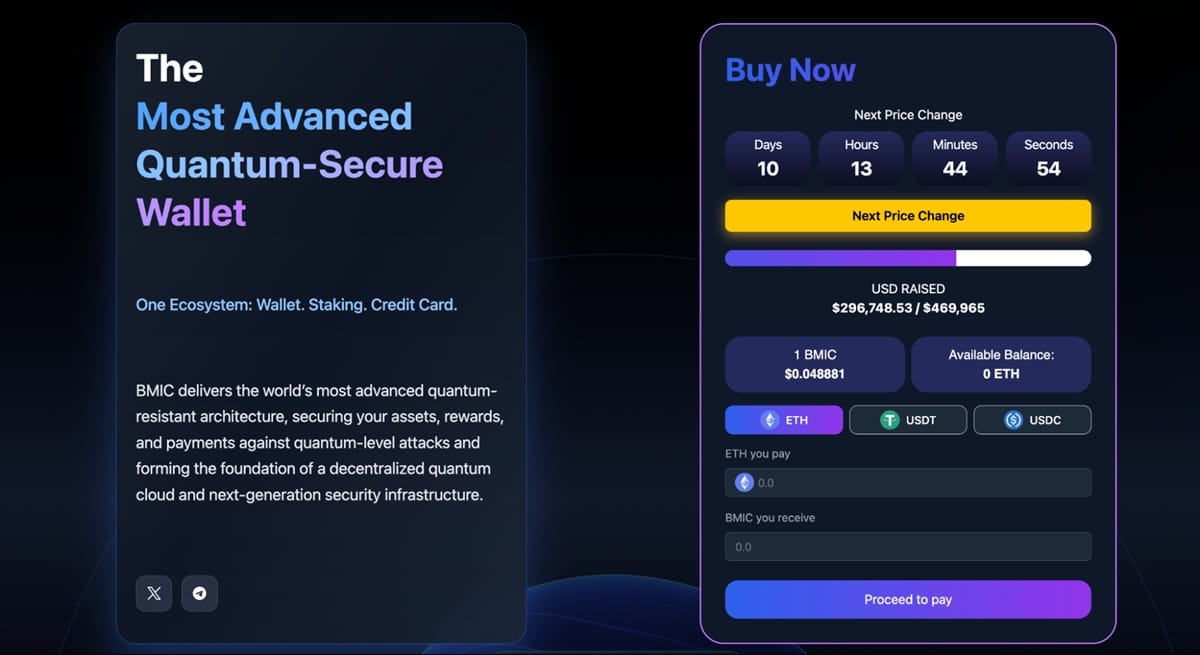

Next on our list of high-potential coins is BMIC, a new Web3 wallet ecosystem that claims to address the huge threat posed by quantum computing. It’s built on the premise that the encryption methods of Bitcoin and Ethereum will, at some point, be susceptible to quantum decryption. To counter this, BMIC has announced plans to build a digital ecosystem centered on a wallet designed to withstand quantum attacks.

BMIC, a new Web3 wallet ecosystem that claims to address the huge threat posed by quantum computing. Source: BMIC

The project goes a step further with plans to launch a “Quantum Meta-Cloud.” If successful, this could give users access to quantum computing power in exchange for BMIC tokens, creating a deflationary economic model. The highly ambitious roadmap also outlines plans for a staking layer and a credit card.

Why Our Editors Think BMIC Could 1000x

In the near future, powerful quantum algorithms could break widely used cryptographic systems, exposing encrypted data, digital signatures, and blockchain systems to forgery or decryption. If the team successfully launches its Quantum Security-as-a-Service (QSaaS) API, it could even attract enterprise clients from sectors such as finance and healthcare.

4. LiquidChain (LIQUID) – Layer 3 Unified Liquidity for BTC, ETH, and SOL

LiquidChain is a Layer 3 blockchain that connects Bitcoin, Ethereum, and Solana into one unified liquidity layer. Users and developers can interact with assets across all three networks without relying on slow or risky bridges. The platform uses a Solana-style VM and trust-minimized cross-chain proofs. The idea is to allow for fast and secure trading and dApp deployment in a single transaction.

