Weekly Recap: Bitcoin and Ethereum Enter New Bullish Cycle, But Technicals Spell Trouble

Konstantin Anissimov, Director at CEX.IO, shares insights about the bitcoin and ethereum weekly price movements.

This news section spotlights emerging altcoins, project updates, tokenomics changes and ecosystem developments driving innovation in DeFi, Web3 and digital assets. Keep track of the next wave of digital currencies before they make headlines—and gain insights that matter in the altcoin sector.

Konstantin Anissimov, Director at CEX.IO, shares insights about the bitcoin and ethereum weekly price movements.

The continuous delay in the launch of Ethereum 2.0 threatens its dominance as market analysts question whether its development will be able to keep pace with the DeFi growth. Some new DeFi projects have already started looking for alternatives in the meanwhile.

292,672 ETH enclosed make up more than 55% of Ethereum 2.0 deposit contracts required.

The launch of OPEN tokens on November 26 may be in time for investors. Moreover, there are specific fundamentals that may support prices.

Y Financial’s index token holders have robust opportunities to voice their opinion. Each YFIN index token holder is eligible for YDOT governance tokens at a 1:1 ratio.

Ethereum price breaking above the $500 level is a confirmation of the long-awaited bull rally.

1inch said that there will be no vesting schedule and that its liquidity providers will be able to collect their rewards once the 1INCH token has been issued.

In March 2019, Zeenea, a data company, revealed that 60 petabytes of TV shows and movies are stored by Netflix which is less than 7% of the current capacity of Filecoin.

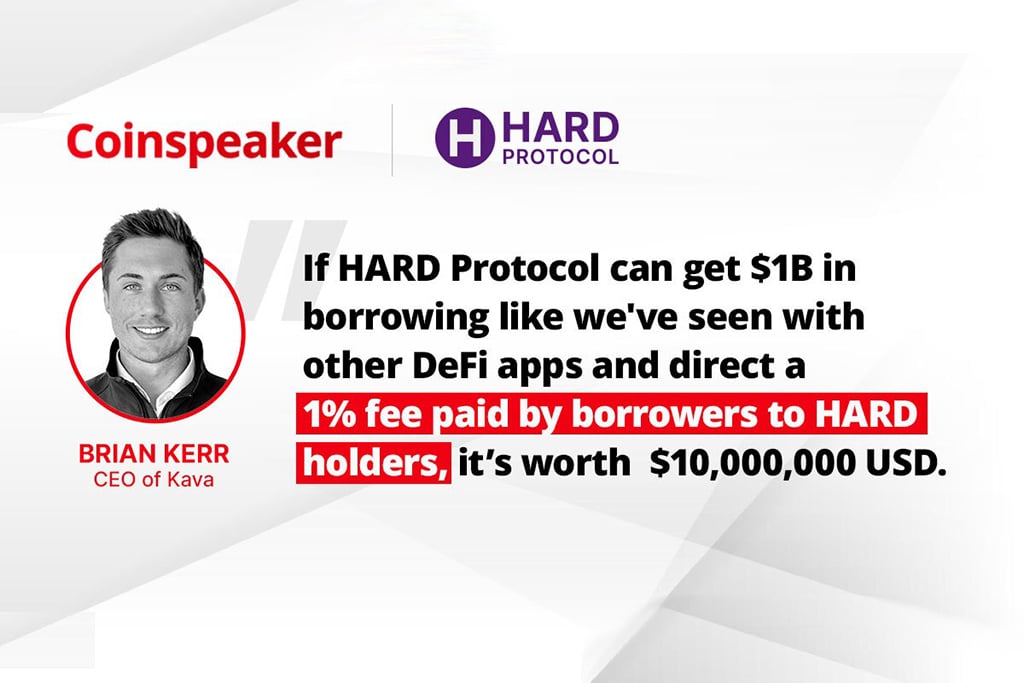

For those holding HARD, it is not just the governance of Hard protocol that is at stake. Controlling the economic makeup of Hard’s forecasted $3 billion valued platform and implementing a 1% fee policy could generate around $30 million to HARD holders.

The pandemic presented the need for an alternative, convenient, and safe payment system that will limit the use of cash which can further help spread the virus. And CBDCs can be a solution.

A day after the reported release of the OKEx founder, the crypto exchange announced that it will soon be resuming withdrawals. Amid the crackdown by Chinese authorities, OKEx withdrawals remained suspended since October 16. The exchange noted that it has restored all other security measures now.

The debut of QiSwap, its current partnership with Qtum, and its proposed future alliances may serve as one of the game-changers of the DeFi ecosystem.

The testing phase will see private banks in Japan fully in charge of issuing private digital currency.

The rumors of OKEx founder’s release brings some optimism back to the Chinese crypto market as the OKB Coin clicked $143 million volumes on Wednesday. It’s not clear whether this is a conditional bail or the end of the investigation.

Online cryptocurrency platforms have made it easy for customers to purchase well-known retail gift cards.