Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Coinbase is a cryptocurrency exchange that lets people buy, sell, and store digital currency, and serves over 100 million users worldwide.

We’re going to break down how Coinbase works, from its fee structure and security specs to which assets are available to trade. We’ll also examine the platform’s regulatory position, account options, and its development roadmap, so you can decide whether Coinbase ranks among the best crypto exchanges for your needs.

Key Takeaways:

- Coinbase is a U.S.-regulated, publicly traded crypto exchange that offers spot trading, a self-custody wallet, and educational tools.

- Users can access more advanced features (such as derivatives trading) through Coinbase Advanced Trade.

- Fees depend on the payment method and order type, and bank transfers usually cost less than card-based purchases.

- Coinbase keeps 98% of customer funds in offline cold storage, and the platform also requires two-factor authentication.

- Anyone using the self-custody Coinbase Wallet app is responsible for managing their own keys.

What Is Coinbase?

Coinbase is one of the industry’s largest centralized exchange (CEX) platforms, meaning it holds custody of user funds and routes trades through its own infrastructure instead of settling them directly on-chain. That custodial model contrasts with decentralized exchanges (DEXs), where users trade from their own self-custody wallets and retain complete control of their keys.

Beyond spot trading, the Coinbase platform enables users to access additional features, including recurring buys, a crypto-linked debit card, and a subscription service called Coinbase One that provides reduced fees and extra account protections. Institutions can access custody, trade execution tools, and reporting services through Coinbase Prime.

Coinbase trading interface. Source: Coinbase

The company also runs Coinbase Wallet, a secure crypto wallet with its own smartphone app, which lets users manage their own keys and interact with DeFi protocols and NFTs. Lastly, Coinbase supports the development of Base, an Ethereum Layer 2 network built on Optimism’s OP Stack.

Who Founded Coinbase and When

Coinbase was founded in June 2012 by Brian Armstrong, then an engineer at Airbnb, and Fred Ehrsam, who previously worked as a trader at Goldman Sachs. Starting in San Francisco, the company aimed to make buying Bitcoin as simple as a bank transfer.

As public interest in crypto grew, Coinbase added support for altcoins like Ethereum and Litecoin, eventually becoming a multi-asset exchange. By the mid-2010s, institutional services followed, including Coinbase Prime and dedicated custody.

In April 2021, Coinbase Global, Inc. went public through a direct listing on the Nasdaq stock exchange under the ticker COIN. On its first day of trading, the company was briefly valued at almost $86 billion based on intraday prices, making it one of the most high-profile public listings linked to crypto.

Founders, early venture investors like Andreessen Horowitz and Union Square Ventures, institutions, and public shareholders now share ownership. Armstrong remains CEO and a major shareholder, and the company continues to invest in areas such as derivatives and on-chain infrastructure.

Coinbase’s Role in the Crypto Market Explained

Coinbase ranks as the largest U.S.-based crypto exchange by spot trading volume, and is one of the few publicly listed companies in the Web3 sector. That regulatory and market standing makes it a common entry point for retail traders who prefer to use regulated venues.

Based on Coinbase’s shareholder letters and third-party analytics, several metrics illustrate its scale:

- Verified Users: Coinbase no longer reports its “verified users” metric, but its most recent public figures put the total at roughly 108 million customers worldwide. In its Q4 2024 Form 10-K, Coinbase reported an average of 8.7 million Monthly Transacting Users (MTUs).

- Trading Volume: In 2024, Coinbase processed about $1.16 trillion in total trading volume (spot plus derivatives). As of 2026, it also processes approximately $5.7 billion in volume per day across spot markets ($1.3 billion) and derivatives ($4.4 billion).

- Assets on Platform and Custody: Coinbase reported $404 billion of customer assets on its platform at the end of 2024, including about $220 billion worth of assets under custody (AUC).

- Listings: Across its consumer and institutional platforms, Coinbase lists several hundred cryptocurrencies and roughly 400-500 spot markets. New Coinbase listings are added regularly, though BTC and ETH pairs remain the largest drivers of trading volume and fee revenue.

- Market Presence: Aggregated CEX datasets generally put Coinbase at around 7% of global spot trading volume. But the exchange handles a considerable share (often estimated at above 50%) of U.S centralized spot volume.