LiquidChain’s tokenomics allocate 35% to development and 32.5% to marketing. Source: LiquidChain

The LIQUID token is designed for presale buyers, staking rewards, and liquidity incentives. It has a total supply of 11.8 billion tokens.

Why Our Editors Think LiquidChain Could 1000x

LiquidChain tackles real problems in DeFi: fragmented liquidity, slow bridging, and redundant work for developers. If the tech works as described, the project could attract many early adopters looking for faster and safer access to BTC, ETH, and SOL markets.

5. PEPENODE (PEPENODE) – Viral Mine-to-Earn Meme Coin

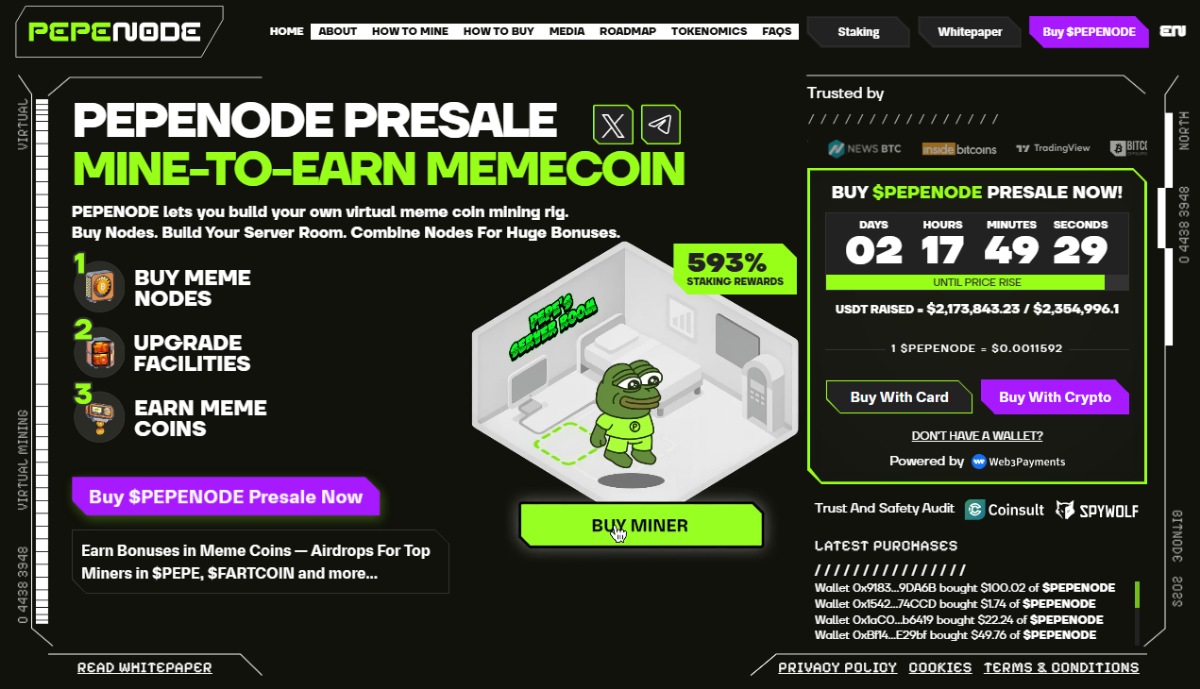

PEPENODE is a mining simulator that allows users to earn real crypto rewards like Pepe, Fartcoin, and PEPENODE by managing virtual server farms. Once you buy tokens, you can start staking them immediately, build your mines, and start accumulating rewards while waiting for the token launch.

PEPENODE presale dashboard. Source: PEPENODE

The PEPENODE team has also designed its tokenomics to help reward investors with a token burning mechanism that will destroy 70% of all tokens spent on rig upgrades. Ideally, this will create scarcity and potentially push its value up over time.

Why Our Editors Think PEPENODE Could 1000x

PEPENODE has the kind of simple, addictive mechanic that drives early meme-game tokens: stake, build, upgrade, earn. The mining simulator angle gives it more stickiness than the usual meme coin. The 70% token burn on rig upgrades could create strong scarcity if the user activity keeps rising.

