Ripple (XRP) price consolidates above $3 despite a considerable decline in trading volumes over the weekend. Can bullish expectations on Rabby Wallet integration of XRPL EVM contracts nullify US inflation jitters?

Initial coin offerings (ICOs) offer investors a chance to buy into the most exciting new cryptocurrencies at a discounted price, before they hit exchanges. Here’s a complete calendar of upcoming ICOs to watch.

| Full Name | Date | Meta | Blockchain | Useful Links |

|---|

| 06 May - 30 Nov, 2025 | Solana Virtual Machine (SVM) | ||||

|

Bitcoin Hyper (HYPER) is the first meme coin built on a real Bitcoin Layer 2. It combines the viral energy… |

|||||

| 30 Jul - 01 Oct, 2025 | Ethereum | ||||

|

Maxi Doge (MAXI) is a meme coin and a dog on a mission to be the alpha of the Shiba… |

|||||

| 05 Aug - 31 Dec, 2025 | Ethereum | ||||

|

Mine-to-Earn gamified token and presale on Ethereum, with Pepe the Frog. |

|||||

| 28 May - 01 Oct, 2025 | Ethereum, Solana | ||||

|

Snorter (SNORT) is a meme-powered Ethereum and Solana token combining viral culture with real staking and reward utility. |

|||||

| 01 Nov - 31 Dec, 2025 | Ethereum | ||||

|

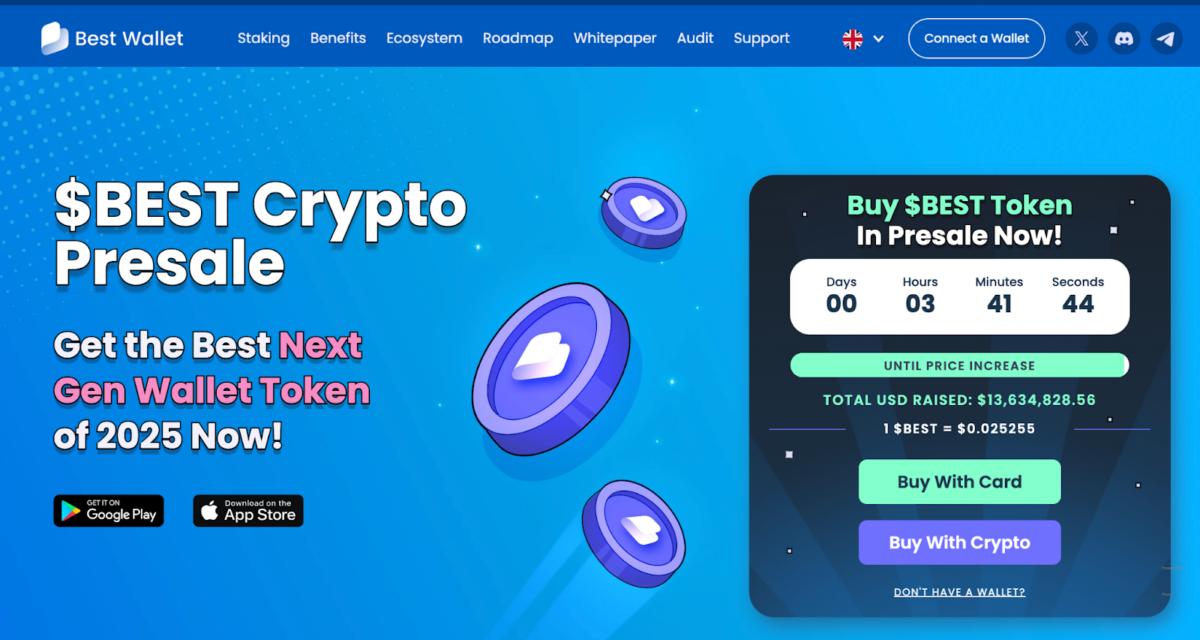

Best Wallet is set to disrupt the booming $11 billion non-custodial wallet industry. |

