Injective Protocol Catapults to Over $1 Billion Valuation after Latest Growth Funding Round to Create a Robinhood for DeFi

The proliferation of decentralized finance (DeFi) continues as a new unicorn is crowned: decentralized derivatives exchange Injective Protocol announced that it has closed $10 million, valuing the network over $1 billion.

A group of prominent new and existing investors who participated in the round include Pantera Capital, BlockTower, Hashed, Cadenza Ventures (formerly BitMex Ventures), CMS, and QCP Capital. It was also reported that billionaire NBA team owner and Shark Tank judge Mark Cuban made a strategic investment into Injective. Cumberland, the crypto arm of one of the largest trading firms DRW, also recently disclosed their investment in Injective.

Injective has been in the unique position of turning away a flurry of interested investors in the greatly oversubscribed funding round that follows its recent hockey stick growth. Raising a sum of money so small relative to its valuation means that the project effectively had near zero dilution.

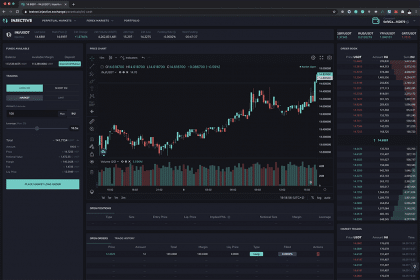

Led by a team of Stanford and Harvard graduates, Injective streamlines fully decentralized trading with a fast and secure layer-2 exchange that allows individuals to trade any market, including stocks, crypto, forex, crypto, NFTs, and even synthetic assets.

Injective enables instant transaction finality, and allows its users to trade with zero fees. Legacy platforms like Robinhood take about 2 days to execute the deals and make money behind the scenes through market maker rebates, which ends up increasing the costs for traders.

Eric Chen, CEO of Injective Protocol, said:

“Legacy institutions and practices create a number of artificial delays and middlemen that prevent innovation in the financial markets ecosystem. At Injective, our goal is to enable an unparalleled decentralized trading experience, whereby retail traders globally can for the first time access limitless markets without the typical predatory fees and slow transaction times”.

Much of Injective’s recent growth was propelled by the failures of Robinhood and other trading applications that infamously shut down trading for a number of trending stocks such as GameStop a few months ago. This in turn led to users fleeing legacy brokerages to platforms such as Injective that claims to offer uninterrupted 24/7 trading.

Problems associated with high fees are also rampant within the crypto sector with companies such as the recently publicly listed Coinbase continuing to charge retail traders with exorbitant fees.

Joey Krug, Co-CIO at Pantera Capital, says:

“DeFi seeks to democratize finance by replacing legacy institutions with trustless relationships that provide a full spectrum of financial services, from banking and lending to more sophisticated products such as derivatives. Injective is pioneering a new paradigm within decentralized trading that will undoubtedly serve as a stepping stone for retail traders globally to access exciting and innovative financial markets”.

Previous investors of Injective Protocol include Binance, one of the largest cryptocurrency exchanges, that also incubated the project. Earlier a few Injective team members were put into the international spotlight for joining an anonymous individual known only as Burnt Banksy who created a non-fungible token (NFT) of an original Banksy piece as covered by CBS News, BBC News, The Guardian, and others.

About Injective Protocol

Injective Protocol is the first layer-2 decentralized exchange protocol that unlocks the full potential of decentralized derivatives and borderless DeFi. Injective Protocol enables fully decentralized trading without any restrictions, allowing individuals to trade on any derivative market of their choosing. For more information please visit the website.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.