Binance Moves $3 Billion Worth of BTC to New Address

Despite the large amounts being removed, data suggests that Binance remains the exchange with the largest BTC balance.

Despite the large amounts being removed, data suggests that Binance remains the exchange with the largest BTC balance.

The combination of BSC’s strong ability and opBNB’s dedicated new features will make data access easier.

Binance has been considering expanding its business to the UK and other regions due to the crackdown on crypto exchanges in the US.

The only recognized Binance arm on the African continent is Binance Africa.

The official Binance exit from the Netherlands follows the exchange’s inability to secure an official license with Dutch regulators.

Sources familiar with the matter said that Binance.US has been laying off employees from the legal, compliance and risk departments.

Binance also disclosed that the BTC mining subscription service will only be active for 180 days or thereabout.

Several market analysts, including Dylan LeClair and Cory Klippsten, CEO of Swan Bitcoin, have voiced concerns about Binance’s alleged activities in manipulating the market.

The deal will require Binance.US to submit its operating expenses to the court and the SEC to protect the business as the case progresses.

The Maverick Protocol will be available on the Binance Launchpool as the newest project launched after the Sui blockchain in April.

Binance.US experienced a significant market crash following the lawsuit slammed on the company by the US SEC last week.

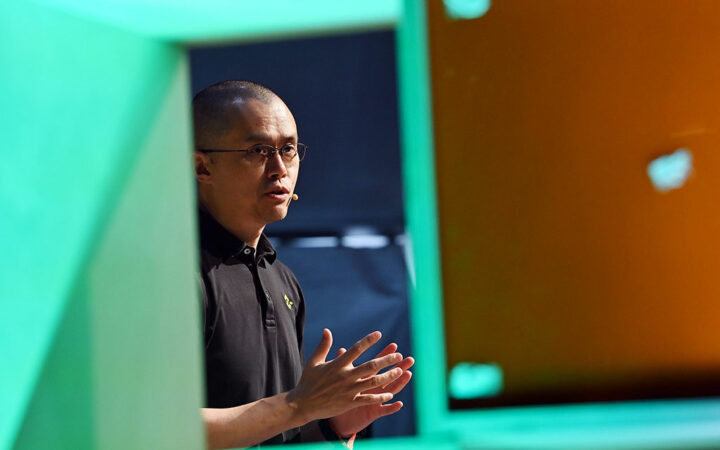

Following reports of increased outflows after news of the lawsuit broke, Binance CEO CZ argued that there was potential for on-chain data to be misinterpreted.

Binance operates an independent entity dubbed Binance Nigeria Limited similar to the United States entity that was also deemed illegal earlier last week.

At the time Gensler was offered to be an advisor to Binance, he was teaching at Massachusetts Institute of Technology’s Sloan School of Management.

The filing by the SEC cites Binance’s operations in Malta with CZ noting that he won’t have to appear in person.