|||||

| 01 Apr - 30 Nov, 2025 | Ethereum | ||||

|

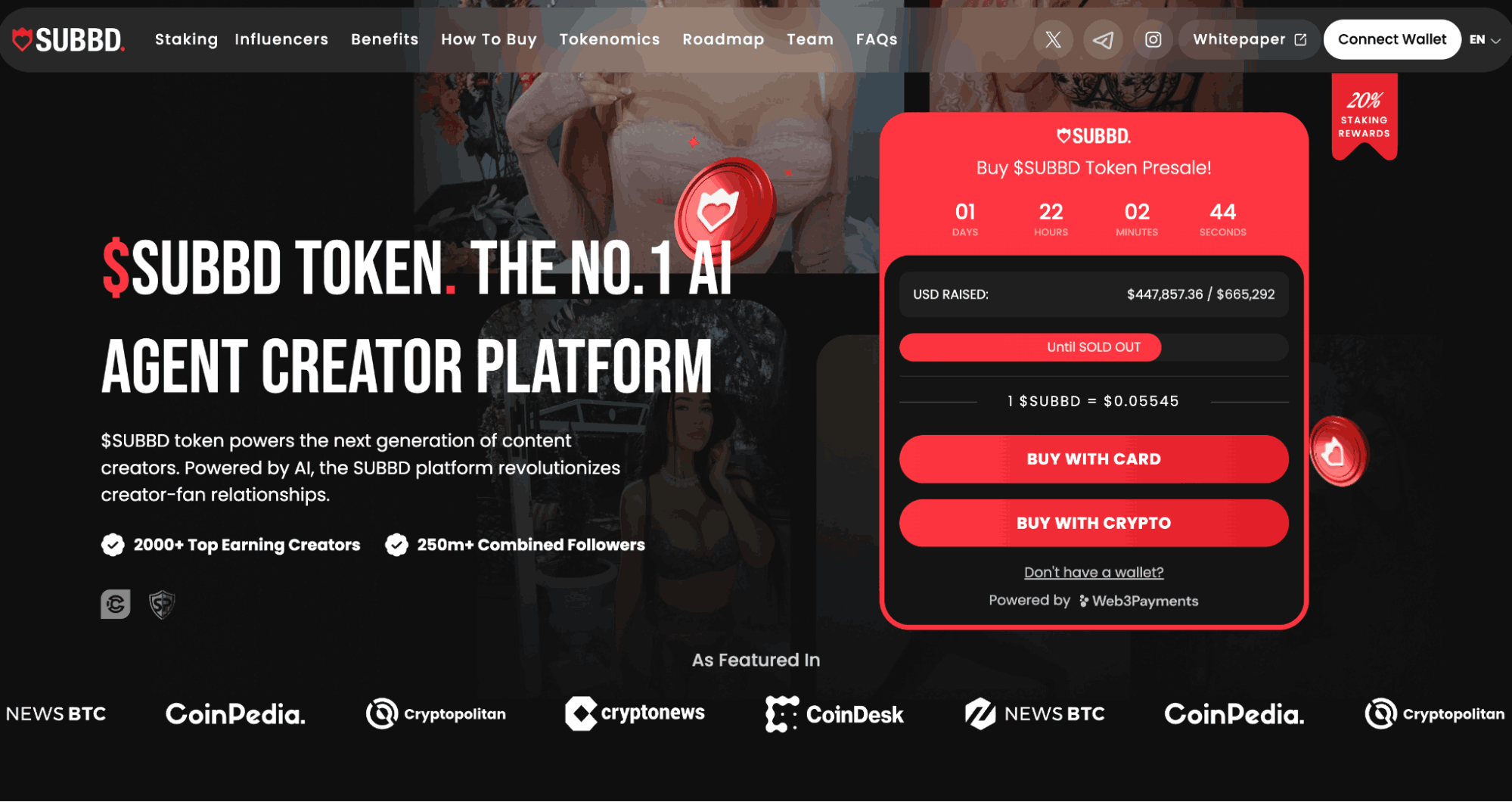

The $SUBBD token fuels a new era for content creators, transforming how they connect with their audiences. |

|||||

| 15 Sep - 31 Dec, 2025 | Ethereum | ||||

|

Low-Fee Crypto Payment Solution for Merchants and Shoppers |

|||||

| 15 Apr - 01 Oct, 2025 | Ethereum | ||||

|

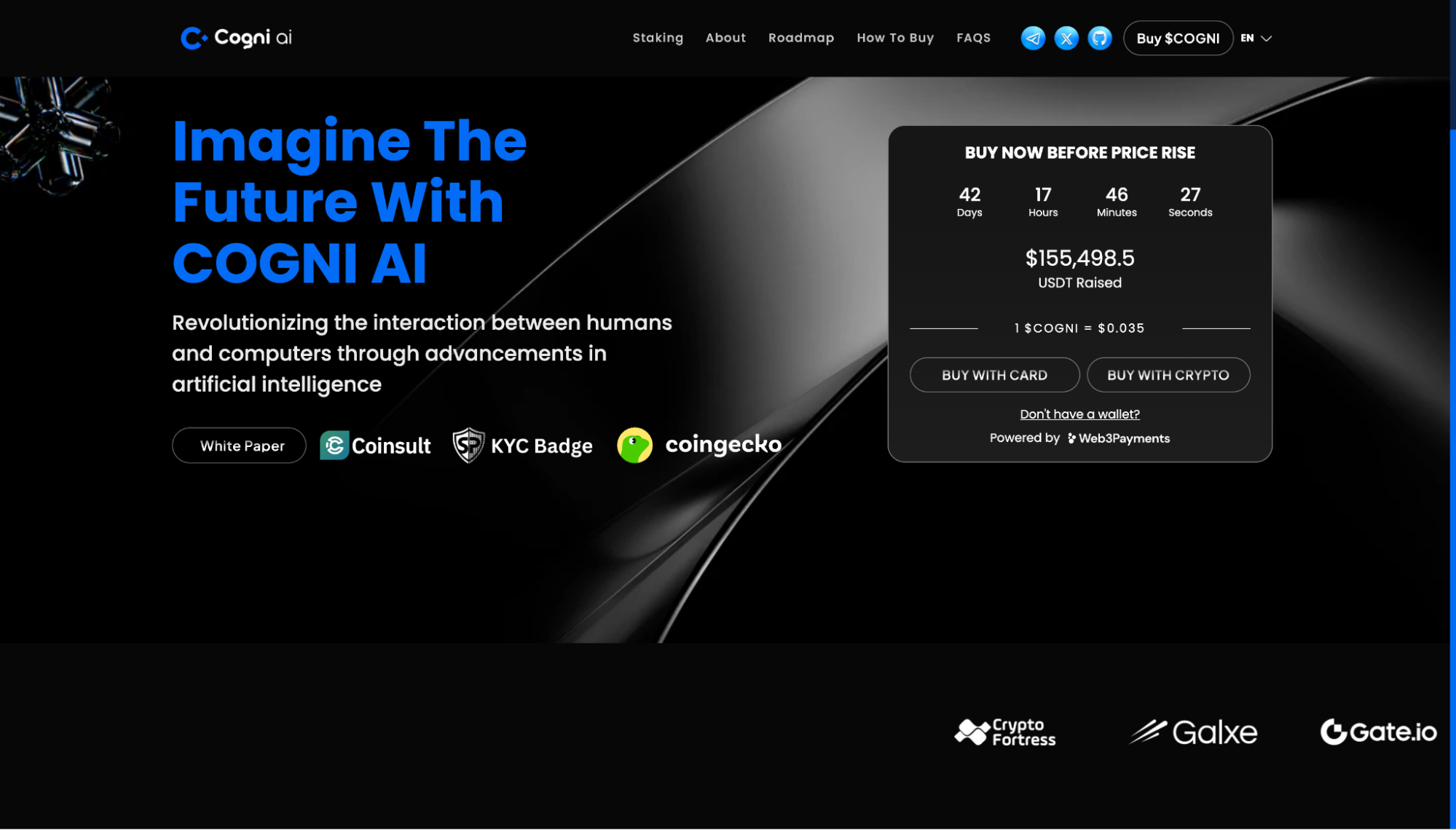

Platform for Building Custom AI Agents for Web3 Tasks and dApps. |

|||||

01 HYPER

Bitcoin Hyper (HYPER) is the first meme coin built on a real Bitcoin Layer 2. It combines the viral energy…

02 MAXI

Maxi Doge (MAXI) is a meme coin and a dog on a mission to be the alpha of the Shiba…

03 PEPENODE

Mine-to-Earn gamified token and presale on Ethereum, with Pepe the Frog.