6. EigenLayer (EIGEN) – The King of Ethereum Restaking

EigenLayer is one of the most influential crypto projects in recent memory, innovating the concept of restaking. Restaking is now a major driver of innovation in the crypto market – before this idea was put into practice, investors could really only stake their assets to secure one network, but now many of them use restaking platforms like EigenLayer to multiply their passive income.

EigenLayer homepage. Source: EigenLayer

EigenLayer has significantly reduced entry barriers for new projects by essentially pooling resources together to secure dozens of platforms. But despite EigenLayer’s immense influence in the modern market, its native token, EIGEN, which is used for both governance and utility, is still relatively small.

Why Our Editors Think EigenLayer Could 1000x

EigenLayer is one of the most important projects in the market today, and restaking seems to be gaining popularity remarkably quickly, which could give EIGEN a big boost. As we move into the new year, EigenLayer still looks like a clear leader in staking, and this is important because the entire Ethereum ecosystem is built on shared security. If it continues to dominate the space and onboard more AVSs, it could become a base for dozens of new protocols.

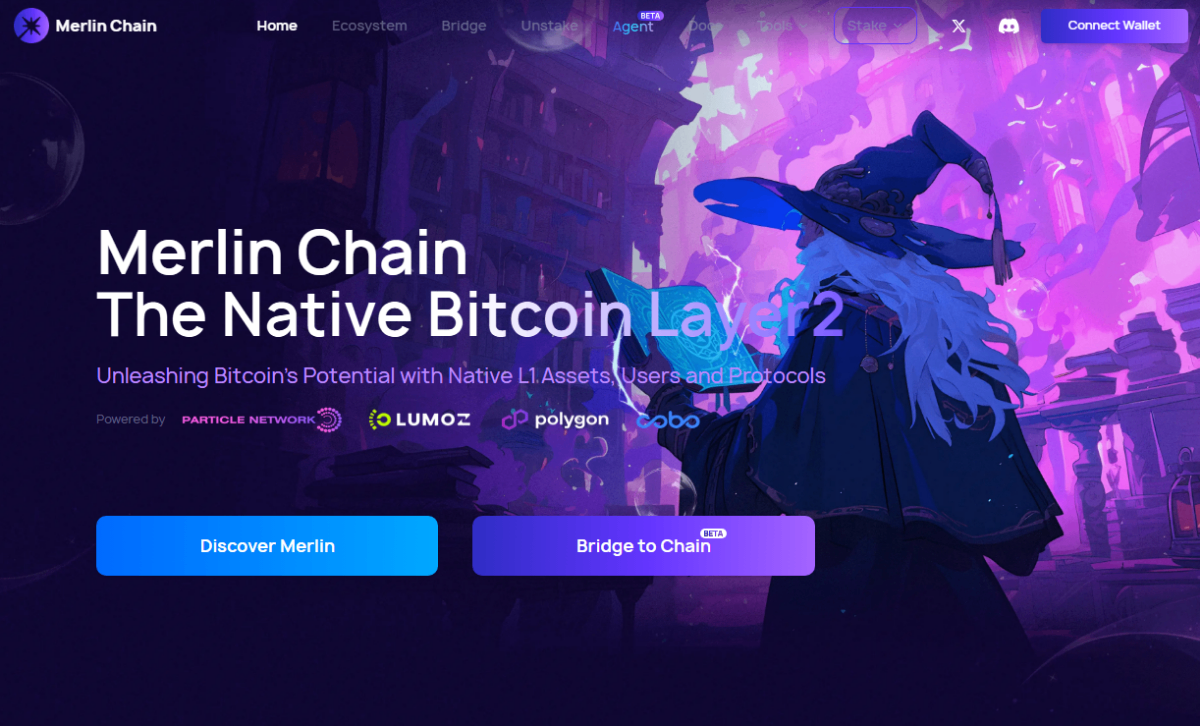

7. Merlin Chain (MERL) – Scaling Bitcoin with ZK-Rollups

Built to improve Bitcoin’s utility, Merlin Chain is a Bitcoin-native Layer 2 solution that lets Bitcoin-native assets like BRC-20 and BRC-420 work in a much more scalable and efficient way.

