How Rocketpad Refines the DeFi Space with Its Tier Structure

Rocketpad is a 100% community-focused IDO launchpad built on the Cardano blockchain to enable businesses and startups to access funding to boost their activities and operations. Rocketpad is highly decentralized and transparent.

This week, Rocketpad entered day 7 of its public sale, the stage before its native token, $Rocket, will be listed on major exchanges.

$ROCKET Token Public Sale Round

Rocketpad fixes all the challenges bedeviling existing launchpads with its revolutionary tier system and input-based modifications. As such, the project continues to gain massive traction.

Users can participate on $ROCKET Public Sale Round by visiting the Public Sale webpage.

Public Sale Details

Token Sale Price- 1 ADA = 37.5 $ROCKET

Minimum Buy- 100 ADA

Maximum Buy- 40,000 ADA

$Rocket token will be send to user’s wallet immediately

You can buy the tokens by scanning the QR code from the site and sending ADA to the supported Cardano wallets.

Token and the Platform

Rocketpad is a Cardano-based community IDO where different businesses and startups can raise funding to run their activities. The Rocketpad community aims to empower high-growth projects to enable them to offer improved services to their customers across the world.

$Rocket, the project’s utility token, has a lot of use cases, including for the payment of goods and services on the Rocketpad ecosystem, to participate in the governance structure of the project, as well as for staking to earn passive income, among others.

$Rocket holders will be able to vote on the most promising startups looking for funding to scale their operations through their dashboards. These startups are those that would qualify for IDO on the Rocketpad launchpad. What’s more? Rocketpad has a 5-dimensional tier system, where each tier receives token allocation.

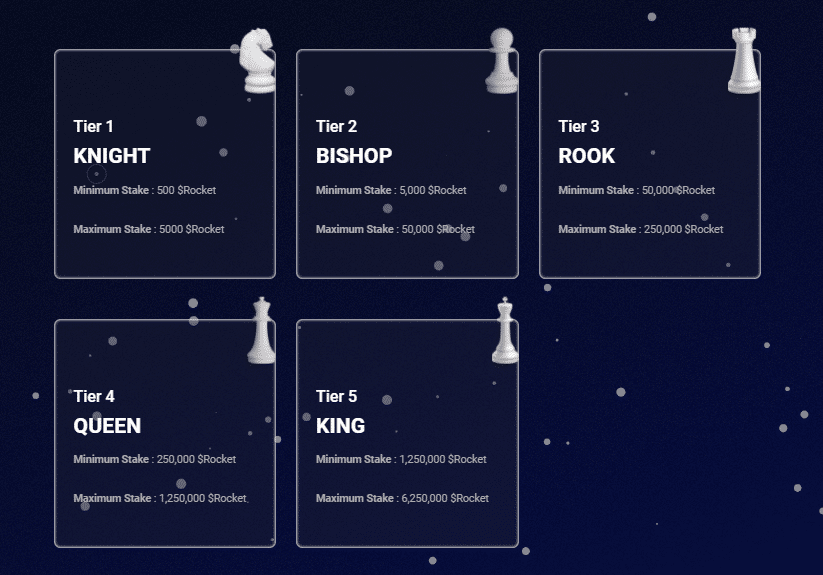

Tier Levels and Allocations

Participants are required to stake their tokens corresponding to their respective tier levels once a project has been approved. The minimum requirements are given as follows:

- KNIGHT: 500 – 5,000

- BISHOP: 5,000 – 50,000

- ROOK: 50,000 – 250,000

- QUEEN: 250,000 – 1,250,000

- KING: 1,250,000 – 6,250,000

The King tier is the highest while the Knight tier is the lowest. The allocation process begins once staking requirements are met depending on the total pool share. Let’s further simplify how the tier system works; suppose a project sells 10 million tokens in an IDO where 30 ROOK and 20 BISHOP tier members participate, according to the pool weighs, the total pool shares are (30 x 3) + (20 x 2) = 90 + 40 = 130 shares. Therefore, to get the total supply, we divide 10,000,00 by 130 to get 76,923 tokens. This means, ROOK tier members can purchase 3x this amount of token, while BISHOP members can purchase 2x the same amount of tokens.

The bottom line? The higher your tier, the higher your ability to contribute more money to any project that’s approved on the IDO launchpad.

To learn more about Rocketpad, visit the Rocketpad website or check out their social media handles: Twitter, Facebook.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.