04 SNORT

Snorter (SNORT) is a meme-powered Ethereum and Solana token combining viral culture with real staking and reward utility.

05 BEST

Best Wallet is set to disrupt the booming $11 billion non-custodial wallet industry.

06 SUBBD

The $SUBBD token fuels a new era for content creators, transforming how they connect with their audiences.

07 SPY

Low-Fee Crypto Payment Solution for Merchants and Shoppers

08 COGNI

Platform for Building Custom AI Agents for Web3 Tasks and dApps.

| Full Name | Date | Meta | Blockchain | Useful Links |

|---|

| To be announced - To be announced | |||||

|

Cargo search |

|||||

| To be announced - To be announced | |||||

|

We use blockchain with a revolutionary voting system to give our fans unprecedented influence over our esports brand. |

|||||

| To be announced - To be announced | |||||

|

Algebraix Data will enable individuals to own and monetize their personal data. |

|||||

| To be announced - To be announced | Ethereum | ||||

|

Assistive Reality is an Australian start-up project creating Augmented and Mixed reality applications for Microsoft, Intel, Google, Apple and other… |

|||||

| To be announced - To be announced | |||||

|

The decentralized continuous audit and reporting protocol ecosystem “DCARPE™ uses a GAAP and IFRS compliant smart contract platform |

|||||

| To be announced - To be announced | Ethereum | ||||

|

The most advanced online digital platform in the automotive market, bridging the gap between cryptocurrency and the automotive industry. |

|||||

| To be announced - To be announced | |||||

|

Don't ready to spend a lot of money on charity yet? |

|||||

| To be announced - To be announced | Ethereum | ||||

|

Christ Coin is the first pre-mined Christian-based Cryptocurrency. It is used to financially reward people who read the Bible, post/view… |

|||||

| To be announced - To be announced | Ethereum | ||||

|

With more than 4,500 cryptocurrencies in circulation, there are bound to be many that are functionally dead. This presents many… |

|||||

| To be announced - To be announced | |||||

|

With Cove you can create a secure wallet on your phone to store digitally-verified copies |

|||||

01 Aeropoisk

Cargo search

02 Aether United

We use blockchain with a revolutionary voting system to give our fans unprecedented influence over our esports brand.

03 ALX

Algebraix Data will enable individuals to own and monetize their personal data.

04 ARX

Assistive Reality is an Australian start-up project creating Augmented and Mixed reality applications for Microsoft, Intel, Google, Apple and other…

05 AUDT

The decentralized continuous audit and reporting protocol ecosystem “DCARPE™ uses a GAAP and IFRS compliant smart contract platform

06 CARR

The most advanced online digital platform in the automotive market, bridging the gap between cryptocurrency and the automotive industry.

07 Charitize.click

Don't ready to spend a lot of money on charity yet?

08 CCLC

Christ Coin is the first pre-mined Christian-based Cryptocurrency. It is used to financially reward people who read the Bible, post/view…

09 JAN

With more than 4,500 cryptocurrencies in circulation, there are bound to be many that are functionally dead. This presents many…

10 SHELLS

With Cove you can create a secure wallet on your phone to store digitally-verified copies

| Full Name | Date | Meta | Blockchain | Useful Links |

|---|

| 01 Feb - 30 Jun, 2025 | Ethereum | ||||

|

BTC Bull Token is the driving force behind Bitcoin’s journey to $1 million and beyond! Grab your $BTCBULL and start… |

|||||

| 30 Jun - 04 Sep, 2025 | Ethereum | ||||

|

A fixed-supply, non-utility meme token inspired by SPX6900. |

|||||

| 01 Dec - 30 Jun, 2025 | Solana | ||||

|

The future of Layer 2 innovation - more than just built on Solana, it unleashes its true power. |

|||||

| 13 Jan - 01 Jun, 2025 | Ethereum | ||||

|

Tap into Live Insights with Hive-Mind Analysis. |

|||||

| 15 Mar - 09 Jun, 2025 | Binance Smart Chain (BSC) | ||||

|

The next-gen DeFi platform with insurance-backed crypto solutions. |

|||||

| 09 Apr - 31 Aug, 2025 | Ethereum | ||||

|

Payment solution for the $25B influencer economy with staking rewards. |

|||||

| 09 Jun - 09 Jul, 2016 | Antshares | ||||

|

Distributed ledger protocol that digitalizes real-world assets |

|||||

| 16 Jul - 16 Aug, 2016 | Tao | ||||

|

Digital asset management system suitable for use within the music industry. |

|||||

| 01 Aug - 01 Sep, 2016 | Waves | ||||

|

Blockchain based loyalty programs for retailers |

|||||

| 05 Aug - 05 Sep, 2016 | Metaverse | ||||

|

Decentralised platform of smart properties and digital identities |

|||||

01 BTCBULL

BTC Bull Token is the driving force behind Bitcoin’s journey to $1 million and beyond! Grab your $BTCBULL and start…

02 T6900

A fixed-supply, non-utility meme token inspired by SPX6900.

03 SOLX

The future of Layer 2 innovation - more than just built on Solana, it unleashes its true power.