Merlin Chain homepage. Source: Merlin Chain

Merlin Chain is also EVM-compatible, giving developers a bridge between Bitcoin’s security and Ethereum-style programmability. The token offers strong utility, including governance, staking, transaction fees, liquidity, and collateral.

Why Our Editors Think Merlin Chain Could 1000x

Merlin Chain feels like one of the more practical ways to give Bitcoin some real utility beyond just holding it. By making Bitcoin-native assets like BRC-20 more scalable, it creates a bridge for people who want the security of BTC with the flexibility of Ethereum’s smart contracts. If the team executes well and developers start building apps on it, Merlin Chain could grow into a key piece of the Bitcoin ecosystem.

8. SUBBD (SUBBD) – Powering a New AI Super-App for Content Creators

SUBBD is shaking up the creator economy with a Web3 platform that mixes AI-powered tools, content creation, and real rewards. The SUBBD token lets creators and fans stake, pay, and actually earn crypto for the content they make and the communities they help grow.

SUBBD token benefits and utility. Source: SUBBD

The team behind SUBBD seems to know the market well and reportedly also has experience in AI and influencer marketing, giving the project some practical grounding. Because of its focus on real-world creator problems (high platform fees, fragmented monetization tools, etc.), SUBBD has already begun gaining attention in niche crypto-creator communities.

Why Our Editors Think SUBBD Could 1000x

Looking into 2026, SUBBD stands out because it is tackling real problems that creators complain about every day (high fees, unreliable monetization, and platforms that take more than they give).

If the team actually merges AI tools, community rewards, and creator payments into one app, it could attract influencers who want more control over their income.

9. BlockchainFX (BFX) – New Trading Super App with 500+ Assets

BlockchainFX (BFX) is marketing itself as the first crypto trading super app that brings together crypto, stocks, forex, and more in one platform. On its website, BFX says users will be able to trade more than 500 assets, including traditional financial markets, all from a single interface. It is also planning to launch a BFX Visa card that could link real-world spending to token utility.

BlockchainFX homepage. Source: BlockchainFX

The project’s tokenomics are built around user rewards, with 70% of trading fees redistributed to the community. If BlockchainFX can become even a moderately sized exchange, this could translate to significant rewards for holders.

Why Our Editors Think BlockchainFX Could 1000x

Heading into 2026, the appeal of BlockchainFX is its attempt to become a true all-in-one trading app for crypto, stocks, forex, and even a Visa card. If the team actually delivers a functional super-app and grows its user base, the 70% fee-sharing model could maek BFX more rewarding than typical exchange tokens.

10. Solv Protocol (SOLV) – Tokenizing Yield-Bearing Assets with Real-World DeFi Utility

Solv Protocol is aiming to turn Bitcoin from a “hold-and-forget” asset into a yield-generating engine. Instead of just holding BTC, Solv lets you lock Bitcoin in a reserve and get a liquid, BTC-backed token called SolvBTC that you can use across chains. You can do this while still earning yield.

With Solv, holders are getting a few things: staking, cross-chain liquidity, and access to DeFi yield strategies. All this should be done while holding a token pegged 1:1 to BTC. This makes it attractive if you believe Bitcoin has long-term value, but want utility and yield rather than just holding.

The SOLV token itself powers the ecosystem: governance, staking, and fee-discount perks for participants. An important milestone recently occurred, too – SOLV got listed on exchanges, which improves its liquidity and makes it accessible to a broader audience.

Why Our Editors Think SOLV Could 1000x

Looking ahead to 2026, Solv feels like it is in a place where it can benefit from a bigger trend: Bitcoin finally getting real utility beyond just holding. If Solv keeps expanding its BTC-backed products and deepens integration with major chains, it could become a popular place for people who want yield without having to leave the Bitcoin ecosystem.

The big question in 2026 is whether Solv can scale liquidity and secure partners that would make SolvBTC widely usable. This is a difficult milestone, but if they pull it off, the token could have a strong year.