Coinbase also operates an international derivatives venue (Coinbase International Exchange) that offers perpetual futures outside the U.S., and its custody arm (Coinbase Custody) services ETF issuers/institutional funds. Together, the derivatives venue and custody arm make Coinbase a key part of the crypto market’s core infrastructure.

How Does Coinbase Work?

Understanding what Coinbase is becomes clearer once you see how it works in practice. Users create a Coinbase account with an email and phone number, complete identity verification with a government-issued ID, and link a payment method such as a bank account or debit card. Once Coinbase approves the account, users can deposit funds right away.

Coinbase has built its trading flow around a simple interface. To buy an asset like BTC or ETH, a user selects the asset, enters their buy amount, reviews Coinbase’s fee estimate, and confirms the order.

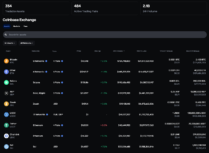

Coinbase exchange details. Source: Coinbase

The platform then processes the order and credits the asset to the user’s custodial wallet, which appears alongside any cash balance they might have. Selling follows the same steps, and the proceeds move into the user’s fiat wallet, ready for withdrawal to a linked bank account.

Users can access Coinbase in a few different ways:

- Web Browser: Full dashboard access on Coinbase.com, including access to Coinbase’s advanced trading platform for limit orders, charting tools, and order-book execution.

- Mobile App (iOS/Android): Simplified interface with a portfolio view, price alerts, and buy/sell functions.

- Coinbase Wallet: Self-custody app that ranks among the best crypto wallets for people who want to manage their own keys and interact with NFTs and dApps. It does not provide direct access to the Coinbase exchange, but you can use it for trading on decentralized exchanges (DEXs) instead.

For everyday activity, many users rely on the main website or mobile app to check their balance and place trades without interacting directly with blockchain tools.

Key Features of Coinbase

Coinbase splits its platform into two main categories: simple tools for beginners and advanced features for power users.

- Spot Trading: Buy and sell a wide range of cryptocurrencies through a simple interface, or use Advanced Trade for limit orders and detailed charts.

- Advanced Trade: A professional order-book environment (formerly called Coinbase Pro) with maker-taker pricing, API access, and granular trade controls.

- Futures Trading: Coinbase offers perpetual futures to eligible users outside the U.S. through its international derivatives venue (Coinbase International Exchange).

- Staking Services: Coinbase provides staking on supported proof-of-stake (PoS) assets in regions where regulators permit it. Rewards vary by network and market conditions.

- Coinbase Card: A Visa debit card that supports spending cash or selected crypto balances and may offer rewards (depending on the user’s tier).

- Coinbase One: A subscription service that provides reduced trading fees on eligible transactions, priority support, and other account benefits.

- Coinbase Wallet: A separate self-custody app where users control their own keys and can interact with NFTs and dApps.

- Coinbase Learn: Educational resources covering crypto basics and project overviews, with reward programs available in supported regions.

- Base Network: An Ethereum Layer 2 ecosystem built on the OP (Optimism) Stack and incubated by Coinbase, offering cheaper on-chain transactions via external wallets.

Which Crypto Are Available on Coinbase?

Coinbase supports a range of the top crypto to buy, focusing on projects that meet its listing standards and compliance requirements. While Coinbase doesn’t list every token on the market, it covers most of the widely traded assets that users look for.

Examples of asset categories available on Coinbase include:

- Layer 1 Networks: Bitcoin, Ethereum, Solana, Cardano, Avalanche, and XRP

- Stablecoins: USDC and Tether (USDT)

- DeFi and Infrastructure Tokens: Chainlink, Uniswap, Aave, and Polygon

- Meme Coins: Coinbase lists several of the best meme coins, including Dogecoin, Shiba Inu, Pepe, Bonk, and Floki.

Coinbase also supports assets connected to Base. Base-native tokens, sometimes among the best new crypto to watch, may be accessible through on-chain tools like Coinbase Wallet before receiving a complete CEX listing.

Supported assets on the Coinbase exchange. Source: Coinbase

The list of supported assets changes over time as Coinbase adds new tokens and removes others. For the most up-to-date information, users can refer to Coinbase’s official supported assets page.