04 MIND

Tap into Live Insights with Hive-Mind Analysis.

05 MEME

The next-gen DeFi platform with insurance-backed crypto solutions.

06 INPEPE

Payment solution for the $25B influencer economy with staking rewards.

07 ANS

Distributed ledger protocol that digitalizes real-world assets

08 TM-TAO

Digital asset management system suitable for use within the music industry.

09 TM-INCENT

Blockchain based loyalty programs for retailers

10 ETP

Decentralised platform of smart properties and digital identities

| Full Name | Date | Meta | Blockchain | Useful Links |

|---|

| To be announced - To be announced | Multi-chain | ||||

|

Wall Street Pepe ($WEPE) is a dual-chain meme coin running on Ethereum and Solana, offering holders access to an exclusive… |

|||||

| 06 May - 30 Nov, 2025 | Solana Virtual Machine (SVM) | ||||

|

Bitcoin Hyper (HYPER) is the first meme coin built on a real Bitcoin Layer 2. It combines the viral energy… |

|||||

| 30 Jul - 01 Oct, 2025 | Ethereum | ||||

|

Maxi Doge (MAXI) is a meme coin and a dog on a mission to be the alpha of the Shiba… |

|||||

| 01 Feb - 30 Jun, 2025 | Ethereum | ||||

|

BTC Bull Token is the driving force behind Bitcoin’s journey to $1 million and beyond! Grab your $BTCBULL and start… |

|||||

| 05 Aug - 31 Dec, 2025 | Ethereum | ||||

|

Mine-to-Earn gamified token and presale on Ethereum, with Pepe the Frog. |

|||||

| 30 Jun - 04 Sep, 2025 | Ethereum | ||||

|

A fixed-supply, non-utility meme token inspired by SPX6900. |

|||||

| 28 May - 01 Oct, 2025 | Ethereum, Solana | ||||

|

Snorter (SNORT) is a meme-powered Ethereum and Solana token combining viral culture with real staking and reward utility. |

|||||

| 01 Dec - 30 Jun, 2025 | Solana | ||||

|

The future of Layer 2 innovation - more than just built on Solana, it unleashes its true power. |

|||||

| 01 Nov - 31 Dec, 2025 | Ethereum | ||||

|

Best Wallet is set to disrupt the booming $11 billion non-custodial wallet industry. |

|||||

| 13 Jan - 01 Jun, 2025 | Ethereum | ||||

|

Tap into Live Insights with Hive-Mind Analysis. |

|||||

01 WEPE

Wall Street Pepe ($WEPE) is a dual-chain meme coin running on Ethereum and Solana, offering holders access to an exclusive…

02 HYPER

Bitcoin Hyper (HYPER) is the first meme coin built on a real Bitcoin Layer 2. It combines the viral energy…

03 MAXI

Maxi Doge (MAXI) is a meme coin and a dog on a mission to be the alpha of the Shiba…

04 BTCBULL

BTC Bull Token is the driving force behind Bitcoin’s journey to $1 million and beyond! Grab your $BTCBULL and start…

05 PEPENODE

Mine-to-Earn gamified token and presale on Ethereum, with Pepe the Frog.

06 T6900

A fixed-supply, non-utility meme token inspired by SPX6900.

07 SNORT

Snorter (SNORT) is a meme-powered Ethereum and Solana token combining viral culture with real staking and reward utility.

08 SOLX

The future of Layer 2 innovation - more than just built on Solana, it unleashes its true power.

09 BEST

Best Wallet is set to disrupt the booming $11 billion non-custodial wallet industry.

10 MIND

Tap into Live Insights with Hive-Mind Analysis.

Disclaimer: All content provided in Coinspeaker’s ICO Calendar is for your general information only. It does not constitute financial, legal or any other form of advice. Any use of or reliance on the content provided is solely at your own risk and discretion. Investing is a high-risk activity that can lead to major losses, therefore, please consult your financial advisor before making any decision. No content in the ICO Calendar is meant to be a solicitation or offer.

Author: Otar Topuria, Fact-checked by: Julia Sakowitz. Last Updated: 11/09/2025

Bitcoin Hyper tops our best crypto ICO watch list in September 2025. It remains speculative, but 650M+ tokens staked signal real interest in Bitcoin L2 experiments. Two alternatives worth watching are Maxi Doge, a gym-and-leverage meme built for traders, and PEPENODE, a mine-to-earn play for GPU miners.

This guide tracks our ICO Calendar picks using a transparent methodology that explains how we score projects, considering project fundamentals, presale traction, on-chain data, and verified community data.

Want to learn more about the top crypto ICOs happening now? We’ll explore each in detail so you can decide which ones to invest in.

Bitcoin Hyper is a Bitcoin Layer 2 meme coin that enhances transaction speed, reduces fees, and facilitates decentralized applications (dApps) on Bitcoin, providing it with the execution layer. The HYPER token powers various functions within the ecosystem, including staking, governance, and payments.

Bitcoin Hyper Website. Source: Bitcoin Hyper

Bitcoin Hyper is built on the Solana Virtual Machine, and it is part of the $18B Layer 2 market. The protocol uses zero-knowledge (ZK) proofs for secure transactions that regularly commit to the Bitcoin mainnet.

Bitcoin Hyper ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| HYPER | $15.97M | $0.012915 | 73% | Ethereum, Solana |

Maxi Doge is an ERC-20 dog-themed meme coin that merges pomposity with a self-deprecating quality, often found in crypto culture, which may make it one of the best crypto presales of 2025. MAXI holders can earn staking rewards and join contests for top ROI trades.

Maxi Doge presale homepage. Source: Maxi Doge

Dogecoin DOGE $0.28 24h volatility: 2.2% Market cap: $42.34 B Vol. 24h: $4.86 B has been reported to have a 93% chance of ETF approval, according to Santiment analyst Brian Q. This suggests that dog-themed meme coins may show strong performance in 2025. Maxi Doge attempts to build on this by offering a newer and edgier low-cap alternative in presale.

