Is Classic GRID Bot Better than the SBot?

Grid trading is one of the more popular and profitable methods to automate trading behavior. However, even though the concept has been around for a while now, improvements are still to be made. Both Sbot and a classic bot work well, although Sbot provides some crucial advantages.

The Popularity of Grid Bots

Grid trading revolves around placing orders above and below a set price. That approach creates a grid of orders for traders to open and close market positions. Moreover, it is viable to capitalize on traditional price volatility through regularly placed buy and sell orders. In addition, the concept of grid trading extends to the cryptocurrency industry, allowing users to take advantage of small price movements.

As grid trading relies on placing many orders, one can automate the process through grid bots. These bots will let users determine their strategy and intervals to create buy and sell orders. In some cases, grid bots have built-in strategies optimized for profit potential. Additionally, certain providers may rely on machine learning to enhance their strategy over time, bringing more revenue to the users.

Users can enhance grid trading by using the correct fractals. By default, all financial markets are fractal, creating repeating price patterns across different time scales. Figuring out the correct fractal can enhance the market returns for users. Moreover, grid trading bots need to be set up to look for these fractals and enhance the profit potential for their users.

Essential Grid Bot Settings

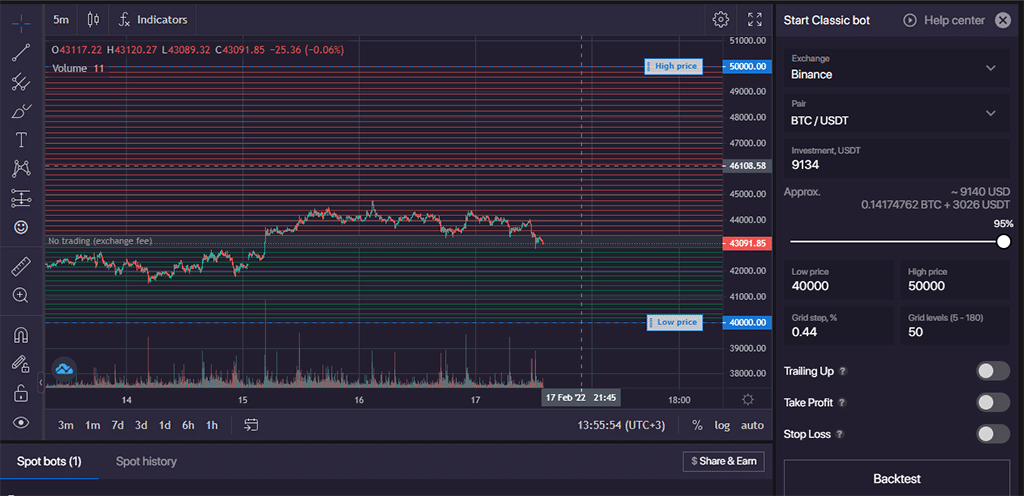

Several crucial settings apply when dealing with Bitsgap‘s grid trading bots. Understanding these parameters is essential, as they can differentiate between a profit and a loss.

- Take-Profit: the maximum crypto price for your trade, allowing a grid bot to sell all positions.

- Stop-loss: the lowest price for your trade at which you automatically exit the position (at a loss).

- Trail Upward: allows the bot to follow an asset; price in an uptrend, dynamically adjusting the grid as prices evolve.

- Trail Downward: Trailing the price in a bear trend and adjusting the grid dynamically as needed.

These parameters work well for basic grid trading, although they do not take all market conditions into account. Cryptocurrencies are notoriously volatile, and it is challenging to make money during intense periods of volatility. Choosing a currency with a substantial trading volume can make that process a bit easier, though.

Using the Classic Bot in an Uptrend

The Classic Bot provided on BitsGap introduces an excellent profit opportunity when markets are in an uptrend. Its primary purpose is to trial the price and dynamically adjust the grid range accordingly. In addition, the bot buys and sells the same quantity of assets to maximize gains during bullish market conditions.

- Classic bot buys and sells equal amount of base currency despite the price

The investment distribution logic achieves greater market exposure as prices go higher by increasing the total amount invested during the rally. Of course, it requires a bit more investment, but that can lead to much bigger profits when the market trend is favorable. Unfortunately, it can also trigger bigger losses if the market suddenly sours.

SBot Is for Sideways Trading

The SBot grid trading solution by Bitsgap takes things one step further. It is a versatile tool when dealing with sideways market momentum and prices seem to remain within a specific horizontal range. Users can set the bot to trail upward or downward and backtest their approach before letting Sbot put funds at stake. Moreover, it limits how much money is spent per purchase, which can be beneficial during uncertain conditions.

- Sbot buys and sells a certain amount of base currency with the same amount of quote currency.

One crucial aspect is how SBot sells and buys a fixed volume of the quote currency per order. Sticking to an equal investment sum provides numerous benefits, either under bullish or bearish conditions. For example, a falling price lets SBot buy more currency, whereas a rising price yields to selling fewer coins and a lower market impact. Therefore, the investment distribution logic of SBot used dollar-cost-averaging to provide optimal results.

Conclusion

While both SBot and the Classic bot have tremendous potential, traders still need to acknowledge market fractals and overall sentiment. No market is only in an uptrend or sideways trading. Other conditions include explosive growth and steep declines, both of which require users to adjust their grid trading accordingly.

Bitsgap makes it easy to switch between grid trading bot types to help users adjust their strategy over time.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.