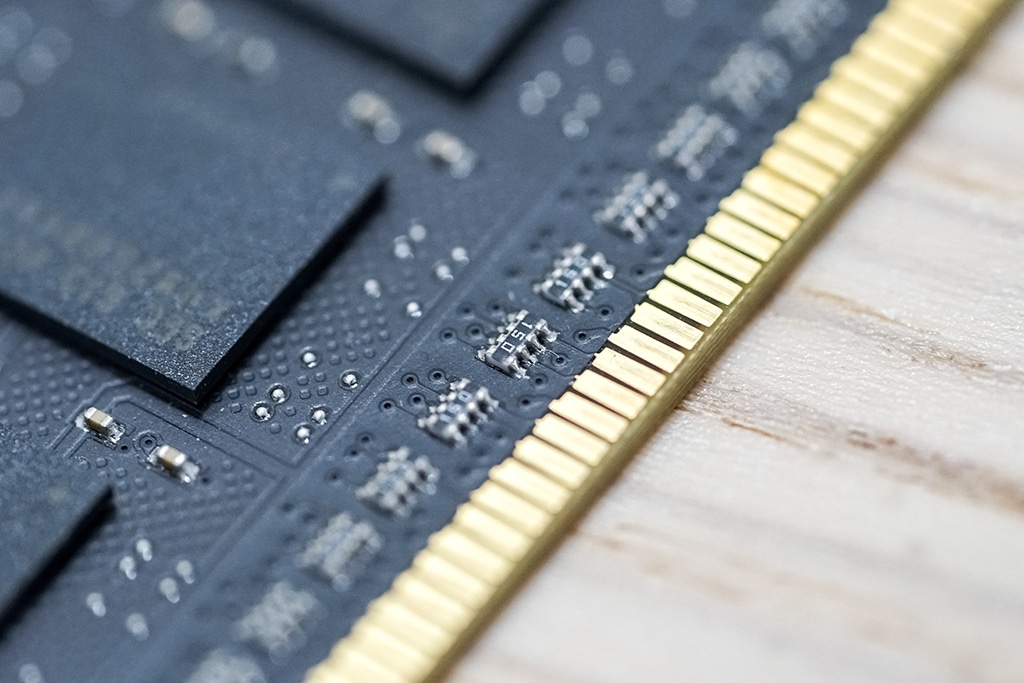

Ampere Computing LLC Confidentially Files for IPO in US

A successful IPO will give Ampere an opportunity for more cash infusion.

A successful IPO will give Ampere an opportunity for more cash infusion.

VinFast is set to use the money to expand its footprint in the rapidly growing US. EV market. It plans a $2 billion investment to build the North Carolina factory.

While the IPO is still on its way, Flipkart has raised funds from a funding round in 2021. The company secured $3.6 billion from the round, pushing its valuation to $37.6 billion.

IPO deals in Greater China and the Asia-Pacific have seen a substantial YoY slump, but are better than the broader global market.

The Domino’s Pizza China operator wants to go public in Hong Kong and eyes establishing more outlets in Beijing and Shanghai this year.

DEWA is looking to sell a 6.5% stake by offering 3.25 billion shares in its IPO. However, the utilities outfit will not receive any proceeds.

Prominent Chinese transportation platform Didi will suspend its Hong Kong IPO listing as it fails to satisfy Chinese internet watchdog.

Currently, N26 wants to ready an IPO by the end of 2022. However, the bank also has other plans if higher interest rates hampers its plans.

This move to list in Hong Kong comes as a response to the growing regulatory risks for Chinese companies listed in New York.

Following a review with Concord, a SPAC, Circle now has a new valuation at $9 billion from the previous $4.5 billion.

The company maintains over $530 billion in assets and has 286 million policies in force according to the information declared in the draft prospectus. Its profit rose to $191 million in the six months ending in September last year.

Japanese holding behemoth SoftBank has shunned the UK and will now float the IPO of chip manufacturer Arm in the US.

Cybereason has raised approximately $750 million to date and was valued at around $3 billion last year following a $275 million fundraising.

China’s securities regulator says that it will treat Hong Kong as an overseas district in its new rules for overseas IPOs.

CEO Kwon Young-soo said that a 260 trillion won order backlog shows LG Energy’s possible growth.