Maxi Doge ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking APY | Network |

| MAXI | $2.19M | $0.0002575 | 155% | Ethereum |

PEPENODE is a presale that enables virtual mining. The GameFi concept allows users to buy node miners and upgrade them for higher staking APYs.

PEPENODE presale. Source: PEPENODE

Participants also have the option to stake with an APY of 1339%. Purchases are available on Ethereum and BNB Chain. However, they should be aware that the ‘buy and stake’ option is only available for purchases made on Ethereum. Rewards will be vested over two years.

Top miners will receive airdrops in memecoins such as PEPE and FARTCOIN.

PEPENODE ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| PEPENODE | $1.14M | $0.0010575 | 1339% | Ethereum |

Snorter Bot is a meme coin project centered around a Telegram-native trading bot designed for Solana and Ethereum users. It will enable Telegram app users to access trading tools such as automated swaps, snipes, stop-losses, copy trades, and portfolio tracking.

Snorter Website. Source: Snorter

Powered by the multi-chain SNORT token (on both ETH & SOL), Snorter unlocks advanced features like MEV protection, instant token launch sniping, copy-trading tools, staking rewards, and cross-chain bridging via the Portal Bridge.

Snorter Bot ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| SNORT | $3.94M | $0.1043 | 120% | Ethereum, Solana |

Best Wallet is a developing crypto wallet platform that supports over 60 blockchains and includes core Web3 features such as the ability to buy crypto anonymously, stake tokens, trade, and take part in community governance. It also has its own launchpad for accessing early token offerings.

Best Wallet Website. Source: Best Wallet

Holders of the BEST token will get lower trading fees on Best DEX, better staking rates, and early access to token sales on the launchpad. The team also plans to connect BEST to upcoming features, like a crypto debit card with cashback and reduced transaction fees.

Best Wallet ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| BEST | $15.86M | $0.025645 | 84% | Ethereum |

SUBBD is an AI-powered platform aimed at creators working in the subscription content space, a market estimated at around $130B by 2032. The project plans to offer AI tools that help automate content production and support more direct interaction with fans. Fans can also use AI to generate and monetize their content based on their favorite influencer, with approval.

SUBBD Official Website. Source: SUBBD

The SUBBD token is used for payments between fans and creators, unlocks access to exclusive subscription content, and offers discounts and access to VIP features like live streams.

SUBBD ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| SUBBD | $1.14M | $0.056425 | 20% | Ethereum |

SpacePay is creating a crypto payments system designed for everyday use. The team says it’s already testing the service with over 250 traditional retailers, letting customers pay with Bitcoin or Ethereum by tapping their phone or scanning a QR code.

SpacePay Website. Source: SpacePay

SpacePay is compatible with major blockchains and features real-time conversion, powered by the SPY token, which handles settlement fees, rewards, and merchant rebates.

PayPal recently announced its entrance into the space, enabling merchants in the US to accept crypto payments, but is known for high fees. This may serve as a great way to draw attention to new, lower-fee products like SpacePay.

SpacePay ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| SPY | $1.3M | $0.003181 | Not at this time | Ethereum, BNB, Matic, Avax, Base |

Cogni AI is an AI agent that helps users track portfolios, optimize DeFi yields, manage wallets, and react to market shifts in real-time. Users can also create their own AI agents using the protocol.

Cogni AI Website. Source: Cogni AI

Built on the Polygon blockchain for fast and low-cost transactions, the platform uses COGNI to unlock premium tools, DAO voting, and early access to new features. Cogni also offers Cogni.fun, a way to launch tokens using AI prompts.

Cogni AI Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| COGNI | >$200,000 | $0.095 | 130% | Ethereum |

