GM Shares Soars 1% Following General Motors Conference Where It Unveils New Products

General Motors investors are arguably betting big on the company’s stock as the firm is set to spinoff about five new products beginning from this year.

General Motors investors are arguably betting big on the company’s stock as the firm is set to spinoff about five new products beginning from this year.

Bob Swan will be stepping down two years after his promotion to the CEO position. The latest decision of ouster comes as Intel has been lagging behind in rolling out its next-generation chips and losing ground to its competitors.

GameStop seeks to increase its e-commerce sales away from physical stores in the coming quarters.

Airbnb saw its market valuation surge above $100 billion for the first time ever.

Tesla is planning to expand its operations in Asia’s second-largest economy and has already registered an office in India. The company is likely to start manufacturing its cars already in 2021.

General Motors is accelerating the development of all-electric vans produced by its new business unit BrightDrop. On the other hand, the company has also revealed its ambitions to bring flying car taxis into the market.

On key earnings and sales metrics, GE stock earned a poor EPS Rating of 11 out of 99. However, the stock still has strong, rising institutional support. Therefore, some experts recommend considering investing in GE stock instead of buying Bitcoin.

As per Zoom, the offering is “subject to market and other conditions, and there can be no assurances as to whether or when the proposed offering may be completed.”

SPCE stock went higher after the news that Virgin Orbit, Virgin Galactic’s sister company, is ready to re-launch a satellite into orbit.

Although Snap did not disclose the financial side, it is expected that StreetCred will shut down its platform as part of the acquisition deal.

Despite the reported drop in the shares of Pinduoduo, the company is still seeing potential growth in other key aspects of its metrics.

The shares of Nio are bound to see bigger moves particularly with the firm’s readiness to throw its gauntlet in churning out advanced technologies.

TSLA stock price corrected as markets remained under pressure on Monday. However, Bofa Securities analyst still remains bullish on TSLA stock saying that it can enter an upward spiral anytime soon.

In a SPAC merger with Victory Park Capital, Bakkt plans to go public on the New York Stock Exchange (NYSE) at an estimated valuation of $2.1 billion. Bakkt parent ICE has pledged a $50 million initial investment.

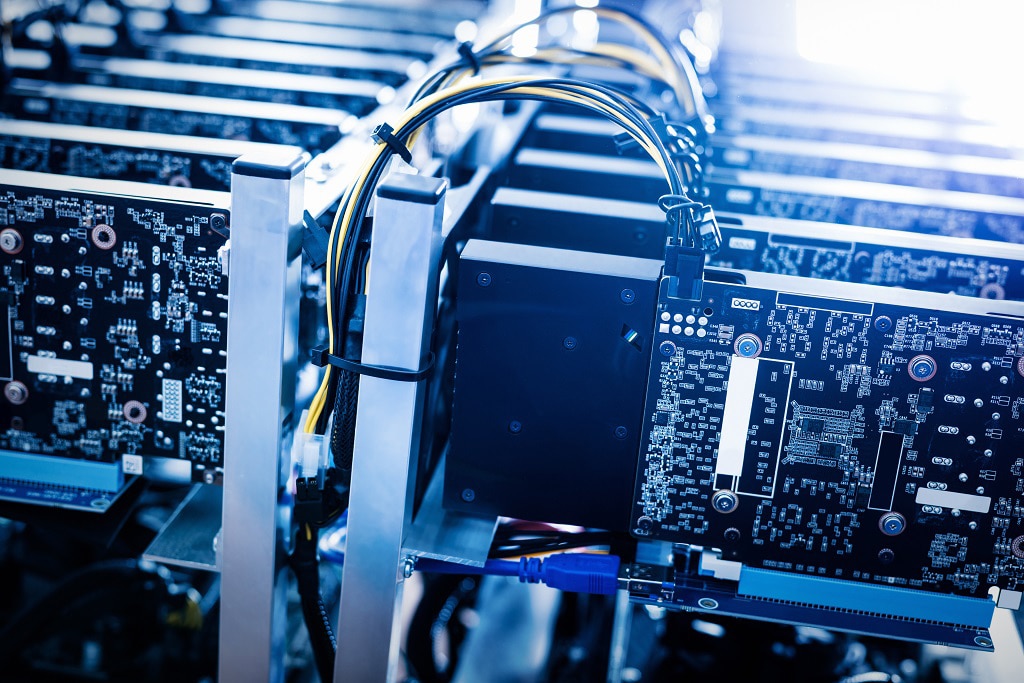

While the proliferation of crypto mining firms is gradually taking the center stage, the duo of Riot Blockchain and Marathon Patent Group currently dominates the sphere and are backed up by investors’ money.