Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

The right strategy is the key to success on any fantasy finance platform. Use our top tips to give yourself an edge.

Trading crypto is a lot like trading stocks. It’s a little scary, a little overwhelming, and a little risky. But these are exactly the reasons why so many people are drawn in. While there’s no sure-fire way to be successful in the crypto markets, fantasy trading platforms like StockBatlle or WealthBase let users get the vital experience needed to find success in crypto trading.

Armed with a little knowledge and the right trading strategies, anyone can find success in fantasy contests. Check out these crypto trading tips and start your investment journey today.

Just like other markets, fantasy crypto traders have several strategies at their disposal. Which one is right for you will depend on several factors, but let’s take a look at the pros and cons of some of the most common ones. Note that for fantasy finance, we’re mainly interested in active trading, so we won’t be talking about longer-term, passive trading.

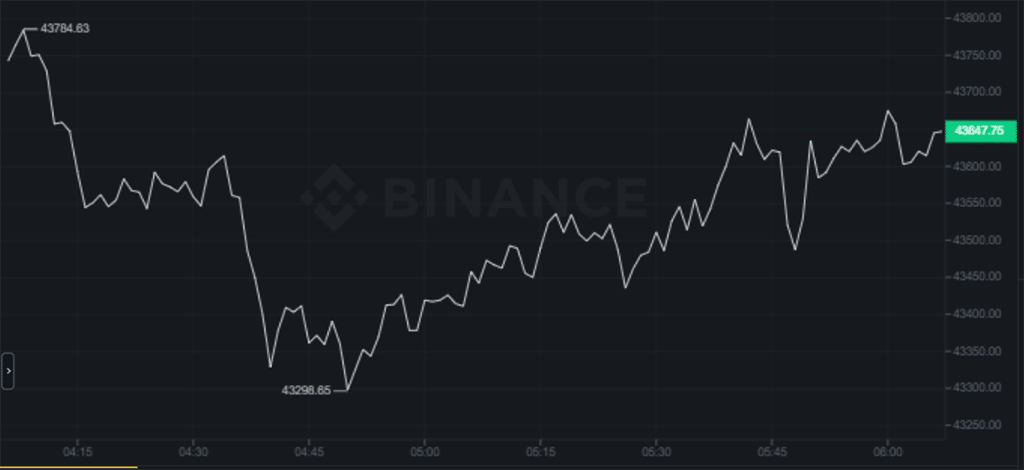

While volatility (the number of changes in price over time) can be dangerous, it also marks the prime time to start day trading a particular coin. Fantasy trading isn’t about slow, steady growth, it’s all about capitalizing on market fluctuations and striking while the iron is hot. Day trading can only work in a volatile market.

Photo: Binance

Here, you can see a pretty standard two-hour window of Bitcoin prices. These huge swings (up and down) mark prime times for buying and selling. Just because the price is down overall, doesn’t mean that this was a bad time to invest. On the contrary, these peaks and valleys were ideal for day-trading. Remember, volatility is the key to success in fantasy trading contests. Below, we’ll go over a few strategies that you can use to get the upper hand.

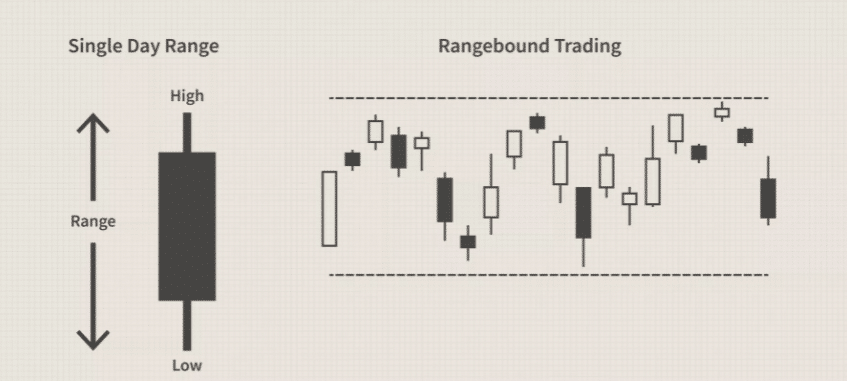

Range trading is perhaps the most widely-used (and widely-understood) active trading strategy. In short, range traders set a “range” for where they predict the price of a stock will go, and they tactically buy and sell stocks within that range over a relatively short period of time. This could be anywhere from just a few hours to several weeks.

For example, let’s say that a coin is trading at $0.75, but you think it will reach $0.85 before crashing. You would buy whenever it reaches the bottom of your range ($0.75) and sell whenever it climbs closer to the higher end of your range ($0.85).

Photo: Investopedia

Here, you can see several rises and falls within the selected range. Each of these presents a prime opportunity for a fantasy trading contest as each one provides a short-term gain. When a coin or stock rises beyond the range, this is called a “breakout” and can represent a windfall for properly positioned traders.

When a coin rises beyond a set range, this is called a “breakout” and it usually signals the start of a trend. Breakout traders will often seek to exploit this increased volatility by either scalping the next few climbs, or by taking a long position and waiting a bit longer.

Photo: Investopedia

Here, you can see the upper bound on a range as the top line. Once the coin has passed that limit, a breakout has occurred. This can be a prime time to get on board.

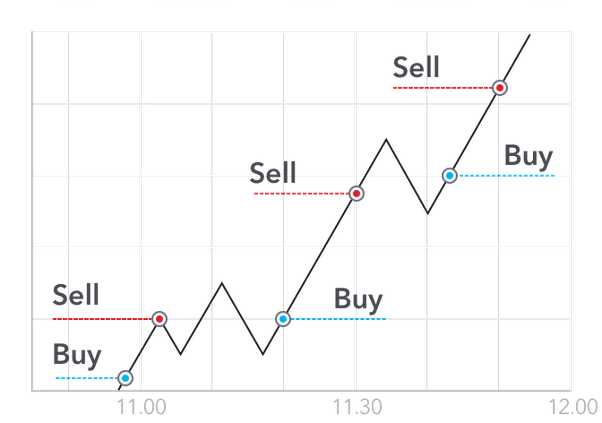

Scalping is an extremely fast-paced and demanding active trading strategy. But it’s one with truly awesome potential if done correctly. Scalp traders tend to buy and sell much faster and more frequently than other traders. Scalping is the practice of buying a coin and selling it almost immediately as soon as it has made any positive gain. This results in a very small return but it can be offset by both volume and a large upfront investment.

Photo: Benzinga Crypto

This is a pretty simplified version of what a typical scalp trader might do. Over the course of an hour, the price of a coin can fluctuate heavily. A scalper would buy and then sell as soon as they had a gain and would repeat this potentially dozens of times.

Since fantasy trading contests typically only last less than an hour, scalping is a popular strategy as it can lead to some of the most reliable short-term gains.

That’s a lot to take in, I know. No matter how much you read or how many charts you look at, there’s no substitute for rolling up your sleeves and getting your hands a little dirty. Fantasy trading lets users get the hang of all the ins and outs of the markets in a safe, controlled setting. On apps like StockBattle, Ivestr, and several more, users can capitalize on their knowledge and experience to earn real rewards and extra income in all manner of fantasy contests.

Trading crypto can be a high hurdle to clear, but with fantasy trading platforms, everyone can get a leg up. There’s never been a better time to learn how to start investing in your future. The skills users gain from fantasy trading carry over directly into real-world applications and just might be the key to your financial future.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.