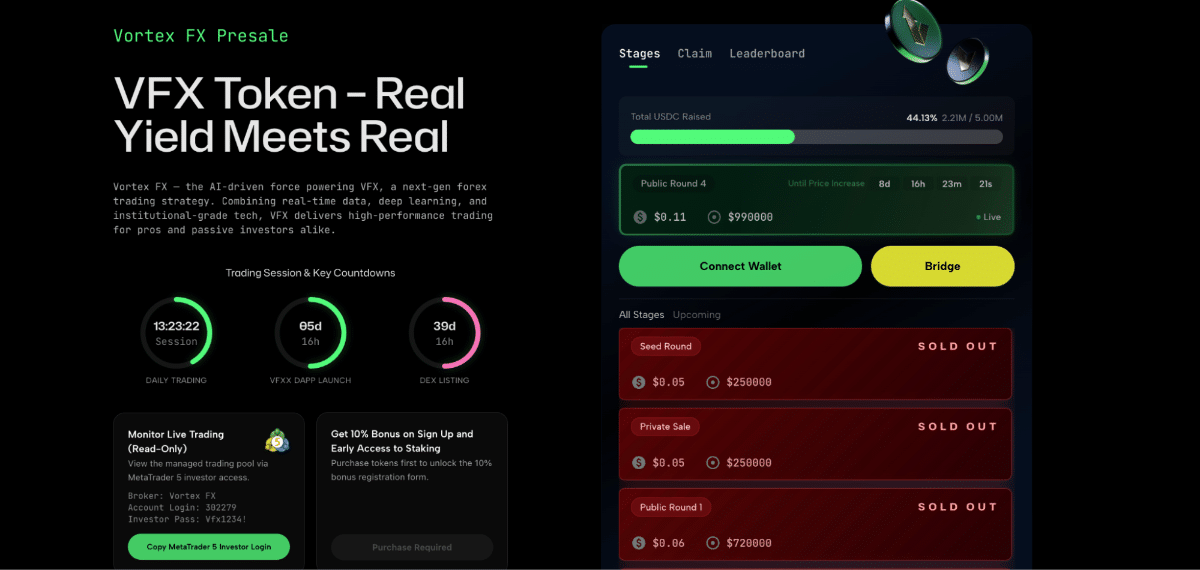

11. Vortex FX (VFX) – AI-powered Forex Trading Platform

Vortex FX is a broker platform that aims to reduce the divide between traditional finance (TradFi) and decentralized finance (DeFi). Its website claims that Vortex FX is a regulated forex and commodities broker that handles about $40 million in client assets. The project intends to offer a transparent, “direct-to-broker” model for relatively low-cost trades. The team also announced the presale launch of native VFX tokens, which serve as utility tokens in its ecosystem.

Vortex FX presale dashboard. Source: Vortex FX

The project’s whitepaper states that it will help users deploy capital by using an AI-based strategy across the forex, gold, and crypto markets, and VFX holders can earn staking and revenue-based rewards. The roadmap also references a potential no-KYC crypto card featuring spending rewards.

Why Our Editors Think VFX Token Could 1000x

One of the main factors that could contribute to the project’s success is its “Real Yield” economic model. In this model, token holders can directly earn brokerage revenue rather than relying solely on market speculation. In fact, the project states that it will allocate 50% of the revenue generated from its trading operations to fund token buybacks and staking rewards.

High-Performance Coins That Didn’t Make the Cut

The crypto market is full of so many exciting new projects that we couldn’t include all of them on our list. Here are a few honorable mentions that didn’t quite make it.

Mina Protocol (MINA)

Mina is known as the “lightest” blockchain. Its entire chain remains just around 22KB, allowing truly lightweight apps to run on phones and browsers. It uses zk-SNARKs for privacy, which could make it a go-to for smart contract use cases, especially in resource-limited environments.

Why it didn’t make the cut: Its relatively larger market cap and more mature development reduce its 1000x potential compared to newer micro-cap gems.

Render Network (RNDR)

Render Network lets users rent out GPU power to render high-quality graphics, 3D content, and even AI-generated media. As demand for AI rendering is growing, RNDR could see strong utility-based adoption.

