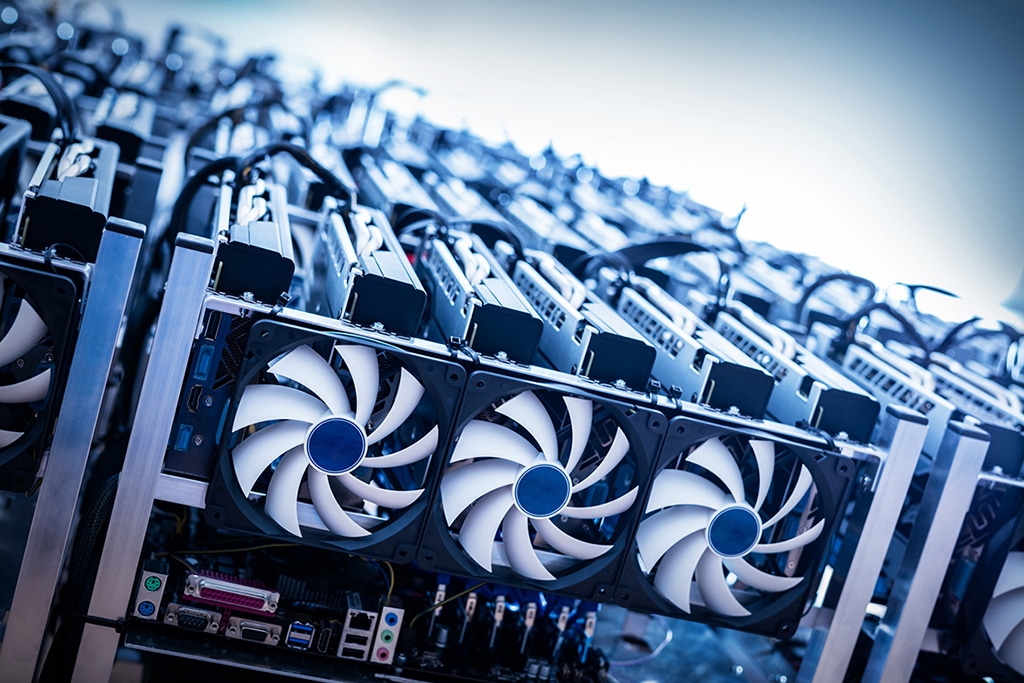

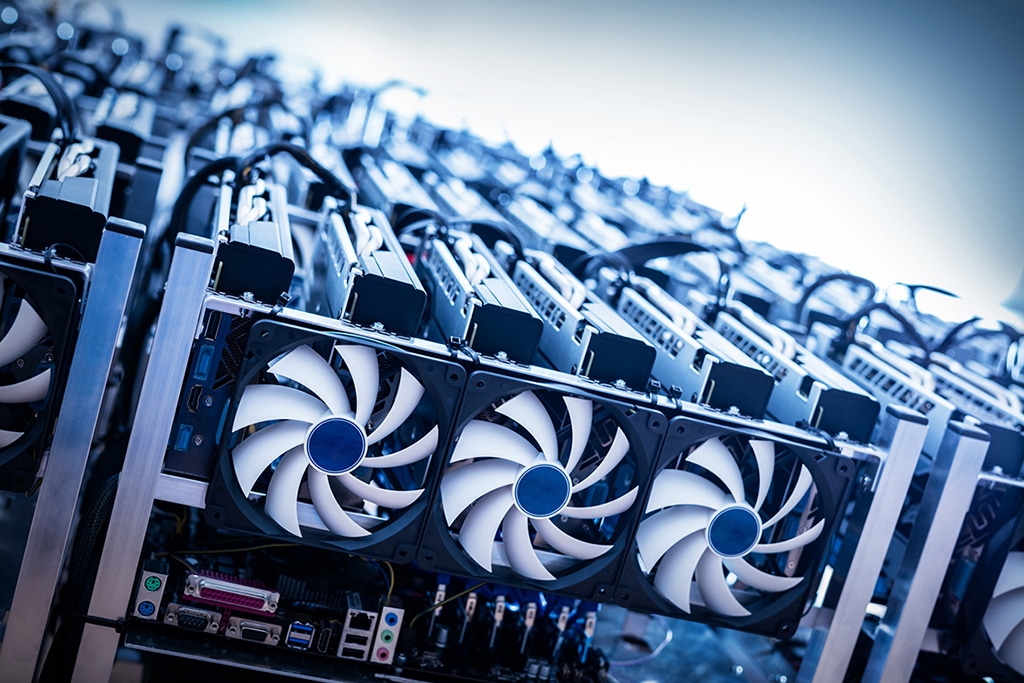

RIOT Stock Up 22% Yesterday, Riot Blockchain Appoints Jason Les as New CEO

The newly-appointed CEO said Riot is “extremely well-positioned” to make efficient use of the opportunities ahead of the company.

The newly-appointed CEO said Riot is “extremely well-positioned” to make efficient use of the opportunities ahead of the company.

On Monday, Ocugen stock was the most actively traded stock with a volume of 504.7 million shares.

By adding a crypto wallet and exchange capabilities, Apple could attract a huge customer base due to its up to standard security system.

The coronavirus vaccination program in the United States of America and around the world is also a boost to the growth of the global stock market.

Palantir stock price is moving higher these days being boosted by the announcement about the company’s new partnership.

Tesla’s Bitcoin purchase has provided Bitcoin the much-needed catalyst to break past all resistance and hit a new all-time high at $47,500. With over a 22% rally in the last 24-hours, BTC overtakes Tesla’s valuations.

Wall Street’s rally has resulted mostly from investors’ bet on a new fiscal relief package and a global vaccine roll-out that could lead to a faster economic recovery.

Reddit’s huge bet might have been viewed as too risky but the company’s popular logo that was visible at the bottom of the ad made all the difference.

At press time, AstraZeneca stock is at $50 in the pre-market trading, which shows a 0.54% increase over its previous close of $49.73.

It is yet unclear which industries Elliott Management may be looking to pitch tents with but the hedge fund’s SPAC is bound to be one of the biggest.

The pandemic and global restrictions have taken a heavy toll on shares of Booking Holdings. In January alone, BKNG shares tanked by 12.7%. One-month change makes up negative 8.11%. Year-to-date, BKNG stock is 5.87% down.

Oscar Health prior to this IPO was valued at about $3.2 billion in a 2018 funding round.

Robinhood had earlier put buy limitations on approximately 13 equities including GameStop, Koss, Express, Nokia, Blackberry and others.

Qualcomm saw impressive growth in its business segments including its handset sales, RF Front end, Automotive, and IoT which collectively represents the QCT Revenue Stream.

With the coronavirus still a threat to our normalcy, Snap stock investors remain optimistic about the company’s ability to deliver better results in the coming quarters.