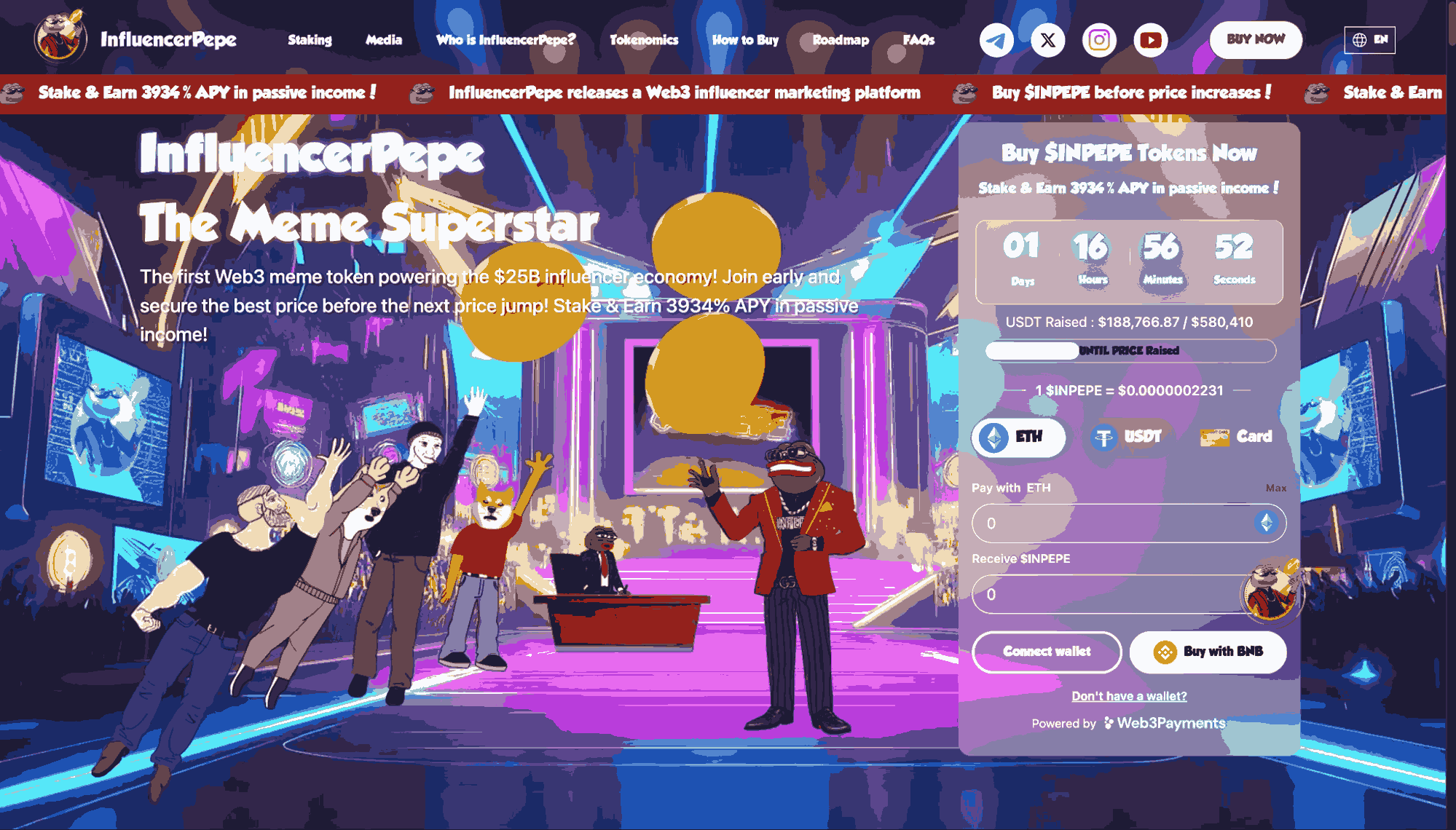

InfluencerPepe is a meme coin ICO blending degen culture with influencer marketing mechanics. The project partners with a network of mid-tier and micro-creators who actively promote the coin.

Holders of INPEPE can stake tokens behind their favorite influencers, boost campaigns, and earn rewards based on performance, potentially turning social capital into tokenized value.

InfluencerPepe Website. Source: InfluencerPepe

While there are many memecoins, the combination of meme coin virality with creator-led growth is successful; this presale may show signs of significant growth.

InfluencerPepe ICO Key Facts

| Token Symbol | Amount Raised | Current Price | Staking Rewards | Network |

| INPEPE | $200,000 | $0.0000002528 | 3792% | Ethereum |

Stay on top of the fastest-moving ICOs with our weekly market recap. From top fundraising projects and new presale launches to viral community growth and exchange listing signals, here’s what’s shaping the crypto launch landscape right now.

Understanding what made previous ICOs succeed helps sharpen your investing edge. Below is a curated snapshot of the factors behind recent top-performing ICOs and the core factors that drove their growth.

What Drives High-Performing ICOs?

Reviewing the top-performing ICOs of 2025 so far reveals several consistent patterns that separate high-ROI launches from the rest. While individual projects may differ in theme or tech, successful ICOs tend to share a handful of strategic advantages:

Transparency is crucial when tracking new crypto launches. Our evaluation framework blends qualitative and quantitative data to help readers identify the most promising, active, and community-validated ICOs each month. This ranking is informational and not financial advice. It follows the principles of our Coinspeaker methodology and is adapted for pre-launch assets.

We review each project’s core documentation, including whitepapers, litepapers, tokenomics pages, and roadmap disclosures. We look for clear value propositions, credible utility (including meme-driven positioning when relevant), and realistic execution timelines. Projects with vague promises or over-engineered tokenomics are filtered out.

We also assess transparency around team, advisors, and backers, favoring verifiable identities, clear legal structures, and third-party audits or attestations where available.

To gauge early traction, we analyze on-chain wallet data via block explorers and community dashboards. We track presale participation, wallet concentration, distribution models (e.g., fair launch vs private rounds), vesting and lockups, and early trading activity once tokens go live.

We prioritize ICOs with fair access, capped allocations, and minimal insider control. When data is incomplete, we apply conservative imputation with penalties or proportional reweighting, whichever is stricter. Venue-quality and wash-trading heuristics are applied to any post-launch volume.

Using Telegram analytics, X engagement, and Discord activity, we evaluate the pace and quality of community growth. We reward organic conversation, credible influencer traction, and user-generated content over bot-driven followers or low-effort shilling. Sentiment inputs include user feedback, AMA quality, and campaign participation, with anti-bot filtering.

We assess narrative alignment and ecosystem support, including grants, partnerships, integrations, and realistic token utility post-ICO. We monitor reputable industry news and ecosystem signals to understand whether a project aligns with prevailing market trends, without relying on any single company example.

In line with our main framework, certain events cap or exclude a project until they are resolved:

An ICO, or initial coin offering, is a type of token sale in which a crypto project offers its new coin directly to public investors. It’s also known as a crypto presale. ICOs are one of the most common methods for new projects to distribute their tokens to investors.

In an ICO, anyone with a crypto wallet can purchase a project’s new token. All they have to do is connect to the ICO and swap an established token for the project token. Typically, this reserves their coins, and investors receive them after a token generation event (TGE), which is the actual process by which the new token is created on the blockchain. In 2025, many ICOs allow for staking from the moment of purchase, although the tokens will still be received at TGE.

ICOs are significant in the crypto market because they put new cryptocurrencies into the hands of investors. This is important for decentralization, especially if tokens are used to validate transactions or govern a decentralized autonomous organization (DAO). The more investors holding a token, the more decentralized the validation and voting power. Greater levels of decentralization can also help the price performance.

ICOs are also important because they represent a way for new projects to raise investment. Investors in an ICO offer cash or established cryptocurrencies (often Ethereum, Bitcoin, BNB, Tether, or another major token) in exchange for the project token. The project can use the tokens it receives to pay for development, marketing, and other startup costs.

Many crypto exchanges also monitor ICOs to determine which tokens to list. Projects that raise a significant amount of money during their ICOs or attract a large number of investors are more likely to be listed on major centralized exchanges.