Why it didn’t make the cut: While promising, its use case is somewhat niche and capital-intensive. This may limit its speculative upside, and it would need massive growth to reach 1000x gains..

Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix tokenizes cloud mining, so everyday investors can stake the token to earn mining power. It’s a bold play on mining and DeFi, offering potentially strong and long-term utility if it scales.

Why it didn’t make the cut: Its models depend heavily on energy costs and mining economics. This adds a big operational risk.

What “1000x” Really Means (and Why It’s Misleading)

When crypto investors talk about a penny crypto with “1000x potential”, they usually mean a token that has a relatively low market capitalization now but could multiply its value a thousand times from its current value. For instance, a $0.01 coin going to $10 would technically be a 1000x gain.

Naturally, 1000x gains can be absolutely life-changing, and the promise of such returns is very enticing. This is also why phrases like “next 1000x crypto” are so commonly used in social media and marketing.

Still, this kind of promotion is usually misleading. First, very few tokens ever achieve these kinds of returns. Those that do usually start with an extremely tiny market cap, or are early presales that come with high risk, like the ones we mentioned above.

Second, 1000x returns assume perfect timing. You would need to buy at or near the bottom, hold through volatility, and sell at just the right moment. Most investors who find meme coins with 1000x potential buy or sell their tokens at the wrong time because it’s essentially impossible to accurately predict the future prices of volatile assets.

It’s also important to remember that hype-driven coins can pump quickly but will often crash just as fast. They often leave the latecomers with heavy losses.

In other words, “1000x” is usually more of a marketing hook than a reliable investment forecast. Thinking in terms of multiples rather than fundamentals can lead to poor decisions.

What Users Say on Reddit, X & Discord

On r/PresaleCryptoHub, a common theme is that Layer 2 blockchains are one of the hottest trends right now:

Post from the PresaleCryptoHub Subreddit. Source: Reddit

On r/NextCryptoMoonshots, users are again talking about the resurgence of meme coins, but not just simple jokes. They talk about meme coins built on real infrastructure like Layer 2 or EVM chains. This seems to fit with the market data as many of the most successful presales of this year combine memes with real utility.

On X and Discord, sentiment aligns. Presale communities are prioritizing utility-first meme plays and low-tax, fast-transaction tokens.

The Risks Behind the 1000x Dream

Chasing the next 1000x crypto can be exciting, but it comes with risks that most new or inexperienced investors underestimate.

The biggest issue here is market cap math. For a coin to 1000x, it usually has to start extremely small. This means it is early, unproven, and operating with very limited liquidity. These tiny caps are also the most vulnerable to failed launches, team abandonment, or simply fading out before they gain traction.

Another risk is presale volatility. Even strong presale projects can drop sharply once they hit the market if hype cools, early buyers take their profits, or liquidity doesn’t build fast enough. Timing plays a major role here. Buying even a few hours too late (or too early) can cut potential returns dramatically.

There is also the reality that most low-cap projects never deliver their full roadmap. For some, it is a lack of funding. For others, it is weak marketing or poor execution, and some new projects turn out to be total scams. Whatever the reason, most early-stage tokens simply don’t survive long enough to grow.

Finally, many 1000x narratives rely heavily on social sentiment. If the buzz dies, the chart usually follows. Huge gains are still possible, but they require research, patience, and most importantly, realistic expectations.

How to Find 1000x Crypto in 2026: My 5-Point Framework

Finding out which crypto will give 1000x in 2026 or beyond isn’t all about luck. It is mostly about timing, market cycles, and spotting early momentum before everyone else does (but luck can help quite a bit).

The projects that tend to take off usually sit at the intersection of low market cap, strong storytelling, and real utility. The list below is built on those trends.

1. Market Cap and Timing

Technically, the lower the starting market cap, the higher the upside, but only if the timing and fundamentals are right. Early presale stages or newly launched micro-caps have the most room to grow. A token going from $2M to $2B is possible. A token going from $2B to $2T is not. So, I always start by looking at where in the cycle a project is and whether early buyers still have a meaningful advantage.