Coinbase Fees: Quick Guide

Coinbase fees vary based on which interface you use, your payment method, and your trade size. The simple buy/sell experience is convenient but costs more; Advanced Trade and bank transfers are much cheaper.

Here’s the breakdown:

- Simple Trades: Coinbase embeds a spread (often around 0.5%) into the quoted price, plus a flat or percentage-based fee. Small buys under $200 incur fixed fees of $0.99-$2.99; larger card and PayPal purchases can push all-in costs into the 3-4% range.

- Advanced Trade: A volume-tiered maker-taker model, with maker fees of 0.00%-0.40% and taker fees of 0.05%-0.60%, dropping with higher 30-day volume. This is typically far cheaper than simple trades for active users.

- Fiat Deposits: In the U.S., ACH deposits are free; USD wire deposits cost $10.

- Fiat Withdrawals: For U.S. customers, ACH withdrawals are free; USD wire withdrawals carry a flat fee of approximately $25.

- Crypto Withdrawals: For regular crypto withdrawals, you pay the underlying blockchain network fee (including miner/gas costs) rather than a separate Coinbase withdrawal fee.

- Staking: No upfront fee, but Coinbase takes a service commission on staking rewards, typically around 25% for major assets like ETH.

- Coinbase One: In the U.S., the mid-tier Coinbase One Preferred plan costs $29.99/month and waives trading fees on simple trades up to $10,000 in monthly volume (spreads still apply). Higher and lower-priced tiers are available with different fee-free limits and benefits.

Coinbase Security Measures

Coinbase uses a security model designed to protect both customer funds and account data. According to the company’s public security disclosures, Coinbase keeps around 98% of customer digital assets in offline cold storage, meaning private keys are completely disconnected from the internet. Only a small portion of customer assets sits in hot wallets.

A security policy covers the assets held online. That insurance does not extend to losses caused by user behavior, such as phishing attacks or compromised passwords.

Coinbase security measures. Source: Coinbase

At the user level, Coinbase enforces two-factor authentication and provides additional safeguards like device verification, biometric login, and withdrawal address allowlists. Coinbase encrypts sensitive personal and financial data with AES-256 encryption.

Beyond user-facing protections, Coinbase also conducts continuous internal monitoring, engages external security auditors, and operates a bug bounty program that pays researchers to report vulnerabilities.

Looking Forward: Coinbase’s Future Developments

Coinbase’s roadmap builds on the roles outlined earlier: regulated trading, institutional infrastructure, and access to on-chain activity. Recent moves, including Coinbase’s acquisition of derivatives exchange Deribit and the launch of a token-sale platform, highlight the platform’s expansion efforts.

The company also continues to support Base, the Ethereum Layer 2 ecosystem built on the OP Stack and incubated by Coinbase. As of Q4 2025, Base has approximately $4.3 billion in total value locked (TVL), making it the largest Layer 2 network by DeFi TVL.

Coinbase token sales platform. Source: Coinbase

Users can interact with Coinbase in a range of ways, depending on their requirements. Beginners usually stick to the main app for quick buys, bank transfers, and educational tools. Meanwhile, active traders typically use Advanced Trade for lower fees and order-book execution.

Long-term holders may focus on recurring buys and custodial storage, while on-chain users treat Coinbase as a gateway into Coinbase Wallet and Base. Lastly, institutions primarily engage through Coinbase Prime for custody, execution, and reporting.

Ultimately, the answer to the question “What is Coinbase?” depends on what you need it to be: a simple on-ramp for buying Bitcoin for the first time, or a high-volume execution venue for your thousandth trade.

Articles You May Be Interested In

FAQ

Is Coinbase a wallet or an exchange?

Is Coinbase a safe crypto exchange?

What is the minimum deposit required on Coinbase?

Can I use Coinbase in my country?

Is Coinbase suitable for beginners?

Can I buy and sell crypto on Coinbase?

What does Coinbase Wallet do?

How do I withdraw money from Coinbase?

What’s the difference between Coinbase and Coinbase Pro?

References

- Centralized Cryptocurrency Exchanges: How They Work and Why They Matter (Investopedia)

- What is AES 256 Encryption & How Does it Work? (Progress)

- Coinbase pricing and fees disclosures (Coinbase)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

13 mins

13 mins

Otar Topuria

Crypto Editor, 37 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.