Microsoft (MSFT) Stock Down 2%, Windows 11 Release Date Arrives but Not for Everyone

MSFT stock has gained approximately 37.49%, 27.29%, and 1.9% in the past year, YTD, and three months respectively.

MSFT stock has gained approximately 37.49%, 27.29%, and 1.9% in the past year, YTD, and three months respectively.

The company will be adopting a new name as it planned to sell its FireEye Products business to Symphony Technology Group.

Ramp received its first funding in 2018, a $1.2 million pre-seed round from investors including Firstminute Capital, Fabric Ventures, Seedcamp, and MakerDAO.

Rising bond yields continue to pressure on tech stocks with Nasdaq Composite correcting another 2%. On the other hand, energy stocks gained momentum amid optimism of economic reopening.

The new unit will be headed by Brud’s CEO, Trevor McFredies who comes on board with his 31-member team.

The Facebook stock has risen approximately 23.27%, and 19.43% in the past year and YTD respectively.

Regarding the proposed IPO, GlobalFoundries noted that “Mubadala will continue to have substantial control” after the offering.

One of the possible reasons cited has been the consistent loss made by Monzo in the past few years, despite having been in existence for six years.

The increased revenue and earnings inflow HIVE blockchain reported in its Q1 ended June 30 might have been boosted by the incessant crackdown on mining activities by Chinese authorities.

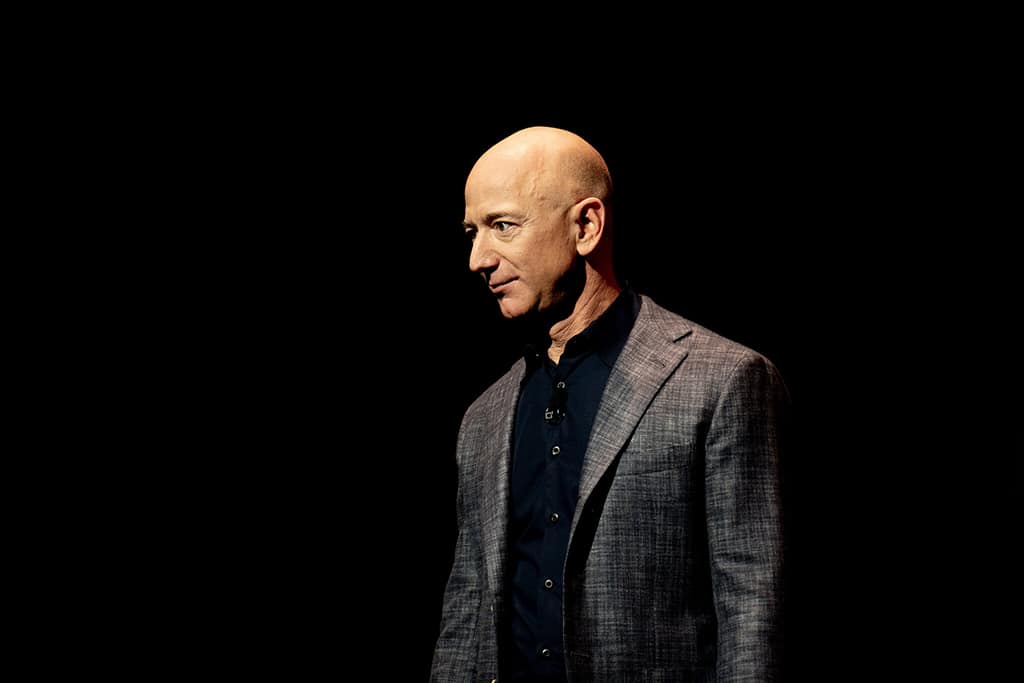

Jeff Bezos joined Northstar group, AC Ventures, Citius, and Tencent in a new funding round for Ula, months after the startup raised $20 million.

Facebook stock has dropped 3.30%, 8.84%, and 2.82% in the past three months, one month, and five days respectively through Monday’s pre-market.

To make its bond interest payments, Chinese realtor Evergrande Group raised $5.1 billion by selling a 51% stake to Hopson Development. Asian markets remained under pressure as a result of this matter on Monday trading.

The proposed IPO plan by Volvo is arguably one of its long list of strategic goals to power the capital injection that will fuel its switch to electric car production in the coming years.

Elon Musk is currently looking to reform his electric car empire with plans to move the headquarters from Palo Alto, California, to Austin, Texas.

The company plans to apply for Emergency Use Authorization (EUA) with the US FDA based on the findings of the trial and there are also plans to submit marketing applications to other regulatory bodies worldwide.