ICOs have been popular for many years, dating back to the launch of Ethereum in 2014. When the Ethereum ICO began, investors could trade 1 BTC for 2,000 ETH. The ICO sold more than 60 million ETH at an average price of $0.31 and raised more than 31,500 BTC (worth around $18.3 million at the time).

This success foreshadowed the ICO boom that came in 2017, as new tokens built on the Ethereum blockchain began to launch in droves. More than 800 crypto projects held ICOs and raised more than $10 billion. Some of the best crypto started as ICO tokens in 2017.

In the wake of the ICO boom, new token offerings have continued at a rapid pace. The number of crypto ICOs and their value have risen with each successive crypto bull market, although ICOs have also declined in number and value during bear markets.

ICOs are just one of several ways that new crypto projects can release their tokens. Other options include IEOs, IDOs, and STOs:

Since projects have several options for releasing tokens, why do so many choose ICOs? ICOs offer several key advantages:

ICOs all work in the same way: they enable investors to swap established tokens or fiat for a project’s new token. They also follow the same basic three-phase structure.

An ICO’s token sale phase can be further subdivided into stages, which last for several days or until a certain fundraising milestone has been reached. The price of the project’s token typically increases in each successive stage of the sale.

Smart contracts play a crucial role in ICOs, especially since investors typically pay for tokens during the sale phase but don’t receive them until the distribution phase. Smart contracts ensure that when distribution happens, investors can claim their tokens simply by connecting their crypto wallet to the project site. The smart contracts underlying ICOs are visible to investors and are often audited by third-party security firms to ensure the process is truly automated and trustless.

Now that you know the basics of how ICOs work, let’s walk through the steps involved to join a crypto presale.

To get started, it’s important to carefully research any ICO you’re interested in joining. While there are many legitimate ICOs, this space is also a common target for scammers. Additionally, not every ICO will be a success; some tokens can see their value decline rapidly after launch. It’s important to make sure the ICO has a good chance at success.

To conduct research, dive into the project’s materials. This can include the whitepaper, project roadmap, tokenomics, and social media channels. Explore what crypto analysts have said about a project and try to learn more about the project team members, especially if they are doxxed. It’s also a good idea to look at similar crypto projects and their recent performance.

The more information you can analyze, the better positioned you will be to make a decision about joining the ICO.

Next, you must create a crypto wallet that’s compatible with the ICO. Your wallet needs to be able to connect to the project site and hold the project tokens. Most presales work with any ERC-20 compatible wallet, but it’s important to double-check.

We recommend using Best Wallet as one of the best decentralized crypto wallets. It’s free, secure, and supports thousands of tokens across 60+ blockchains. You can create a new wallet anonymously in a few minutes. Best Wallet is available for iOS and Android.

Your wallet will need to be funded with ETH, USDT, or another token accepted by the ICO for payment. If you already hold these tokens in another crypto wallet, you can transfer them to the wallet you set up in Step 2. Blockchain transfers incur a gas fee but take place instantly.

If you don’t already own the required cryptocurrency, you can purchase it with fiat on a centralized crypto exchange such as Binance or Coinbase. You’ll need to create an exchange account, go through the ID verification process, deposit funds, and then purchase the tokens you need. After purchasing tokens, you can make a withdrawal to transfer them to your crypto wallet.

Some presales let you buy tokens directly with fiat, but will still require a decentralized wallet to determine where to send your tokens at TGE / or what wallet address is allowed to claim.

Now navigate to the ICO platform, which may be the project’s website or a crypto launchpad that the project is working with. Ensure you have the correct website, and not a scam copycat. Click ‘Connect Wallet’ or a similar prompt and choose your wallet from the menu that appears. Follow the prompts from your wallet to authorize the connection.

Some crypto ICOs require you to complete Know Your Customer (KYC) checks before you can make a purchase. This process includes providing details like your name and birthdate, uploading a photo of your ID, and providing proof of address.

Many ICOs don’t require KYC, so you may be able to skip this step.

Now you can purchase tokens. Enter the amount you want to invest in ETH, USDT, or whatever token you’re paying with. The ICO site should display the equivalent number of project tokens you’ll receive in return.

Confirm the transaction to complete your purchase.

Some ICOs will send tokens to your wallet immediately after you make a purchase. In these cases, you can store your tokens in the wallet you used to join the ICO or transfer them to another wallet for safe storage. Consider moving your tokens to a cold storage or hardware wallet if you have one, since this is the most effective way to keep them safe.

Most ICOs will not distribute tokens right away, but rather will hold a distribution event or token claim once the presale ends. At this time, you must return to the ICO platform and reconnect your wallet to add your tokens to your wallet. Once your tokens are in your wallet, you can transfer them to another wallet for storage if needed.

Investors who are first to an ICO can lock in the lowest token prices and the highest staking rewards. So, for maximum potential returns (but also higher risk), it’s important to get early access to new ICOs.

There are a few ways to do this. Some projects offer a whitelist you can join, which is similar to a waitlist for a new ICO. If you’re on the whitelist, you’ll have exclusive access to buy tokens before anyone who isn’t on the list.

Other projects require involvement in the community. This is especially common for established projects that already have a strong following, but are releasing a token for the first time. These projects often provide early presale access to existing community members, such as those who own NFTs or have other proof of membership.

Launchpads, like the one within the Best Wallet app, sometimes offer early ICO funding rounds, only available for their token holders.

Finally, be on the lookout for airdrops, which can be a way to get tokens without having to purchase them. Airdrops often require investors to complete tasks, like sharing information about a project on social media. Completing more tasks may qualify you to receive more tokens when the airdrop happens.

There are hundreds of legit ICOs in the cryptocurrency market every month. Still, investors must be vigilant for scams and inauthentic projects that aim to defraud unsuspecting investors. Unfortunately, crypto scams and rug pulls have been highly effective at stealing money from ICO investors, taking more than $500 million from investors in 2025.