2. Utility and Problem Solving

Hype can move a chart, but it is utility that keeps it alive. I look for projects that solve real problems: faster transactions, improved scalability, better payment rails, or new creator tools. If a token answers the question “why would anyone use this?”, it already stands out from 90% of new launches.

3. Tokenomics and Transparency

I avoid unclear or overly complicated tokenomics. What I want to see is:

- A capped supply

- Transparent vesting schedules

- No unrealistic team allocations

- Incentives that reward actual participation

Projects with clear tokenomics and open communication tend to survive longer.

4. Community and Narrative

Every 1000x winner has one thing in common with the rest: a strong story people want to repeat. Utility is important, but strong narratives are typically better at driving momentum. Whether it is “meme revival” or “Bitcoin Layer 2”, the project needs a hook people care about. A loud and active community on X and Telegram, and Reddit is often the first sign of a token with breakout potential.

5. Market Cycle and Momentum

Even the best token won’t pump in a dead market. I watch the trends. Are memes running again? Are presales outperforming? Are Layer 2s heating up?

When a project fits the phase of the cycle, the chances of a big multiple often grow.

Editor’s Personal Takeaway

After digging through dozens of early-stage projects, I find one thing to be very obvious: the coins with the highest upside in 2026 aren’t necessarily the flashiest. They are the ones that combine strong narratives with smart launch timing.

At the moment, meme coins are still dominating retail attention. Still, the real standouts are the projects that mix this meme culture with actual utility or infrastructure.

At the end of the day, a potential 1000x play will come down to entering early, understanding the token’s purpose, and making sure the community is actually alive and not manufactured.

This is what separated the names on this list from the dozens that didn’t make the cut.

Action Plan Checklist

| Research the market cap | Aim for low caps or early presale stages with transparent valuation |

| Understand the utility | Ask: What problem does this token solve, and why would anyone use it? |

| Review the tokenomics | Look for clear supply, vesting, burns, and fair allocations |

| Check the community | Scan X, Telegram, Reddit, and other social media. Real engagement matters. |

| Look at the narrative timing | Does the project fit a trend that is heating up right now? |

| Track the roadmap and transparency | Teams that communicate consistently usually execute better |

| Beware of going all-in | Spreading risk across several early-stage plays instead of chasing the ‘perfect’ pick boosts our chances and reduces risk |

Key Takeaways

Heading into 2026, the next wave of potential 1000x cryptos will likely be driven by projects that solve real problems, not just hype. Layer 2 networks, scalable blockchains, AI-powered creator tools, and DeFi innovations are areas to watch closely.

Early adoption and active developer ecosystems, not to mention practical token uses (like staking and governance), will matter more than marketing alone.

Ultimately, there are no guarantees in crypto. But if you focus on trends, utility, and momentum, you can better spot the most promising opportunities on the market.

FAQ

Can a crypto really 1000x?

Do most 1000x gainers come from early-stage presales?

Can meme coins still deliver 1000x returns?

What signals suggest a project might have a thousand-fold increase?

What types of projects have the best chance to explode?

Can a crypto 1000x in 2026?

What market cap does a token usually need to grow a thousand times?

How do you calculate whether a token can even reach a 1000x valuation?

What types of crypto have historically produced the biggest multipliers?

How risky is it to chase the next 1000x crypto?

References

- What Is the Solana Virtual Machine (SVM) – CoinGecko

- Directed Acyclic Graph (DAG) – CoinMarketCap

- What Are Self-Custody and Non-Custodial Wallets – Telco

- How Much Does YouTube Pay Per View?

- What Are Zk-Rollups (Zero-Knowledge Rollups) – Chainlink

- Security First: How SpacePay Protects $1.1M Presale and Payment Data

- Are Layer 2 Blockchain Presales the Next Big Trend – r/PresaleCryptoHub

- Hottest Meme Coins of July 2025 – Which Ones are Exploding Right Now – r/NextCryptoMoonshots

- What Is a Cryptocurrency Exit Scam? How Do You Spot One – Investopedia

- Social Sentiment Indicator: What It Is and How It Works – Investopedia

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked by:

Fact-Checked by:

25 mins

25 mins

Nadica Metuleva

, 42 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.