So, it’s important to know how to identify legitimate ICOs. We’ll explain how.

The best way to invest in ICOs safely is by doing thorough research. You need to know as much as possible about a project and make sure that everything checks out.

Key elements to investigate include:

When researching a project, it’s important to watch out for any red flags or suspicious activity that could indicate the ICO is a scam. Potential flags include:

ICOs are generally legal, although there are nuances in different markets and for different types of tokens. Let’s take a closer look at the regulatory landscape.

In the US, ICOs are legal as long as the underlying tokens are not considered to be securities.

During the Biden administration, the Securities and Exchange Commission (SEC) broadly defined most crypto tokens as securities and thus made most ICOs illegal as unregistered security offerings. Many ICOs have language indicating that US residents are not able to join, although, unless KYC checks are required, there are no barriers to buying tokens in the US.

Under the Trump administration, this has changed significantly. Most legal action against crypto projects and exchanges has been dropped, and there is increasing confidence that ICOs will not be challenged. The recent CLARITY Act passed by the Trump administration, introduced new clear criteria and indicates that as long as a cryptocurrency is sufficiently decentralized, it will not be classified as a security.

In the EU, most ICOs are legal as long as they comply with the Markets in Crypto-Assets Regulation (MiCA) legislation. MiCA provides a framework for registering new tokens, and projects must go through this process if their token meets specific registration requirements. Projects that are required to register under MiCA but do not can face penalties. The UK does not permit its citizens to enter ICOs at this time, though it’s important to keep an eye on current developments as the UK often follows the lead of the US, albeit slowly and cautiously.

There is no single regulatory framework for crypto ICOs in Asia. Each country has its own process, and they can vary considerably. For example, in Japan, crypto ICOs are legal, but tokens are subject to heavy regulation. In China, ICOs are completely banned. In Malaysia, ICOs are legal, but cryptocurrencies are regulated as securities. So, new offerings must have approval from the Securities Commission Malaysia.

Most investors are interested in joining ICOs because of their potential for high returns compared to investing in established cryptocurrencies. So, what kind of returns can you actually make?

An analysis of more than 1,600 ICOs from 2017–2022 provides an in-depth look at the historical performance of new tokens. According to that analysis, the vast majority of tokens provided a positive return on investment (ROI) at their all-time high. However, while a subset of tokens provided gains from 100% to 10,000%, most successful tokens offered a return of 10% to 70% at their all-time high.

Importantly, not all investors will have the opportunity to sell at the all-time high. And if you miss this opportunity, the data suggests that fewer ICOs produce returns. Nearly all of the ICOs had a negative ROI at the time of the analysis, although it’s worth noting this was up to five years after the token’s launch. Several tokens offered long-term returns of 1,000% or more; however, returns exceeding 100% were relatively rare.

More recent examples have demonstrated that ICOs continue to exhibit explosive potential after their launch. Here is how three tokens performed at different intervals after launch.

| Token | ROI 1 Week Post-launch | ROI at All-time High |

| Tamadoge (TAMA) | 324% | 606% |

| Wall Street Pepe (WEPE) | -7% | 91% |

| Ethereum (ETH) | 843% | 1648500% |

| Solana (SOL) | 332% | 133082% |

This shows that while life-changing gains are possible, returns of a few hundred percent from launch are more likely for most ICOs. However, these gains often take place very quickly, often within a few days of launch, so investors can earn much higher annualized gains compared to investing in established cryptocurrencies.

Wall Street Pepe was a successful presale that is now live on CEXs and DEXs, up 384% from its all-time low. The team continues to do marketing pushes and is expanding onto the Solana blockchain, showing that in the long term, presales and memes with a roadmap, community, and a good team can continue delivering returns to investors.

One way to estimate the potential ROI from a crypto ICO is to conduct a risk vs. reward analysis.

This analysis should take into account not just a project’s potential for long-term growth, but also trading metrics like volatility and liquidity. It should also consider market sentiment, since this can significantly impact how an ICO token performs in the days immediately after launch, when its growth potential is highest.

Since ICO tokens have not yet traded on public markets, investors should consider similar tokens that are already trading on exchanges. Investors can also look at trends in the broader market to identify bullish periods when ICOs are more likely to be successful.

New crypto ICOs occur frequently. There are usually several ICOs going on during any given week in the crypto market, and new ICOs launch several times a week.

That said, ICOs aren’t as common as new direct-to-exchange launches like IDOs. That’s because meme coins are the most common type of new crypto launch, and the majority of them go straight to listing on decentralized exchanges. There can be hundreds or even thousands of new IDOs every day, although most of these tokens attract less attention and investment than new ICOs.

Importantly, new crypto ICOs don’t take place at a constant, steady pace. Instead, the frequency of new token sales rises and falls with the fortunes of the crypto market.

When the crypto market is going through a bull run, ICOs are more frequent, and they tend to raise more money ahead of launch. When the crypto market is bearish, ICOs are less frequent. Presale stages also tend to last longer, and projects raise less investment overall before they are listed.

Another factor to consider is that ICO frequency and fundraising can vary significantly across different sectors of the crypto market over time. Typically, trending sectors tend to see a higher number of token launches (as ICOs, IDOs, and IEOs) and larger raises from investors.

Examples of hot categories that have seen surges in ICO activity in the past include DeFi, NFTs, and metaverse tokens. Most recently, the AI agent token category experienced a massive boom in ICOs.

Can You Make Money Investing in ICOs?

What Is the Next Big ICO?

Ripple (XRP) price consolidates above $3 despite a considerable decline in trading volumes over the weekend. Can bullish expectations on Rabby Wallet integration of XRPL EVM contracts nullify US inflation jitters?

The chances of being at the market top have increased by 3% despite multiple bullish indicators from both retail and institutional investors.

After the fatal shooting of conservative activist and vocal crypto proponent Charlie Kirk, Bitcoin.com has established a fundraiser to support his family.